Tech Titans the world over look at WeChat and see the promised land. And why would they not? Launched in 2011 in China as a messaging service, WeChat took seven years to become the world’s largest standalone mobile app by 2018 with over 1 billion monthly active users.

What set it apart even more than its massive user base was that the app didn’t have a single purpose. In fact, WeChat quickly became known as the “everything app” in China. From instant messaging to social media, ride hailing, and payments this one application housed everyday tech needs under one platform.

It is no wonder that WeChat became such a Shining City On The Hill for techpreneurs everywhere. This was the world’s first ‘Super-App’ after all. The concept of a Super-App is pretty simple. Startups all over the world provide tech-powered solutions to everyday problems. To get people hooked onto this solution, startups often spend insane amounts of money on acquiring customers. But once an app has acquired these customers, if the startup wants to provide a different service, they will have to build a new app and acquire customers from scratch.

The Super-App model proposes that we skip this step and simply integrate new functions onto existing apps with already acquired customers. Essentially a single platform to do everything. WeChat proved that this is possible.GoJek and Grab in Southeast Asia gave proof of concept beyond China as well. But the Super-Apps have remained elusive everywhere else. Western Tech Giants in particular have failed to capitalise on such an opportunity. Both Elon Musk, the CEO of X (formerly Twitter) and Mark Zuckerberg (founder of Facebook) have made their intentions known of creating superapps for the Western world. In India too, the Tata Group backed Tata Neu superapp has remained an underperformer, failing to gain traction since its launch in 2022. Despite this, dedicated platforms have held sway.

But interestingly enough one place has been receptive to the idea of Super-Apps: Pakistan. Perhaps it is because of the proximity to China where WeChat has proven itself a Gargantuan force. Maybe it is because the startup space in Pakistan has proven to be limited, and there is the chance of a single player controlling many different streams. For all we know it might just be a fad. What is undeniable is that there have been three very serious attempts in Pakistan to create a Super-App.

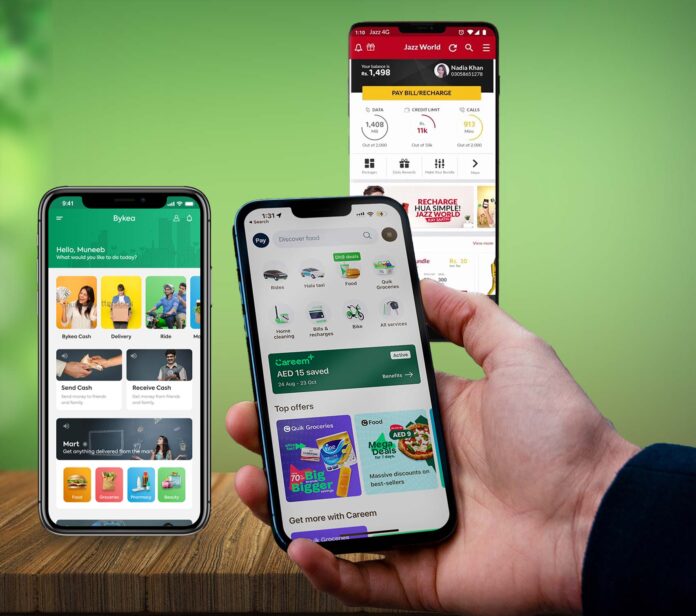

All three have had vastly different starts and winding journeys. The first such effort was from Jazz, which launched Veon as a messaging app in 2016 and has since had a change in heart as well as strategy. Then there is Careem, one of Pakistan’s initial startup success stories that had enough of a customer base to be a Super-App contender but has since found itself in a spot of trouble. And finally there is Bykea, the original local competitor to Careem that is going through a shift of its own. How have these three attempts fared? And as we settle into 2024, where do Pakistan’s Super-App hopefuls stand? Are they still committed to the dream or has pragmatism planted its sobering roots? Profit looks at the fate of the Super-App dream in Pakistan.

The Jazz (super)apps ecosystem

This isn’t Jazz’s first rodeo. In 2016 the Telco had launched its own messaging app called Veo modelled on WeChat. But since then it seems that the folks over at Jazz have had a change of heart. You see Veon didn’t work. Jazz ventured into and busted its superapp before any of the technology companies in Pakistan had conceived the idea. But it turned out to be technology mostly that Jazz was not able to manage Veon and eventually shut it down. An ambitious experiment worth an estimated $100 million was aborted but the idea was never abandoned and Jazz seems to have risen up and gotten bigger and better. Jazz has doubled down on the idea that a superapp is very much for the Pakistani market, could be built here but doesn’t necessarily have to be a single app like WeChat where services ranging from eCommerce to financial services, food and entertainment are available.

The conviction now is that one single app where all services are available is unachievable in Pakistan. Even though Aamer Ejaz, the chief digital officer at Jazz, says that the adoption of Veon was slow because of technological issues more than it being a flawed concept in the Pakistan market.

“It will not work,” argues Aamer Ejaz, the chief digital officer at Jazz, spearheading the (super)apps ecosystem of the company. “The concept of a ‘SuperApp’—an all-encompassing platform meeting every user’s needs — is more conceptual than tangible – notably in terms of screen and application size,” he says.

Instead, conviction at Jazz has now moved to creating “specialised superapps” that excel in specific domains by offering depth and quality within their niche. For instance JazzWorld offers account management for Jazz users besides faith and Bajao, an entertainment platform, making it a superapp in the self care category.

Similarly, JazzCash extends beyond mere payment solutions to offer a suite of financial services, positioning itself as a SuperApp in financial services.

“Every app has a main value proposition. For instance, Tamasha is emerging as a SuperApp in the entertainment arena by encompassing a broad spectrum of video content—from movies and TV shows to live sports—thereby catering to diverse entertainment preferences. This specialisation allows us to engage audiences with a rich, tailored experience,” Amer says.

This approach underpins our belief that the true value of a SuperApp lies not in attempting to be a jack-of-all-trades but in mastering specific domains, thereby offering specialised and personalised services that resonate deeply with users.

What exactly could be the problem in consolidating all of these services, and some more, onto a single app? After all, Jazz had thought about bringing it all to a single platform earlier.

“Packing an array of services into one app not only challenges the user experience but also strains technical resources, making the pursuit somewhat unrealistic,” says Amer.

Adding more services could be an expensive endeavour and these services might go unused. Amer says that as more features are added, ones that go down wouldn’t be used much. Because of the costs associated with adding such features, and then if they remain unused, it would bring down the overall feasibility of the app.

Bykea – not a superapp anymore

While Jazz has created an ecosystem of apps that they consider are superapps in their respective categories, some startups have been flirting with the idea for a while now. Bykea is one. Bykea got its inspiration to become a superapp from the Indonesian superapp GoJek, and modelled into car hailing, deliveries and financial services, and consolidated all these services onto a single app. But eight years later, Bykea has scrapped all services but ride-hailing and is expanding its footprint in the same category. Not only has Muneeb now given up. The idea was that if Bykea could take its core mobility operations to a certain scale, it could convert these customers to do other services such as eCommerce, food delivery, financial services and more, just like GoJek.

In fact, from the get-go, Bykea had been ideated not as a singular regular ride-hailing app but as a superapp that would provide other services such as financial services, mart and deliveries besides the core ride-hailing. Today, all other services have been scrapped and the company is planning to focus only on ride-hailing services, introducing new products in the ride-hailing category.

So why the change of heart at Bykea? The answer is Bykea’s learnings of the Pakistani market where achieving a certain scale in ride-hailing so that providing other services is viable is unachievable. If ride-hailing is limited to three or four big cities and can not be expanded to other cities, the scale then is not enough, given also that there is competition from other companies such as Careem and Uber in ride-hailing in big cities, that making a superapp would make sense.

“Why are superapps even interesting? Because when you have a lot of traffic on a platform, you could get people to use multiple other services and so that you don’t have to spend money on acquisition of new users,” Muneeb Maayr, the founder and CEO of Bykea, said.

The diverse demographics of the country also make certain services unfeasible. Muneeb explains that for instance JazzCash and EasyPaisa have multi million users of their services, positioning them well to offer other services such as eCommerce or food delivery, but they wouldn’t be able to power through it because their core customers in financial services are not the ones who would be an enticing market for say food delivery services.

“JazzCash and EasyPaisa have been the best poised to be superapps. But because they only pander to an audience of people who are largely unbanked, there is no overlap in the traffic of JazzCash and EasyPaisa and food delivery,” explains Muneeb.

Something similar is in the case of Bykea. People who prefer bike-hailing would most likely not be the ones who would pay bills through an app and wouldn’t be the ones to shop online on Bykea mart. Offering services where such a mismatch exists, is not going to work. This would also be a waste of money, already short for Pakistani startups.

Funding is one of the factors that Muneeb believes has impeded the growth of superapp in Pakistan. The South Asian country hasn’t been a market that would attract big amounts in venture capital funding to pay out for a GoJek style superapp. In 2019 alone, the Indonesia-based GoJek raised over $1 billion in funding and has raised over $6 billion since its inception and has scaled the superapp to over 40 million users in Southeast Asian countries. On the other hand, since 2019, Pakistan has cumulatively raised less than $800 million in VC funding.

“If you look at Southeast Asia, Gojek and Grab (another superapp) didn’t do wonders. After ride hailing, they just raised so much money that they outfunded competitors like foodpanda in other verticals,” Muneeb says. “What that basically means is that they funded more capital than a foodpanda equivalent in that market and hence stole the food delivery business. They also outspent many others who were in payments. I think the digital adoption that has happened there has happened at the behest of burning billions of dollars.”

While all of the aforementioned problems outline why creating a superapp in Pakistan is difficult, it also hints at the inability to create a Southeast Asia style or a China style superapp in the future.

“Whether this opportunity to create a superapp continues to exist is questionable. No one has that much traffic to begin with,” says Muneeb, explaining further that superapps don’t look attractive anymore either because of the cutdown in valuations.

GoTo Group, which owns GoJek, had lost about 70% of its $28 billion valuation by December 2022, after its IPO in April of the same year. It has since been focused on cutting losses and improving profitability.

Careem – The Everything App

While Bykea has its reasons not to continue on the superapp road, ride-hailing company Careem still continues to believe in the idea of creating a superapp for the Pakistani market. Just like Muneeb Maayr, Careem founder Mudassir Sheikha had been vocal about creating a superapp for Pakistan with its eventual launch in June 2020. The idea is the same: if Careem has an app for ride-hailing services, it could be used to offer other services as well. Some of the features it had planned to launch for the Pakistani market included food delivery and digital payments.

“Super App by Careem will be like a virtual mall, where there will be two models – services owned and offered by Careem itself (ride hailing, food, same-day-delivery capped at Rs5,000, and payment from CareemPay), and other third parties on board offering any sort of services that need communication of the vendor to the customer base,” Zeeshan Baig, former CEO of Careem Pakistan, had said in a June 2020 interview with Profit. “The third-party vendors [marketplace] will begin to unroll towards the end of the current year or early next year,” he added.

The model never really panned out. Rather, in a plot twist Careem shuttered its food delivery service in 2022, about three years after its launch, and in August last year, the company withdrew its licence for the electronic money institution, also shuttering plans for a digital wallet.

This was done just a few months after a $400 million investment into Careem by e& to become a majority shareholder in Careem’s Super App alongside Uber and all three of Careem’s co-founders. Currently, the Careem Super App offers over a dozen services including food and grocery delivery, micro-mobility, a digital wallet and suite of fintech services, and additional third-party services such as home cleaning, car rental and laundry but in markets other than Pakistan.

In Pakistan, Careem only offers ride-hailing and parcel delivery services. The company has not completely given up on its superapp ambitions for Pakistan, however. In a statement to Profit, Careem said that it was “expanding its Everything App in the UAE, KSA and Jordan before expanding across the wider region.”

“The opportunity for an Everything App in our region is huge and we are just scratching the surface in the ways we can simplify lives and create earning opportunities on the app,” Careem’s statement read.

Why does Careem think it can be a superapp? Because it has a strong presence in mobility, with as many as 12 million registered customers in Pakistan alone. The company also has digital payments functionality embedded in the app which allows it to collect cash through debit or credit cards. That is besides the strong technology core that enables it to deliver good user experience.

“Importantly, we are a local brand that understands the specific challenges that people in this region face every day,” Careem said in a statement.

“As we scale the Everything App platform to provide more services to more people across the region, we remain steadfastly focused on the quality and reliability of the experience of customers to ensure that they can easily save time and access value across multiple different services. Pakistan faces its own unique challenges with growing digital services, such as the pricing of global tech infrastructure being impacted by currency devaluations.”

Easypaisa and Jazzcash can be super apps but tech illiteracy is major issue here in this country.

Easypaisa and Jazzcash can be super apps but tech illiteracy is major issue here in this country.

Many may not agree but in Karachi bykea is loosing out since they have updated their app and now you cannot top-up any amount that is paid against the charged bill. This is frustrating for many.

you should cover easypaisa here as well. they are the best suited and potential in reaching the super app ambition among all the ones you have mentioned here primarily because they own the super app tech and the learnings from their investors(alipay) who has implemented it in several markets.

This is an Amazing App & Movie Provider!

Pakistanis can beat any country in the IT if they are support well.