Bank Alfalah Limited, one of Pakistan’s leading commercial banks, has announced an investment of Rs 1.2 billion in its brokerage subsidiary, Alfalah CLSA Securities (Private) Limited.

The brokerage house is a sort of partnership between the Abu Dhabi Group-owned Bank Alfalah and CLSA Limited, which is a brokerage house based in Thailand.

The company is currently running a pure agency brokerage house offering equity brokerage, online trading, commodities trading, research, investment banking, foreign exchange services, money market, and advisory services.

Why is there a need for such a large investment?

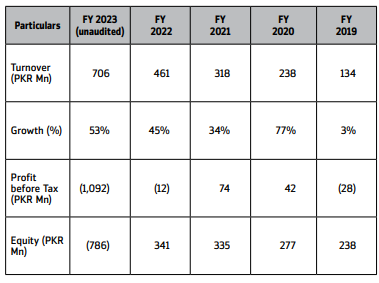

The recent accounts of Alfalah CLSA show that the company went from making a profit of Rs. 7 million in 2022 to a loss of Rs. 1.1 billion in 2023. The onus of the poor performance lies on the brokerage house’s inability to control operating expenses. Additionally, the company utilized a short-term borrowing facility to increase its exposure margin, leading to a significant rise in finance costs.

In order to shore up the brokerage house, the bank has decided to invest a large amount. in fact, due to the loss made this year, Alfalah CLSA saw its equity turn negative. In order to shore up investor confidence and to make sure the brokerage house keeps operating, the bank was strengthening the balance sheet.

This is not the first time such an investment is being made. The bank originally owned 97.91% of the brokerage house when it was incorporated in 2003. Once the house started to perform, right shares were given out to investors which decreased the bank’s shareholding. Financial years of 2019, 2020, 2021, 2022 and 2023 have not been good for the brokerage house as it has made a cumulative loss of Rs. 1 billion which led to the equity turning negative.

Backed by big players

Bank Alfalah is one of the largest banks of Pakistan with a network of over 1000 branches across more than 200 cities and has an international presence in Afghanistan, Bangladesh, Bahrain and UAE. The bank is originally owned by Abu Dhabi Group and has been operating since 1992. The bank owns 61.2% of Alfalah CLSA Securities (Private) Limited and has 40.2% ownership of Alfalah GHP Investment Management Limited which is an asset management company of the bank.

CLSA BV was a company founded in 1986 by Jim Walker and Gary Coull who were journalists by profession and are considered to be pioneers of the Asian securities industry and its development. The company has a network spanning Asia, Australia, Europe and United States and has offices in 21 locations around the world. The company is known for its investment advisory and asset management services and has been awarded for its renowned services. CLSA was overtaken by CITIC Securities in 2013. CLSA owns 24.9% of Alfalah CLSA as of today.

CITIC Securities is China’s leading brokerage and investment bank and largest underwriter of Chinese debt and equity. CITIC was founded in 1995 and offers brokerage services, investment banking and asset management to corporations, financial institutions, governments and individuals.

The new investment in perspective

The investment of Rs. 1.2 billion would be channeled towards purchasing and subscribing additional shares of the brokerage house at Rs. 10 per share. This investment is going to be for an indefinite period.

The resolution, as mentioned earlier, has been passed which means that an additional 120 million shares in the brokerage house will be issued and subscribed.

The brokerage house currently has 40 million issued and subscribed shares and would be increasing them to 160 million with Bank Alfalah’s shareholding increasing from 62.5% to 90.6% and decreasing CLSA BV’s share from 24.9% to 6.2%.

What a fool you are. Brokerage houses lose 1.1bn because of fraud. Get another job, something you understand.

Mr Jack please elaborate.

don’t get what u stated

Atif Khan committed this fraud where clients debits were cleared by Bank Alfalah as the clients didnt have exposure and were taking positions. Atif Muhammad Khan was also running big debits on his own trading account too. Now he has been fired. He did the same at Foundation Securities and now here again.