The stock market started positively but faced uncertainty over potential interest rate cuts, ending the week on Friday with a moderate gain.

The benchmark index closed at 65,152 points on Friday, up by 335 points or 0.5%.

The week started with the Monetary Policy Committee (MPC) meeting, where the State Bank of Pakistan (SBP) kept the interest rate unchanged at 22%. This decision had little effect on the market, as it was anticipated.

Talks with the IMF on the second review of the Stand-By Arrangement (SBA) concluded by signing a staff-level agreement on Tuesday, boosting the equity market and attracting international investors, as evidenced by the rise in dollar bonds and the KSE-100 index.

Discussions also revealed the focus on tax base expansion, including plans to tax retailers through electricity bills and recommendations to end GST exemptions on petroleum products, posing risks to inflation despite the recent easing.

Economically, the current account showed a surplus of $128 million in February, with an 8-month deficit of just under $1 billion. The SBP’s reserves increased by $105 million week-on-week, totaling $8 billion.

Market activity rose by 13%, with an average daily volume of 323 million shares. Key financial updates included $6.68 billion borrowed, a 17.1% drop in FDI, a 32% increase in IT exports, and a Supreme Court order for NBP to pay Rs60 billion in pensions.

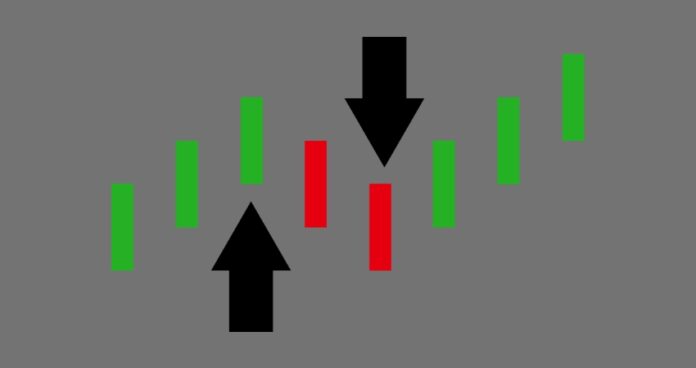

Performance varied across sectors, with notable movements in Transport, Investment Banks/Securities, and Tobacco sectors.

According to a report by AKD Research, the potential new taxes and price hikes, especially with the GST on petroleum, may affect inflation and delay interest rate cuts, possibly dampening market performance. However, successful tax reforms could enhance long-term economic stability.

With the SBP’s real effective exchange rate at 102.2 in February, currency devaluation risks persist.

The brokerage firm advised the investors to remain cautious and focus on fundamentally strong stocks with attractive dividends.