There was a time when Al-Shaheer was used as a shining example of companies on the Pakistan Stock Exchange. In an index dominated by oil refineries, textile companies and banks, Al Shaheer was a company which broke the mould. A company involved in distribution, marketing and sales of meat products in Pakistan and outside the country, Al Shaheer was the pioneer in terms of being listed on the stock exchange. Al Shaheer walked so companies like The Organic Meat Company could run.

Recently, Al-Shaeer has been going through some serious issues. A company which was seeing profits and dividends has suffered its worst year till date in 2023. June 2023 saw the company making losses of Rs 1.8 billion. This fact was compounded by the recent quarterly earnings which saw the company going from a profit of Rs 13.6 crores last year to a loss of Rs 90.3 crores this year for the same quarter.

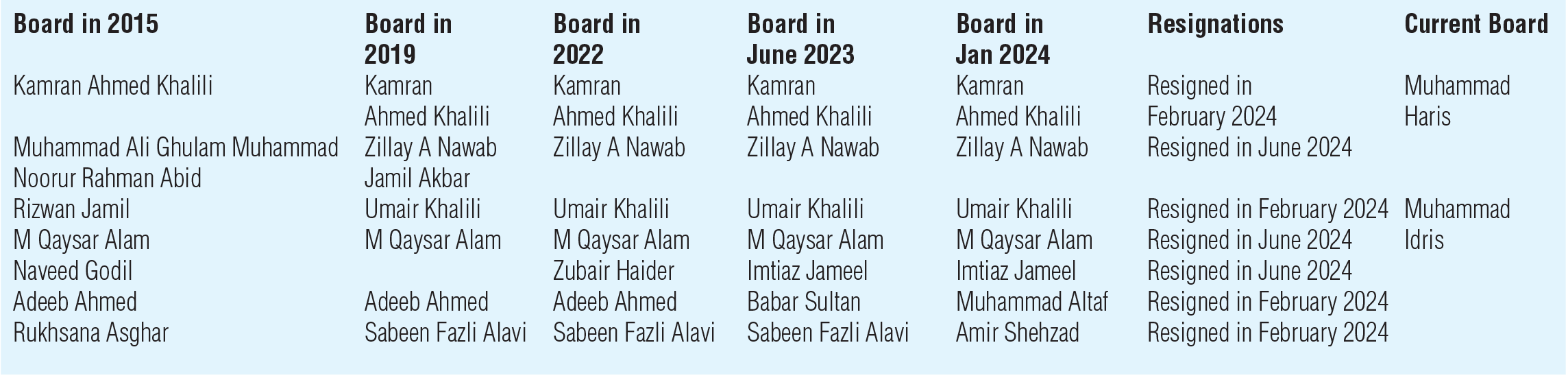

As the losses have started to accumulate, there has also been an exodus taking place in the board of directors with the company seeing almost five of its seven directors leave in a span of six months. The company has seen many of its top level executives leave and the accounts for December 2023 have still not been posted by the company. There is a history at the company to ask for extensions from the Securities and Exchange Commission of Pakistan (SECP) for extension in filing of accounts. The latest extension was sought by the company on 29th of February 2024, however, no such extension was granted to the company. The accounts which should have been filed by the start of March are still pending in June.

With so much chaos taking place at the company, what exactly is going on and how did things get so bad? Profit tries to piece together the puzzle.

The meat company gets listed

Al-Shaeer was established in 2008 as a partnership and in 2012 it was converted into a private limited company. The company quickly became a household name in the meat industry of the country as it developed its own branded retail network all over the country. From a small company, the brand quickly grew to be a fresh meat retailer and exporter exporting halal meat products as far as the Middle East. The company started with fresh beef, mutton and poultry before it developed its own range of ready to cook products. The company’s meat processing facility was HACCP certified which made sure the meat was of top quality and free from any external contamination. Even the company’s abattoirs were certified by International bodies in order to maintain high standards and quality assurances. The company prided itself for generating most of its revenues in the form of exports.

The company has been operating Meat One, Khaas and Al Shaheer farms under the umbrella of the company. Meat One and Khaas provide retail based solutions to the Pakistani market while the company also provides B2B solutions by providing meat to notable clients like Agha Khan University, Abbott Pharmaceuticals and Pizza Hut. Under the leadership of its founder, Kamran Ahmed Khalili, the company was able to expand its brand name in the local and international market.

In 2015, the company also ventured into the farming business which allowed it to source its own livestock. The company felt that it was depending on an antiquated system in order to get access to the meat and set up its own farming setup from which it could source healthy and high yielding animals.

By 2015, the company was exporting meat worth around $45 million and was expecting to expand into other markets like China and Russia as the meat export market had a potential to expand further. Sitting on such an amazing opportunity, the company planned to get listed on the stock exchange in order to gain access to a cheap source of funding. The Initial Placement Offer (IPO) was carried out at Rs 92 per share and it was received well by the market.

The initial years after the IPO proved that the company was performing very well. In 2015, the company had earned profits of Rs 19.4 crores which had grown to Rs 35.7 billion by 2016. The share price of the company also breached the Rs 100 level mark in November 2015 owing to the performance of the company itself. The company also gave out bonus shares of 35% and 15% in 2015 and 2016 respectively. It seemed like things could only get better.

The performance takes a turn

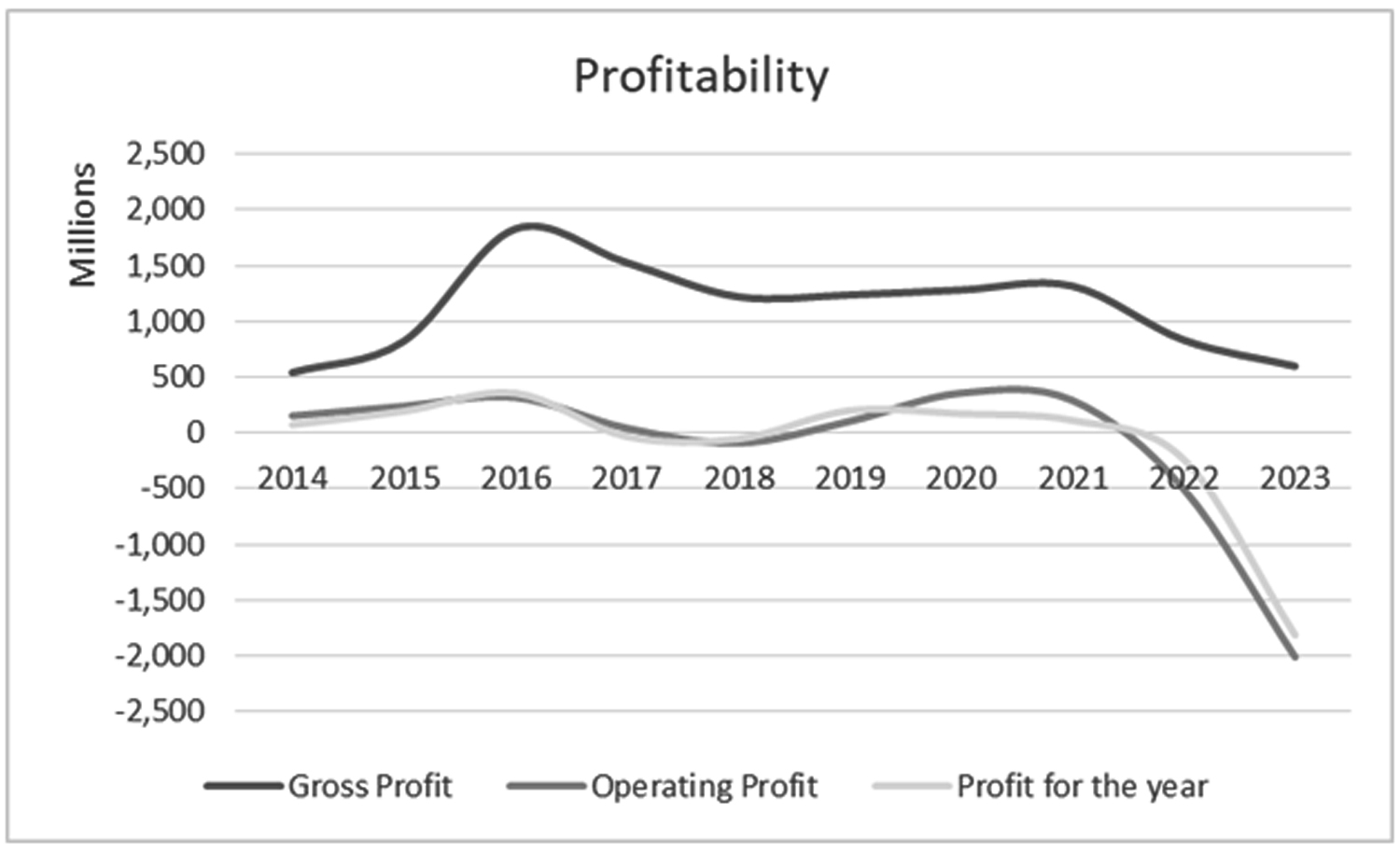

After sales slumped in 2017 and 2018, sales and profits rebounded in 2019, 2020 and 2021 as the company looked to consolidate on its product portfolio. By 2022, it was becoming apparent that the company was starting to face issues which needed to be addressed. Even when the rupee depreciated in 2022, the company saw its losses grow to Rs 23.5 crores despite the fact that exchange gains were around Rs 57.1 crores for the year. The increase in cost of goods sold and administrative expenses was weighing down the profitability of the company. These costs only increased in 2023 and the company saw operating losses of Rs 2 billion for the year. Again, the exchange gain was able to cushion some of the losses as they were valued at Rs 1 billion by themselves but the company still made a net loss of Rs 1.8 billion for the year.

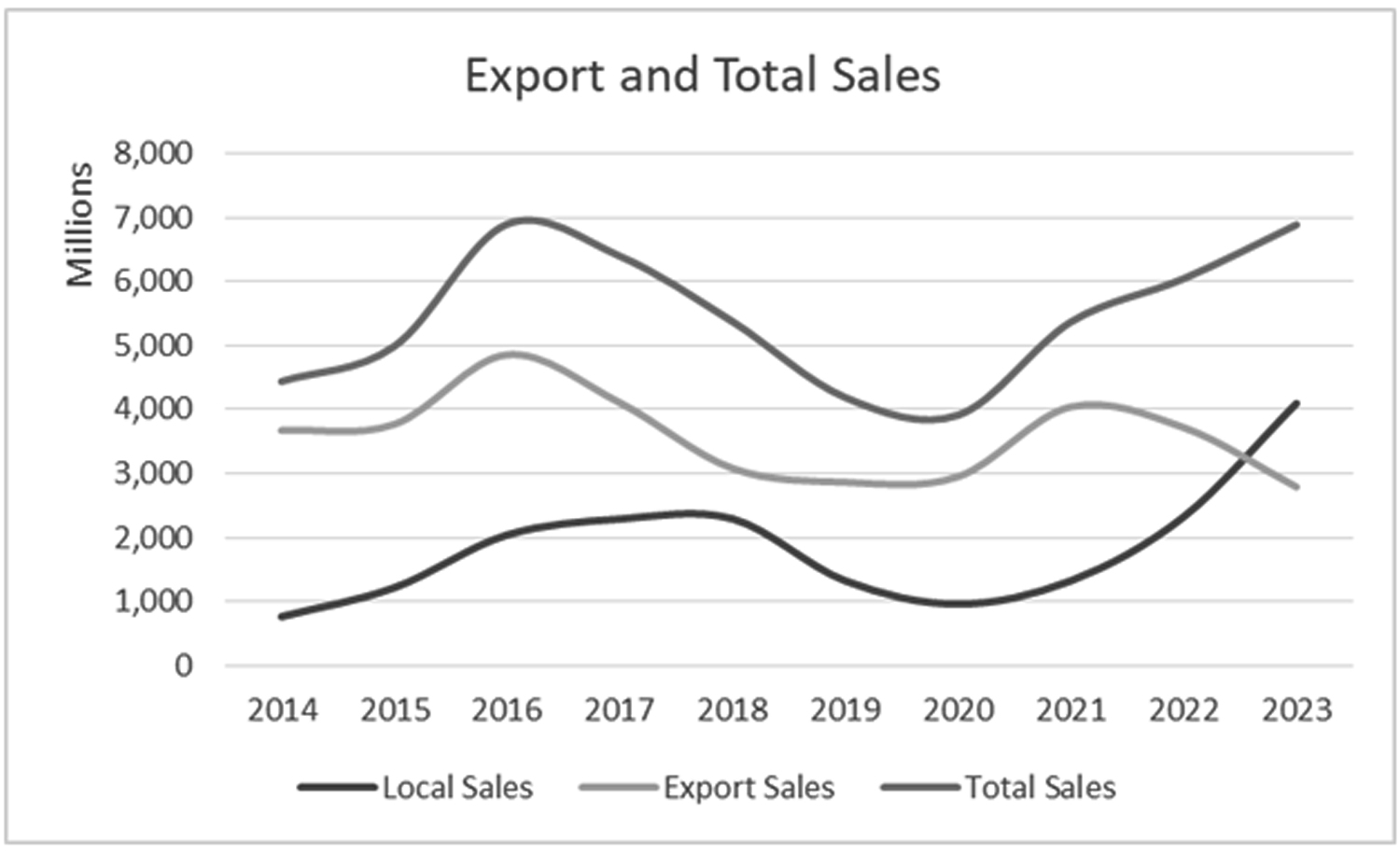

The downturn in the performance can be attributed to different factors which took the turn for the worst. First of all, the company was earning more than 80% of its revenues in the form of exports. Due to the pandemic and the worsening economic conditions, the exports have fallen to almost 45% of the sales. This shows that the company was losing one of its biggest advantages, which was exporting to the foreign markets.

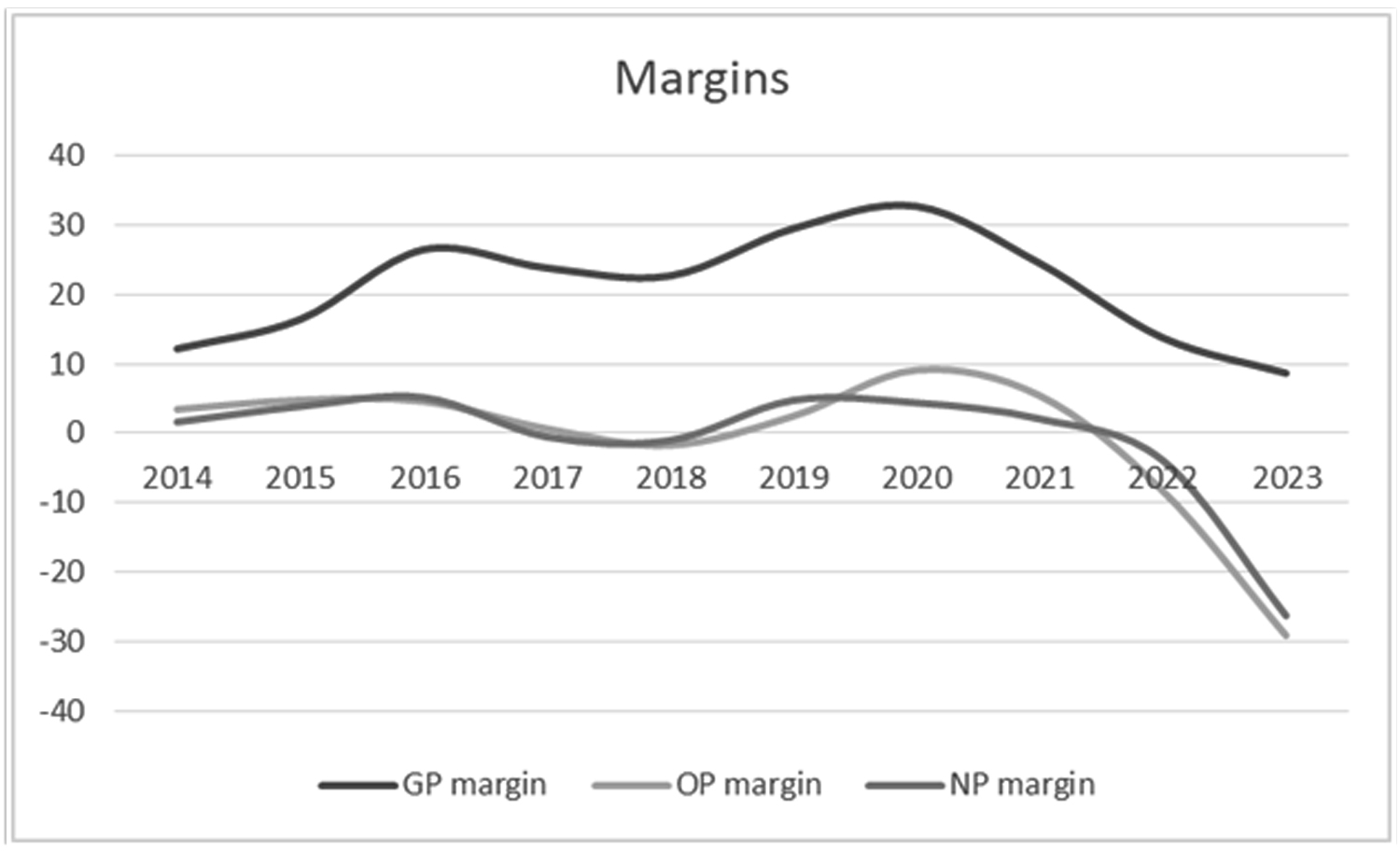

The company also saw its gross profit margin fall in recent years as its direct costs have been on the upward trajectory. Gross profit margin was around 16% in 2015 and more than doubled to 33% by 2020. In recent years, this margin has shrunk vastly as gross profit margins have fallen to 9% in 2023. This reflects the fact that the company has not been able to maintain its margins and costs which have grown out of control.

As the gross margins have been hit, operating margin and net profit margin have gone through a similar trend. Operating margins were around 5% in 2015 which had improved to 9% by 2020 but clocked in at -29% in 2023. As direct costs have increased, the company has also seen an increase in its administrative expenses which are having an influence on the operating margin. Similarly, the net profit margin was 4% in 2015 which has fallen to 26.3% in 2023.

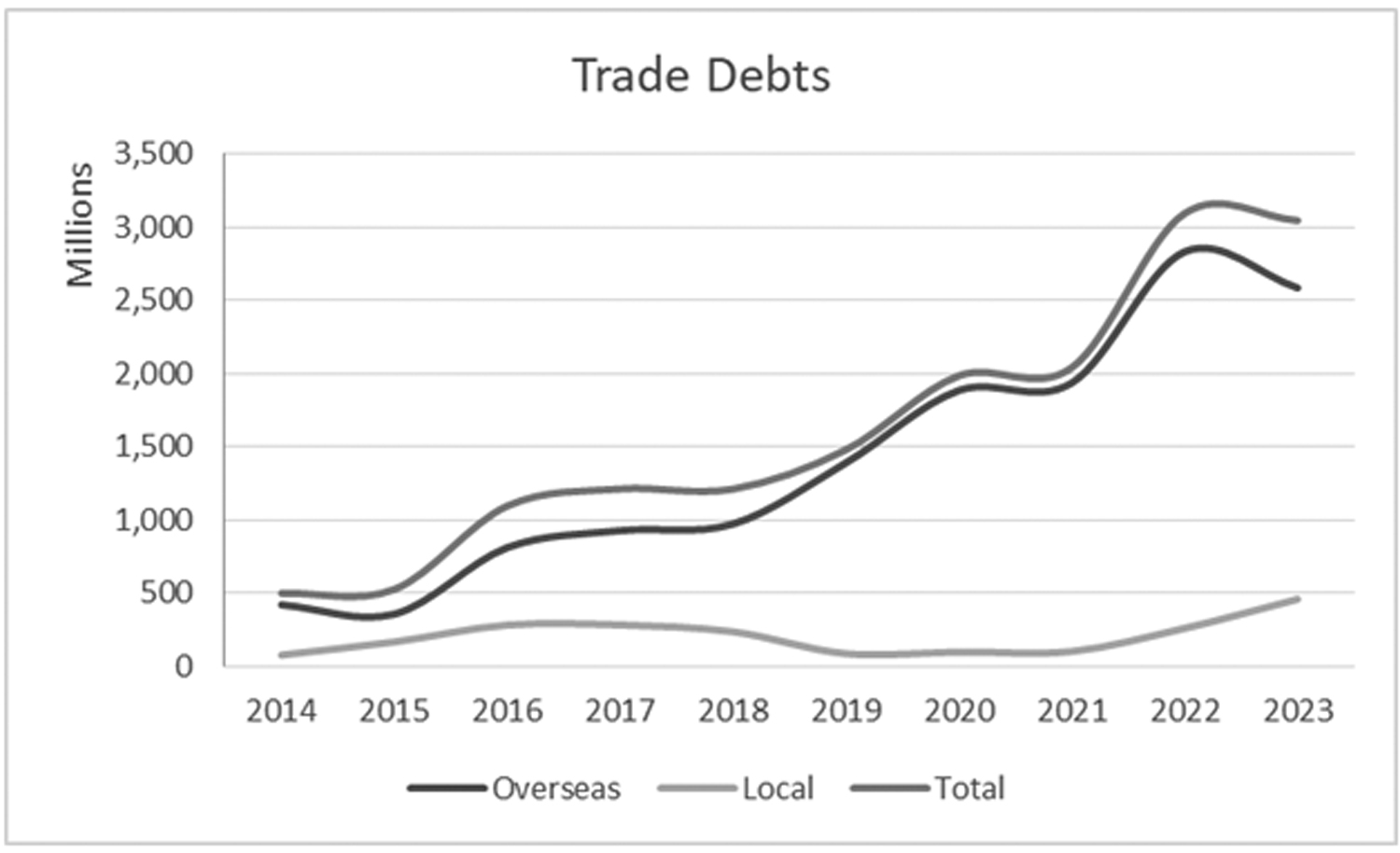

One of the biggest expenses booked by the company for the year was provision for doubtful debts which meant that an amount of Rs 1.2 billion was written off. In past years, provisions for doubtful debts were around 5% of total debts. This year the company has had to account for IFRS 9 which is in relation to expected credit loss. The company had trade debt of Rs 50 crore in 2014. The business model of the company is to extend a credit facility to overseas and local suppliers. As a greater credit facility is extended, the trade debts of the company have grown to 3 billion in 2023. Due to IFRS 9, the company has had to realize credit losses of Rs 1.2 billion which is around 40% of its total trade debts.

According to the accounting standards, these are considered as losses and have to be booked accordingly. Considering the size of the loss suffered by the company, most of the loss was suffered due to writing off of this debt. Considering the accounts for the first quarter ended September 2023, it can also be seen that the company has shown other expenses of Rs 500 million almost which have led to the company making a loss of Rs 900 million. If a breakdown was given, it would be evident that the jump in other expenses from Rs 9o lakhs last year to Rs 50 crores this year would have some portion of bad debts in it as well.

So it is evident to be seen that the company has been suffering financially. Some of the debts it considered good have turned bad while the cost of the company has increased which has turned profits into losses. One bright light for the company has been exchange rate gains that it has been able to earn as the rupee has depreciated considerably since 2015. The company has been able to earn cumulative gains of around Rs 2 billion in the last 9 years with Rs 1.6 billion seen in 2022 and 2023 alone. Some of the hit from the losses has been cushioned by this gain seen.

But there is another development that has taken place at the company that needs to be investigated further. The revolving door at its own board room.

The boardroom mess

When the company was listed in 2015, the company had 8 directors. Some of the directors were executives who had worked to make the company into the powerhouse that it was. The Chief Executive Officer at the company was Kamran Ahmed Khalili who was also serving as the Chairman of Al Shaheer Corporation. Kamran had established the company from scratch and had been the reason behind the success of the company. Before establishing the company, Kamran had been a member of Karachi Stock Exchange having been CEO of Fortune Securities and had experience as an Investment Banker at MCB Bank Limited.

In terms of the shareholding, Kamran Ahmed Khalili had 36.66% of the shares of the company after the IPO had taken place. Some of the other major shareholders were directors like Naveed Godil, Muhammad Ali Ghulam and Noorrur Rahman who held 7.17%, 3.23% and 2.34% of shares respectively. There were also certain sponsors like Shaikh Qaisar, Aftab Zahood Raja and Rehan Mansoor Khawaja who held 7.17%, 5.52% and 1.94% of shareholding respectively.

Other directors serving on the board were Muhammad Ali Ghulam Muhammad, Noorrur Rahman Abid, M Qaysar Alam, Rukhsana Asghar, Rizwan Jamil, Adeeb Ahmed and Naveed Godil. All of these directors had worked at local and international firms in the past and brought an array of skills and experiences to Al-Shaheer in some capacity. Due to their successes elsewhere, the company benefitted as it looked to improve its financial positions and performance.

The board had been elected in a staggered manner which meant that their date of retirement did not coincide with each other. After the company got listed, its first elections were held in 2016. The number of directors were increased from 8 to 10 and new board members were inducted like Zafar Siddiqui, Sarfaraz Rahman and Umair Khalili.

SECP mandates that elections are to be held after every 3 years which meant elections were held in 2019 and then 2022. After the recent elections were held in November of 2022, the new board composition meant the board now had 7 members. These were Kamran Ahmed Khalili, Zillay A Nawab, Qaysar Alam, Adeeb Ahmed, Sabeen Fazli Alavi, Zubair Haider and Umair Khalili.

It is common for the board of a company to go through a change from time to time as they try to gain experience from different directors and their relevant skill sets. The thing that raises eyebrows is what happened to the board from November 2022 to June of 2024 which confounds the mind.

First of all, Adeeb Ahmed left the board and was replaced by Babar Sultan and Zubair Haider left and was replaced by Imtiaz Jameel. This happened before June 2023 and the company announced these changes to the stock exchange. Then in December 2023, Kamran Ahmed Khalili sold 10 million of his shares while Babar Sultan and Sabeen Fazli also left the board on 6th of December 2023. They were replaced by Muhammad Altaf and Amir Shehzad. It has to be noted that Babar Sultan had been appointed less than one year and had chosen to resign.

Amir Shehzad also disclosed to the market that he had bought 10 million shares from Kamran Ahmed Khalili in December of 2023. While this is going on, the company also removed its company secretary and appointed Syed Muhammad Tariq Nabeel Jafri on 15th of January 2024. January also saw Kamran Ahmed Khalili and Umer Ahmed Khalili sell 10 million more shares from their holdings.

Are you with us so far? Good as this gets more convoluted.

The company announced that the board came together and decided to close the factory for two weeks starting from 26th January 2024 in lieu of maintenance being carried out at the factory. The company also announced that it had accepted the resignation of Kamran Ahmed Khalili from the position of Chief Executive Officer which would come into effect from 24th of April 2024. A new CEO would be appointed in due time.

The fun did not stop there. On 2nd February 2024, the company announced that both Kamran Ahmed Khalili and Umer Ahmed Khalili would be resigning from their directorships from February 1st 2024 as well. On a later date, it was disclosed that Kamran Ahmed Khalili was replaced by Muhammad Haris and Umair Ahmed Khalili had been replaced by Muhammad Idrees.

Next, the company announced that Muhammad Altaf and Amir Shehzad were resigning as directors at the company on 28th of February 2024. These two had become directors in December 2023 and were choosing to resign within two months of signing on as directors. Just when it was looking like things were beginning to settle down, the recently appointed company secretary Syed Muhammad Tariq Nabeel Jafferi resigned and was replaced by Mubasshar Asif as of 16th of May 2024. Jafri served for 5 months at the company. The latest development that has taken place is that Imtiaz Jaleel, Zillay A Nawab and Qaysar Alam have also resigned and none of these have been replaced.

Overwhelmed? You should be.

After the dust settles, it can be seen that the current board only comprises of Muhammad Haris and Muhammad Idris. These two had taken over from Kamran Ahmed Khalili and Umer Ahmed Khalili since February 2024. The company secretary has been changed twice in the last year while many of the directors signed on and then resigned later as well. With five vacant director seats and so many directors failing to even last more than 6 months, the questions do come to mind. What is going on at the company?

And there is still the pending question in terms of who the CEO is going to be at the company. The last CEO was asked to leave in January and his tenure ended in April. Two months have passed and there is still no name that has been given for the replacement. With so much turmoil at the company, it is no wonder that it is having difficulty meeting the deadline for its accounts which is almost 3-4 months past due.

One thing that might be deduced from this chaos is that there can be certain decisions that are being made at the company that are not approved by most of the directors at the company. Till December 31st of 2023, it was evident that the board was stable at the company. There was a full strength of board which existed with Kamran Ahmed Khalili at the helm. Since then, both the Khalili brothers resigned by 1st of February and were replaced. Once this took place, there were further resignations that took place as Amir Shehzad and Muhammad Altaf left after serving less than 2 months.

This left the board with 5 active members as the previous ones had not been replaced. Recently, the company called a board meeting on 6th of June 2024 which was postponed due to lack of quorum. After this, three more directors resigned. What can be gleaned from this information is that some of the directors were proving to be holding out to the agenda which was being steered in a direction which was against the company’s benefit. With only 5 active directors, three of them were not participating in the board meetings which would mean that no board meeting could be held without them. Any such meeting would not have the prerequisite number of directors participating and would have to be adjourned.

In order to work around this formality, three of the directors have resigned. Now that only two directors can be considered as being active, they can drive the agenda of the board meetings in the manner that they wish.

The real situation will start to reveal itself in the coming months as the new board sets a path it wants to achieve. Till then it can be seen that the company which was paving a path forward in the industry is suffering from uncertainty within its own board of directors for the time being. First the results of the company started to take a nosedive, then many of the founding members and directors have left the company and now the board members are falling like flies. The next 6 months will give some clarity on what has been going on at the company and why such drastic resignations were seen.