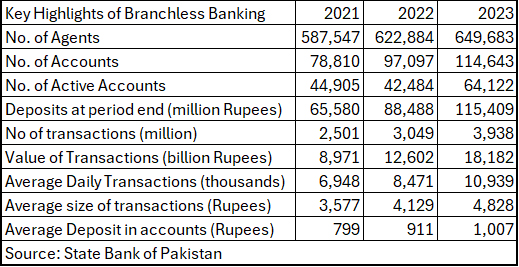

In 2008, a seismic shift occurred in Pakistan’s financial services landscape with the introduction of Branchless Banking (BB). This innovation sparked a digital revolution, reshaping how millions of Pakistanis access and use financial services. By the end of 2023, this transformation had reached new heights, with BB accounts soaring to 114 million—an 18.1% increase from the previous year. Even more striking, active accounts surged by 50.9% to 64.1 million, underscoring the growing adoption of digital financial solutions.

At the heart of this digital finance boom are two titans: Telenor Bank’s Easypaisa and Mobilink Bank’s JazzCash. These digital wallets have become household names, each carving out a significant portion of the market. While JazzCash leverages its vast customer base and market reach, Easypaisa, as a pioneer, boasts an extensive network of agents and merchants. Their rivalry not only fuels innovation but also raises a compelling question: In this rapidly evolving landscape, who truly leads the digital wallet revolution in Pakistan?

Both companies claim market leadership. VEON’s 2023 annual report states, “JazzCash was the largest domestic fintech platform and the most popular mobile fintech application in Pakistan.” Conversely, Telenor Bank’s annual report asserts, “The bank continued to solidify its position as a leading player in Pakistan’s digital financial sector in 2023.”

Given these competing claims, how can we determine which company truly leads the market?

History of Easypaisa and JazzCash

The advent of branchless banking in Pakistan can be traced back to the mid 2000s. We had Tameer Bank (Now rebranded as Telenor Bank) which was suffering from high delinquencies and was looking for a way out. As fate would have it, SBP was also looking to introduce the branchless banking regime in the country.

Sensing the opportunity, the sponsors of Tameer went to Telenor to strike a partnership for the branchless banking operations. Negotiations went back & forth. Finally, Telenor put an offer on the table. and a deal was struck with the SBP to allow Telenor a 51% stake in Tameer Bank, subject to pricing, with an option to buy another 25% stake later. A year later in 2009, Tameer Microfinance Bank and Telenor Pakistan jointly launched Easypaisa, Pakistan’s first branchless banking solution.

A few years later in 2012, Mobilink Microfinance Bank Limited was incorporated in February. The Bank commenced its operations in April 2012 and launched branchless banking services under the brand name “MobiCash” in partnership with Pakistan Mobile Communications Limited (Jazz), in November 2012. This was later renamed to JazzCash.

Performance of wallets

Profit reached to Telenor Bank and Mobilink Microfinance Bank, the companies behind Easypaisa and JazzCash respectively, to find out which metrics can help determine the biggest digital wallet in Pakistan.

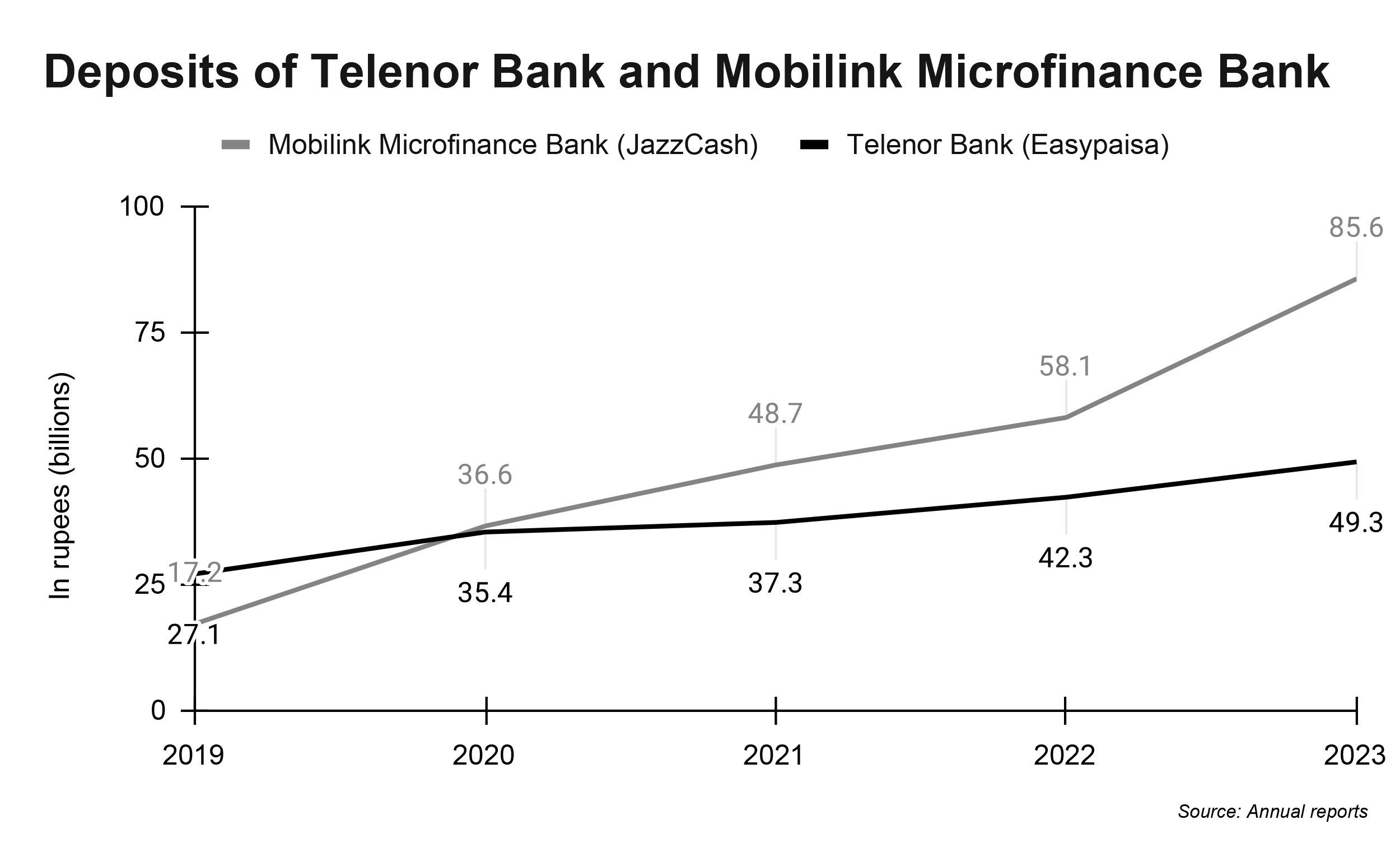

Both players stated that a digital wallet’s success depends on user activity, measured by the number of transactions performed by users. Further, the specific measures including those around lending and deposits also indicate who owns the digital financial services space.

Profit looks at these metrics to find out exactly that.

Monthly Active Users

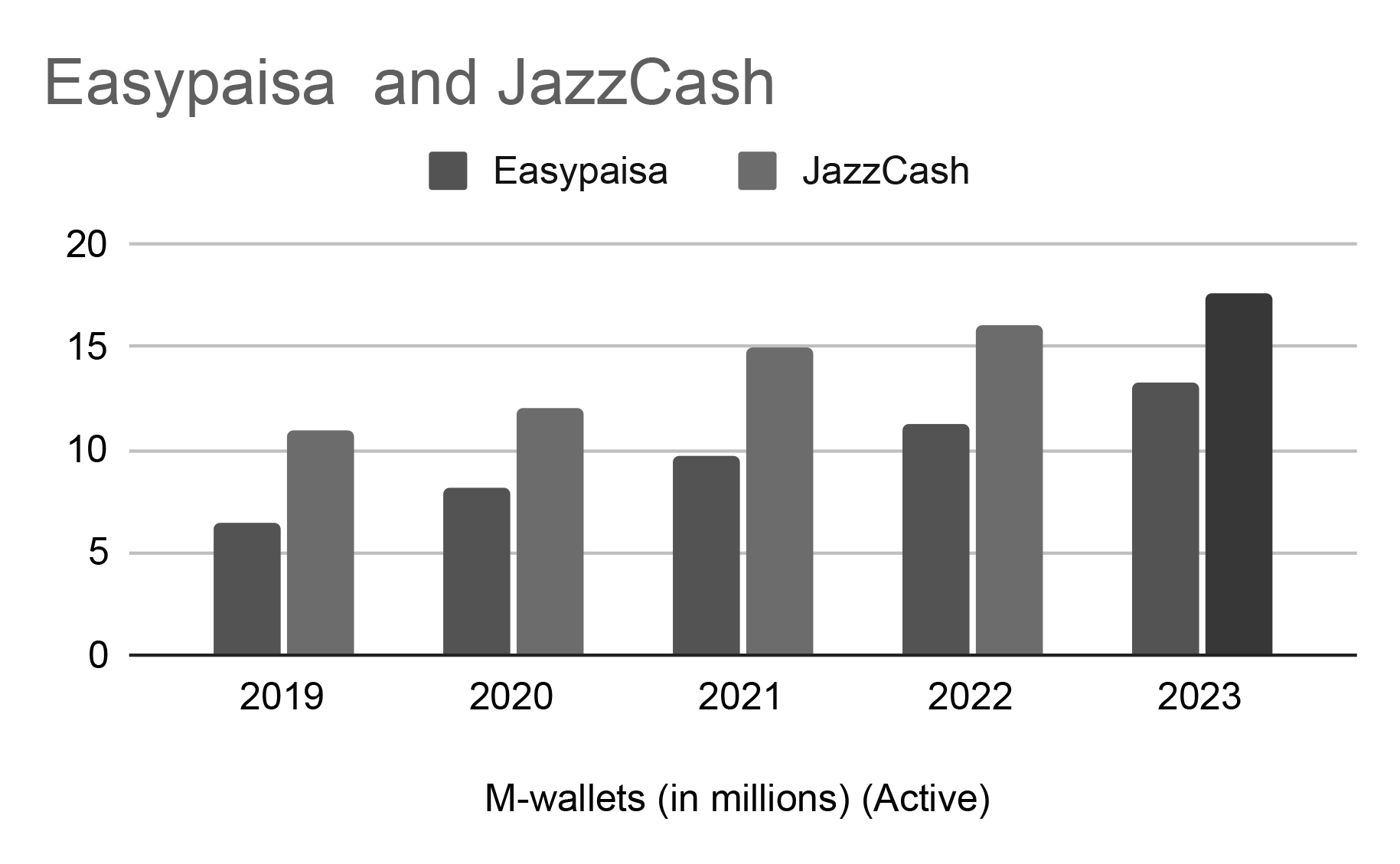

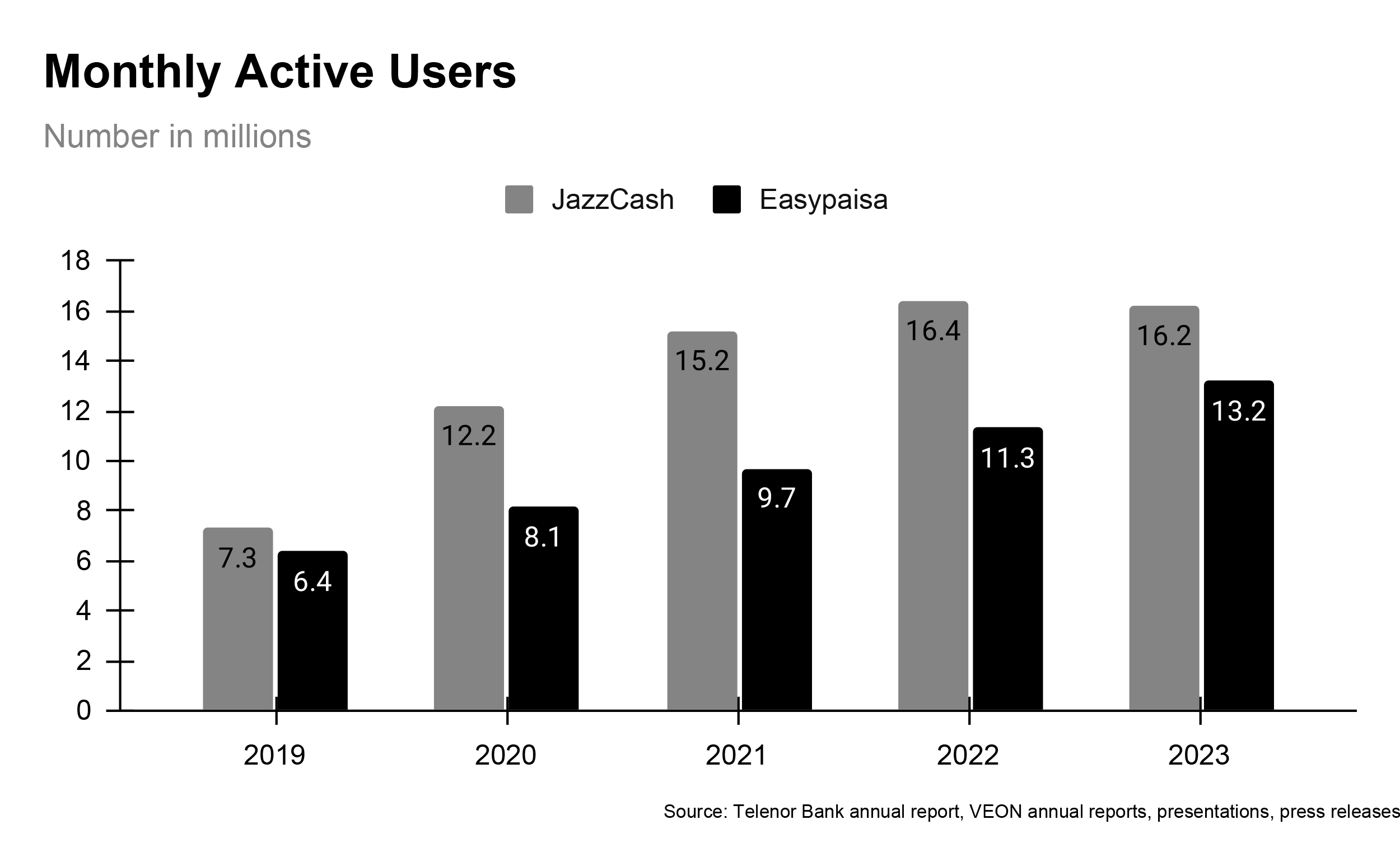

As the name suggests, Monthly Active Users (MAU) is a key metric used to measure the number of unique users who engage with the wallet within a month. A user is classified as transaction active if he performs any debit or credit transaction regardless of the transaction frequency.

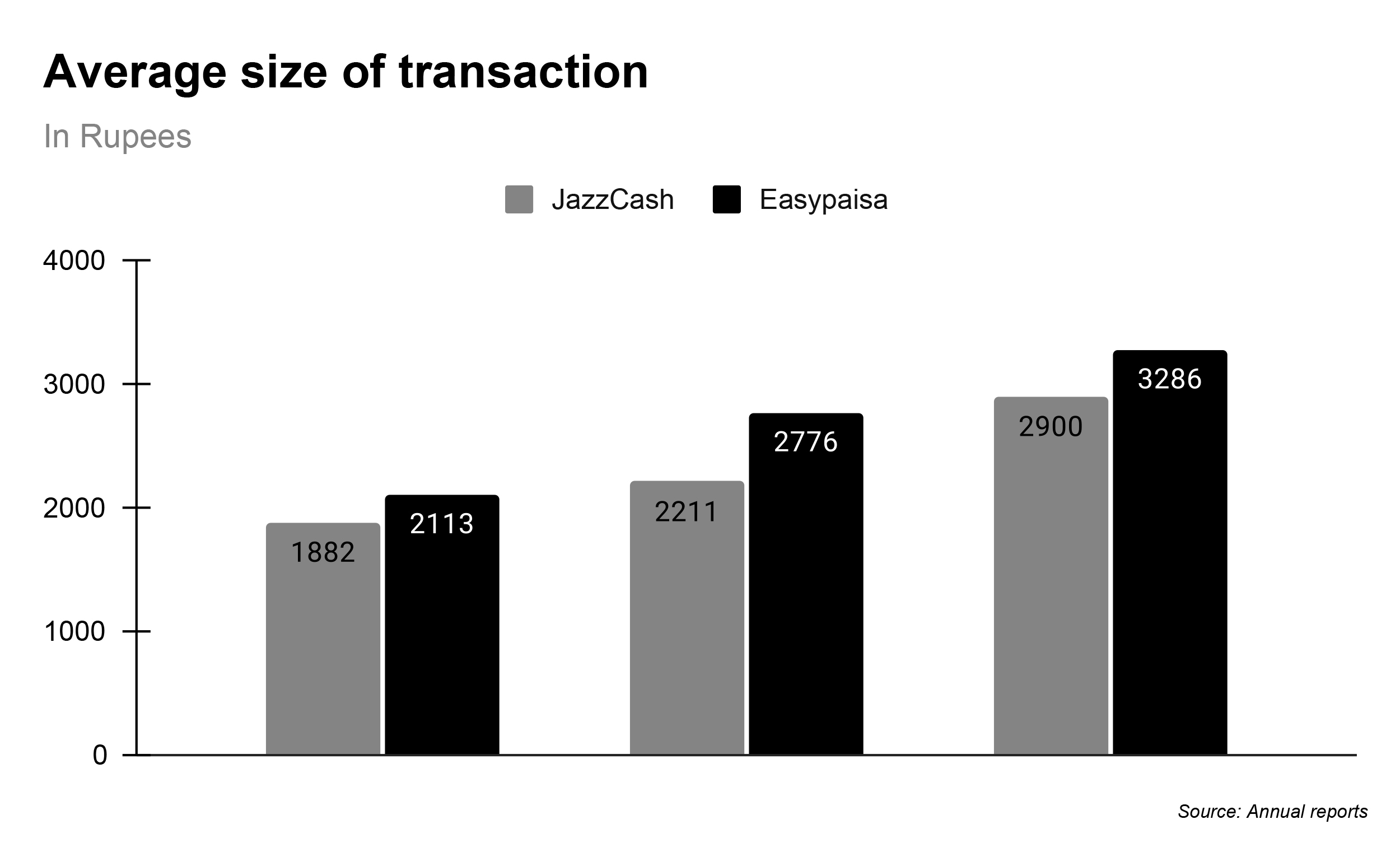

As the chart shows, JazzCash leads in terms of Monthly Active Users (MAUs). Interestingly, the number of MAU for JazzCash dipped slightly in 2023. This can be linked to the rationalization of incentives on initiating transactions.

However, it’s important to note that not all of these active users are mobile application users. Both JazzCash and Easypaisa can be accessed through various channels, including the mobile app and USSD, the latter commonly used by branchless agents.

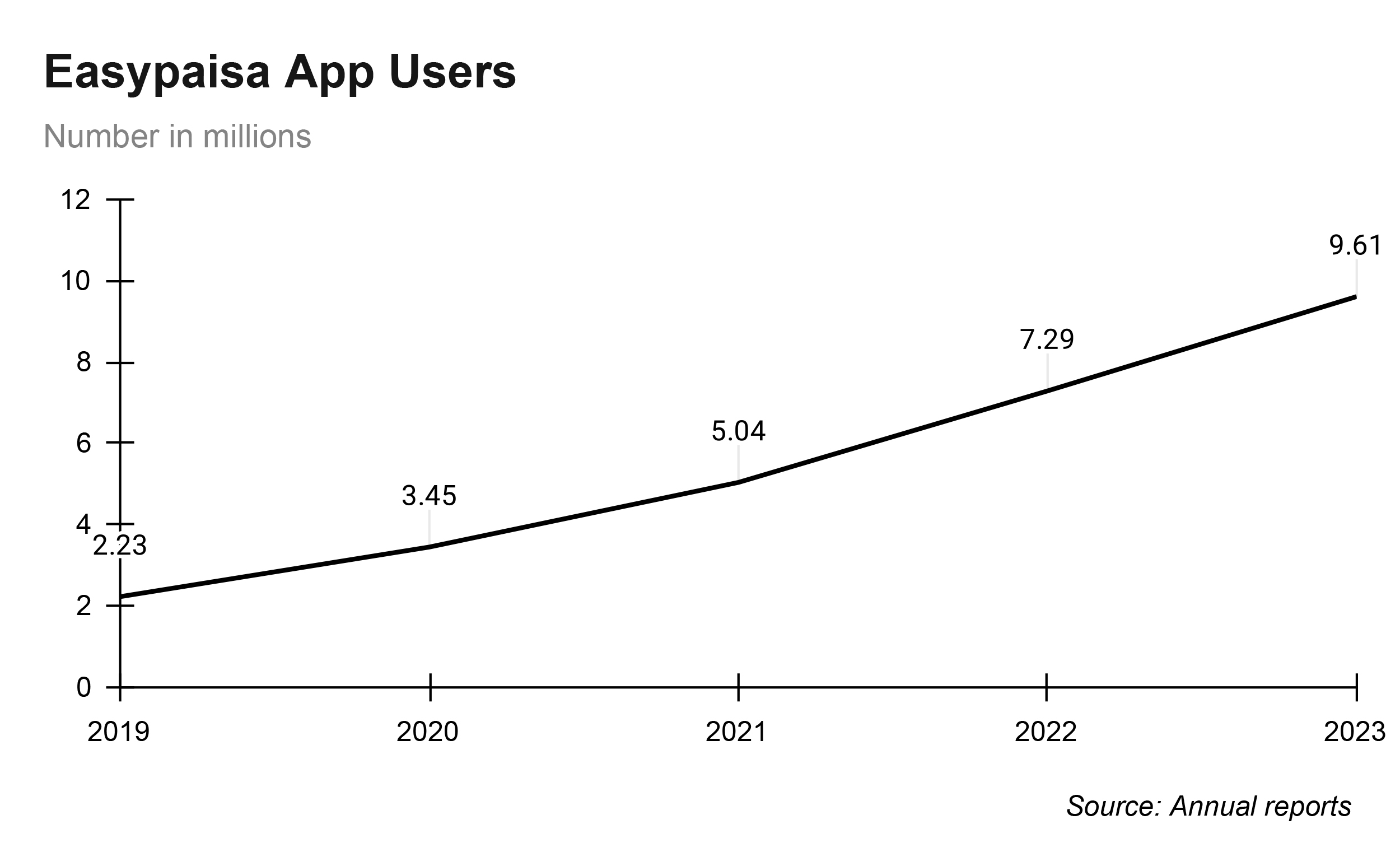

Easypaisa’s mobile application users has grown by around 34% over the past five years from 2.23 million users in 2019 to 9.61 million users in 2023. As per the company’s social media announcement in early March 2024, Easypaisa crossed 10 million active users.

In 2023, active app users of JazzCash amounted to 9.3 million, just slightly below Easypaisa. Unfortunately, JazzCash does not release the breakdown of its monthly active users, making it difficult to determine the exact number of active mobile app users and USSD users. However, as per the latest announcement by the company Jazzcash has crossed the 11 million app user mark.

Number and value of transaction

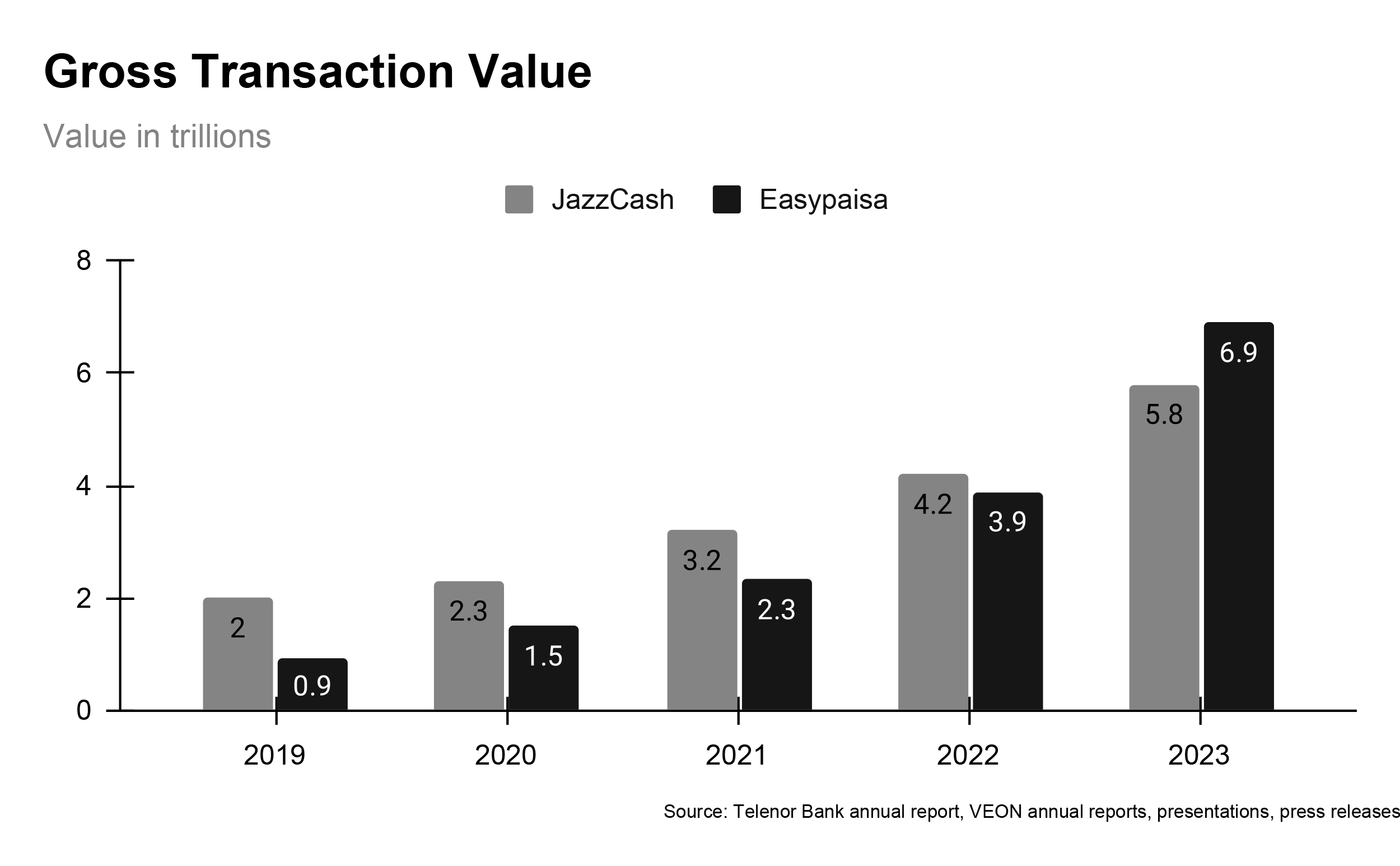

Another metric we will consider is the gross transaction value. Put simply, this represents the total value of transactions processed by a digital wallet in a year. It includes all transactions, regardless of their nature or origin, within a specific timeframe.

Between 2019-2022, JazzCash was leading in this forefront. However, in 2023, Easypaisa took the lead by a whopping Rs 1 trillion.

It is worth noting that this number is usually inflated. Digital wallets like JazzCash and Easypaisa typically give a free top-up in the wallet when a new customer signs up, an amount of around Rs 50 and other incentives. This allows users to initiate transactions, and it encourages user engagement and participation on the platform

When the customers would use this balance for whatever purpose, this would result in a debit transaction and hence will be added to the GTV, inflating the GTV.

However, in gross transaction value, Easypaisa has a legacy lead on OTC in terms of utility bill payments while it also counts P2P transactions twice unlike Jazz which considers it a single transaction.

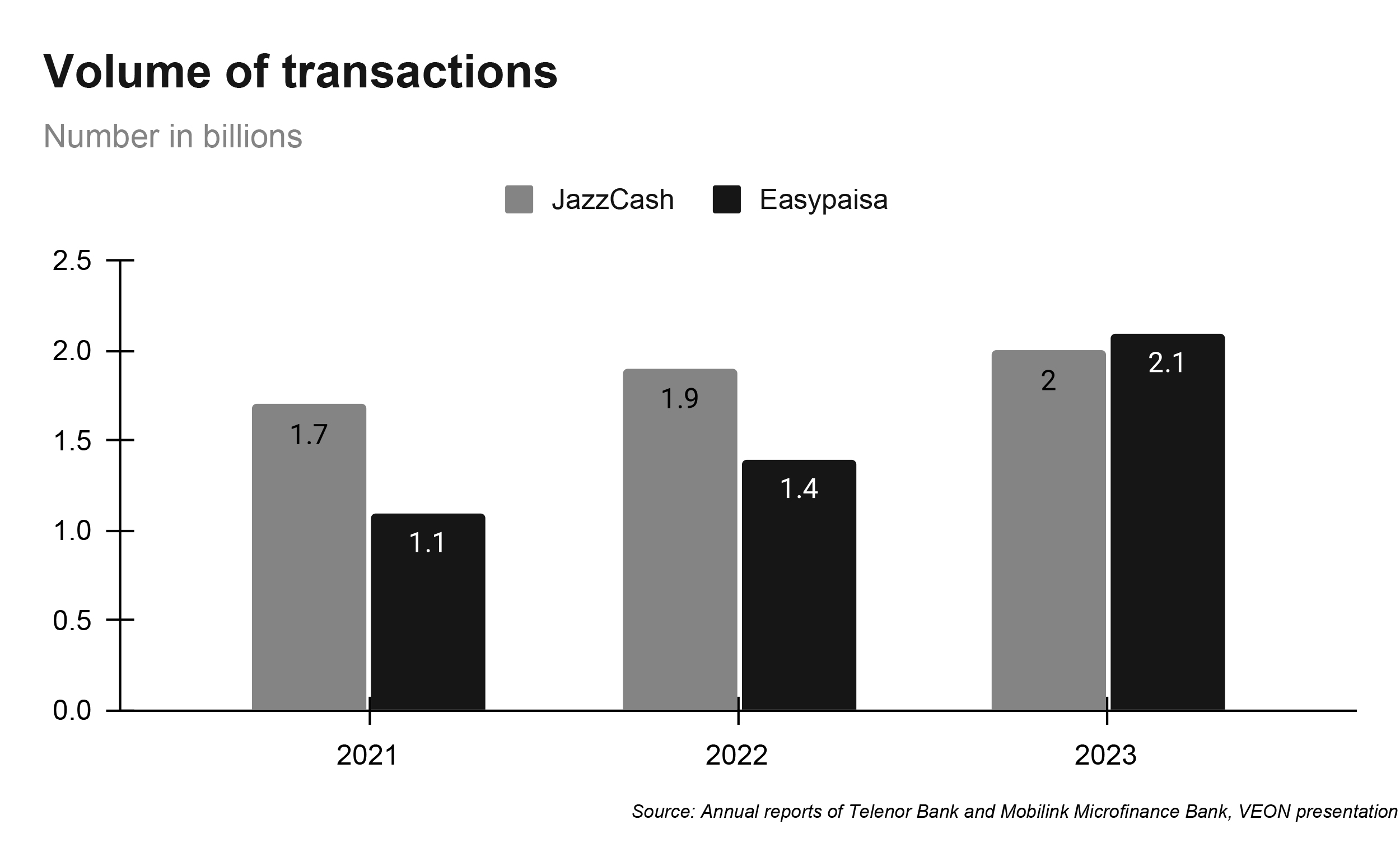

In terms of volume, JazzCash had a significant lead over Easypaisa in 2021 and 2022. However, Easypaisa’s transactions surged by 56% in 2023 to 2.1 billion transactions, inching up slightly as compared to JazzCash’s 2 billion transactions.

Digital/nano loans

In recent years, there has been a change in the strategy of both telco-led digital wallets. As per a report by Data Darbar, microfinance banks have been moving towards nano loans. The number of disbursed loans has increased while the amount has increased by a smaller percentage. Between March of 2016 and 2023, the value of disbursed loans to individuals has increased at a compound annual growth rate of 27.1% and the number at 44.2%.

JazzCash was the first one to give into the nano loan obsession. The Nano loans utilise enhanced technology and are applied for digitally, with disbursements made directly to the customer’s digital account, using automated scoring criteria.

In 2023, the JazzCash disbursed 21.7 million loans amounting to 73.3 billion in 2023.

On the other hand, Telenor Microfinance Bank has seen a somewhat bumpy ride. It started nano in 2018. However, as mentioned earlier, the bank had to scrap off its lending book due to fraud in microfinance lending and bullet loans. The bank’s management restructured and introduced nano loans at the end of 2021.

Resultantly, Easypaisa is behind Jazzcash in nano loan with a significant margin.

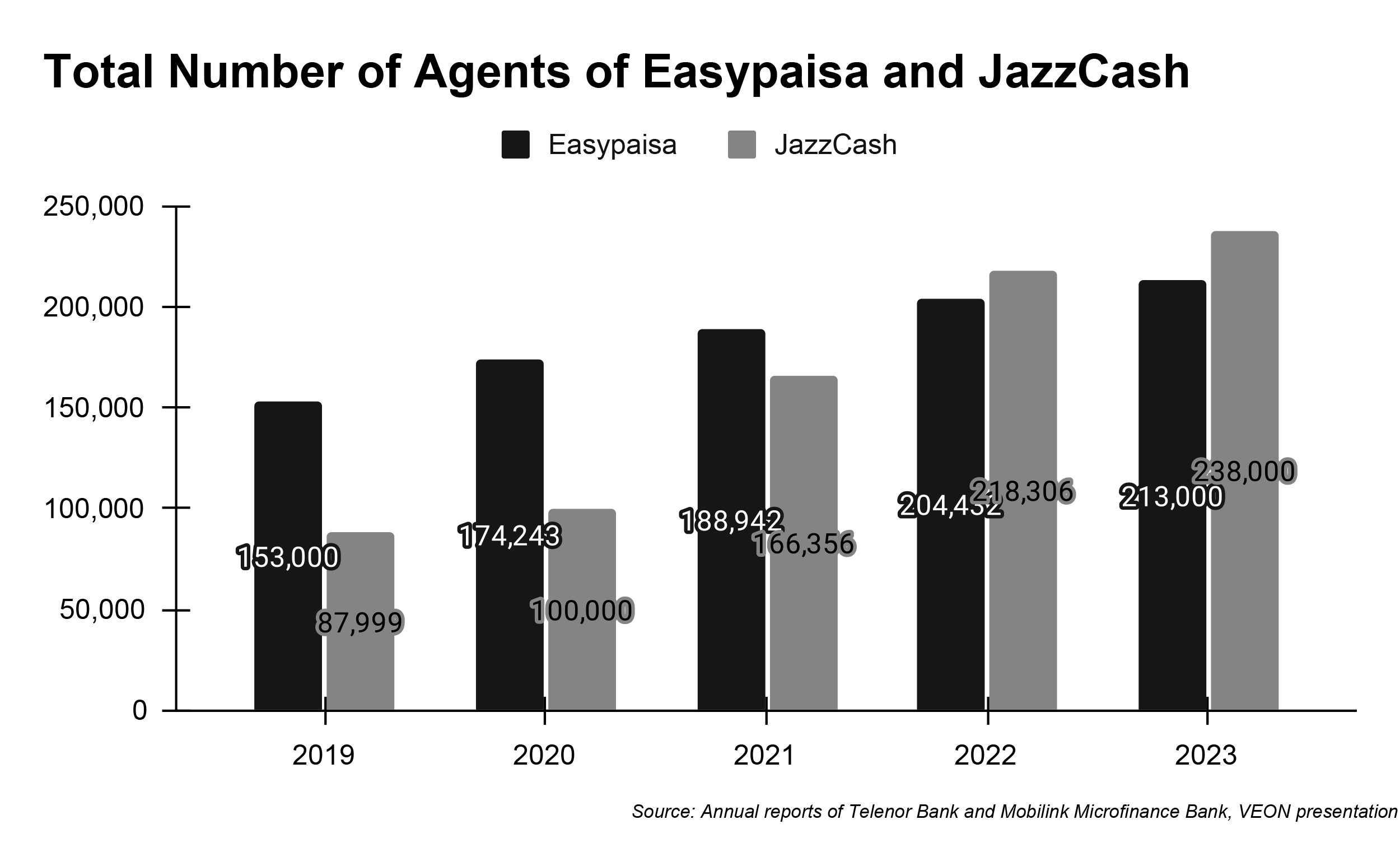

Total Agents

As per SBP, in 2023, the number of branchless banking agents amounted to around 650,000. Easypaisa and JazzCash cumulatively account for around 70% of the total branchless banking agents. The number of agents for Jazzcash stood at 238,000 in 2023 and 213,000 for Easypaisa at the end of the same period.

The Verdict

Determining the biggest digital wallet in Pakistan between JazzCash and Easypaisa isn’t straightforward, as both platforms excel in different metrics. JazzCash leads in Monthly Active Users (MAUs), demonstrating a strong user base and highest mobile app users of 11 million. Easypaisa has also reached over 10 million mobile application users. However, Easypaisa surpassed JazzCash in gross transaction value in 2023.

In terms of loans, JazzCash has led with its early adoption of nano loans, and Easypaisa is also focusing to increase its disbursements.

Ultimately, both digital wallets have carved out substantial and unique niches in Pakistan’s fintech landscape. JazzCash’s broad user base and consistent transaction activity highlight its widespread adoption, while Easypaisa’s transaction value underscores its expanding presence. The competition between these two giants continues to drive innovation and growth in Pakistan’s digital financial sector, benefiting millions of users across the country.