On October 11, the State Bank of Pakistan (SBP) released its annual payment system review for fiscal year 2024. The SBP publishes the Payment Systems Review on a quarterly and annual basis to provide insights into the national payments ecosystem.

The reported data is collected from the regulated entities, including banks, microfinance banks, electronic money institutions (EMIs), Payment Service Operators (PSOs), Payment Service Providers (PSPs), the Raast system, and the Real-Time Gross Settlement (RTGS) system.

Payments can be classified into two distinct categories. One is wholesale payments, which are served through the RTGS system. RTGS allows banks to transfer large sums instantly, essential for high-value transactions like government securities. While the other is retail payments, which are large in volume but relatively smaller in value. These retail payments are mainly processed by banks, MFBs, EMIs, branchless banks (BB), and PSOs/PSPs.

Retail payments overview

Retail payments cater to everyday consumer transactions, encompassing a variety of payment methods such as mobile payments, card-based payments, e-commerce payments, and online banking transfers. These systems facilitate the smooth exchange of goods and services, enhancing the convenience and efficiency of day-to-day commerce. Retail payments, processed by banks, microfinance institutions, and branchless banking systems, saw a dramatic rise in 2024. The expanding share of digital payments is mainly due to the increasing number of customers using digital channels due to the convenience and wide range of products/ services offered through these channels.

Mobile banking apps and internet banking portals have been instrumental in driving the growth of digital payments by offering customers seamless, convenient access to a wide range of banking services 24/7. Likewise, digital wallets issued by BBs and EMIs also played an important role in increasing digital payments.

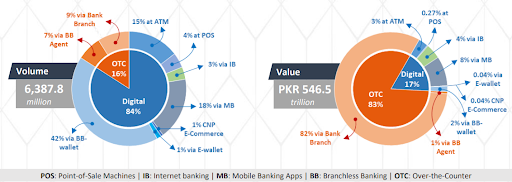

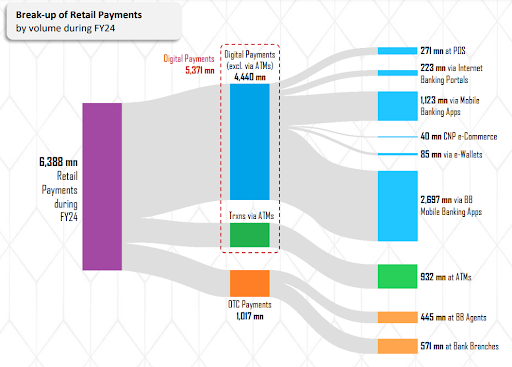

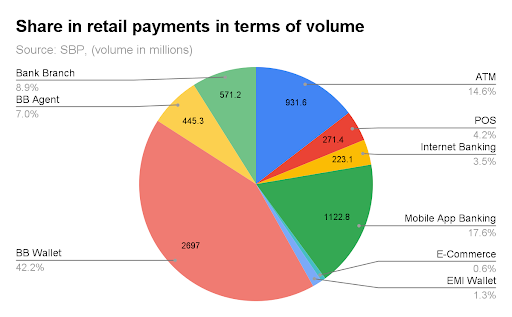

The number of retail transactions surged from 4.7 billion to 6.4 billion—a 35% increase. More strikingly, digital payments accounted for 84% of the total volume in 2024, up from 76% just the year before. This is a clear sign that Pakistan’s financial landscape is shifting online

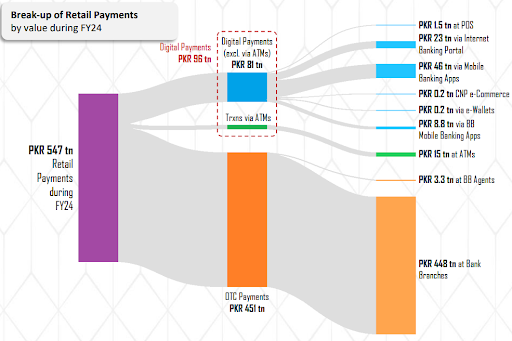

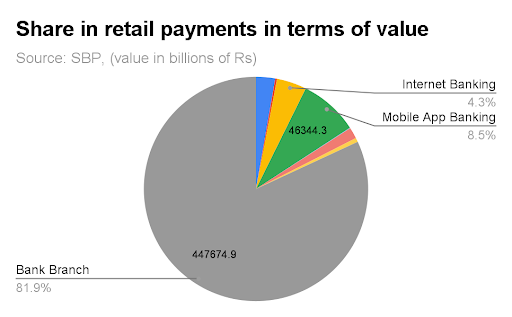

However, in terms of value, paper based transactions occupied the lion’s share of 83% amounting to around Rs 448 trillion.

Within the digital payments landscape, branchless banking wallets had the highest share, accounting for 42% of total transaction volumes at 2,697 million. Mobile banking and ATM channels followed closely in terms of transaction volumes of 1122.8 million and 931.6 million respectively.

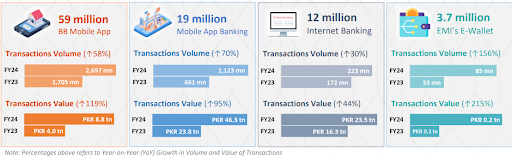

Mobile banking apps and internet banking portals have been pivotal in driving the growth of digital payments by providing customers seamless, convenient access to a wide array of banking services around the clock. During fiscal year 2024, payments through these channels collectively increased by 62% to 1,345.9 million, with the total value rising by 74% to Rs 69.8 trillion. Likewise, digital wallets issued by BBs and EMIs also played an important role in increasing digital payments. During the fiscal year, customers made 2,697 million payments through their BB mobile app wallets and 85.2 million through EMI e-wallets, increasing from 1,704.7 million and 33.3 million during fiscal year 2023 respectively. The value of BB mobile app wallets transactions doubled to Rs 8.8 trillion, while the value of e-wallet transactions increased threefold to Rs 0.23 trillion.

This year, users of internet banking portals have increased by 25%, mobile app banking by 16%, branchless banking (BB) mobile app by 2% and notably customers of e-wallets have increased phenomenally by 85%.

Dying cash transactions?

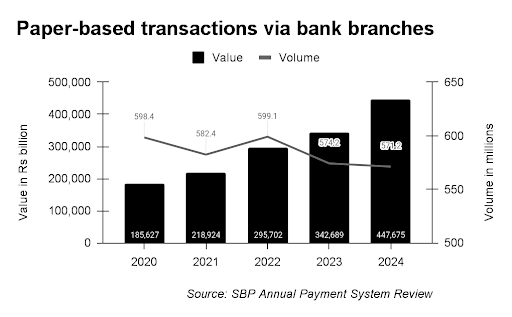

While mobile and internet banking are powering growth, traditional channels are facing declines. Cash transactions, for example, are shrinking year by year. Cash transaction volume via bank branch declined for the second consecutive year. At the end of fiscal year 2022, transaction volume of cash transactions was 599.1 million. In the next two years, the number of transactions decreased by 4.16% and 0.52% respectively, amounting to 574.2 million at the end of fiscal year 2023 and 571.2 million at the end of fiscal year 2024.

Despite relatively lower transaction volumes, traditional bank branches processed a staggering value of Rs 447.7 trillion, resulting in an average transaction size of Rs 783,000. Over the past five years, the average size of transactions through branch banking has grown by 20.4% – from Rs 310,000 at the end of fiscal year 2020 to Rs 783,000 at the end of fiscal year 2024. This underscores the continued importance of physical banking for high-value financial transfers.

The market share of traditional bank branches has been on a sharp decline over the past few years. In 2020, paper-based transactions represented a significant portion of retail payments—45% by volume. Fast forward to 2024, and that number has plummeted to just 8.9%. Similarly, when it comes to transaction value, paper-based payments dominated with a 94% share in 2020. However, by the end of fiscal year 2024, that share had shrunk to 82%. The high cost of time and convenience has played a role in the shift, with digital services offering a quicker, more accessible alternative.

Mobile banking and internet banking

Mobile banking continued to experience robust growth, with the volume of mobile banking transactions increasing by a consistent 70% for the second consecutive year. Transactions rose from 660.6 million at the end of fiscal year 2023 to 1,122.8 million by the close of fiscal year 2024. A similar trend was visible in the value of transactions, which surged by 95%, resulting in Rs 46.3 trillion in value at the end of fiscal year 2024 as compared to Rs 23.8 trillion at the end of fiscal year 2023.

Likewise, internet banking transactions grew by 30% from 172 million last year to 223 million at the end of fiscal year 2024.

Point of Sale (POS)

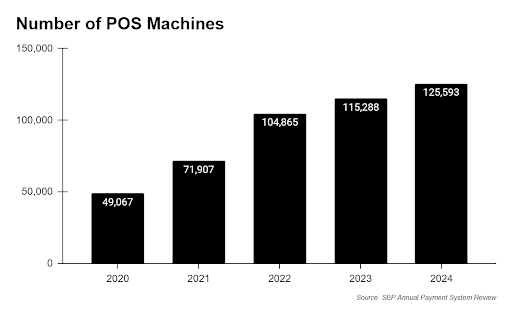

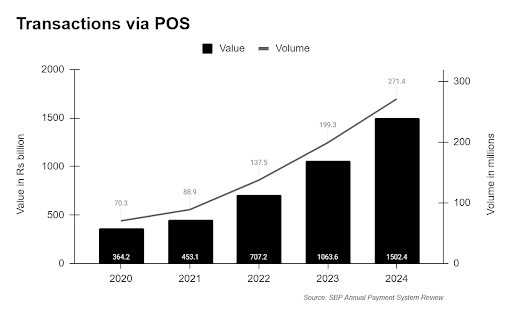

The number of POS machines has grown to 125,593, up 8.9% from last year. This shows more stores and shops are accepting card payments. By the end of the previous fiscal year, there were 85,386 merchants with POS machines. That number has now increased to 98,936 – a 16% jump in just one year. 271.4 million POS transactions worth Rs 1.5 trillion in the latest fiscal year were processed, up 36% in volume and 41% in value from the prior year. The average number of transactions per POS-enabled merchant also rose 18% to 2,744. This suggests consumers are choosing cards more for everyday purchases, and merchants are adding more POS machines to boost their business.

Beyond these traditional merchants, around 516,317 micro-merchants have signed up with major digital banking providers. These smaller shops and stores can now accept payments through QR codes and digital wallets, which is a more affordable option than typical POS terminals. This is especially helpful for small businesses and corner shops, allowing them to offer digital payments without the usual high costs.

Raast

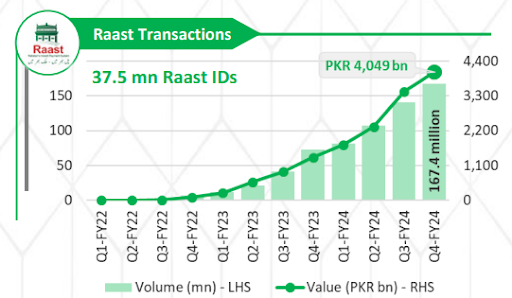

Raast is a back-end payments system that allows real-time settlement of transactions and makes them more instantaneous. The idea was to use it to fix Pakistan’s low digital payment penetration compared to other countries such as India or Brazil. Raast is paving the way to increase the adoption of digital payments. When the SBP first rolled out Raast in 2021 they introduced it with its first feature which is bulk payments. This would allow, for example, companies to disburse salaries instantaneously with the tap of a single button. During fiscal year 2024, a total of 850,000 transactions amounting to Rs 100.0 billion of bulk payments were processed.

Later, the SBP launched Raast person-to-person (P2P) use case that offers a free-of-cost facility for fund transfers between individuals. One can transfer funds using their mobile banking app or internet banking portal using IBAN or Raast ID. Further, SBP has now also launched an interoperable Raast P2M service to facilitate digital payment acceptance for merchants and businesses. The P2M service will enable payment acceptance by businesses using Quick Response (QR) Codes, Raast Alias, IBAN and Request to Pay (RTP).

During the fiscal year FY24, a total of 496.1 million transactions were processed through Raast amounting to Rs 11,558.3 billion. Last year in FY23, the number of transactions stood at 147.2 million with a value of Rs 3,074.4 billion.

Fiscal year 2024 marked an important milestone in cross-border payments, as the SBP and Arab Monetary Fund established a framework for cooperation between Pakistan’s Raast and the Buna cross-border payment system. Key agreements were signed, transitioning the project from feasibility and design to the implementation phase. The Buna-Raast integration aims to enhance accessibility, convenience, and cost-effectiveness for banks and customers, supporting financial integration between the Arab region and Pakistan. The project seeks to address inefficiencies and high costs in cross-border remittances by offering a transparent and secure solution that will promote economic well-being and greater financial inclusion.

It is worth noting that Pakistan receives most of its remittances from the Arab countries. In September 2024, workers’ remittances recorded an inflow of US$ 2.8 billion of which almost 44% was from Saudi Arabia and the United Arab Emirates ($681.3 million and $560.3 million respectively).

RTGS payments

PRISM is Pakistan’s real-time gross settlement system, designed to handle large-value payments. It enables instantaneous fund transfers, settlement of government securities, and ancillary clearing in real-time, ensuring smooth, efficient, and irrevocable transactions. Transactions via RTGS saw a significant uptick, rising from 4.9 million to 5.8 million in volume and from Rs 640.4 trillion to Rs 1,043.1 trillion in value during fiscal year 2023. The major contribution to RTGS transactions came from the settlement of government securities, followed by inter-bank fund transfers, third-party customer transfers, and ancillary clearing settlements, respectively.

Overall, the remarkable growth in Pakistan’s payment ecosystem is driven by a combination of factors. The increasing availability and adoption of digital channels, such as mobile and internet banking, has provided consumers with unparalleled convenience, while regulatory initiatives like Raast have paved the way for faster, cost-effective transactions. The shift from cash to digital payments is also a reflection of evolving consumer behavior, where speed, accessibility, and security are now paramount. Moreover, the surge in e-commerce and the rise of micro-merchants embracing digital solutions further indicate a broader transition toward a cashless economy. Together, these forces are shaping a new financial landscape, positioning digital payments as the cornerstone of Pakistan’s economic future.