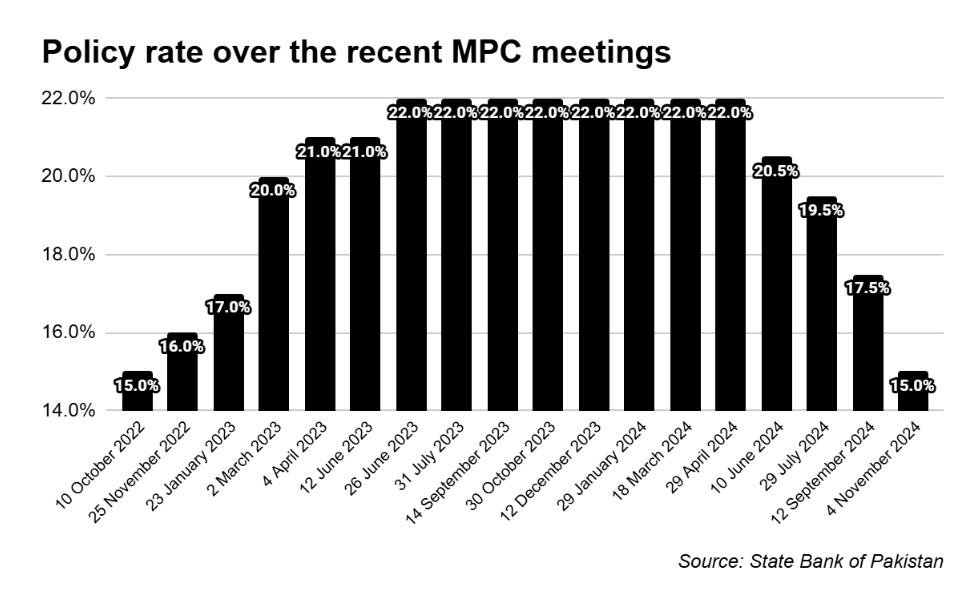

KARACHI: The Monetary Policy Committee (MPC) of State Bank of Pakistan (SBP) met on Monday, November 4 2024, to decide the policy rate of Pakistan. The MPC decided to bring down the policy rate by 250 basis points to 15%, effective from November 5, 2024.

The rate cut slightly above the analysts’ expectation of 200 basis points cut. However, the secondary market had already priced in the rate cut as yields in the secondary market are down to 13-14%

In its MPC statement, the MPC noted that inflation has declined faster than expected and has reached close to its medium-term target range in October (7.2%). The Committee assessed that the tight monetary policy stance continues to play an important role in sustaining the downward trend in inflation. Moreover, a sharp decline in food inflation, favourable global oil prices and absence of expected adjustments in gas tariffs and petroleum development levy (PDL) rates have accelerated the pace of disinflation in recent months.

Considering these developments, the Committee views the current monetary policy stance as appropriate to bring inflation within the 5 – 7% target range and support macroeconomic stability and help achieve sustainable economic growth.

This is the fourth consecutive cut by the SBP. The SBP has cut the rate by 700 basis points cumulatively in last four monetary policy meetings

With this rate cut, the real interest rate now stands at 780 basis points vs earlier 1030 basis points. To highlight, this is still higher than Pakistan’s historic average of 200-300 basis points.

Commenting on the latest announcement, independent economic analyst AAH Soomro said: “MPC now deliberates more on the timing and quantity of cuts more intensively than previously. Sustained single digit inflation coupled with ample dollar liquidity due to rising remittances and exports with lower imports are keeping (foreign exchange reserves) well managed.”

“The rate cuts may slow to 150-175 basis points next time. With unresolved external and fiscal imbalances, I don’t see the economy ready for a 10-11% rate yet”, added Soomro.

Inflation expectations

The SBP’s decision comes on the back of a favourable inflation report, with October’s inflation rate at 7.2%, inching close to the SBP’s medium-term target range of 5-7%. Besides contained demand, improved domestic supply of key food commodities, steady global oil prices and favourable base effect accelerated the pace of disinflation in recent months. The MPC’s outlook remains cautiously optimistic, expecting inflation to ease further if these trends continue.

Considering these developments, the MPC anticipates the average inflation for fiscal year 2025 to be significantly lower than its previous forecast range of 11.5-13.5%. The exact range of inflation will be disclosed in January 2025.

However, this outlook is subject to multiple risks, such as escalation in the Middle East conflict, recurrence of food inflation pressures, ad hoc adjustments in administered prices and implementation of contingency taxation measures to meet shortfalls in revenue. In the post MPC analyst briefing, the Governor Jameel Ahmad highlighted that, current monetary policy has enough room to accommodate any variation of 10-15% in oil prices and other commodities.

Challenges in fiscal sector

In the fiscal sector, Pakistan’s government is showing early signs of fiscal discipline. The first quarter of fiscal year 2025 posted a fiscal and primary surpluses of 1.4% and 2.4% of GDP, respectively, supported by record SBP profits which boosted non-tax revenue

However, tax collections by the FBR have lagged behind targets, raising concerns over meeting the fiscal year 2025 revenue goal – a task that will require substantial effort. At the start of the fiscal year, the government projected interest expenses of Rs 9.8 trillion. But with recent interest rate cuts, strategic buybacks of securities, and a reduction in external debt, interest costs are now expected to fall below Rs 8.5 trillion. This would save the government Rs1.3 trillion, or roughly 1% of GDP.

While debt management might help in containing fiscal expenditure, still, meeting the primary balance target will be challenging, with the MPC underscoring the need for fiscal reforms. Priorities include expanding the tax base and restructuring loss-making public-sector enterprises (PSEs) to sustain macroeconomic stability.

SBP-banks-government nexus

The money supply (M2) growth has increased slightly to 15.2% year on year as of October 25. High money supply in the economy creates inflationary pressures.

However, the MPC noted favourable developments. Owing to SBP’s bumper profits, the government reduced its borrowing from banks and also initiated buy-back operations of its outstanding debt securities to reprofile debt by swapping expensive securities for lower-cost alternatives.

As the net budgetary borrowing from the banking system declined, SBP’s liquidity injections also declined, which is reflected by a decline in outstanding stock of Open Market Operations (OMOs). Outstanding OMOs have declined to Rs 9.4 trillion as of October 21, 2024 as compared to Rs 10.8 trillion at the end first quarter of fiscal year 2025.

In the post-MPC analyst briefing, the Governor highlighted a strategic shift in debt composition, noting that as of June 2024, short-term securities made up 24% of Pakistan’s domestic debt. This share has since dropped to 21%, with plans to bring it below 20% by June 2025.

As per the MPC, “deposits continued to remain the major driver of M2 growth.” However, the MPC believes that deposits will decline in the coming months as private sector lending picks up. “Private sector credit demand is likely to pick up as financial conditions ease,” the MPC noted, anticipating that banks may increase lending to meet regulatory thresholds and avoid penalties on their advances-to-deposit ratios (ADR).

Strengthening economy

The MPC noted encouraging signs of economic recovery, with recent data pointing to a steady pick-up in activity across key sectors.“The initial estimates of major Kharif crops turned out better than the MPC’s earlier expectations. Higher-than-targeted estimates of rice and sugarcane production have more than offset the estimated shortfall in maize and cotton output,” reads the MPC statement.

The industrial sector is also showing robust performance, driven by strong growth in textiles, food, automobiles, and allied industries during July and August 2024. This momentum is expected to build further in the coming months, supported by increased imports of raw materials and machinery, which indicate renewed investment. Additionally, improving business sentiment and more favourable financial conditions are driving the positive outlook for industry. Easing inflation and promising developments in the commodity-producing sectors are likely to spill over into the services sector, creating a ripple effect across the economy.

The MPC expects that, given these factors, Pakistan’s real GDP growth in fiscal year 2025 will exceed previous forecasts, settling within a projected range of 2.5% to 3.5%.

In September 2024, Pakistan’s current account recorded a surplus for the second consecutive month, bringing the cumulative deficit down to $98 million for the first quarter of fiscal year 2025. Despite an uptick in imports, robust remittances and stronger export performance have kept the current account deficit in check.

“The MPC expects that sustained levels of workers’ remittances and export growth will help maintain the current account deficit within the targeted 0-1% of GDP,” according to the MPC statement. The SBP projects that October remittances will reach or exceed $3 billion, potentially reducing the four-month current account deficit to a negligible level.

This, together with the realisation of planned official inflows, is expected to increase the SBP’s foreign exchange reserves to around $13 billion by June 2025. Moreover, the Asian Development Bank (ADB) is also likely to disburse around US$500mn in the next few weeks, which will take reserves to more than $11.5 billion.

In the post analyst briefing, the SBP informed that debt repayments for fiscal year 2025 amount to US$26.1 billion, slightly down from earlier US$26.2 billion due to interest expense adjustment. In the next 8 months, the government has to pay $6.3 billion, rest would be either rolled over or refinanced.