The State Bank of Pakistan (SBP) has announced a revised framework for collateral requirements and counterparty eligibility under its Monetary Policy Lending Operations and Mudarabah-Based Financing Facilities.

The updated measures, which include stricter compliance criteria and graded haircuts on government securities, aim to strengthen risk mitigation and ensure the stability of financial markets. These changes will come into effect on July 2, 2025.

The SBP has introduced a detailed haircut structure based on the residual maturity of government securities used as collateral.

Applicable haircut on up to 3-months Maturity (Residual) Buckets will be 0.2%, 3–6-month Maturity (Residual) Buckets 0.4%, 6 to 9 months at 0.6%, 9-month to one year at 1%, 1–3 years 2%, 3–5 years 3.5%, 5-7 years a haircut of 5%, 7–10 years 7% and a haircut of 10% will be applicable on Maturity (Residual) Buckets of above 10-year.

For floating-rate instruments such as Pakistan Investment Bonds (PIBs) and Government Ijarah Sukuks (GIS), the haircut will depend on the frequency of coupons or rentals, with quarterly and semi-annual payments placed in different maturity buckets.

The SBP has set specific eligibility conditions for institutions seeking access to lending operations, including:

- Regulated Entity: Institutions must be regulated by the SBP.

- Current Account Maintenance: Maintaining a current account with SBP-BSC is mandatory.

- Participation in PRISM: Institutions must be part of the Pakistan Real-Time Interbank Settlement Mechanism (PRISM).

- Financial Soundness: Institutions must comply with solvency and liquidity requirements, such as the Minimum Capital Adequacy Ratio (MCR), Leverage Ratio, Liquidity Coverage Ratio (LCR), and Net Stable Funding Ratio (NSFR).

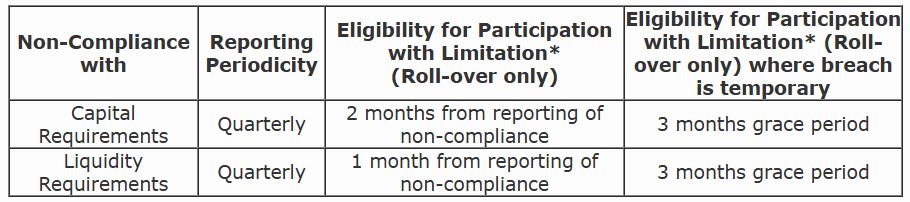

Institutions failing to meet these standards will be placed on a “watch list” with limited access to financing facilities. For temporary breaches, a grace period of up to three months will be granted. However, institutions failing to rectify non-compliance will face suspension from SBP operations.

Institutions falling under specific criteria will be deemed ineligible for participation in lending operations. These include institutions declared as failed under the Deposit Protection Corporation Act 2016, those under liquidation or resolution, and those whose licenses have been revoked.

The SBP emphasized that institutions must address liquidity and capitalization shortfalls within the specified grace period or risk suspension.