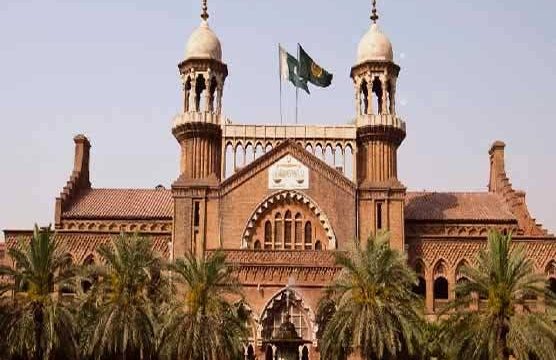

LAHORE: The Lahore High Court (LHC) expressed strong disapproval over the Federal Board of Revenue’s (FBR) exemption from paying court fees for filing tax references, while ordinary litigants are required to pay Rs 50,000 per reference.

The court described this as a clear case of discrimination, depriving Pakistani citizens of equal access to justice.

The court’s remarks came during its ruling on the case concerning the abolition of the Commissioner Inland Revenue (Appeals) under the Tax Laws (Amendment) Act, 2024. The LHC, Rawalpindi bench, concluded that the amendment is obstructing the judicial system, causing delays in other cases, and hindering the dispensation of justice.

The court emphasized that while the FBR faces no financial barrier in filing tax references due to its exemption from court fees, ordinary litigants are burdened with a Rs 50,000 fee per reference. This unequal treatment, according to the LHC, violates the fundamental rights of citizens guaranteed under Articles 4, 10-A, and 37(d) of the Constitution.

Additionally, the LHC noted that the Tax Ordinance outlines a multi-stage appeal process, beginning with the Commissioner (Appeals), then the Appellate Tribunal, and ultimately, the possibility of a Tax Reference to the Court. However, the amendment has removed one forum of appeal, further complicating the legal process.

In its reply, the Ministry of Law and Justice explained that the goal of the amendment was to reduce the number of appeals, simplify the process, and expedite case resolutions. It cited concerns over delays caused by an arbitrary constitution of benches and insufficient bench numbers, which have led to a backlog of cases, with approximately Rs 2 trillion in revenue held up in litigation before the Appellate Tribunal Inland Revenue (ATIR).

The ministry argued that reducing appeals would result in administrative cost savings and discourage frivolous litigation.