If I say the word Hallmark, what do you think of? Readers familiar with US companies will remember the giant card company, founded over a century ago, and now with upwards of $5 billion in revenue. Most importantly, Hallmark ingrained itself in US culture: a Hallmark card is synonymous with a short, sweet, sometimes even corny card for special occasions.

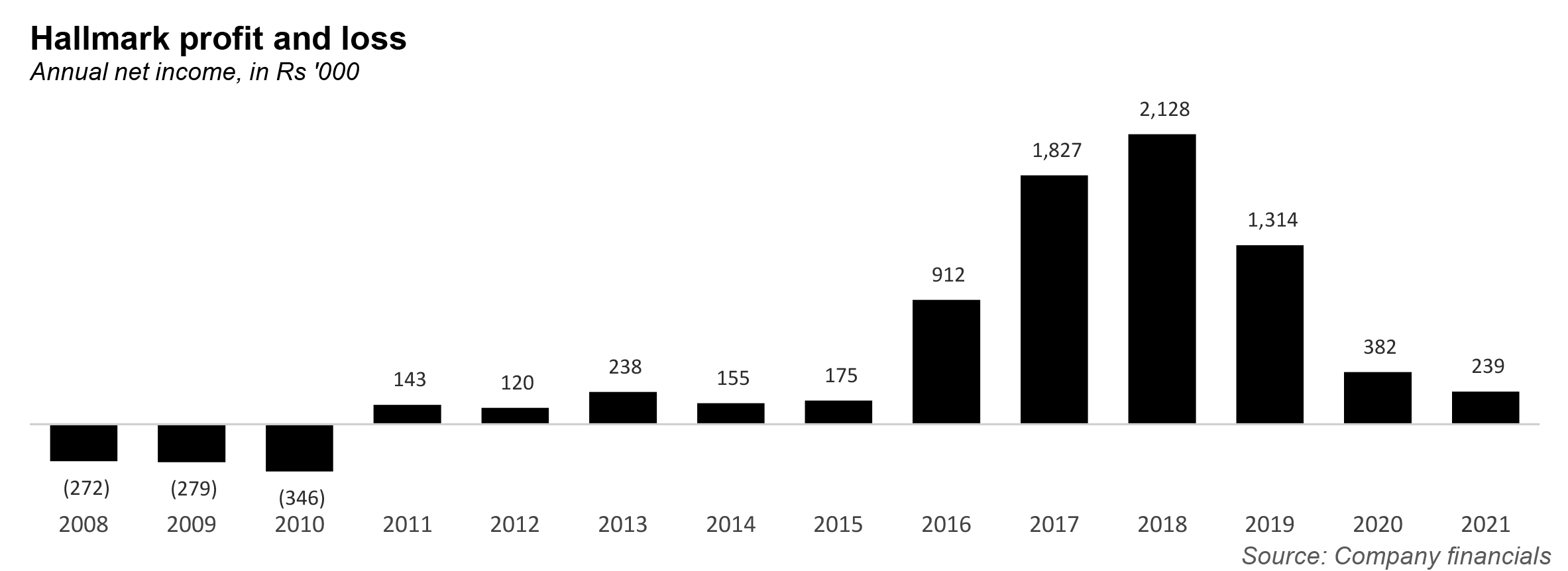

Sadly, the Pakistani company Hallmark has not had the same luck, nor has it had the same focus in what it has wanted to do with itself. For a while they tried to be synonymous with insurance – that failed miserably. Then it tried to pivot to IT related services, with somewhat better luck. In fact, what’s remarkable is not that Hallmark failed to market its brand, but that it managed to have a brand at all – for a good chunk of this decade, the company barely existed.

These days, it is busy gearing up for a potential buy-out. On August 6, the company told the Pakistan Stock Exchange (PSX) that an offer letter had been received by Muhammad Munir Muhammad Ahmed Khanani Securities Limited (or the manager to the offer) on behalf of Irtaza Zafar Sheikh and GAZPAK (Private) Limited to acquire 82,890 shares and control of Hallmark Company. It would represent the most interesting thing that has happened to this company in years – that is, apart from almost falling apart.

So, first some history. Hallmark Company Limited (formerly “Hallmark Insurance Company Limited”) was incorporated as a Public Limited Company on 31 October 1981 under the repealed Companies Act, 1913, (thereafter the Companies Ordinance, 1984 and now the Companies Act, 2017) and subsequently registered as an insurance company under the Insurance Act, 1938, (now the Insurance Ordinance, 2000) as an insurer.

Now, that date of the Insurance Act is key. Most of Pakistan’s financial laws, regulations, and streamlining of business sectors happened in the 1990s and early 2000s (part of the general awakening of the country, years after independence, that it is, in fact, part of a global financial system). And so, that 1938 act was examined and reissued as the Insurance Ordinance, 2000.

There was only one problem. With the promulgation of the Insurance Ordinance 2000, the requirement of minimum paid up capital for an insurer was increased, to Rs300 million. Unfortunately Hallmark was not able to increase its paid up capital to the required minimum level. In fact, it ceased to underwrite insurance business, starting January 01, 2003.

The situation remained like that for the next thirteen years. The earliest available annual report from 2013 gives some clues as to what happened. Essentially, the management decided that it was simply unable to procure those Rs300 million over the course of a decade, and in its annual report, confusingly blamed the deteriorating ‘bad law and order situation’ in Karachi as one of the reasons it could not meet the minimum requirement (is that the situation was so bad that not one investor wanted to spend Rs300 million on an insurance company?)

Instead, the company had an investment property of Rs800,000, which gave a return of Rs25,000 a month, in rent. It also sold some assets for Rs51,000. Basically, a former insurance company was now acting as a basic landlord. And even that investment property was questionable: as an auditors report from 2014 stated, there were no title documents or valuation of the land, nor could the income generated from the land be verified.

Obviously, this situation was untenable. But rather than fade away into a renting business, the company finally woke up in 2017. That was when the members of the company resolved that they were not interested in injecting the required minimum paid up capital (this decision took them 14 years to make).

Instead, the company pivoted into information technology, a wise move considering Pakistan was now entering the digital age, and 4G services had launched in 2014. Today, the company says it offers devices for datacenter, end user computing and identity and security portfolio. It also deals in pre and post sale support services.

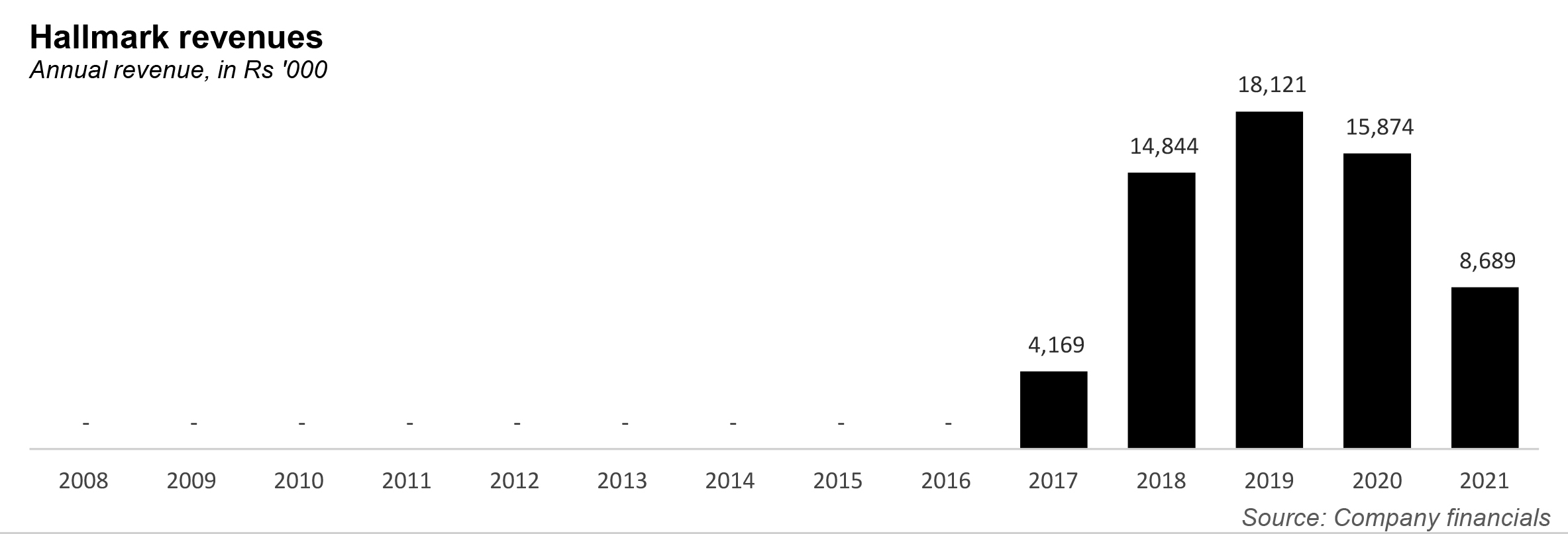

Most importantly, it finally saw that magical figure: revenue. In 2018, its revenue was Rs14 million; in 2019 it hit Rs18 million, and in 2020 it stood at Rs15 million. The year 2021 was not as great: the company’s annual report blamed reduced business during the Covid-19 pandemic.

Still, the company is now being eyed with interest by others. Gazpak, a company incorporated only in March 2021, along with an individual Irtaza Zafar Shaikh, submitted a public announcement of intention in June 2021. Previously in March, Gazpak had acquired more than 51% stake in the Landmark Spinning Industries Limited, along with the management control. Little else is known about Gazpak, except that it is owned by a man named Salim Chamdia, and a woman named Zainab, who live in Karachi.