Every time technology disrupts an exploitative business sector, the crying, wailing, and frothing at the mouth by Whatsapp uncles is inevitable. We saw this in 2016, shortly after Savaree, Careem, and Tripda went mainstream. We saw this recently in 2020 when the All Pakistan Restaurant Association announced the suspension of business with Foodpanda, citing unfair business practices.

That is not to say that these tech forward start-ups do not then become exploitative entities in and of themselves, but for a brief glowing moment they offer respite. And for every one of those brief moments there is panic and outrage. And now, the start-ups are coming for something that is perhaps and nearest and dearest to the hearts of the Pakistani Whatsapp uncle – real estate.

Having a ‘plot’ (pronounced pee-lat) in Pakistan, particularly in Lahore and Punjab, is a concept that both boggles the mind and makes a person sad. There is such little investment opportunity in the country and markets and financial institutions are so far removed from the middle and upper middle class that most people find themselves investing in things like real estate and gold. And because people park outrageous sums of money in these properties, the market maintains a self fulfilling prophecy of prices remaining high.

Now, the start-ups are planning on tapping into the same obsessions and offering small term investments in real estate, in a bid to offer the true middle class of Pakistan a chance to own and flip a slice of the real estate bubble. The Real Estate Investment Trust (REIT) model is facing disruption from several stealth startups.

Notably, these include xState and FracEstate, which allow budding investors to own a piece of Pakistani real estate through fractional ownership using digital security tokens. Investors can buy and sell their property tokens on a digital exchange or keep and gain a yield.

“The solution is to create liquidity in real estate, allow investors to liquidate their investments in real estate quickly,” said Asif Khan, co-founder & CEO of xState. “There is a need for an exchange for real estates, like Nasdaq or Binance for real estate properties.”

Khan said that xState plans to give liquidation to the traditional real estate holdings and transactions, help Pakistani expatriates invest in premium locations without needing to visit the country to transfer their money, and empower real estate agents to earn a 1% commission through a partner program.

“Pakistan’s GDP is USD $280 billion but $400 billion are parked in Pakistani real estate,” said Khan. “Comparing it to the USA, their economy is over $20 trillion but only $10 trillion are parked in real estate. xState is a real estate investment platform that enables anyone to invest in real estate with as low as Rs. 5,000 and allows for an exchange in real-time. Think of xState as Binance for real estate.”

Promising greater efficiency, higher security, and lower costs to the financial industry, xState is a real estate equity crowdfunding and exchange platform that intends to use tokenization, which enables investment in the form of digital tokens backed by real-world securities or assets, to transform the real estate investment landscape in Pakistan.

Signaling confidence

It is a concept that has SECP approval under the 2nd Cohort of Regulatory Sandbox shortly after publishing a position paper in 2020 titled Regulation of Digital Asset Trading Platforms, which introduced the concept of digital assets and gauge the opportunities and risks of introducing the same in Pakistan, under a bespoke regulatory framework.

With the position paper from the SECP signaling to investors and business builders that the financial regulatory agency would recognize the need to allow the new middle class to invest in real estate at affordable prices, through fractional ownership, three companies have emerged: DAO PropTech in September 2020, xState in January 2021, and FracEstate in July 2021.

In an RFP from Karandaaz from mid-2021, the financial inclusion nonprofit sought a landscape study and framework for the regulation of digital assets & digital asset trading platforms in Pakistan. Industry insiders told Profit that the outcome of the RFP will become law.

Within a month of this news, industry insiders learned that Foodem.com co-founder Kash Rehman – who recently joined Sarmayacar Ventures as a limited partner – was in Pakistan and meeting with various mobility industry co-founders in a bid to find partners for a service around real estate tokenization and another InsurTech service around offering extended warranties.

Sources close to Kash told Profit that the drawbacks with real estate tokenizing, such as lack of management and deeds, scalability problems, and liquidity paradoxes, led Kash to seek alternative business models for investment, such as cloud kitchens and InsurTech.

As reported by Profit, Kash recently invested an undisclosed amount towards Lettus Kitchens, a cloud kitchen business, at a rumored $3 million valuation. Sources said that upon studying the Pakistan market at length, he was bearish about fractional ownership.

Tokenization barriers

“The biggest challenge is to ensure that the title of the underlying property is clear,” said Mubariz Siddiqui, a legal practitioner with a demonstrated history of working with early-stage businesses and investors in the technology industry. “So, for fractional ownership, the customer gets shares of a company. The company owns the property. While the customer’s ownership of the shares is fine (record with the SECP), the company’s ownership of the property could be disputed easily.”

Among the barriers to the idea that Kash came across were the capital gains tax structures which create a disincentive for the sale of real estate before the holding period. As reported by Profit, a longer holding period indicates that property was not bought for the purpose of making a profit on its resale, and hence, leads to lower taxes. On the other hand, a higher amount of capital gains earned is subjected to a higher tax rate by the authorities, leading to higher taxes.

“The first property we listed had a holding period of 2 years as we overlooked this,” said Azfar Kashif, the VP of business development at xState. “In that case, xState will bear the CGT on its own and not let its investors get affected by that. All of our next properties including the current one have a holding period of 4 years, in which case CGT won’t be applicable. If anyone wants to sell their shares in our properties, they’ll be able to do it on the xState Xchange launching next month. Since that is P2P trading, CGT won’t be applicable to that. The property itself will only be sold after the holding period.”

The second challenge with regards to real estate tokenization is how the token will remain linked to the asset regardless of what occurs in the real world: the most common example for land in Pakistan is the creation of a mosque on the property by land grabbers, which inevitably hurts the token owners.

“This burden of responsibility lies on us,” said Kashif. “We pick prime properties in trusted societies like DHA, Faisal Town / Hills, Eighteen, and others where there are no NOC or litigation issues. It’s because we don’t need to go for cheap properties. That is exactly the benefit we’re providing to our investors that through us they can invest in those safe properties that were previously out of their budget. We stay away from all those projects where there is high speculation & are still pending NOCs etc. This is also the reason we have expensive but few properties listed on the portal.”

The third challenge is the uncertainty of the value proposition in the eyes of regulators, central banks, private companies, and even local communities. Regulators will be focused on striking a balance between supporting innovation and ensuring systemic financial stability. Furthermore, they will need to consider whether to include tokenization under existing legal frameworks or develop new ones.

“This is an unregulated space as of now. e.g. In Dubai, this is being regulated by DFSA,” said Kashif. “Here, SECP is yet to regulate this space. Since we lie in equity crowdfunding, it’s a space that is not prohibited by any laws as of now. However, it would be great if there were regulations that would actually add a further layer of security for our investors. This will also increase the element of trust in a business like ours.”

The fourth challenge pertains to the extensive nature of real estate scams, wherein either the same plot is sold repeatedly to multiple investors or they are charged an unfair premium without understanding the basis behind the unfair pricing.

“The real estate market is home to a lot of scams, with people dividing properties in the form of kiosks, pearls, and cubes while calling this approach fractional ownership,” said Owais Barlas, the co-founder & chief sales officer at DAO Proptech. “And as a result of those deals being exposed as scams, it has left a bad taste for prospective buyers and investors. So now people associate fractionalization with a scam.”

Speaking with Profit, Barlas said that an inherent problem with fractional ownership is the tendency of double-spend: wherein one property can be oversold, which happens when the seller does not know or does not disclose the total supply of investments available for the real estate they are selling.

“If there’s a building, it matters to know whether it’s half a million square feet or what the total area in terms of square foot per floor is,” he said. “Even if the seller knows this, there is no way for a buyer to verify the number of transactions completed and the number of investors who have purchased the available units and whether the property has more area available to sell. To resolve this, we need a distributed ledger for that particular property.”

Similar to how Binance and Nasdaq operate, an exchange for real estate properties would help investors evade sellers that intend to sell the same property to them that has already been promised to countless others.

“To address this, we need a database or a blockchain where the transactions are transparent and irreversible,” he said. “The lack of transparency also creates resistance for investors that want to dabble in fractional ownership – buyers are unsure about where they are investing, whether the price being set is fair, what premium – if any – is being charged to them.”

He added that when it comes to fractional ownership of land plots, it enables liquidity and if not monitored properly it can lead to high speculation which may artificially drive up the price within hours and days, which usually does not happen with regular real estate transactions, that are relatively opaque by their nature, and thus can heighten FOMO and trigger frequent trading of fraction of a plot at speculative prices.

“While fractional ownership won’t solve all the problems in the real estate industry, it will create a new generation of financial freedom by giving investors data on the valuations, the premium being charged, and transparency around all reactions surrounding that asset,” he said.

Global acceptance

A report from Moore Global stated that tokenization is going to be a disrupter in global property markets because it has the potential to lower the cost of capital, increase the pool of potential investors and increase liquidity.

Dan Natale, Global Leader of Moore Global’s Real Estate Group, said that it could take time for a critical mass of institutions to invest with confidence in tokenized real estate, adding that if even just 0.5% of the total $280 trillion global property market were tokenized in the next five years, it would become a $1.4 trillion market.

“The concept of a REIT is significantly different,” said Kashif. “In that, the company has its investment holdings in real estate, and people buy shares of the company. In our case, people only use our platform to buy shares, in particular, assets that they choose themselves, based on the info provided by us. We have one property live right now but will have multiple options pretty soon. Investors will only hold shares & “investment certificates” for those assets, not xState itself. We’re a centralized platform right now but in the future will be moving to decentralized and will be blockchain-based. There are similar models in the rest of the world, including Dubai, the UK, Australia, etc.”

In the United Arab Emirates, Emaar Properties partnered with the distributed ledger technology of IBM in 2020 to pilot the tokenization of its real estate assets. Lead Real Estate plans to tokenize Tokyo real estate projects on a platform built by Securitize. And Tokai Tokyo and iStox invested in Hash Dash Holdings. Last month, real estate tokenization platform RedSwan CRE began efforts towards raising $5 million preferred equity capital, with the company reporting that it has already tokenized more than $2 billion worth of the commercial real estate.

Working with Japanese blockchain startup LayerX, last month Mitsui Bussan Digital Asset Management announced plans to issue regulated digital asset securities linked to real estate. The company claims to have a project pipeline of $170 million for assets to be tokenized, with plans to reach $910 million within three years. Using its Progmat security token platform, Japanese firm MUFG Trust is planning real estate asset-backed securities.

“The cons with real estate tokenizing exceed the pros, although the phenomenon has great potential in a more mature market,” said the former CTO of a leading bank. “In Pakistan, real estate tokenization will face implementation obstacles when converting the real estate industry to blockchain technology. As such, the success of FracEstate or xState is dependent on the regulator’s view of blockchain technology, which we know is bearish.”

Establishing trust

An advisor to the central bank told Profit that real estate tokenization companies such as xState would have to think about the incentive mechanism and the type of participant behavior that could add the most value to the platform, adding that xState needs to consider which type of tokens it plans on using and whether those tokens have additional applications.

“The tokens used by xState and FracEstate will impact its tax treatment and if it has additional applications, this may create a wide tax implication depending on the jurisdiction at hand,” said Ali Rehman, founder of Allee and co-founder of Find The Venue. “They need to make the distinction between utility, equity, and security tokens, and deciding which rights are available to token holders are vital to determining how it will be taxed and regulated.”

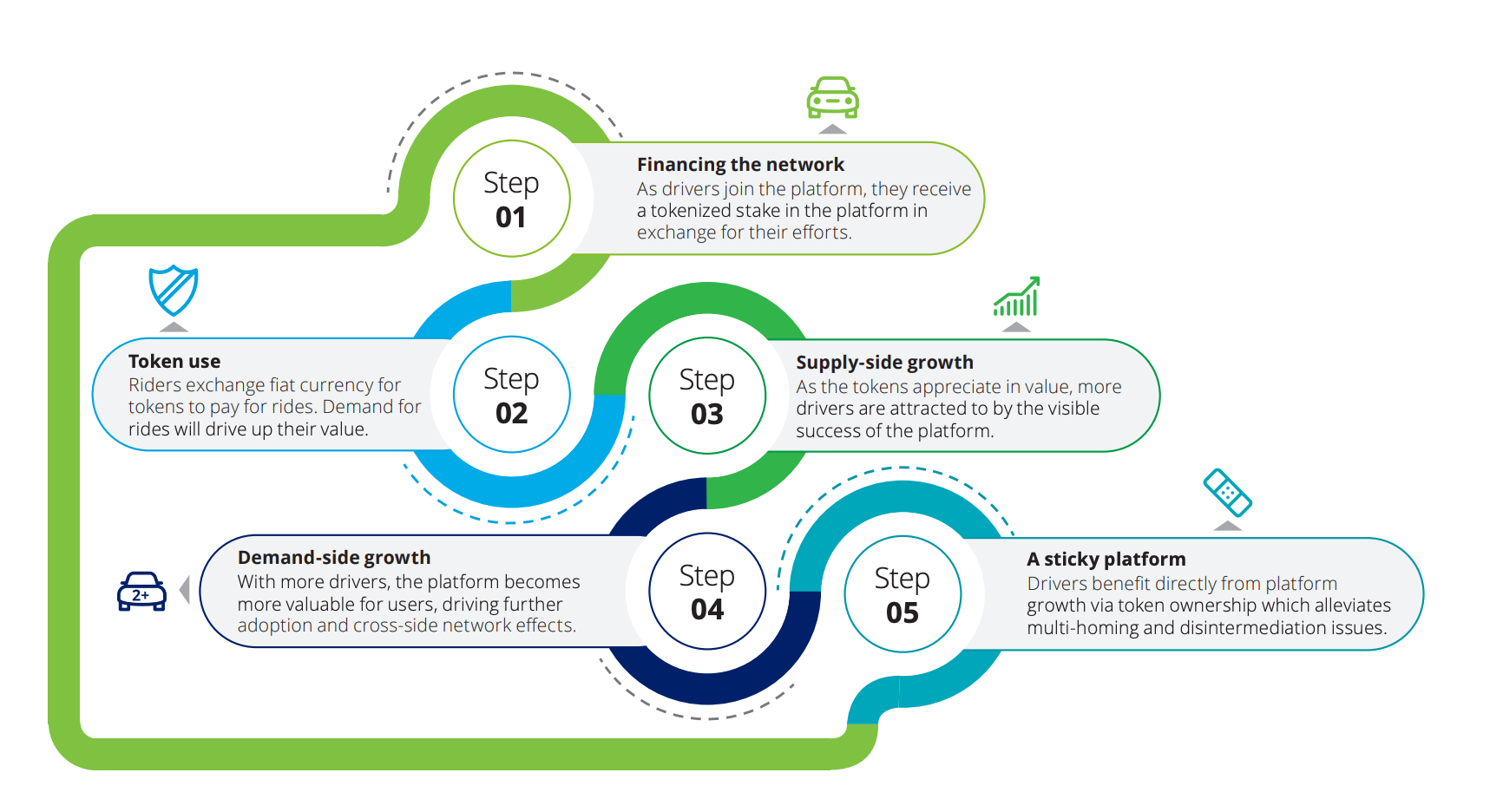

An incentive mechanism that is developing rapidly, tokenization has the potential to become the new means of generating stronger indirect network effects and subsequent. In the Pakistan market, tokenization could address challenges such as multihoming and disintermediation.

“Both xState and FracEstate would do well to get the necessary certifications and accreditations to become 100% Shariah-compliant and use state of the art on-demand cloud computing platforms to secure their service infrastructure,” said Rehman. “They should also implement two-factor authentications at every step.”

Kashif told Profit that xState is in the process of converting to a public limited company and has initiated the process with the SECP. This will ensure higher levels of transparency as xState’s records & audits will be public.

“I am hugely bullish on fractional ownership in real estate,” said Habibullah Khan, a strategy and branding advisor for early-stage companies. “Wheels [are in] motion to set regulations.”

Excellent financial innovation…

grillage foundation