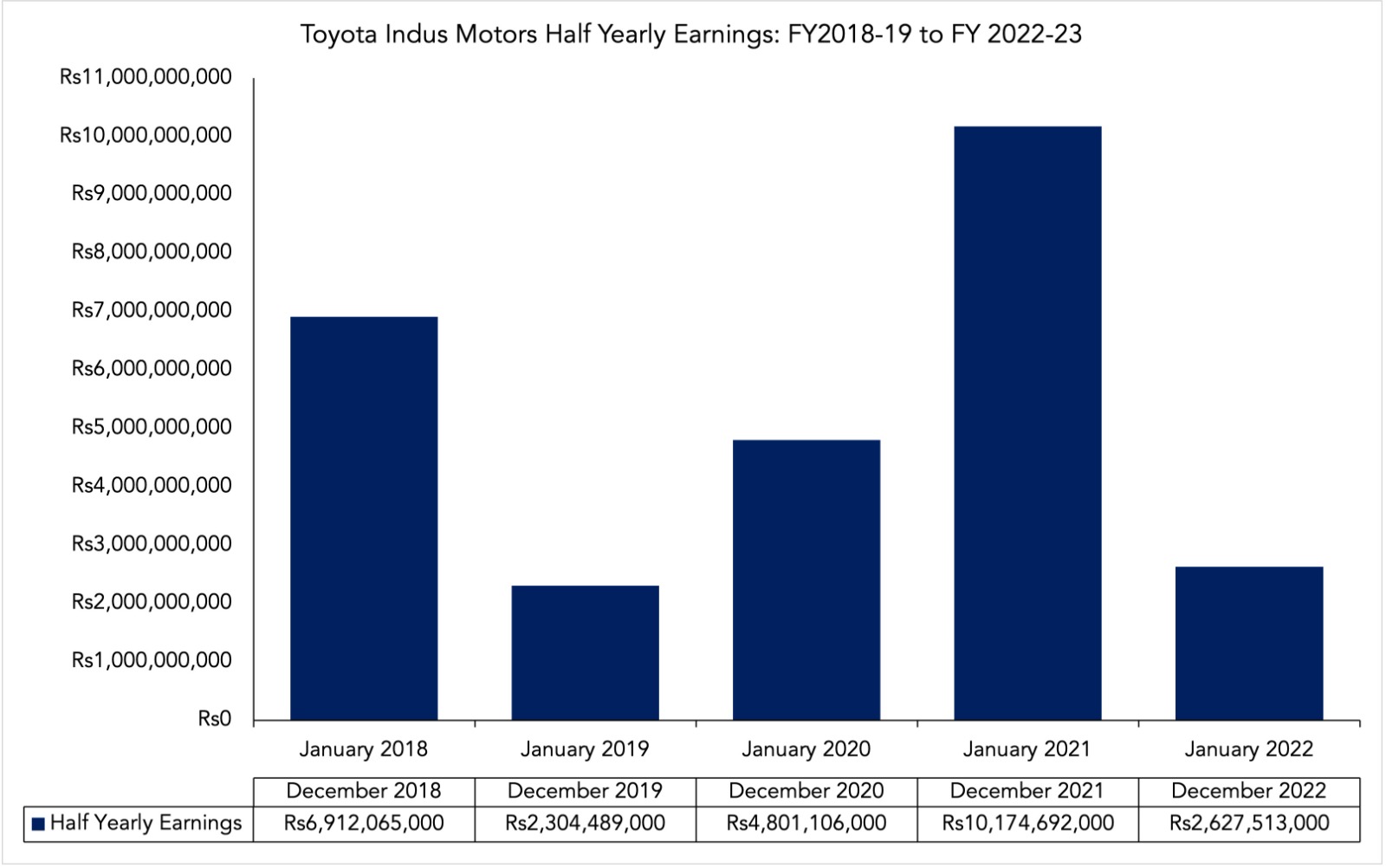

LAHORE: Toyota Indus Motors has released its quarterly financials for Q2FY23 on the Pakistan Stock Exchange. The financials reveal that Toyota was able to record a Quarter-on-Quarter (QoQ) increase of 2.59%, however, its half year financials stand at Rs 2.67 billion. This amounts to the lowest half-yearly earnings Toyota has recorded since December 2019, with this also being the second lowest half-yearly earnings in the past five years.

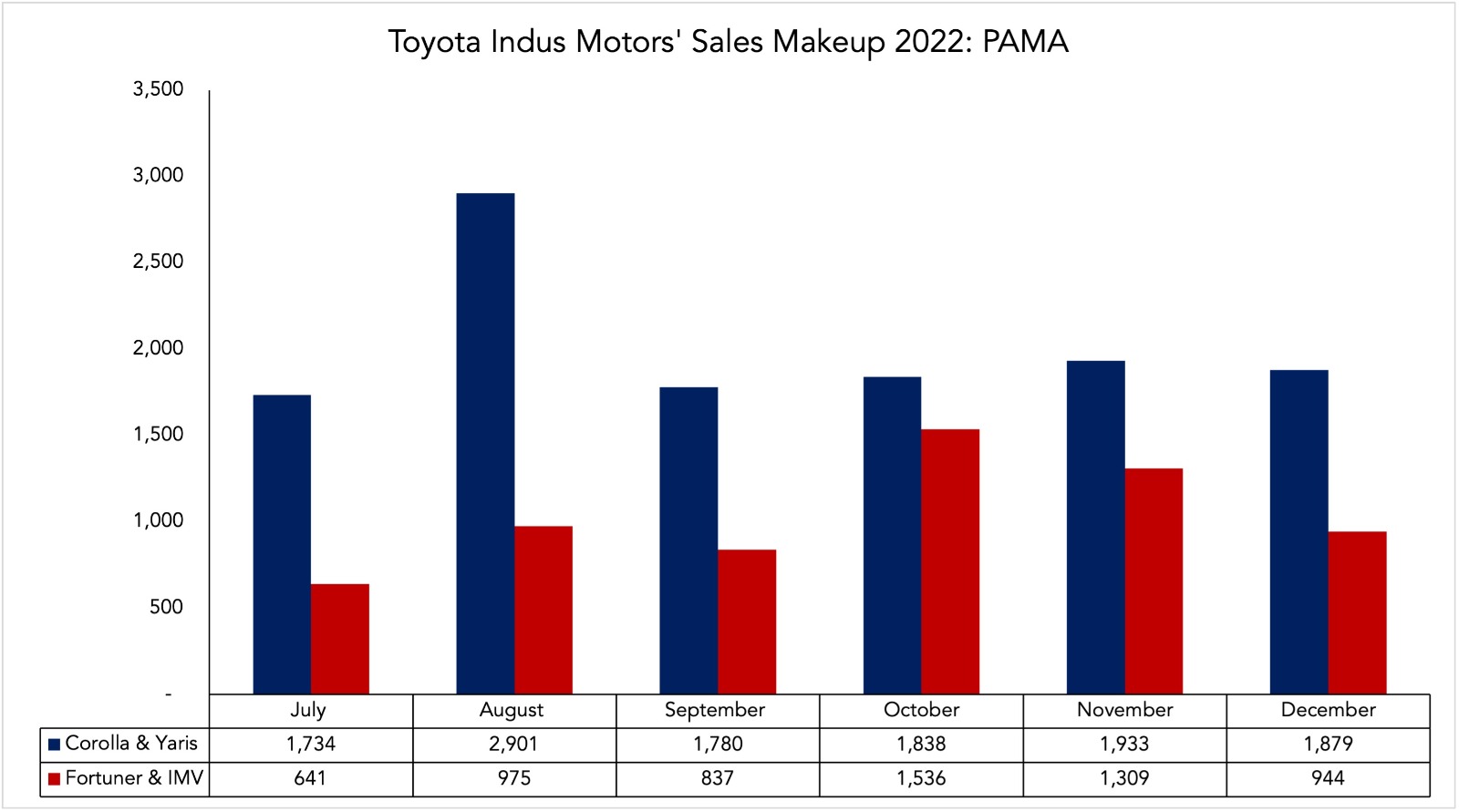

Toyota’s sales revenue grew by 33% QoQ to Rs 49.5 billion. The whopping 33% is significant given that Toyota only saw a 6% increase in the number of units sold QoQ based on the sales data provided by the Pakistan Automotive Manufacturers Association (PAMA). The increase is likely a result of the composition of vehicles Toyota sold over the period. Q1FY23 saw the Toyota Yaris and Corolla constitute 72% of total sales, with the remainder being attributed to the Toyota Fortuner and its IMV line of vehicles. Q2FY23, in contrast, saw the Yaris and Corolla’s share dip to 60% with the shares of the Fortuner and the IMV line of vehicles rising to 40%.

On a Year-on-Year (YoY) basis, Toyota’s revenue is down 29% from the Rs 69.6 billion it earned over the same period last year.

Toyota, however, still recorded a gross loss of Rs 490 million. This is an 80% QoQ reduction on the Rs 2.3 billion gross loss it incurred in the previous quarter. The change in Toyota’s sales composition is also the likely reason for its gross profit margin (GPM) improving from -6.33% last quarter to -0.99% this quarter. Its current GPM still stands significantly lower than the 7.56% it recorded last year over the same period.

Toyota’s operating expenses have increased by 4.86% QoQ to Rs 954 million. This is also a 2.27% YoY increase. Similar to last quarter, Toyota was able to record sizable income from its other earnings to bolster its overall earnings, and thereby prevent a cumulative loss. Toyota’s quarterly financials do not reveal the make-up of its other income. However, its other income elucidates upon how these are the gains that Toyota makes from engaging in investment activities.

Toyota’s other income, similar to last quarter, exceeds its operating income which, again, indicates that Toyota made more money from being a bank or investment institution than a car company. Its other income stands at Rs 3.45 billion, and is Rs 4.89 billion in excess of its operating loss of Rs 1.4 billion. Toyota’s other income has experienced a 33.09% QoQ decrease, but it is still 38.07% higher on a YoY basis.

Toyota ended the Q2FY23 with a net income of Rs 1.3 billion. This amounts to a 2.59% QoQ increase but a 72% YoY decrease.

Looking at the quarter ahead, it is likely that Toyota will do similarly, if not worse. By similarly, we mean that it will record a sluggish QoQ increase if it does at all. Toyota has not only undergone three upward price revisions across January and February, but it has also observed non-production days from February 1 to February 14. Toyota has announced that it will operate a single shift going forward from February 15 due to its inability to maintain its inventory levels which in turn are a consequence of the country’s forex, and the subsequent import situation.

Toyota has also reinstated its refund policy earlier this month. The refund did not lead to a significant dip in sales according to Asghar Ali Jamali, CEO Toyota Indus Motors, however, it remains to be seen whether a similar outcome will happen this time. Toyota’s biggest challenge, beyond its supply-chain quagmire, will be the waves of inflation that will erode customers’ purchasing power in the months to come. January has already recorded the highest inflation in the past five decades, with most expecting February and March to exceed this.

Thank you for sharing a post, nice to read it, good work keep going

Wow, this blog post is incredibly uplifting and inspiring! It’s evident that the author put a lot of thought and effort into crafting such a positive message. I appreciate how they highlighted the importance of gratitude and self-care, reminding us all to focus on the bright side of life. Thank you for spreading positivity and making my day brighter with this wonderful post!