KARACHI: U Microfinance Bank (UBank), after a significant delay, has at last unveiled its much-anticipated half-yearly reports for January 2023 to June 2023. Usually, the half-yearly reports are released by the end of August or early September. However, UBank released its half-year report at the end of November.

What’s intriguing in these newly released financial statements is the restating of UBank’s year-end figures for the concluded year of 2022. The statements offer surprising insights and dispel previous uncertainties.

Prior speculation was circulating about a hefty Rs 8 billion provisioning charge (expected losses) imposed by the State Bank of Pakistan (SBP) on UBank resulting in the bank becoming insolvent (negative equity). A sudden change in leadership of UBank in October along with the delay of half-yearly financial reports added fuel to speculations. Soon after, in a press release issued on October 23, the PTCL Group vehemently dismissed all allegations and speculations surrounding the financial well-being of its wholly-owned subsidiary, Ubank. The leading ICT services provider in Pakistan reiterated that Ubank possessed a robust and resilient capital base.

The suspense has finally been shattered by the freshly disclosed financial statements where the equity figure stood at Rs 5.3 billion at the end of June 2023. For context, microfinance banks are supposed to maintain a minimum capital of Rs 1 billion as mandated by the SBP. The equity figure stands at five times the required amount, showcasing a significant surplus in comparison to the mandated threshold. Moreover, the bank reported an impressive Rs 1.4 billion in profit after tax.

While the recent financial statements have revealed that UBank is nowhere near default, the statements also reveal revisions made to the 2022 figures. UBank wrote off Rs 1.7 billion as credit loss allowance in its restated half-year 2022 statement, a significant increase from the initially reported Rs 248 million, a difference of around Rs 1.5 billion. This recalibration stems from the application of the International Financial Reporting Standards (IFRS-9), specifically concerning the treatment of rescheduled loans under the expected credit loss (ECL) model.

Application of IFRS

International financial reporting standards (IFRS) are global standards that set the rules for drafting financial statements. The standards are adopted by numerous countries including Pakistan, to ensure the uniformity of financial reporting to allow for comparability of financial statements and investor reliance. IFRS-9 governs the treatment of financial instruments including assets and liabilities.IFRS-9’s ECL model mandates periodic assessment of the outstanding loan portfolio to determine its recoverability.

Under the ECL model’s standard, there is a requirement to regularly evaluate the outstanding loan portfolio and create an expectation regarding its potential recoverability. If a segment of this portfolio is seen as unlikely to be recovered, it is necessary to make an appropriate provision or, in simpler terms, record a loss.

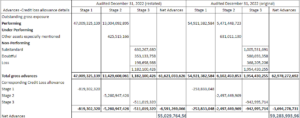

The extent of this loss is determined by the level of assessed credit risk. Initially, loans are categorised under stage 1, indicating a low risk of default. Nevertheless, if there is a notable rise in credit risk, such as amounts rescheduled, these loans are moved to stage two, requiring additional provisions. Stage three consists of non-performing loans, i.e. the loans on which the consumer has defaulted.

The SBP had concerns regarding the treatment of rescheduled loans under the ECL model of the IFRS-9 and prompted the bank’s auditors to reassess their treatment. As quoted by a source privy to the matter, the bank classified a significant portion of its Covid-era rescheduled portfolio under stage one of the ECL model which implied that there was no significant decline in credit quality. However, according to the source, the classification was erroneous as the recoverability of these loans was contentious.

Additionally, the amount to be booked as a loss on these loans, according to sources, are likely to be adjusted in the prior year financials of 2022, which would impact the bank’s equity but not be significant enough to wipe it out completely.

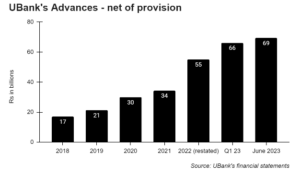

In the revised financial statements of 2022, there is a notable decrease in net advances (loans) by Rs 4.3 billion, dropping from Rs 59.3 billion to Rs 55 billion.

As detailed in the financial statement notes, UBank has reduced its gross advances (loans) in stage 1 from Rs 54.9 billion to Rs 47 billion, marking a difference of approximately Rs 7.9 billion. Simultaneously, there’s been a Rs 7.3 billion increase in gross advances in stage 2. Additionally, gross advances in stage 3 have declined by around 40% from Rs 1.95 billion to Rs 1.18 billion.

Moreover, UBank has made adjustments to its credit loss allowance for stages 1 and 2: the allowance for stage 1 has surged significantly, tripling from around Rs 254 million to Rs 819 million, while for stage 2, it has nearly doubled from Rs 2.5 billion to Rs 5.3 billion. However, the credit loss allowance for stage 3 has decreased by 46%, moving from Rs 943 million to Rs 511 million.

All these adjustments led to a decrease of around Rs 4 billion in net advances.

Effect on balance sheet

Meanwhile, the total assets have taken a hit, decreasing by Rs 2.8 billion from Rs 221 billion to Rs 218.5 billion. Total liabilities have also seen a dip, shrinking by Rs 80 million. Perhaps most strikingly, the total capital has dropped by Rs 2.7 billion, plunging from Rs 7 billion to Rs 4.5 billion.

| 2022 (Rs in millions) | 2022 (restated) (Rs in millions) | Change (in Rs millions) | |

| Total Assets | 221,296 | 218,526 | -2,770 |

| Total liabilities | 214,210 | 214,130 | -80 |

| Net assets/Capital | 7,086 | 4,396 | -2,690 |

Performance in the first half of 2023

During the initial half of 2023, UBank experienced a staggering profit after tax amounting to Rs 1.4 billion. According to the revised June 2022 statement, the bank recorded a loss of Rs 175 million.

The markup income surged more than twofold from its restated June 2022 figure of Rs 8.4 billion to an impressive Rs 19.8 billion. This surge, however, was matched by a substantial rise in markup expenses, soaring from Rs 5.2 billion to a staggering Rs 15.95 billion, marking an increase of more than threefold. Consequently, the net markup income saw a nominal increase of 17%, rising from Rs 3.25 billion to Rs 3.8 billion.

The bank’s advances grew to Rs 69 billion from Rs 55 billion.

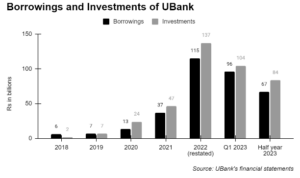

UBank’s investments declined by around 39% from Rs 137 billion in 2022 to Rs 84 billion in June 2023. UBank’s borrowings witnessed a similar trend and decreased by around 42% from Rs 115 billion in 2022, to Rs 67 billion at the end of June 2023.

UBank’s deposits have increased from Rs 92 billion in 2022 to Rs 99 billion in first half of 2023.

Unlike other big telecom-based microfinance banks, like Telenor Microfinance Bank and Mobilink Microfinance Bank, that had set their sights on branchless banking, UBank took a more conventional brick-and-mortar strategy. UBank had been spearheading an ambitious campaign to open new branches in urban cities like Karachi, Lahore and Islamabad.

Read: Has UBank cracked the code to making a microfinance bank profitable?

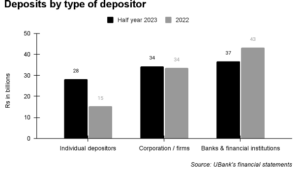

In an interview with Profit, Kabeer Naqvi who was then CEO of the microfinance bank disclosed that the expansion of branch network would bolster deposit mobilisation and attract funds to the bank. While this initiative did result in a surge in deposits, it predominantly drew high-cost deposits from other banks and financial institutions

According to the VIS credit report dated March 31, 2023, UBank faced a pronounced concentration risk, particularly within its deposits portfolio. The report highlighted a high concentration risk stemming from the significant share held by the top 50 depositors, particularly when compared to industry peers. Notably, the top 5 depositors, including asset managers such as NBP Financial Sector Income Fund (NBP FSIF), Faysal Income and Growth Fund (Faysal IGF), JS Microfinance Fund (MICR), alongside major banks like Habib Bank Limited (HBL) and Faysal Bank, accounted for a substantial 38% of the total deposit mix, up from 29% in the previous fiscal year.

This concentration reveals that these five financial institutions collectively deposited Rs 35 billion out of UBank’s Rs 92 billion deposit base, averaging Rs 7 billion per institution. However, these deposits from banks and financial institutions are often considered ‘hot money’ due to their nature. If these major depositors harbor concerns regarding the bank’s financial stability, they hold the potential to withdraw their substantial amounts. Such an event could trigger a severe liquidity shock for the bank, potentially causing disruptions in its financial operations.

The recent half-yearly reports highlight a notable shift in deposit dynamics within UBank’s holdings. Although deposits by banks and financial institutions continue to claim a substantial portion of the total deposits, there has been a marked change. Deposits by individuals have surged impressively by approximately 87%, escalating from Rs 15 billion to Rs 28 billion.

This surge has significantly elevated the share of individual deposits within UBank’s portfolio, rising from 16% to a substantial 28%. Conversely, deposits by banks and financial institutions have undergone a marginal decline of around 14%, dwindling from Rs 43 billion to Rs 37 billion during the first half of 2023.

The proportion of deposits contributed by banks and financial institutions has notably diminished from a commanding 46.7% to 37% in the same period.

excellent work Mariyam

nice content keep it up

excellent performance

thanks a lot for a detailed analysis, keep it coming