The stubborn refusal to look reality in the face and instead wish for ‘good daddy savior’ has been our norm for 75 years. The advocacy of non-realistic planning, the inability to make timely decisions, and the lack of focus on homegrown measures: these are all continuously replaced by dreams of biogas, hydrogen, creating a market for rice stubble, renewable energy potential and coal gasification as our savior.

Only a country with an analytical mind can find real solutions, instead of believing in fantastical things being done in the West. Besides, according to the UN trade chief, the rich use green policies to hold back the poor.

Our five year plans are devoid of action, plans and strategy. The evaluation of Thar, Riko Diq, EXIMP Bank, hydel and nuclear projects reaffirm this. But they also identify process improvements to bring change – if we want to. Who will bell the cat?

Our Planning Commission must become the equivalent of China’s NDRC, which was established as the State Planning Commission in 1952. It is the third ranked executive department, and functions as a macroeconomic management agency with broad administrative and planning control over China’s economy. Its subsidiary is the National Data and National Energy Administration, which is responsible for energy policy, decision-making, formulating development strategies, coordinating energy development as well as international cooperation on energy.

The ‘ostrich phenomenon’ has continued, and there have been meaningful efforts in spurts to develop alternative sustainable resources based on individual initiatives, rather than a well thought-out plan with timely decisions.

A new beginning has to take place with the 13th Five Year Plan (2024-2029) by discarding ‘hopium’, and by challenging Winston Churchill “I contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle”.

It has been repeatedly confirmed that raising tariffs does not reduce circular debt and is contained by regular increases in line with cost. The reduction requires distinct alternate measures in parallel.

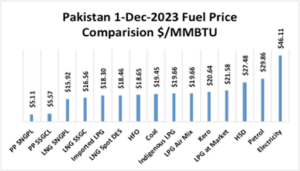

The chart below by DEA Pakistan depicts the need to price energy in an understandable unit, so as to enable comparison and fuel choice by consumers.

For many decades, the National Energy Efficiency & Conservation Authority with EDB should have followed a target driven aggressive energy conservation and equipment efficiency program.

We need to start again aggressively, and conserve energy with measurable targets of 2% improvement every year by 2029 or saving of 2.2 MTOE of energy and 8.29MTCO2 per NEECA current goals.

Reducing our import dependency involves a rolling road map of enhancing productivity, the need to build a trading portfolio with long term agreements directly with liquefication facilities and refineries (instead of expensive spot procurement), developing gas storage in depleting fields, E&P focus shift to offshore, understanding criticality of regional cooperation and in becoming part of energy networks evolving in our surroundings.

A 5+5 year revolving planning strategy to diversify energy import sourcing has to be driven by geoeconomic and regional cooperation to ensure economic security as we build on our geostrategic focus.

It now needs to define fuel mix based on IGCEP, energy transition fuel (pipeline gas/LNG), coal with target of 60% renewable energy independently and taking into account the economic corridor from India to Europe; sourcing fuel out of North American Energy Platform; LPG from Iraq, Central Asia, Saudi Arabia, Russia; Silk Road rail access to the Mediterranean Sea; and commercial long term engagement with Qatar, Oman, UAE, Australia, USA, Saudi Arabia and Russia.

Continued rethinking due to growing need of energy infrastructure, depleting reserves and dependency on imported fuel would have also determined energy provision to consumer in form of only electricity. Also, 5.7m gas consumers would be delivered piped gas at imported LPG or LNG price (whichever is higher) with cross subsidies done away with. A monthly direct subsidy to 70% of the population using LPG and wood would focus on measures to reduce “dole” by recipients under a time driven skill development program.

We have started to walk the talk: homegrown solutions for captive power plants has introduced 50:50 blend for 9 months and 100% LNG for 3 months (this year additional benefit for a month has been given). For industrial units, 75:25 blend for 12 months in Sindh and Punjab is presently at $9.7 and $10.8/mmbtu with increased gas load shedding, CNG priced at LNG cost and going forward spot buying of LNG for consumer to be phased out by 2025.

These ratios will change depending on the availability. The application only to zero-rated industries registered till June 2022 needs to be done away with. The tax, import duty, ST subsidy needs definition and needs to be given to all listed firms based on an increase in audited exports value, tax paid, volumes increase, investment and/or increase in employment under a progressive “slab” system with blacklisting of audit firms misreporting above in annual accounts including extending Foreign Investment Promotion and Protection Act (FIPPA) to them.

Plans are also being considered to reduce the industry subsidization of consumers and to ensure consistency of pricing; SHC stay and APTMA lobbying will delay matters. Citing Bangladesh has backfired as it went under an IMF program, now needs to manage its $5bn circular debt with increasing CAD. Our refinery industry has now started to export furnace oil when pushed and rent seeking was denied.

The long overdue deregulation of the oil and gas sector starts by rescinding the Marketing Petroleum Act, oil marketing companies determining provincial or national retail price, doing away with the Inland Freight Equalization Margin, and removing anti-competitive clause in white oil pipeline hindering Pakistan Railways freight growth.

Furthermore, a deregulated environment also requires the removal of the monopoly of Fauji Oil Terminal and Distribution Company on import infrastructure in Port Qasim, rebuilding oil piers in KPT on priority, and connecting the two ports by pipeline, which has pending now for over a decade.

You are a very knowledgeable person in the field.