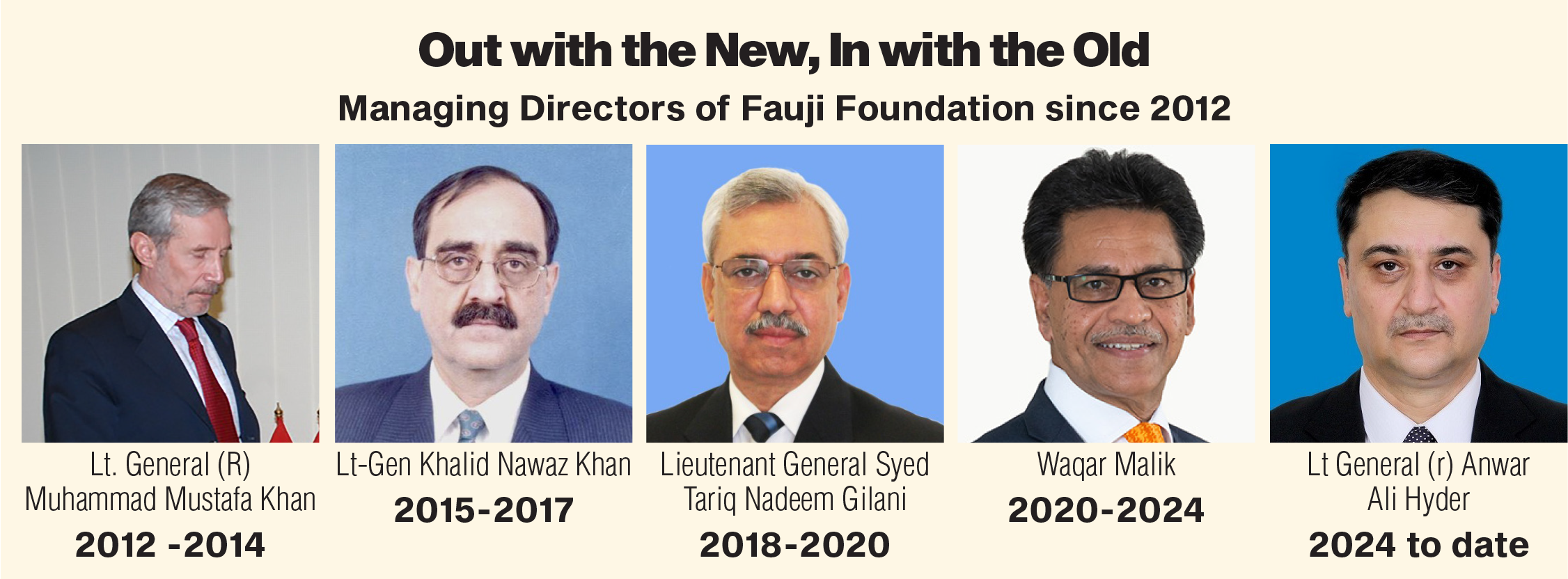

Four years after becoming the first civilian CEO and Managing Director (MD) of the Fauji Foundation, Waqar Ahmed Malik is on his way out. For the past two weeks he has been going from subsidiary to subsidiary of the Fauji Foundation on the sort of farewell tour that the Chief of Army Staff (COAS) usually takes upon retirement.

By most measures Mr Malik’s tenure has been a success. A number of the company’s publicly listed companies have seen an uptick in performance. In particular, the Fauji Foundation’s perennial problem subsidiary, Fauji Foods, witnessed profits for the first time in years as well as improved margins at a time when its competitors have actually seen a dip. It is a wonder how it took so long for a civilian to lead what is one of the largest conglomerates in Pakistan. His secret? Bringing in industry professionals to helm the different businesses of the Fauji Foundations in place of military management.

None of that, it seems, was enough to convince the Faujis of the benefits of allowing an outsider to come in and captain the ship. Not only has Mr Malik been replaced, Lt General (r) Anwar Ali Hyder has been given the charge. The cigar-smoking, smooth-talking General Hyder has been one of the most active ex-servicemen in the country. He was previously the chairman of the Naya Pakistan Housing and Development Authority and just finished a stint as caretaker defence minister in the caretaker cabinet of Anwar Kakar.

The flamboyant Mr Malik has been replaced by the Faujiest of Faujis in a clear indication that the Fauji Foundation is done with its little experiment with civilian supremacy. But this four year period leaves behind many questions. How did Waqar Malik rise to the top of what is considered the crown jewel of the Pakistan Army’s economic interests? How did he manage the foundation? And where will the good general that has replaced him take the Fauji Foundation? Based on conversations with Waqar Malik, discussions with former high-ranking military officials, and the analysis and comparison of financial data, Profit investigates.

A civilian crashes the party

In April 2020, Waqar Malik walked into the boardroom at the headquarters of the Fauji Foundation and took his seat at the head of the table. Looking back at him were the faces of high-ranking military officials. Some of them had been working at the Fauji Foundation for many years. Some of the men at the table had served together. There were even some whose fathers had also worked at the Fauji Foundation after completing their service in the armed forces. This is the same organisation that was described by one former high-ranking officer of the Pakistan Army as “the heart of the military’s economic machine.”

And here was this hotshot civilian about to tell them how to run their foundation. The reception Mr Malik got was understandably frosty, but he was unnerved by the hardened faces that greeted him. One must understand the gravity of the moment. The Fauji Foundation is run by a two-tiered management structure. There is first the Committee of Administration consisting of serving representatives of all three branches of the armed forces (two stars or more). This committee has overarching control of the foundation and its investments without being involved in the day-to-day oversight.

Then there is the Board of Directors, which consists of retired members of the armed forces that manage the day-to-day running of the foundation. The CEO and MD of the company chairs the latter and is a second lead on the former body. This makes him the link between the armed forces and the management of the foundation.

Never before 2020 had a civilian been in this role. In fact, the armed forces have had total control of the Fauji Foundation through retired officers since 1954. The story of the Fauji Foundation actually starts with a sum of $5 million left by the British in 1945 for the Indian veterans of the second world war.

The money was left in the Post War Services Reconstruction Fund (PWSRF) for Indian War Veterans, which remained unused and was divided between India and Pakistan in 1947 at the time of partition. The civilian administration transferred control of this still unused money to the Pakistan Army in 1954.

At the time, Pakistan’s share was around Rs 1.82 crore. Instead of distributing this remaining money, the army invested it in setting up a textile mill. Why would the army do this? Because there are essentially two kinds of charitable organisations. The first kind are the ones which for the most part collect donations and funds and spend those directly on charitable endeavours. They rely on a constant stream of donations. The second type is a little more complicated. These are organisations that operate as profitable entities. They undertake business and use the profits from these businesses to engage in charitable activities.

Fauji Foundation, set up under the Endowments Act of 1870, is the latter kind of organisation. Using that initial Rs 1.82 crore, the foundation has grown into a massive conglomerate that looks after the needs of retired servicemen and their families. For example, with the money they made from that first textile mill, the Fauji Foundation set up the first 50-bed tuberculosis hospital in Rawalpindi.

It is an entirely self-sustaining entity. Over time, the business interests of the Fauji Foundation have expanded including ventures in the fertiliser, banking, food, energy, and cement industries. Almost since the inception of Pakistan, the Fauji Foundation has been a point of pride for the armed forces and has been run by them. Which is why when Waqar Malik showed up, there was a sense of apprehension within the conglomerate.

So how’d a non-Fauji get to the head of the table?

Perhaps what surprised the old guard over at Fauji Foundation had less to do with Mr Malik’s appointment and more to do with the route it took. In his own words, his journey to the top of Fauji Foods happened almost out of nowhere. Standing in the offices of the foundation’s managing director, Mr Malik cuts an eccentric and flamboyant figure. Profit interviewed him last year while he was still in office. Standing behind his desk, arms folded over his chest he spoke candidly in English in an accent we couldn’t quite place.

A veteran of the corporate world, he had retired after serving stints as CEO first of ICI Pakistan and then Lotte Chemicals. During his retirement period he would occasionally consult for different companies. It was on one such consulting mission that he first found himself involved with the Fauji Foundation. “My first engagement with the foundation was around 2018, I got a call out of the blue from the then MD of FF asking me to consult with them on governance related issues. I initially came in, had a few conversations and took four or five months to prepare some research on the welfare side as well. I eventually got to present this research at General Headquarters (GHQ) where General Bajwa was present too.”

Mr Malik claims this is the first time he met General Bajwa, and that the COAS took an immediate liking to him. Impressed by his presentation, General Bajwa told the foundation that Mr Malik should continue consulting on different matters. At the time, General Qamar Javed Bajwa was in his last year as Chief of Army Staff. There were other matters on his mind, and he did not have the time to see through a major change over at Fauji. But the idea, according to one official close to the former COAS, had taken root already by then. While he didn’t have much time left in office, the COAS was expecting a three year extension from the freshly formed government of Imran Khan. After some legal technicalities, the extension came in by the end of 2019. In April 2020, just a couple of months after the extension was confirmed, Mr Malik was appointed CEO and MD of the Fauji Foundation.

This automatically raises some questions. Why Waqar Ahmed Malik? Sure, he is an immensely qualified individual with the correct education, pedigree, and experience at running large companies. He is an effective communicator, and his behaviour with his staff and colleagues indicates a man that knows how to get work done from a team. But he isn’t the only one with such qualifications. There are plenty of others out there as passionate and as qualified as him that would jump at such a chance.

So either it must have been one hell of a presentation he gave at GHQ or something else made him trustworthy to General Bajwa. According to one source, there is a link between General Bajwa and Mr Malik. It seems that the COAS had felt for some time that the Fauji Foundation was not performing well and there was a dire need to fix its operations and profitability. The idea of a corporate professional coming in to fix the problem had been on his mind for some time, he just had to wait to secure his extension first. Mr Malik presented the perfect opportunity to implement this plan.

He had been engaged as a consultant by the Fauji Foundation. The same senior source from the armed forces that told us about the initial pressure faced by Waqar Malik said that the consulting role he had been called in for was on merit. But later it turned out he was a friend and colleague of Matin Amjad. Matim Amjad is the son of Major General (r) Ijaz Amjad who is the father-in-law of General Bajwa. Matin Amjad had started his professional career at ICI Pakistan in 1998. In 2005, Waqar Malik would become CEO of ICI.

This connection was further cemented in 2018, around the same time that Waqar Malik had started to consult for the Fauji Foundation. After his retirement, Waqar Malik was also involved in a Capital Holdings company called Adira that he had founded with Atif Bukhari, Fawad Anwar and Siraj Dadabhoy — other business leaders with similar experience as him. In 2017, Adira acquired Linde Pakistan, which had been a leading player in the industrial gases industry in Pakistan for more than 70 years.

Through this acquisition, they launched PakOxygen which is an Oxygen manufacturing company established in 2018. When this company was created, Waqar Malik was the chair of its board. And for the position of CEO he brought in Matin Amjad — the brother-in-law of General Bajwa.

So what did he do with the Faujis and how did it pan out?

Waqar Malik was competent, he had the right experience, he had the right connections and he had found himself leading one of the largest conglomerates in the country. But there was a small problem. While he had the trust of General Bajwa, others in the military brass and in particular those on the Committee of Administration felt slighted. On top of this, officers began to worry about how this would affect their retirement plans, since the Fauji Foundation also provides employment to a number of retired officers.

On top of this, Mr Malik had come in with the plan of changing things up at a lot of the subsidiaries that the Fauji Foundation owns. As we mentioned earlier, the Fauji Foundation itself is a charitable entity that uses its profits to work for the betterment of military personnel. But to make these profits it owns majority shares in a number of subsidiary companies. Many of these subsidiaries are listed on the Pakistan Stock Exchange (PSX) and have their own minority shareholders and management. They are independent companies. But because the majority shareholding belongs to the Fauji Foundation, the CEO of the foundation is the chairman of many of the boards of these subsidiaries. So along with being responsible for the welfare activities of the foundation, Waqar Malik was suddenly also responsible for the profitability of these other companies. He was the chairman of the board of Fauji Fertiliser, Askari Bank, Mari Petroleum, Fauji Cement, and 15 other companies.

At the time that he took over, many of these companies were staffed with retired army personnel. When Malik was made the Chairman, he started off by trying to bring in people with experience in the corporate world. Positions which were seen to be held for retiring army generals were now being given to business oriented people who had experience in running successful organisations.

In fact, many of the CEO positions in these subsidiaries were filled by Mr Malik as per his comfort. People like Zaheer Ahmed, Sarfaraz Rehman, Qamar Manzoor, Atif Bokhari and Faheem Haider were brought in. These people had a wealth of knowledge and experience behind them and had served in local and international experience in running businesses. The aim was to bring a touch of professionalism in order to make these companies successful.

“The most important thing that we did was to bring the best people possible in. I needed to find the best of the best to head my companies. And to this end I have to give my sponsors credit they gave me a very free hand. They did not interfere at all which I might even have expected. Instead I was given a free hand to do what I wanted,” he told Profit last year. “They were focused on outcomes, not inputs, which is the right way. They wanted to see the outcome of that strategy. And I must say, I got a great deal of support from all of them. So these CEOs who have come in are industry veterans. Together, if you look at the top tier that I’ve got, and my CEOs, and people who are supporting me, we’ve got 300 years of cumulative experience.”

What was the result of replacing the Faujis with Civvies?

This is the part of the story where we try to see what effect Waqar Malik brought on the Fauji Foundation. To assess his performance and the performance of the organisation’s subsidiaries after Waqar Malik’s reforms, we need to compare financial performance with two different factors. The first is to try and understand how each company did before and after the management changes that came after Mr Malik took charge. The second is to see how these subsidiaries did compared to their main competitors, so we can also contextualise the performance in the time that it took place.

In order to carry out a fair analysis, five of the listed companies of Fauji Group are taken and are compared with other listed companies which are operating in the same environment. The performance is being analysed to see how the company was performing before 2020, under retired army officers and how the performance of these companies changed, after civilians from the corporate world took charge. A caveat needs to be placed here that when the past performance is being seen, it is done in context of the competition.

By adding this context, it is made sure that the performance of the Fauji company is compared to a company which is operating in the same business environment. For example, consider that a Fauji company was earning a net profit of Rs10 billion before 2020 which actually decreased to Rs8 billion after that. This tells in absolute terms that the company has performed worse under the civilains. But what if this was not due to the management’s fault, but because of an industry wide issue, or because of a larger macro economic issue out of management’s control? So for example, a competitor in the industry was previously earning Rs15 billion net profit which fell to Rs1 billion? This would show that actually, in context, the Fauji company did not suffer to the same extent as others did which shows that the Fauji company actually performed better under the new structure.

That said, there are many limitations to this analysis. For one, there could be many other factors at play affecting profitiability, and the choice of competing companies for comparison purposes might also skew the results.

It is also important to note here that corporations are massive and huge in size. A decision taken today at the top will see its impact long into the future. Imagine a corporation like a large cruise liner. Even when the captain has turned the wheel, it takes a long time for the ship to actually turn. Corporations also experience this lag. CEOs or captains make a decision and the effects of those decisions take time to manifest themselves.We have also listed for the sake of clarity all of the management changes that took place in each company.

So let’s begin.

Fauji Foods

Previous CEO: Lt General Javed Iqbal

New Civilian CEO: Usman Zaheer Ahmad

Main competition: FrieslandCampina Engro Limited

The first company that is being considered for this analysis is Fauji Foods. Fauji Foods came into being when Noon Pakistan, the company which launched the Nurpur brand, was taken over. The company is known for its range of dairy products running from milk, butter and cheese products.

Before 2020, the company was being led by Lt Gen Javed Iqbal who was replaced by, first, Muhammad Haseeb Alam and then by the Chief Financial Officer of the company Ebad Khalid. As the fortunes of the company were not changing, a final change was done by bringing in Usman Zaheer Ahmad who is still at the post.

Zaheer Ahmad had a strong corporate and commercial track record of over 20 years in local and international markets. He is seen as someone who has strong leadership credentials as he has delivered performance and profitability. He is result oriented and was seen as the missing cog that would bring success to a company like Fauji Foods.

In addition to the CEO, many of the directors were also brought in who did not have military service in their past. Arif ur Rehman, Nadeem Inayat, Syed Bakhtiar Kazmi, Ali Asrar Hossain Aga, Javed Kureishi, Basharat Ahmed Bhatti, Sarfaraz Ahmed Rehman and Nosheen Akhtar were also elected as new directors in 2023. All of these individuals have experience of working in the corporate sector and bring in an outside view and perspective which was not being seen at the company in the past.

As recent as 2019, most of the retired army personnel serving on the board have been replaced by civilians. So how did the company perform after 2020?

In the four year period before Mr Malik was appointed, Fauji Foods made losses of Rs 12 billion with Rs 3 billion loss made every year. In contrast, FrieslandCampina made profits of Rs 2 billion or Rs 0.5 billion per year on average. Once Malik was appointed, Fauji made losses of Rs 6 billion or Rs 1.5 billion per year while FrieslandCampina made a profit of Rs 6 billion of Rs 1.5 billion per year. This shows how Fauji was able to see turnaround as they were able to decrease losses by half while FrieslandCampina performed the same.

The share price for Fauji Foods was at Rs 14 at the start of 2020 which has fallen to Rs 9 by now. This shows that the public perception of the company worsened even when performance improved. FrieslandCampina went from Rs 80 to around Rs 70 right now. The return for both companies has been negative. Fauji lost 36% in 2020 while FrieslandCampina lost 12.5% in the market. Both companies gave no dividends in the period.

Fauji Fertilizer

Previous CEO: Lt General Tariq Khan

New Civilian CEO: Sarfraz Ahmed Rehman

Main competition: Engro Fertiliser, Fatima Fertiliser,

Fauji Fertilizer is a company which was set up in 1978 and is involved in manufacturing of chemical fertilisers. They produce different fertilisers like urea, DP, SOP, MOP, Boron and Zinc. The main brand that is promoted by the company is under the name of Sona. The company has set up its plants in Sadiqabad and Mirpur Mathelo.

Fauji Fertilizer was headed by Lt Gen Tariq Khan in 2020 who was replaced by Sarfaraz Ahmed Rehman. Rehman has provided management expertise to companies like Unilever, GlaxoSmithKline, Jardin Matheson and PepsiCo in the past. He was the one who established Engro Foods as their CEO in 2005 when they became one of the leading dairy companies of the country. He has also carried out consultancy based projects. Before becoming CEO at Fauji Fertilizer, he was the CEO at Fauji Fertilizer Bin Qasim where he turned the company into a profitable entity.

Just like Fauji Foods, the board of directors at Fauji Fertilizer also saw directors being elected who had experience in running or operating businesses. Names like Nadeem Inayat, Saad Amanullah Khan, Maryam Aziz, Syed Bakhtiar Kazmi, Shoaib Javed Hussain, Ayesha Khan, Jehangir Shah, Yasir Ghiyati Ibn Ziyad and Qamar Haris Manzoor became directors who bring a plethora of experience with them.

In 2018, Chairman of the board, CEO and 4 other directors were from the army which is not the case anymore.

How successful was the change?

The results seem like a mix bag to say the least. Yes performance has improved since 2020 but performance was the same back in 2014 as well so to shower all the praise on the new management would be premature.

The performance of Fauji Fertilizer is compared to Engro Fertilizers which is a comparable company. They are both situated near the border region of Sindh and Punjab and cater to the same market.

In the span of four years before 2020, Fauji Fertilizer made profits of Rs 54 billion with an average prof13.of Rs 13.5 billion each year. Engro Fertilizer made the same profits of Rs 54 billion or Rs 13.5 billion per year on average. When the new management came in, Fauji made profits of Rs 92 billion or Rs 23 billion per year while Engro made a profit of Rs 81 billion of Rs 20 billion per year. Where the older management was able to match Engro, the new management has been able to surpass even Engro which is a vote of confidence for the new management.

In terms of market return, the new management came when share price was at Rs 101 which has increased to Rs 126 in 4 years time. The company has also given out dividends of more than Rs 40 which means that the company has made a return of more than 66% in the last 4 years. In the same period, Engro went from Rs 73 to Rs 152 and gave out dividends of more than Rs 50 which means that the market return is in excess of 100% for Engro fertilisers.

Fauji Cement

Previous CEO: Lt General Muhammad Ahsan Mahmood

New Civilian CEO: Qamar Haris Manzoor

Main Competition: Gharibwal Cement

Fauji cement was set up in 1997 and is one of the largest cement producers in the country. The company can produce 11,000 tons per day. It is considered to be the second largest cement producer in the North region and the third largest in Pakistan. In 2021, the company merged with Askar Cement which further enhanced the market share and production capacity.

Lt Gen Muhammad Ahsan Mahmood was the CEO of the company till 2020 after which Qamar Haris Manzoor was appointed by the board. Manzoor has 37 years of experience in plant and project management. He started his career in ICI and then went to work for Exxon Chemical Pakistan Limited. He has also served as a COO at Habibullah Coastal Power Company expanding his expertise in chemical and power sectors of the country.

The board of directors also saw a change in 2020 where Nadeem Inayat, Syed Bakhtiar Kazmi, Maleeha Bangash and Naila Kassim were elected as directors. All these individuals have an array of skills that they have acquired working in different companies locally and internationally.

In 2018, 5 out of the 8 board members had served in the army while in 2023 there were 2 out of 7.Fauji Cement is compared to Gharibwal Cement which is another company which is categorised to serve in the Northern part of the country.

From 2016 to 2019, Fauji Cement made profits of Rs 14 billion with Rs 3.5 billion made every year. Gharibwal cement made profits of Rs 7 billion or Rs 1.8 billion per year on average. Fauji cement was making double the profits before the new management. In the years since 2020, Fauji made profits of Rs 18 billion or Rs 4.5 billion per year while Gharibwal made a profit of Rs 4 billion of Rs 1 billion per year. The new management has been able to perform even better than the older management in comparison.

In terms of market return, the new management came when share price was at Rs 15.5 which has increased to Rs 18 in 4 years time. The company has also given out bonus shares worth Rs 1.2 which means that the company has made a return of more than 24% in the last 4 years. In the same period, Gharibwal went from Rs 14 to Rs 23 and gave out dividends of more than Rs 1.75 which means that the market return is in excess of 78%.

Askari Bank

Always run by corporate professionals.

Askari bank was established in 1991 before it was taken over by Fauji Foundation in 2013. The bank has around 600 branches and 500 ATMs all over the country. The bank provides financial services, banking services, islamic banking, capital market related services and asset management. The company earned revenues of Rs 72 billion in 2003 and has assets of Rs 2.124 trillion.

Askari Bank has always been run by corporate professionals and in 2020 was being led by Abid Sattar. After Waqar Malik became the Managing Director, he brought in Atif R Bokhari to run the operations of the bank. Bokhari was a career banker and had 38 years of experience in local and international banking. He started his career in 1985 at Bank of America and worked there for 15 years. He later joined Habib Bank in 2000 and UBL in 2004 as President and CEO till 2014. He was able to help UBL become a diversified bank by increasing its revenue streams in consumer financing, branchless banking and insurance.

The board of directors at Askari also elected Sarfaraz Ahmed Rehman, Arif Ur Rehman, Nadeem Inayat, Zoya Mohsin Nathani, Kamran Yousaf Mirza and Samina Rizwan. The directors had background in finance, banking, accountancy and corporate governance which were the reason for them being chosen for the positions.

In 2018, there were 4 retired army personnel on the board which has decreased to 1.

In terms of performance, it was seen that the company actually saw worse performance since 2020 which shows that the change in the senior management actually saw the company perform worse in terms of all three metrics.

In order to put the performance of Askari in context, Allied Bank is chosen which has a similar asset base of around Rs 2 trillion just like Askari Bank.

For Askari Bank, the period of four years before Waqar Malik, saw profits of Rs 22 billion which comes to an average profit of Rs 5.5 billion each year. On the other hand, Allied Bank made profits of Rs 54 billion or Rs 13.5 billion per year on average. The multiple between the two was around 2.5 times. After the new management, Askari made profits of Rs 56 billion or Rs 14 billion per year. Allied Bank made a profit of Rs 97 billion of Rs 24.25 billion per year. The multiple shrank to 1.76 times in favour of Askari.

The share price for Askari was at Rs 18.5 at the start of 2020 which has gone to Rs 20 by now. With dividends of Rs 8.5, the total return in the share has been 54%. Allied Bank went from Rs 100 to around Rs 87 right now. In addition to Rs 30 in the form of dividends, the company made a return of 18% for the period.

Mari Petroleum

Previous CEO: Lt General Isfaq Nadeem Ahmed

New Civilian CEO: Faheem Haider

Mari Petroleum is a petroleum exploration and production company which is operating the second largest gas reservoir at Mari Field in Ghotki, Sindh. The company is engaged in exploration, development and production of hydrocarbon products which include natural gas, crude oil, condensate and liquefied petroleum gas. In 1983, Fauji Foundation, Oil and Gas Development Company Limited and Government of Pakistan acquired the business.

In 2020, Lt Gen Ishfaq Nadeem Ahmad left the post of CEO and Faheem Haider was put in charge in his place. Faheem Haider has a career spanning 29 years in various technical and leadership positions at international companies like Union Texas Petroleum, OMV Pakistan Exploration GmbH, Helix RDS Limited and Neptune Energy group. He has a deep understanding of the exploration and production industry and has worked in development, organisation, and transformation of companies

Mari board also elected individuals like Nadeem Inayat, Muhammad Amir Salim, Abid Niaz Hasan and Seema Adil who bring their own sets of skills to the table.

Due to the shareholding of the company, many of the directors are nominated by sponsors and change on a regular basis. In 2018, 3 of the directors had an army background which now stands at two.

From 2016 to 2019, Mari Petroleum made profits of Rs 55 billion with Rs 13.75 billion made every year. Pakistan Oilfields made profits of Rs 45 billion or Rs 11.25 billion per year on average. Mari was making 22% higher profits before the new management. In 2020, Mari made profits of Rs 151 billion or Rs 37.75 billion per year while Pakistan Oilfields made a profit of Rs 92 billion of Rs 23 billion per year. The new management was able to grow the multiple to 1.64 from 1.22.

The new management came when share price was at Rs 1,310 which has increased to Rs 2,517 in 4 years time. The company has also given out dividends worth Rs 516 which means that the company has made a return of more than 132% in the last 4 years. In the same period, Pakistan Oilfields went from Rs 450 to Rs 435 and gave out dividends of more than Rs 275 which means that the market return is in excess of 57%.

So why’d they get rid of the civilian experiment?

That is the million dollar question. On the one hand it seems clear that bringing in professional management with Mr Malik on top has been good for Fauji Foundation. The experiment that was carried out by General Bajwa seems to have worked with results improving to some extent. The real test would have been to give a longer time period and tenure to Malik, or for that matter to his civilian successor, to have an even clearer answer.

Then why wasn’t he given more time? From 2020 to 2023 Fauji Foundation was clearly doing better than before. It is not to say that the organisation was in the dumps and was taken out of it, but rather that Waqar’s time clearly made a difference. In 2023, at the end of his three year term, Mr Malik was given a one year extension as CEO and MD of Fauji Foundation.

But there was a massive change for him this time around. He had initially been appointed during General Bajwa’s time for a three year period. His presence had not been appreciated by the military brass in the foundation but they had deferred to his wisdom. After all, General Bajwa seems to have been of the opinion that a corporate professional was exactly what the Fauji Foundation needed. When General Bajwa retired in November 2022, however, there was a new man in charge of the Pakistan Army.

At the time there was a lot else going on in the country. There was political instability, the country was on the brink of default, and the army was facing opposition from within the political sphere. The Fauji Foundation was probably not the top priority at the moment. Plus, with the ship very much on course, Mr Malik was given an extension. But the signs were clear. The usual extension for situations like this are for three years, so it was already evident that the CEO was on thin ice.

Now, a year after that extension, he has not been granted another extension. The reason for why Mr Malik has been replaced is not clear as of yet. But it is also clear that the Fauji Foundation does appreciate what these four years have meant for them financially, and they’ve sent Mr Malik off with a farewell tour fit for a General and adulatory goodbye posts on social media.

There are a few possibilities for why this has happened. The popular theory going around is that this is a regression. That the military brass was unhappy with civilians being given control of the foundation and its subsidiaries, and the recent decision is in response to this perceived unhappiness. An attempt, perhaps, to give officers something to be chuffed about. It is plausible, but one source gives us a different perspective.

According to this former officer, the reason Waqar Malik was not given another extension was the impression that he was appointed by General Bajwa. The new military leadership wanted to have their own people leading the Fauji Foundation. And while this might be true, our source also says it will be difficult to justify removing those CEOs and their staff that have proven to be successful. Now it will all be a question of what approach the new CEO takes.

What’s in store for the new CEO?

With most indicators in its favour, it can be seen that having a board with a background in business and corporate experience is good for a company. For now, the replacement has come in. Lt General (r) Anwar Ali Hyder brings experience as well. As mentioned earlier, General Hyder just finished a stint as Defence Minister and has previously managed DHA Islamabad, the Army Welfare Trust and the famous Naya Pakistan Housing Authority. While the success or failure of NAPHDA’s projects is up for debate, by all accounts he is a rare example of a military man with natural corporate acumen.

But as we have seen in the past four years, running the Fauji Foundation is not a one man job. We have listed at least four CEO level appointments of former officers that were replaced by corporate professionals in this story. One wonders if the new CEO and MD of the Fauji Foundation will be tempted to reverse these changes or will stay on the path. That, only time will tell.

Excellent analysis!

it’s worth reading 🙌

Would have been better if ROE was compared instead of absolute profit of companies. Absolute profit is not the best comparison

Boycott All Fauji products

Beautiful!

Seems you are totally unaware that the current HR Heads at Askari bank were largely to blame in Malik Ex military replacement decision. Hundreds of lay offs, out of policy termination and harassment by HR heads caused the military to rethink their leadership.

This gentleman has destroyed the values of administration by appointing poor quality persons for management who love to run the institution unprofessionally. Now there is no management in bank except a gang of dacoits. Hope the army person will devise good strategy for banks administration.

Thank God the army has intervened again.

Read the article in full. which I rearly do.

exelent and indepth

The fifth paragraph, under Askari bank heading has states the Askari bank’s performance has worsened. Don’t you think it’s actually opposite.

A great article indeed. Mr. Malik and team actually didn’t not performed as per their credentials rather they kept on exploiting their links in portaraying their profits which are questionable? Currency devaluation, post COVID boost and real-estate cum construction boom if considered then all gains by Malik teams are minions. Malick and team did resort to some unethical spree of sending good people home further complicating the issue. Nevertheless a great research work. Gods speed.

1. Position is three years tenure based and he was given additional year as extension. Extensions are always bad.

2. Regarding performance, Isn’t this article too early; things usually unfold once tenure is completed.

it would be for better if you used to turn on equity return on investment etc instead of profits

Jahangir Piracha has recently joined as MD & CEO of FFC in place of Sarfaraz Ahmed Rehman. So a market professional has replaced another

Worth reading

there is one man that connects the dots here. unforutunately he passed away in 2023. you have to go back to DHA Phase 1 to understand how this works.

good innfo