LAHORE: Pakistan’s Consumer Price Index (CPI) inflation was recorded at 8.2 per cent on an Year on Year (YoY) basis in May as compared to 8.5 per cent in April and 8.4 per cent during the corresponding month of last year.

According to State Bank of Pakistan’s (SBP) Inflation Monitor, national CPI inflation on a month on month basis was recorded at 0.3 per cent in May compared to -0.8 per cent in April and 0.6 per cent during the corresponding month of last year.

Rural areas experienced higher CPI inflation compared to urban areas in May, with rural CPI inflation recorded at 9.7 per cent on YoY basis compared to urban CPI inflation of 7.3 per cent on an YoY basis.

Meanwhile, Wholesale Price Index (WPI) on a YoY basis stood at 1.5 per cent in May compared to 4.9 per cent in April, while Sensitive Price Indicator (SPI) inflation stood at 9.6 per cent in May compared to 8.5 per cent in April.

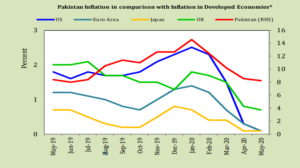

In the global context, Pakistan’s CPI inflation was the highest compared to the US, Euro area, Japan and UK.

Source: State Bank of Pakistan

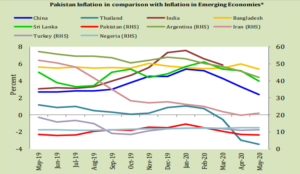

However, CPI inflation rate in Pakistan was on the lower side compared to inflation rates for emerging economies for May.

Source: State Bank of Pakistan

According to the SBP inflation monitor, inflation rates in Argentina, Iran, Nigeria and Turkey stood at 42.1 per cent, 21 per cent, 12.4 per cent and 11.4 per cent respectively.

On the other hand, India has not released inflation data for the months of April and May.

The recent increase in petroleum prices announced on June 26, that saw the price of petrol increase by more than Rs25 in a single day, is expected to add more inflationary pressure going forward.

“The recent hike in fuel prices is expected to push the inflation rate higher. The trend in food inflation is upwards and doesn’t look to be easing soon. If the number of Covid-19 infections continue to decrease and life resumes back to normal, it will also spike the inflation index in months to come,” said Capital Stake Research Director Maha Jaffer Butt.

Earlier in January, Pakistan witnessed a 12-year high inflation of 14.6 per cent prompting the central bank to raise interest rates to 13.25 per cent.

Since then the central bank has cut interest rates to 7 per cent in a bid to provide liquidity to cash strapped businesses during the Covid-19 induced economic slowdown prompting speculations that inflation rates might increase in the future.