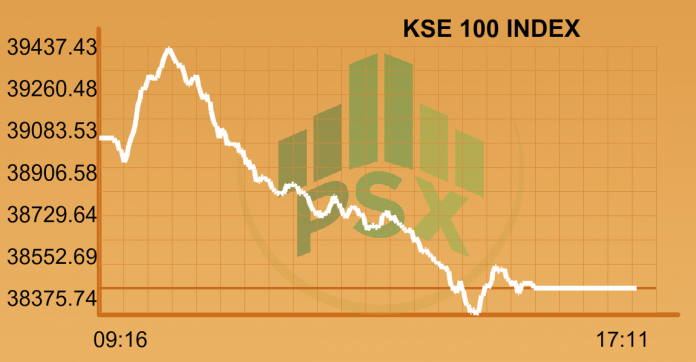

LAHORE: The Pakistan Stock Exchange (PSX) opened another week bleeding as Pakistani rupee continued to depreciate against the dollar. The KSE 100 index dropped to a fresh 52-week low, the third in three sessions, when it was seen trading at the same levels as of July 2016. In absence of a positive motivator and blur future, volumes remained thin.

The KSE 100 index depleted 1.84 per cent or 705.27 points to intraday and 52-week low of 38,374.73 falling from intraday high of 39,437.43 (+357.43 points) touched early morning. The index settled with a 598.30 points loss at 38,481.70. The KMI 30 index got hammered oil scripts closing in the green. The index crumbled 980.50 points to 66,032.96 while the KSE All Share Index lost 308.67 points. Only 52 scripts closed in the green as 294 dropped.

The market volumes were recorded at 129.42 million with 57.16 million shares traded in the KSE 100 index scripts. Worldcall Telecom (WTL -4.79 per cent) was the leader by miles, volume 18.54 million, TRG Pakistan Limited (TRG -5.00 per cent) was next with 8.30 million shares exchanged and K-Electric Limited (KEL -2.43 per cent) followed with a volume of 5.94 million.

The oil and gas exploration sector, rolling against the market, added 2.28 per cent to its cumulative market capitalization. All four scripts in the sector appreciated crawling up along higher crude oil prices in the international market. Oil and Gas Development Company Limited (OGDC) inched up by 2.71 per cent, Pak Petroleum Limited (PPL) gathered 2.21 per cent, Pakistan Oilfields Limited (POL) and Mari Petroleum Company Limited (MARI) accumulated 0.96 per cent and 1.85 per cent respectively.

Dawood Lawrencepur Limited (DLL -4.76 per cent) in a notice to the exchange informed all stakeholders about the decision of the Board of Directors to invest Rs 280 million by subscription of 28,000,000 right shares of Reon Energy Limited, a wholly owned subsidiary.

Dost Steels Limited (DSL -8.40 per cent) announced negotiations with Pak Kuwait Investment Company (PVT) Limited regarding debt restructuring have been stalled.