‘By allowing non-filers to purchase land and motorcars, the government has legitimized corruption’

ISLAMABAD: The amendments presented in the Finance Bill 2018-19 lack direction and vision, as the government missed the opportunity to present out-of-the-box solutions to fix the economic woes.

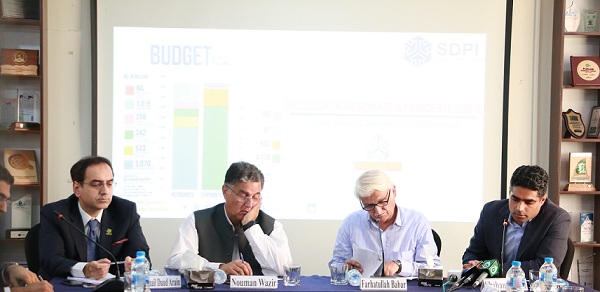

Overall the mini-budget did not meet the expectations as it incentivized non-filers, whereas taxpayers were further burdened, said speakers representing the business community and civil society during a discussion on ‘Amendments in Finance Bill 2018-19’, organized by Sustainable Development Policy Institute (SDPI), on Monday.

Pakistan Tehreek-e-Insaf (PTI) Senator Nouman Wazir Khattak said that when PTI came into power, the economy was in shambles. He said that his government raised the tax rates on imports of luxury items only in order to cut the import bill, adding that the government would take concrete measures with the consultation of stakeholders to bring the non-taxpayers into the tax net.

He said that the government requires at least next 3 to 4 months to analyze the economic crisis and find ways to come out of the crisis. “For future taxation measures, we need stakeholders’ consultations and also need to take the business community on board,” he added.

Pakistan People’s Party Parliamentarian (PPP-P) leader and former senator Farhatullah Babar said that the mini-budget presented by the government was an utter disappointment, as it supported the corrupt mafia of the country. He said that the biggest corruption is deeply rooted in the sale and purchase of land while the budget rewards the corrupt land mafia.

He said that by allowing non-taxpayers and non-filers to purchase land and motor cars, the government has legitimized corruption, adding that the government has failed to provide a comprehensive roadmap to revamp and streamline economy and regional trade.

SDPI Joint Executive Director Dr Vaqar Ahmed said that the government has tried to keep the income tax structure progressive by maintaining low rate of tax on lower income groups, adding that advanced tax on transaction through the banking system by non-filers was increased. He said that this measure should be accompanied by a reduction in time and cost of becoming a filer, where all scheduled banks should be allowed the powers to facilitate a willing person to become a filer.

Dr Vaqar said that to curtail non-essential imports, the government has increased duties on imported vehicles. This increase may not be enough in the light of past experience to reduce non-essential imports, he added.

Rawalpindi Chamber of Commerce & Industry (RCCI) former president Dr Shumail Daud Arain said, “We were expecting tough decisions on taxation front but on contrary, there is a precarious situation for the taxpayers. The government missed the opportunity in the mini-budget to bring the non-taxpayers into the tax net. The overall measures so far taken by the incumbent government are similar to old budgets. The mini-budget does not show any direction and does not show any vision.

Islamabad Chamber of Commerce & Industry (ICCI) former president Shaban Khalid on the occasion said that the business community was hoping substantial initiation on increasing the tax base but the mini-budget fell short of expectations as several previous federal budgets did. He said that though the government tried to rationalize the tax rate for the salaried class, the tax base was not increased.

He said that the current government aim to achieve the target of Rs 100 billion is sceptical and threat for the business community, as these taxes may be collected from the existing taxpayers when there are no new taxpayers.