Arif Naqvi is the most shunned man in Pakistani finance of the current era because Arif Naqvi failed at the one cardinal, inviolable, unspoken rule that governs the lives of every Pakistani who aspires to scale the heights of global finance: don’t become another Agha Hasan Abedi.

In the power centers of the global capital markets – New York, London, Hong Kong – Pakistanis are not an underrepresented class of people. You can find at least a few Pakistanis at almost every level of every division of every major global financial institution.

(We even have a small impact on the culture of Wall Street and the City of London. Once, while working late at night at the New York offices of Deutsche Bank, I suddenly heard the sound of Nusrat Fateh Ali Khan’s Tumhein dillagi bhool jaani pare gi. It turned that a colleague of mine was playing it on his iPhone to keep himself from falling asleep while pulling an all-nighter. He was not Pakistani, but had worked alongside enough Pakistanis to have become a fan of the qawwali maestro.)

But nearly all Pakistanis who have ever worked in those institutions feel the shadow of one man, and a fervent desire never to be linked to his legacy: Agha Hasan Abedi, the founder of the now-defunct Bank of Credit and Commerce International (BCCI).

When the scale and speed of the collapse of Abraaj Capital became known in the earlier half of this year, Arif Naqvi, its Karachi-born founder, was inevitably compared to Abedi. Naqvi may think the comparison unfair, but after everything that transpired, it was always going to be inevitable.

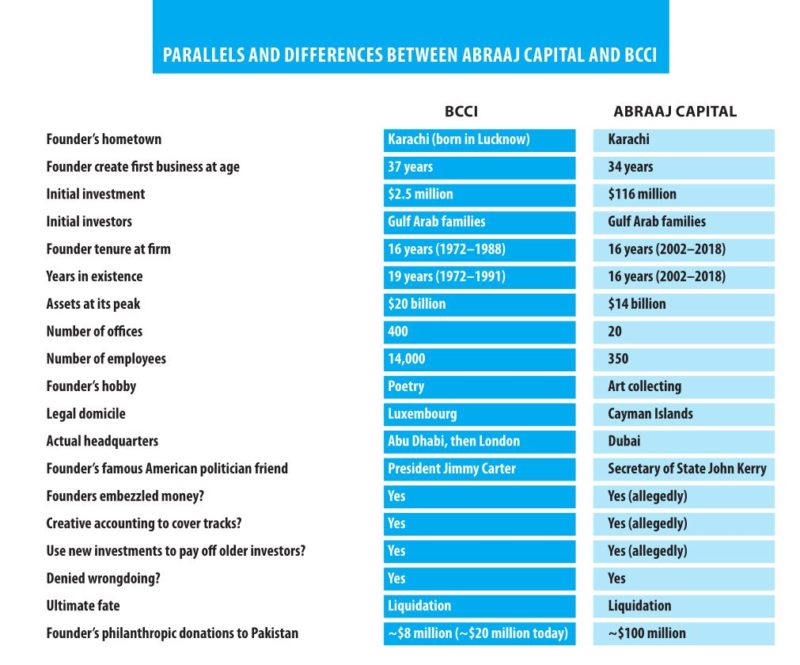

Abedi and Naqvi are decades apart, with the latter starting his Dubai-based firm a decade after the former’s London-based bank collapsed. Abedi ran a bank with retail depositors, and Naqvi a private equity firm that catered almost exclusively to institutional investors and high net-worth individuals. The two did not cross paths in time and ran institutions that were very different in character in most ways.

At least on the surface.

The truth is that in many ways, Abedi and Naqvi are very, very similar, and the trajectories of both BCCI and Abraaj Capital have considerable parallels as well. The core problem at both companies was the exact same: the larger than life personality of the founder, who viewed the company and its wealth as an extension of his own personal property, and had the charisma to get away with not having put in place enough governance controls to prevent the worst of his own behavior.

Despite repeated attempts, Arif Naqvi declined to answer any of Profit’s requests for comment.

Middle-class origins and the early rise

Neither Abedi nor Naqvi were born rich, but both were born in proximity to wealth and political power. Abedi was born in Lucknow, into a family that were not themselves aristocracy, but served as important advisors and courtiers to the Nawabs of Awadh until Partition, when they migrated to Karachi to become a part of the new country’s professional classes. Naqvi was born in the following generation as the fourth son of a successful businessman who owned his own small plastics manufacturing company, and was educated alongside Karachi’s economic and political elite at Karachi Grammar School.

One key difference between the two men’s backgrounds: Abedi stayed local for his education, graduating from the University of Lucknow with a degree in law. Naqvi, by contrast, was able to jet off to the London School of Economics, from where he was able to give his career a more global orientation from the very beginning.

Because Abedi never got a foreign education, his career started closer to home: he joined Habib Bank in 1946, when he was just 24 years old, and the bank was just five years old, albeit owned by the Habibs, a wealthy trading family that had even back then been in business for more than a century. Abedi was clever, and had the good fortune of timing: Habib Bank was one of two local banks left operating in the territory that eventually became Pakistan at the time of Partition, which meant that the entire nation’s banking system was reliant on two (and soon four) banks for nearly the entirety of the first decade of its existence.

But it was not just the advantages of that greenfield environment: Abedi proved himself to be a fast learner and high performer, rapidly ascending the ranks of Habib Bank, and excelled at helping maintain the bank’s corporate relationships.

Naqvi’s beginnings were similarly dominated by his early success in climbing the corporate ladder. He graduated from LSE in 1982 and began working for Arthur Anderson – then one of the largest accounting firms in the world – in their London office, where he spent four years. For a time, he moved back to Pakistan to work for American Express Bank in Karachi, before moving to the Middle East where he began working for the Olayan Group, one of the largest conglomerates in Saudi Arabia.

The entrepreneurial bug

Despite being a high flyer, Abedi was not content to simply do well at a bank owned by someone else. He had an entrepreneurial drive, and in 1959, at just 37 years of age, was able to convince the Saigol family to invest in creating a fifth local bank in Pakistan – United Bank Ltd – with him as its first President.

Naqvi got a slightly earlier start in entrepreneurship when he was 34 years old. In 1994, having saved up $50,000 from his time working for other people’s companies, Arif Naqvi decided to invest his own money into setting up a firm called Cupola, which he has described as an investment advisory firm, but was really more of a micro-cap investment bank and private equity firm, which helped other businesses raise capital while also seeking to make its own investments.

Both men had spectacular success in their first entrepreneurial ventures, but both were accused of less than above-board behaviour in doing so, though the allegations against neither were ever substantiated.

In the case of Abedi, he grew United Bank to become – for a time – the second largest bank in Pakistan. His very success attracted the ire of the leftist, anti-capitalism wave sweeping Pakistan’s political landscape in the later 1960s and early 1970s, and in 1972, Abedi was briefly placed under house arrest for alleged crimes that remain unclear while the government prepared to nationalise United Bank.

Abedi did not let neither his own house arrest nor the nationalisation of the bank he created get in the way of his ambition, though. While under house arrest, Abedi began plotting his next move, calling investors to secure capital and interviewing young candidates from the University of Karachi’s Institute of Business Administration (IBA) for jobs at a bank that did not yet exist.

Eventually, the government of Pakistan dropped its charges, and Abedi was free to leave, and he instantly decamped to Abu Dhabi, and then on to London to create BCCI.

Naqvi’s initial success, by contrast, was a little more muted. His first deal earned him an $800,000 advisory fee for helping a company raise $8 million to set up duty-free kiosks in Dubai. He kept doing more deals, and eventually landed his first whale: a $102 million acquisition of Inchcape Middle East, a grocery chain. The transaction involved only $4.1 million in equity. The rest was all borrowed from banks. Naqvi was able to sell that business in pieces over the next couple of years for a total of $173 million.

It is for this transaction that some of his initial investors in Cupola have accused Naqvi of impropriety, suggesting he was not entirely forthcoming in what proportion of the profits belonged to him versus what belonged to his investors. The allegations are documented in a book titled “Leverage in the Desert” by Imtiaz Hydari.

Nonetheless, the allegations were never substantiated, and Arif Naqvi went on to use the profits from that Inchcape transaction to create Abraaj Capital, arguably the first – and eventually the largest – professional private equity firm in the Middle East.

The troubles begin: lying about losses

The problem with trying to talk about what went wrong at BCCI to a Pakistani audience is that both BCCI and Agha Hasan Abedi have way too many defenders who peddle a completely fictional account of what actually happened at the bank. But essentially, the trouble at both Abraaj and BCCI started in exactly the same way: they started lying about losses, they hoped that future growth would preclude the need for them to ever disclose those losses, and that nobody would ever find out.

And both BCCI and Abraaj Capital lied about losses for very similar reasons: to reveal the truth would involve turning off the supply of money to businesses owned by close friends and family of the founders, which was deemed unacceptable by the founders themselves, and never checked because the initial investors never asked for the creation of robust corporate governance structures that would have prevented such a thing from ever happening in the first place.

In the case of BCCI, the problems began early, but were disguised because of a remarkably complex set of accounting tricks used by the bank to hide its problems, and by a rapid deposit growth that saw the bank become, at one point, the seventh largest private bank in the world.

A report in The New York Times dated August 12, 1991, described the scheme in the following way:

“A rapid growth route was big customers. And Mr. Abedi tapped his contacts in Pakistan for the biggest, the Gulf Group, a shipping and trading conglomerate owned by the Gokal family of Karachi. The relationship began in 1972 when the company made substantial deposits in BCCI.

In 1976, according to Price Waterhouse documents, the Gulf Group began borrowing heavily from BCCI for trade financing and shipping loans. The following year, the loans had grown to the point that BCCI transferred the Gulf Group accounts from the London office to its Cayman Islands subsidiary, BCCI Overseas, to sidestep Bank of England restrictions on lending limits.

But by 1978, the Gulf Group was in financial trouble and so were BCCI’s loans. To hide its losses, BCCI funneled money — often unrecorded deposits — from elsewhere in the bank into the Gulf Group accounts to make it appear that loan repayments were up to date when they were not.

Frequently, the funds were routed through BCCI shell companies. Sometimes payment documents were simply faked.”

Once the bank began to create both a culture and an infrastructure for lying about how much money it was losing to help out friends of Agha Hasan Abedi, there was no turning back. Once you have lied that much, you cannot then suddenly come clean and admit just how crooked your whole business model has been. And so the temptation becomes to continue lying and hope that future profits will wipe away past losses and thus nobody will ever need to know the truth. At BCCI, doctoring loan documents became a “full-time occupation”, according to the auditors’ report.

Here is where things get worse. You see, the more your losses mount, the more incentive you have to try to hide them and seek to maximise future profits. That, in turn, leads to reckless decision-making, which in turn magnifies the losses and keeps making the situation even worse than when you started trying to cover it up.

In the case of BCCI, that recklessness came in the form of derivatives trading. On a $20 billion base of assets, the bank started off investing $1 billion in cotton futures and other derivatives, but as the losses mounted, quickly grew that investment book to over $11 billion, in a futile gambling addict attempt to “win back the losses”. The bank lost hundreds of millions of dollars each year in this kind of trading activity.

In Abraaj’s case, the lying started with the fact that the profits from Abraaj’s investments were not able to keep pace with the lifestyle and financing needs of Arif Naqvi and his family and friends.

When initial reports came out about financial problems at Abraaj Capital, it was assumed that Abraaj simply had operational costs that exceeded its revenues in the normal course of doing business. However, a more detailed review of Abraaj’s financial documents and internal communications by The Wall Street Journal published last month reveals a much messier – and less flattering – picture.

It shows Arif Naqvi treating not just Abraaj’s money, but also Abraaj’s investors’ money, as his own personal piggy bank to finance investments into his children’s and his friends’ businesses and frequent “loans” to himself made by Abraaj using not its own money but that of its investors, who had entrusted the firm to invest it into businesses on their behalf. Those investors include the Bill & Melinda Gates Foundation and the United States government.

As much as $660 million was moved out of investors accounts without their knowledge to pay for money that Naqvi wished to either gift or invest in his family or friends, especially his two sons. Abraaj moved $200 million out of its investors accounts into Naqvi’s personal account at Deutsche Bank, reports The Wall Street Journal. It is still not clear what justification was used to do so.

To cover up its tracks, Abraaj relied on loans from banks or companies it had investment relationships with in order to make its financial statements look whole. For instance, on November 30, 2017 the Gates Foundation asked Abraaj for bank statements from its healthcare fund in which they had invested money. On December 5, Abraaj borrowed $140 million from Air Arabia and $29 million from its own funds to deposit into the fund’s accounts. The money was returned to Air Arabia and its treasury by December 15, but by that time Abraaj was able to produce a bank statement saying that it had the $170 million it needed to show in the fund’s account on December 7, 2017.

There were times, reports the WSJ, when Abraaj did not have money to pay employee salaries and still prioritised the personal needs of Arif Naqvi.

And Profit has learnt through a source familiar with the matter that money was frequently moved back and forth between Abraaj’s client funds and the trust funds of Arif Naqvi’s sons, named Coronation I and Coronation II.

The philanthropic legacy

In addition to their finance careers, both Abedi and Naqvi fancied themselves philanthropists and patrons of the arts. For Abedi, his preferred art form was poetry, and for Naqvi, it is painting and sculpture. But more than their patronage of the arts, one thing clearly animated both men: visible philanthropy in Pakistan.

Abedi’s philanthropy was geared mainly towards education and healthcare. He helped fund the creation of what is now known as the National University of Computer and Emerging Sciences, and funded part of the creation of the Ghulam Ishaq Khan Institute of Engineering Sciences and Technology, arguably Pakistan’s leading engineering school.

In healthcare, his Infaq Foundation helped finance the operations of Sindh Institute of Urology and Transplantation, the National Institute of Cardiovascular Diseases, and Lady Dufferin Hospital.

Arif Naqvi’s philanthropy was also focused on similar areas, with a slightly greater emphasis on healthcare through the Aman Foundation, which was primarily an ambulance service that also offered other healthcare programs and services. In education, the Aman Foundation helped fund the construction of the new city campus for the Institute of Business Administration in Karachi.

But while Abedi’s philanthropic legacy lives on in the form of the Infaq Foundation, the Aman Foundation’s survival is in question. Sources familiar with the matter say that the foundation’s headquarters in the upscale E.I. Lines Area of Karachi – bought in 2010 for a reported Rs400 million ($5 million at the time) – has already been sold off, as have many of its ambulances.

Abedi was unquestionably a crook, but so many in Pakistan have continued to benefit from his philanthropy, long after his death in 1995, that it is somewhat unsurprising, if still infuriating, to see him being defended against the now proven charges of financial malfeasance.

The charges against Naqvi are still unproven, though the evidence appears to be mounting. How will he be regarded by Pakistanis, now that it looks like his philanthropic venture may not survive his business?

The fate of Abraaj’s investments in Pakistan

Abraaj’s two biggest investments in Pakistan are in K-Electric, and in Byco Petroleum. Many of Abraaj’s supporters point to the delays in the sale of Abraaj’s stake in K-Electric as the reason behind Abraaj’s collapse, and indirectly blame the government of Pakistan for Abraaj’s demise. The argument goes that had Abraaj been able to realise the profits from the K-Electric sale, it would have been able to pay back all of the money it moved from its investors’ accounts.

This assertion may or may not be true. What is absolutely true, however, is that Abraaj would not have collapsed had it never moved money out of its investors’ accounts without their permission in the first place. They were engaged in such complicated accounting at Abraaj and had such little by way of corporate governance (the head of corporate compliance was Arif Naqvi’s brother in law) that, sooner or later, they were going to get caught stealing from their clients.

Abraaj argues that they did not steal, merely borrowed. That distinction may help Naqvi sleep better at night, but the fact of the matter is that Abraaj broke their investors’ trust. And trust, ultimately, is the only currency that matters in finance.

As for K-Electric, Abraaj’s share in the company will eventually be sold, though sources familiar with the matter say that Shanghai Electric – still considered the likeliest buyer – will ask for a $300 million discount off the initially agreed-to $1.7 billion price tag.

There are similar reports about Byco Petroleum, with sources telling Profit that the Abbassciy family, who own the majority stake in Byco, have been begging Abraaj to sell them the private equity firm’s stake, and Abraaj had been refusing. The Abbassciys had been raising capital to make an enticing offer – reportedly north of $250 million – for Abraaj’s share in Byco, though that number is now expected to be substantially lowered as Abraaj exits all of its investments in the form of a distressed sale.

An earlier version of this article incorrectly stated that the initial investors in United Bank Ltd were the Nahyan family of the United Arab Emirates. That is incorrect. It was the Saigol family. The error is regretted.

Great article – loved to read it. Profit is fast becoming my number 1 read.

An article citing micro instances which say little about the overall picture.

The language reeks of vengeance and it seems that the writer has a personal score to settle.

An overview of their financial statements would have had been more forthcoming.

Agreed. Seems like a paid job. No substantiation. Not a fan of this paper anymore.

Sorry to say that the writer of this article did not do proper research and seems to have some kind of bias towards Agha Hasan Abedi as well as Arif Naqvi. United Bank was established and owned by Sehgal family and later run by Agha Hasan Abedi.When Sheikh Zayed became rich by oil money and Agha Hasan Abedi brought that money to UBL. When Butto nationalized the banking and financial institutions in Pakistan. Mr Abedi moved to Abu Dhabi and with the Sheikh Zayed’s money and patronage formed BCCI . There are many other glaring misstatements. I can go on and on

Arif Ali. Former Investment Manager ADIA. 1980-1984

People will naturally defend their icons – Pakistanis who made it big – who they had always looked upto. Doesn’t really matter if they did some shady things along the way. That has become our national culture, a lot of tolerance as long as you have done some good stuff as well, such as making Pakistan’s name prominent in the highly competitive global financial sector. Cheating and lying are not that big an evil here as it is in other countries.

The defenders do no realize the damage such successful people do to Pakistan’s image abroad. The fact that there are not many Pakistanis who made it at the top, and the ones who do, they are all proven to be tainted one way or the other. This makes the world skeptical about all Pakistanis, however honest they are. Rather than making such people heroes, they should be castigated so much that others in that elite circle do not even think about doing some chicanery and thinking to get away with that. Blaming everything to conspiracy theories all the time doesn’t help either.

Fantastic point. Pakistanis for the most part are mushrikeen idol worshippers who have zero morals and zero ethics – hence they are still defending both Abedi; and currently the King of Crooks and Deceit, Arif Naqvi!

There was another charity BCCI FAST (Foundation for Advancement of Science & Technology) funded by Mr. Abedi / BCCI and created in 1980. In 1985 it ventured for university that can produce scientists and technologists. FAST university is now highly placed university in the area of computer science in Pakistan.

So, Mr. Abedi was a visionary leader but like any father wanted to save his child (BCCI).

Re what is written about Mr Abedi and BCCI and comparing with Abraj appears to be the work of not only a heavily biased person but also an ignorant and very low calibre person His understanding of facts history and world of finance and international banking is evidently based on a low level bank clerk working for a large bank probably somewhere in the middle east It is surprising that local print media have decided to pring such low level coverage of issues underlying the collapse of BCCI and Abrage The comparison to the least is utterly ridiculous and needs to be trashed in the dustbins of readers

Pardon me, but you also seem to be heavily biased as apart from the adjectives used to describe the writer, you’ve stated that comparison between BCCI and Abraj is utterly ridiculous, yet didn’t tell the reason why it need to be trashed? Is this comparison unfair to BCCI or Abraj?

Thank you @Khuram. I was thinking the same thing.

Well said, Khurram!

Very well written articles. Bravo!

Read carefully BCCI group was a global banking institution with presence in 73 coutries across the globe including First American Banking Group in USA a franchise at East Coast of USA grandfathered to operate in multiple States BCCI and First American on closure of group had Footings of US dollars 40 billion and a work force of approx 28000 persons which included senior most professional bankers from Pakistan India Bangladesh UK China Hong Kong and USA At the time of shitdown BCCI holdings was 70 percent owned by the ruling family of Abu

dhabi and Some leading business houses

From Saudi Arabia Further The also had significant non banking assets across the globe inc Attock oil and refinery in Pakistan All this was an outcome of the

Vision and incredible talent and capability of Late Agha Saheb the comparison with Abrage and Naqvi is patently absurd and begs the question Re competence ethics morality and standards of our print media and the idiots who contribute to it A senior citizen of Pakistan

As a Central Bank examiner I have documentary proof to indicate that BCCI records were all fraudulently manipulated and this was detected by our team way back in 1982. People defending Abedi are simply ignorant of facts.

As a Central Bank examiner I have documentary proof to indicate that BCCI records were all fraudulently manipulated and this was detected by our team way back in 1982. People defending Abedi are simply ignorant of facts. In short frauds on a massive scale.

BCCI,s capital was totally wiped off by huge losses.

Asset quality was very poor.

Management was ineffective, poor and not professional.

Earnings were inflated enormously with paper profits.

Liquidity was a big question mark.

Agreed. Just want to add that after the fall of BCCI, that management lot went to several banks and they were found out to be highly ineffective and unprofessional. They knew only one way of doing business and were not qualified or even willing to adopt new changes in global banking.

On point, Khurram! BCCI ex-management “managed” to wriggle their way like a bunch of worms and snakes into Middle Eastern domiciled banks – where very unfortunately some still remain!

Mr Muhajir you are not only biased but also ignorent BCCI group operated in 73 jurisdictions ie under regulatory regimes of several central Banks and regulators Wake up you must have been a minnion in State Bank of Pakistan or some other location Re falsification of books Do you live in the teal world or some imagined reality Recall 2008 financial meltdown and disclosures of fudging and falsifications amongst the largest and oldest Banking companies in the Western Hemisphere In fact several large banks were bailed out by Respective central banks under the glaring contradictions of too big to fail Get your facts right At the time of shut fown of BCCI holdingCapital adequacy was not the issue in fact Abu Dhabi

Govt had injected the required capital First American Group was over capitalised when the US govt ceased the bank Wake up gentlemen and live in the real world Your country ie Pakistan is yet to produce an entreprenuer and professional banker of Mr Abedi,stature your comments are at best pathetic

Please get your facts right BCCI group operated in 73 jurisdictions and regulated by

Mutiple regulators across the globe Inc USA Further at the time of shut down BCCI holdings was meeting capital adequacy as Abu Dhabi Govt had injected sufficient funds so capital was a non issue Also I might invite you attention to year 2008 global financial meltdown when some of the largest and leading international banking companies were found to be

Complicit in fudging books and disinformation and many were bailed out under this glaring contradiction of too big to fail Have you heard of any CEO or senior staff of such companies of being indicted for criminal conduct and subsequently punished What about Lehman scandal? Fact is that our beloved nation or whatever has yet to produce an enteprenuer and international professional of Mr Abedi,s calibre Please let us share your insights if any about the great businessmen and their achievements since 1947 comparable to Agha Saheb Grow up and learn to live in the teal world and not in some imagined realities

Refering to remarks about ex BCCI staff and their performance after closure of BCCI group. This statement is yet another reflection of ignorance and low calibre In pakistan alone at one one ppint of time as many seven CEO ,s of local banks in this geography were former BCCI employees and senior officers and guess what Alflah Bank now amongst the top ten banks in

pakistan was built and grew under the leadership of former BCCI professionals Get your fscts right I have difficulty in responding to tomfools

Notwithstanding veracity of the article contents, the main issue is the massive reputationsl damage suffered by and large honest Pakistani professionals. Pakistan already enough issues to deal with and this kind of behaviour and the related adverse publicity doesn’t help – particularly as this helps Indians in the M.E to climb ladders by portraying Pakistani professionals as crooks.

Really do not know who the writer is and why this racist analysis. Do we conclude that subprime and 2008 was a white Christian fraud as it was mainly institutions run by white christians from both sides of the Atlantic. Bank with assets of 20 billion with virtually all depositors paid out and a PE firm managing at its peak 14 billion. The writer has for whatever reason not mentioned a word that the bailout of 2008 was over 1.5 trillion. Just remember one thing – money has no colour and nationality and religion has nothing to do with frauds – analysing on racial lines is evil. That is why we have stupid profiling like ISLAMIC terrorist and referring TONY Blair and George Bush as Christian liar – they repeatedly lied about Iraq.

Imtiaz Hussain

One thing is obvious from the reading of above pieces of comments on the article , that we lack in understanding of the whole picture of International Finance at the time of deliberate collapse of BCCI. They may have committed some mistakes but the regulators were hell- bent to close it down any way. I request to all above commentators to please consider the whole picture while declaring someone of Abedi’s stature as crook. Be rationalist please. Thanks.

Pl note at the time of BCCI closure Mr Abedi was a sick man virtually disabled and no assets in his or in the names of his immediate family In fact he owned no real estate of any worth in UK or Pakistan It was entirely due generosity of Late Shiekh Zaid that the title of Bank house located at Main Clifton road karachi was passed on to him where he finally passed away It is a crying shame to refer to him as a crook His conduct an a person and professional banker is a matter of public record How many Pakistani leading citizens incl politicians and business leaders may claim the above Begs the question

Agreed. In a short piece of comments, we can not analysis true state of problems, rule of international agencies and the cases of entrapment, encountered by the bank. International power houses can destroy any financial institution, irrespective of its repute and health, by using a set of techniques. I hope that the persons having understanding of international capital market will understand this point more clearly than a layman. in nutshell, it can be safely said that the Bank was closed as they wanted so. Definitely, the eagerness of management of the bank to become the lender of third world countries without taking into account ensuing competition with International financial player was may be a reason. But truth is that we Asians generally fail to understand the difference between doing and saying. Numerous examples can be placed here to support this point. Whatever the set of reasons may be , one thing certain than even to think on the lines of a legend like Abedi is hard to imagine. He was a pioneer, who opened the door of international banking to Asians. Time will come when true professionals will come forward to explore the field he opened for them. As a consultant in international capital market and finance , it is my humble opinion. My message is that please do not form opinion by looking some aspects and ignoring the whole picture. Thanks. Imtiaz Hussain

Brilliant article. In my very humble opinion, reasons for the fall of both entities were the same – ie., below-par management (essentially one-man show) and virtually no corprorate governance (or the governance was atleast not at the level as it’s was required for the complexities entities like BCCI and Abraaj)

Drawing parallels between Agha Hassan Abedi (BCCI) and Arif Naqvi (Abraj) is sheer injustice with Agha Hassan Abedi. BCCI was normally running and honouring its commercial commitments untill last moment when it was forced to close down by regulators on filmsy pretext of taking preemptive measures to protect creditors while bank was viable. Many years after forced closure bank could pay 60% or more to its creditors through liquidation. I don’t know any such example of a bank which is put in liquidation and creditors end up getting dividends to that extent. BCCI was financial Saddam Hussain forcefully closed on pretext of fraud, which was never proved like Saddam Hussein’s wepons of mass destruction were never found. On the other hand Abraj is a case of financial mismanagement and happening of real default leading to its liquidation.

“An earlier version of this article incorrectly stated that the initial investors in United Bank Ltd were the Nahyan family of the United Arab Emirates. That is incorrect. It was the Saigol family. The error is regretted.”

The aforesaid statement says a lot about the competence of the author and the so called research he has carried before writing this article.

The funniest part of the article is the table titled “Parallels and differences between BCCI and Abraj”

what intellectual choice of variables to compare the two entities like Founder’s famous American political friend and ultimate fate etc. Never read such thought provoking variables for comparison.

Agha Hassan Abedi might have made some mistakes but definitely not the price he was forced to pay. BCCI was forcefully closed on pretext of fraud, which was never proved.

If Agha sahab would have been alive, I would recommend Arif Naqvi to be his protocol officer. BCCI did not have a home base. $14M money laundering were the basis to shut down. Sh Zayed pai $1.2B one day before the closure under an agreement that restructuring would be allowed. Both big Central Banks backed out. Yes Gokals losses were substantial but all depositors got every cent back. The writer has no idea about the importance of BCCI if it would have been functioning today! My friend, if you are from 3rd world you should remain in your limits otherwise from Faisal, Bhutto, Sukarno to Qaddafi or the fiance of Diana you will have the same fate. Remain in your limits otherwise you will be Shah of Iran or Zia. Happy New Year!

Aga SB was a visionary. Lot of his people around him let him down. The fact that, I believe all the depositors eventually got their funds must show some credence. At about the same time Barings went bust due to a rogue trader namely Nick Leeson. All efforts were made to keep it afloat n in BCCI’s case to close it down. It had become a threat. Kudos to Aga SB. Sadqa Jariya continues through the institutions he founded.

Balanced comment. Sums up the story.

I just love it when a Moron who aspires to be a writer is given a platform and they spew whatever they can regardless of how factually correct or incorrect it is. Such people usually don’t get very far because they sound as credible as Nawaz Sharif and Zardari put together.

So buddy you managed to skim a few articles someone or the other wrote on BCCI and Abedi and put this together by throwing in a little of Abraaj and Naqvi because the latter on it’s own wouldn’t cut it?!

Shmuck. That’s what the Jews would say even and they orchestrated the fall of BCCI.

Atleast if you want to Concord something out of thin air, do it in a way that believable.

Your article is Horse Shit at best

Comments are closed.