This is the story of a company you may never have heard of, but one that includes just about every ingredient of corporate drama that you can imagine. There are allegations of embezzlement, corruption, potential insider trading and what may well be a high-stakes battle for the control of a publicly listed company with a substantial shareholding of the government.

The entity at stake? Pakistan Engineering Company, Ltd, publicly listed on the Pakistan Stock Exchange under the ticket symbol PECO, which, incidentally, is also the abbreviated way to refer to the company.

If one is to only believe the allegations in some rather insufficiently researched newspaper reports, the matter appears simple enough: a group of influential investment bankers and brokers gained insider information about a struggling state-owned company about to be revived and connived to buy shares from a state-controlled mutual fund that owned a substantial number of shares. The goal appears to have been to gain control over the valuable urban land owned by the company and sell it off for a massive profit in the tens of billions of rupees.

Of course, if the matter were quite so simple, this would not be nearly as interesting a story. Reality has a habit of being far more complex than fiction, this story has more twists and turns than a well-written mystery novel.

To avoid getting lost in the complications, we shall start our story at the very beginning.

How PECO got its start

The company now known as PECO began life in February 1950 as the Batala Engineering Company (BECO) by a man named CM Latif, who set up a factory to manufacture light engineering products on a sprawling 34-acre plot in the Badami Bagh area of Lahore. Almost since the very beginning, BECO was a publicly listed company, listed on the Karachi Stock Exchange.

Over the next decade, as the young nation continued to expand its infrastructure, Batala Engineering did well, with business growing so fast that it soon needed to expand its facilities.

So, in 1960, the company bought 247 acres of land in the Kot Lakhpat industrial area in Lahore with the aim of eventually expanding its manufacturing operations there.

Alas, that vision was not to pass, because before the company could fully realise its ambition of expansion, along came the socialist government of Prime Minister Zulfikar Ali Bhutto, which nationalised the company in 1972 and renamed it the Pakistan Engineering Company (PECO).

At the time of nationalization, CM Latif owned 24.86% of the shares of PECO, and the rest of the shares were owned by the general public. Under the 1972 order, the shares held by CM Latif were taken over (or stolen, depending on one’s perspective) by the State Engineering Corporation (SEC), a wholly owned subsidiary of the Ministry of Industries. The government-operated mutual fund National Investment Trust (NIT) also purchased 21.24% of shares of PECO through the stock exchange effectively changing the shareholding pattern to this: 33.25% of the shares were held directly or indirectly by the federal government; 21.24% shares were held by the federally controlled NIT, and 45.51% shares were held by the general public.

It is important to understand the role of NIT in the shareholding. While the federal government owns the management company that runs NIT, and is among the largest shareholders in the mutual fund, the fund itself technically operates on behalf of all shareholders, which includes private individuals. Hence, while NIT often acts as a quasi-government entity when it has a seat on the board of directors of companies it has substantial shares in, it is not directly obligated to do so under the fiduciary duties set forth for it by securities law.

The ambiguity of NIT’s role is where the problem starts in the battle for control over PECO, especially since the government’s ownership of NIT’s management company is what gave it management control over PECO in the first place.

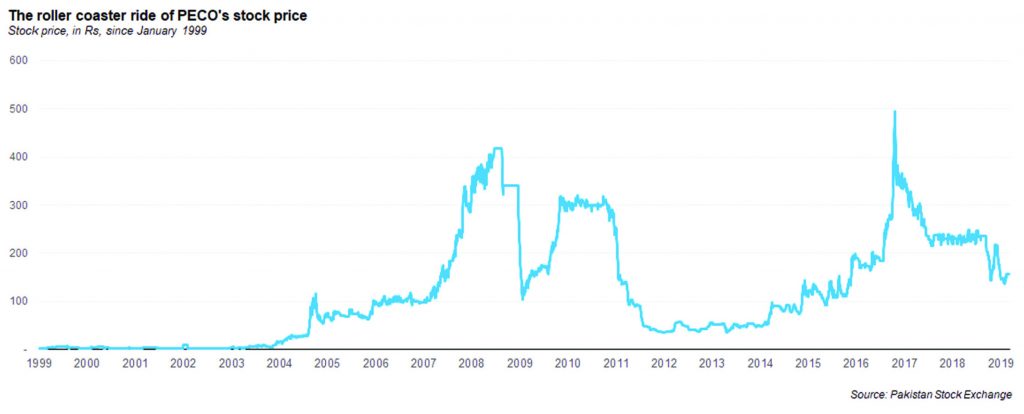

The disaster of government ownership and attempted privatisation

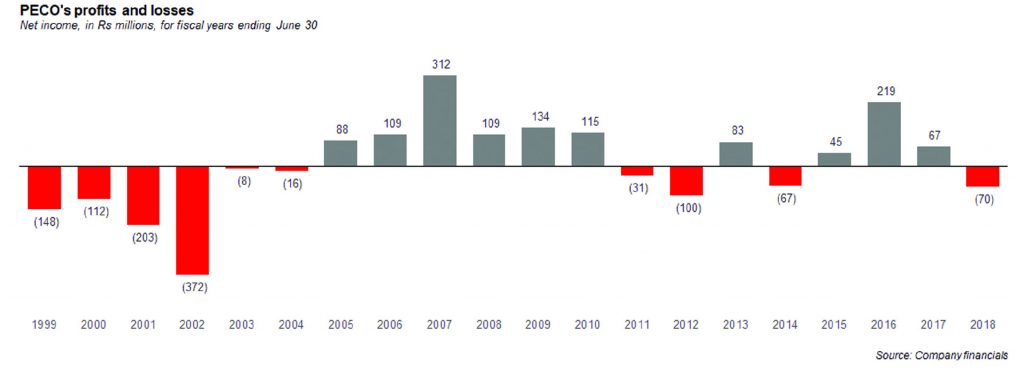

Needless to say, government ownership of PECO did not suit the company well, and in the 30 years that followed its nationalisation, PECO kept on wracking up losses, accumulating a combined Rs2.12 billion in losses by 2002, consistently relying on government-guaranteed loans and bailouts to remain afloat. The company went from being a high-flying publicly listed company expanding rapidly to becoming a dysfunctional ward of the state, technically still listed on the exchange, but with no real trading in its shares and no interest from investors because it was an almost entirely hopeless cause.

Then along came the military coup of 1999, and with it the very pro-free markets former Citibanker Shaukat Aziz as finance minister. Aziz had no interest in continuing to spend government money bailing out a company that should never have been in government ownership to begin with (the government did not create it, after all). And so, in 2002, the company was placed on the “active list” of the Privatisation Commission, meaning the commission was authorized by the cabinet to sell the government’s shares in the company.

However, prior to that cabinet decision, the Privatisation Commission had sent a letter to NIT, ordering it not to sell its shares in PECO without prior approval from the commission. What is not entirely clear – and what has yet to be litigated in court – is whether the Privatisation Commission’s order was superseded by the order from the federal cabinet. It is also not entirely clear whether the Privatisation Commission was within its legal authority to give orders to NIT.

Nonetheless, what happened next would raise some eyebrows.

As part of the attempt to privatise the company, the government had decided to restructure the company’s balance sheet: it authorised PECO to sell some of its prime urban land in Lahore to pay back debts that had been guaranteed by the government, specifically about Rs1.8 billion in PECO liabilities that had been directly assumed by the government that it wanted paid back.

On August 9, 2003, the PECO board of directors was informed that they had obtained the final approvals needed – a no-objection certificate from the Punjab government – to sell the land and clear the way for privatisation. The meeting was attended by, among others, Asif Jameel, who was a director serving as NIT’s representative on PECO’s board.

Within the next four days, NIT sold nearly all of its shares in PECO, all 1.2 million of them. The trading patterns in PECO’s shares went completely berserk. In the year preceding the August 2003 board meeting, the average number of shares traded was 48,727 per day. In the month after the meeting, the average number of shares traded went up to 901,058 per day. More PECO shares were traded in the three weeks after that board meeting than in the previous full year.

In an investigative report compiled by Javed Hasnain Rashid & Company, a chartered accounting firm retained by PECO management in 2018, it is alleged that the ultimate buyers of the shares from NIT were veteran investment banker Arif Habib, through Rotocast Engineering (Pvt) Ltd, and Masood Ahmad Khan Soodi, through Maha Securities. The central allegation in the report is that NIT acted on behalf of Arif Habib and his associates and improperly sold its shares, an action that, if true, would constitute not just insider trading, but several other counts of securities fraud.

For his part, Arif Habib claims that he did not act inappropriately and in fact, was not the buyer when NIT was selling in that frenzied month in August and September of 2003. “I had purchased shares of the company a year after NIT had sold in the market,” said Arif Habib, in a statement e-mailed to Profit.

Once NIT sold, however, the government was no longer the majority shareholder in PECO, retaining only a one-third share in the company. It managed to hold on to most of its board seats, however, until March 2006, when the private shareholders – led by Arif Habib – managed to flip the board of directors. The government had previously held six of the nine board seats prior to 2006. After that election, it only had three seats, and private shareholders then controlled six.

The private control era, and the investigations

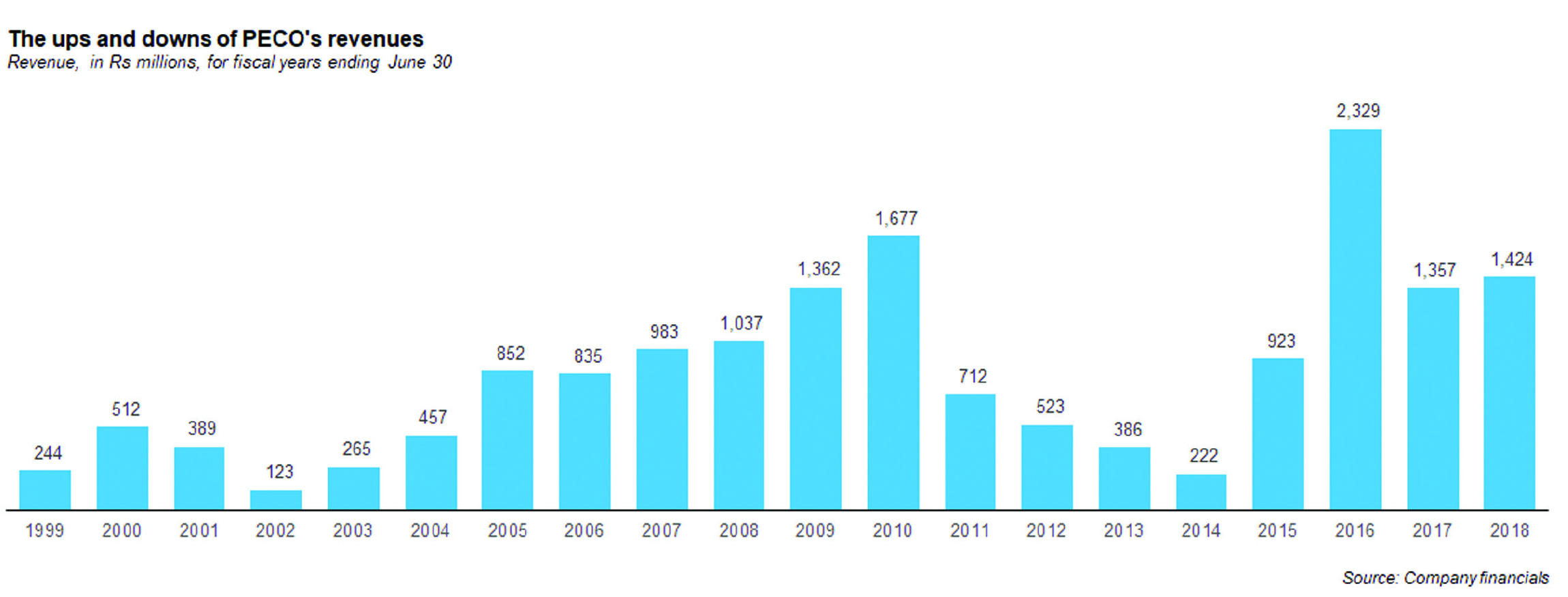

What followed was a period of extraordinary turnaround for PECO. In the six years ending June 30, 2004, PECO accumulated net losses of Rs858 million, even as its revenue grew from Rs244 million in 1999 to Rs457 million in 2004. In the six years after that, however, revenue nearly quadrupled, going from Rs457 million in 2004 to Rs1,677 million in 2010, an average growth rate of 24.2% a year. Profits soared as well, peaking in 2007 at Rs312 million.

And while the allegedly unauthorised sale of NIT shares had been reported to the government almost immediately, no real action was taken during the Musharraf Administration, perhaps in part because the result the government had been aiming to achieve – private management control of PECO and an end to government bailouts of the company – had effectively been achieved, even if a full privatisation auction had not taken place.

That changed in 2008, when President Musharraf left office, and the newly elected government of President Asif Ali Zardari was sworn in.

With a newly reinvigorated Parliament after a decade of military rule, there was renewed interest in the legislature to examine the record of the military government. The Public Accounts Committee (PAC) of the National Assembly, led by Sardar Ayaz Sadiq, began looking into the matter of the allegedly unauthorised sale of NIT’s shares in PECO.

The PAC formed an investigative committee comprised of senior civil servants who were tasked with looking into what happened and who was responsible. The committee ended up blaming officials at NIT for acting improperly and claimed that insider trading had, in fact, taken place. They recommended that the government make efforts to regain controlling shares in PECO at as little a loss to state-owned entities as possible.

The report’s specific language, however, is highly debatable. It claims, for instance, that there was insider trading and that private shareholders were able to gain control of PECO as a result of that insider trading. Yet, it holds officials at NIT responsible, and urges the government to buy back shares rather than demanding they simply be confiscated.

The unwillingness of the PAC-appointed investigation committee to suggest any action against Arif Habib and his associates has been constituted by many including Habib to mean that the committee has exonerated his actions. “The committee, the SECP [Securities and Exchanges Commission of Pakistan], as well the National Accountability Bureau have investigated and found no wrongdoing [on my part],” said Arif Habib, in his statement to Profit.

The government then entered into negotiations with Arif Habib to try to get him to sell his shares with at least some government officials believing they could compel him to do so. However, Arif Habib decided to keep his shares and instead offered the government that he would abide by three conditions:

- The government would be allowed to regain control over the PECO board of directors

- Arif Habib would pool his shares with the government’s shares for sale when PECO’s formal privatisation process started

- Arif Habib would offer the government the right of first refusal before selling any of his shares

But while he was willing to make this offer, the government appears to feel this is not enough and is unwilling to settle for anything less than Arif Habib selling his PECO shares back to the government. As a result, while the chairman of the board and the CEO are still government appointees, the private shareholders, including Arif Habib, still control six of the nine board seats on the PECO board of directors.

The government was able to wrest at least enough control to be able to gain back partial management control, with the right to appoint the CEO. However, that appears to be where things went wrong.

The new CEO, and the battle for control

In March 2016, the government appointed a civil servant – Mairaj Anees Ariff – as the CEO of PECO. And almost from the very beginning, the private sector shareholders were deeply unhappy with the situation, which has resulted in the company descending into chaos, accusations of embezzlement and corruption being traded between the CEO and the private sector shareholders, and the dredging up of the old issue of how the private shareholders managed to even get control over the company in the first place.

In short, the situation is this: Mairaj Ariff wants to assert control as the CEO of PECO, and believes that the private shareholders, led by Arif Habib, are instigating a revolt under him, particularly through their influence with some of the senior finance and operations staff, including the CFO. The private shareholders, meanwhile, believe that the CEO is unqualified for the job and is not only running the company into the ground but also embezzling company funds while doing so.

Matters came to a head on October 3, 2018, when Mairaj Ariff wrote a letter to NAB alleging that three senior company officials – the CFO, the General Manager Audit, and General Manager Works – were acting as “front men” of the private sector shareholders. It is unclear what he means by “front men”. If by that he means that they are acting on behalf of the shareholders, it is unclear why such a thing would be illegal, since company officials have a fiduciary responsibility to shareholders, and the private sector shareholders are in the majority.

Nonetheless, Mairaj Ariff was in no mood to tolerate any dissent and went so far as to fire the three officials and have them physically barred from entering PECO’s offices.

Arif Habib, however, has a completely different version of events. They agree that the CEO and CFO did not get along. They completely disagree on why. “Regrettably, the highhanded and inept manner, in which Mr. Mairaj A. Ariff had been running the day to day affairs of the company had been reported to different fora by the senior management of the company. So much so, that the Chief Financial Officer of PECO was constrained to file a complaint against the Mr. Mairaj A. Ariff after he was pressured by Mr. Mairaj A. Ariff to falsify the accounts of the company to hide the losses being incurred during his tenure. Ever since the refusal of the CFO to adhere to such illegal demands of Mr. Mairaj A. Ariff, he has been on a vendetta against the senior management of the company; he had been preventing them from attending their statutory duties and has also been trying to prevent meetings of the Board of Directors under one pretext or the other,” said Arif Habib, in his statement to Profit.

For their part, Arif Habib and the other shareholders allege that the CEO is trying embezzle funds, which they are trying to prevent him from doing. They went so far as to try to block the company’s accounts at United Bank Ltd, a move that was resisted by the CEO, and for which Mairaj Ariff received support from officials at NAB.

PECO’s accounts in United Bank were suspended after some company officials submitted documents to the bank requesting a suspension of these accounts.

The PECO accounts were restored on January 29, 2019, after NAB intervened, according to sources at Ministry of Industries. The president of United Bank was summoned at the offices of the Combined Investigation Team (CIT). The responses submitted by the bank for the clarification of suspension of accounts were deemed “unsatisfactory” by the NAB and therefore PECO accounts were made operational again. During the time that these accounts were suspended, salaries and payments for raw materials by PECO were delayed.

The justification from the PECO officials was that Mairaj Ariff had unilaterally appointed a new CFO after firing the old CFO, Mian Anwar Aziz. A civil court in Lahore has issued an injunction against Aziz’s termination. They alleged that Ariff unilaterally sought to change the authorized signatories of the bank account maintained with UBL without obtaining approval from the board of directors. By exerting pressure on UBL officials, Ariff got the signatories changed and also conducted certain transactions from the bank account, including a withdrawal of Rs5.6 million which amount is unaccounted for in PECO’s accounts.

Who is to blame for the losses?

The ultimate dispute between the private shareholders and the government-appointed CEO is who is responsible for the fact that PECO’s revenue have plummeted over the past three years and the company has swung from making a profit to a loss. Arif Habib and the other shareholders squarely place the blame on the CEO’s ineptitude, whereas the CEO blames what he calls meddling by officials whom he accuses of being loyal to the shareholders and not him.

Mairaj Ariff hints at what he believes to be a dark agenda that Arif Habib and the other shareholders have. “As a state enterprise, if PECO shuts down, the private investors can pressurise the government to sell the 250 acres of land worth approximately Rs100 billion rupees, or even more,” he said, in an interview with Profit.

And to further embellish his position that the private shareholders were acting in a nefarious manner, he commissioned that investigative report by Javed Hasnain Rashid & Company, a chartered accounting firm, laying out what he believes to be the illegitimate manner in which Arif Habib gained his shares in PECO.

Ultimately, however, as much as the government may dislike the fact that Arif Habib is a shareholder of PECO, they appear to have acted in a manner that suggests that they either believe his version of the story or do not have any evidence to prove otherwise. Mairaj Ariff was removed from his position in February 2019 through a unanimous vote of the board of directors, bringing – for the moment – an end to the drama at PECO.

Let private sector to run this entity

Very well researched, though some important points being missed out.

1) The land on which BECO, now PECO was acquired under West Pakistan Government acquisition ACT, there-fore the Company does not hold title to this asset.

2) Two cases are pending in the Lahore High court since 2003, pertaining to NIT sale of Beco-PECO shares and sale of land, with a final interim order that the land cannot be deposed off without the final say of the Lahore High Court.

You are right. Land acquisition act requires the provincial govt to agree to alternate use of acquired land, which after decision of Koh e Noor textile by Lahore court, is not possible. In all probability the issue of land is raised to justify keeping the company with the government so that corruption in the affairs of the company continues. what a sad end to a company that was once the flag bearer of engineering in Pakistan. Also interesting to read the MD fired CFO. He can not according to code of corporate governance. Also under which law NAB can restore bank accounts? May be the MD of PECO has got good connections there

How come Govt. can restrict NIT not to sell these shares. All the shares held by NIT are a property of unit holders and not the Govt of Pakistan.

Govt can not and there is no law that allows Govt to put any restrictions on shares owned by NIT. There appears to be a massive confusion that NIT is govt, which it is not

Best to check history of Beco/Peco till 2008 from the website: “BECOPECO.COM”.

Further-more, if Govt. does not include NIT shares in the pool of shares it has, from the very date of nationalization of shares in the year 1973 (after taking over the company in 1972), its policy to control such companies through nationalization of shares of their respective managements would have failed the very first day.

So the question would then arise, why did the Govt. nationalization shares, which only gives it a minority position in the share holdings ?, can it be considered a false action of controlling the company under the “Economic Reform Order of 1972”, if its other controlled Govt. entities are allowed to dispose of their holdings, would this not amount to nullify the very aspect of nationalization of shares of these companies ?.

So the government first stole the share,effort and money of a hardfull person. Corrupt people enter government and loot the company from inside out then sells it to their chosen people. Wow we are the worse then we ask why economy is drowning.

Mairaj Anes Arif, former MD of PECO has red-lighted career history. He has been six times OSD in his flawful career. Corrupt Bureaucracy is supporting him by all corrupt means. My life is in danger and I all proofs of corruption of said MD PECO so I cannot show my identity. More news to follow.

Sir immediately contact me. I know he is a false person.I need all proofs against him please send me a copy of them I beg you….He has destroyed us please.

Mr. Miraj Anes Arif was previously deputed as a GM in SMEDA at a monthly salary of Rs.180000 pm with a 1000 CC car. He had no exposure of corporate listed company before deputed to PECO. This is the dilema of Pakistan that wrong persons are assigned jobs. Same was the case when incompetent, irrelevant, non-professional and a person with no commercial sense i.e., Mr. Miraj Anes Arif had been assigned the apex position in a profitable commercial listed entity PECO. It is very important to note that managing a listed commercial entity needs high professionalism and in Pakistan, such entities are managed by highly professional individuals with strong commercial sense.

Very “interestingly”, Mr. Miraj Anes Arif was appointed at a handsome salary of Rs 385000 with 1800cc Company maitained car, unlimited medical allowance for himself and his family including parent, driver, unlimited mobile allowance.

More to follow……

Latest salary details, received from PECO Factory, of Mr. Miraj Anes Arif reveals that he is getting a monthly remuneration of Rs. 432000, along with Rs 140000 for utility allowances, unlimited medical allowance for himself and his family including parents, 1800cc Company maintained car with 270 liters of petrol.

The salary details are given to readers to enable them to fairly judge the performance of former MD Mr. Miraj Anes Arif and the unlimited benefits he is having.

Let me take to the beginning of story from where all disputes started, Mr. Miraj Anes Arif was appointed in PECO on 16 March 2016, with no exposure to any listed corporate manufacturing concern before 16.03.2016. According to credible sources, Mr. Miraj Anes Arif had not have any basic information regarding regulatory bodies and corporate reporting requirements of a listed company.

More to follow…….

Factory sources revealed that PECO earned highest ever sales and profits in the year ended on 30/6/2016. Evidentally, there is no active contribution in it by Ex-MD Mr.Miraj Anes Arif.Documents reveal that such wonderful performance was due to professional directors and senior management of PECO. Sources also revealed that in 2015 PECO was declared a “non public sector company” by SECP on clarification seeked from ministry of industries. Govt of Pak has never facilitate PECO financially or operationally since its privatization in 2003. Interestingly, PECO, like other Govt institutions never enjoyed profits during nationalization i.e., 1972 to 2003; a bereaucratic dilemma with all Govt institutions.Sources revealed that since appointment of Ex-MD Mr.Miraj Anes Arif in 2016, operations of PECO started deteroriating because of lack of business sense and non-professional attitude of Ex-MD Mr.Miraj Anes Arif. Sources also revealed that Ex-MD Mr.Miraj Anes Arif turned down important operational and financial decisions of company without any valid reason that halted operations of the Company with the passage of time. Important decisions of Board of Directors were not complied with by Ex-MD Mr.Miraj Anes Arif deliberatly. Sources revealed that Board of Directors always extended full support to MD by all means.

More news to follow….

For the clarification of all above, who are giving statements against Govt and a govt nominated MD. Let me reveal one thing here. Even after being subverted, specifically during these past 5 months, PECO under Mr. Mairaj Anees Ariff, during these 5 months has won orders of more than 700 million in a go according go an authentic source. These orders are for the products, the tenders of whom had intentionally not been participated by the Ex. Employees of PECO under previous Board. There is a lot more to reveal which goes in favor of the Company and the Govt nominated MD.

One more thing to clarify here is that, there are a lot of instances with proofs, which clearly show that PECO was slowly poisoned by the Ex. Employees. (Not the BOD only). The Ex. Employees in order gain from PECO were keeping both the BOD and the MD in dark. They had been playing their own mafia. Both BOD and MD were not given a clear picture. This is one side of the story. Other side is the BOD playing their role as Mafia. So in both sides PECO was slowly poisoned. This led the situation to be this much worse that today so many employees had to be terminated.

MD PECO, according to authentic sources has always been trying to take PECO to the apex and even above the apex where once it was. MD during his three years tenure has always tried to promote new developments but the Ex. Empoyees always sabotaged and gave the reports of new developments as ‘not feasible’.

One more thing, the senior managemnet had been enjoying for years, more than the 270 ltrs of petrol and a 1800cc car given to MD. (Legally and according to company policies) They (Ex. Employees) had a lot more to enjoy (illegally and not according to company policies) which can be enlisted according to authentic sources.

So, it would not be right to blame MD without knowing the inside situation. May Allah shower His blessings upon the Company and make a good fortune for it. Ameen.

If you know what really happened at PECO you would not have using the word company policy. MD is answerable to BOD and cannot terminate CFO as per your HR policy at PECO.

We are living in Banana Republic with the philosopy of might is right. The terminated MD is still in charge and ruining the company.

Arif habib AND his cartel nothing new for them . Anothet example of Arif habib corrupt practises is Javedan corporation.which was a cement industry and now Arif habib has converted into a private housing society NAYA NAZIMABAD which is again against the law. Dozens of cases and NAB Inquiries but nothing can hold these Mafias . Insider trading manipulating the stock market and for that matter using all the ill means and corruption is what they do .

Factory sources revealed that PECO is in complete turmoil due to pathetic and highly unprofessional policies of terminated MD Mr. Miraj Anes Arif. It is revealed MEPCO is about to blacklist PECO due to non-fulfilment of order which was won (below cost at net loss) on the ill-wills of terminated MD PECO. Suppliers are not getting their paymenys despite of availability of amount in unlawfully operated bank account at Faysal Bank. Importantly, there were withdrawals of 63 million since 1/5/19 to 30/6/19; out of which nothing was paid to suppliers. It seemed that terminated MD PECO is using this money to satisfy his whims and objectives. (ALLAH knows better). This is pure bureaucratic delimma with our country governed by incompetent bureaucracy. Sources revealed that head office employees turned down illegal and unlawful orders/acts of terminated MD due to which they were not allowed to enter their work premises and also not getting their salaries since Oct 18. They are allowed to have their salaries during Ramzan/Eid. These people are facing huge financial and employment crises.

More important to follow……….

(Lots of data has been collected from factory which will be share shortly)

C0RRECTION

******They are notallowed to have their salaries during Ramzan/Eid. These people are facing huge financial and employment crises.

Factory sources told that 80 Head Office staff members are not allowed to continue their tasks and their salaries are not paid since Oct 2018. They revealed that terminated MD Mr. Miraj Anes Arif has ruined company for his personal objectives. Security of IT data server of PECO was compromised by unauthorized team of MD. Illegal appointments were made by terminated MD. Illegitimate tenders of scrap/procurement are authorized by terminated MD. Illegal withdrawal of money was made from Company’s bank account and put at an illegal bank account opened at Faysal Bank with the malafide involvement of a Regional Manager of Faysal Bank and conivance of Branch Manager of Johar Town branch. Corporate experts are of the view that such bank account will be persumed as “Benami” as no approval from directors is sought for operations of such account. Signatories of this account (Terminated MD and illegaly appointed CFO) will be convicted with criminal offences.

Sources told that NAB officials including DG NAB was disguised due to submission of fabricated documents and fiction stories by terminated MD. This resulted in waste of precious time of NAB in fake cases.

More news to follow………..

The Constitution of Pakistan is the most superior and dominates all intra-company policies. The Pakistani law has vested powers in MD which makes him superior to BOD in special circumstances, which are prevailing upon the company. Moreover, for a kind information to ALL, the BOD had been declared ‘defunct’ by the NATIONAL ACCOUNTABILITY BUREAU (NAB). So, MD is there on instructions of the Government, the Establishment Division, and thus there remains no doubt of him being the In-charge of this State’s Unit. In short, the BOD does not exist now and MD has all powers as per law.

Secondly, as far as the MEPCO’s order is concerened, the authentic sources told that this was the last order which was delibrately procured by the Ex. GM’s, appointed by the illegal Board, at a low cost in order to slowly poison the company. Now, when there is a huge dollar surge, (everyone is aware of this), this is not feasible to supply at the same rates as it would not be beneficial for this State’s Organization. (In order to save it from loss, the supply is not being made) One more thing to clear here is that, MEPCO itself is a State’s company and PECO is also a state’s company, so the blacklisting of PECO by MEPCO is not a correct news as it will be a decision of both Secretaries of Power and MOI&P to make a decision on this order of MEPCO which would not hurt any of the State’s Unit.

Thirdly, a very authentic source told us that the employees of PECO (Headoffice staff) were given several notices for not attending the office. They have never appeared and attended the office since October’18. They were given “Reminders” to attend the office. But none of the staff attended on instructions of defunct BOD. How can and on what grounds company is liable to pay them salaries when there is neither a single attendance nor a response to letters given to them through couriers. They have sabotaged the state’s company by leaving it un-attended. There must be a case against them for giving such loss to PECO.

Fourthly, the authentic sources told that Bank Account being maintained at Faysal Bank was tried to be blocked by the Ex. BOD and their endulged GM’s but after intervention of NAB the bank account was revived and it was opened according to law and their remains no legal hitch as the NAB itslef had been involved in this. These are all rumours that the MD is terminated, the bank account is illegal etc. The government is in full control and no corrupt practices would be allowed and no interfernce by Ex. BoD will be tolerated by the Govt regarding company’s affairs. (As per authentic source).

You need to clear your understanding about constitution of Pakistan. MD is answerable to board of directors under corporate laws. The economic reforms under the pretence of which Ex md kept on practising his powers has become null and void in 1978. Also note Bank account of any public limited company cannot be operated without consent of BOD. Termination of company secretary and appointement of new secretary and CFO is also not the jurisdiction of MD. Only bod has the authority to do so. Even meiraj arif was appointed after the approval of BOD. We always try to ammend facts by our subjective approach, the competency of ex md reflects by huge losses PECO has made during his tenure. He is the biggest disaster that ever happened to PECO. You are requested to kindly share volumes of productions, sales and losses in order to portray extra ordinary performance of ex Md meiraj Arif sb. And believe me if goverment has decided that no corrupt practices would be allowed you ex md will be thrown out the very next moment.

His illegal charge will soon be dismissed.

National Accountability Bureau (NAB)!!!! Should not this institution be respected? If in your book of knowledge, NAB’s decision is not according to Constitition of Pakistan then you must refresh your concepts.

In short, if NAB is declaring the BOD defunct then there remains none other than MD appointed by PMO who would have to control all affairs until further decision. The ex. BOD once cleared by NAB may join the board again. But obviously till further orders.

Apart from this the loss, if it is being incurred, is only due to operational issues that are being created by Defunct board as a revenge. The instance is the delibrate riot and protest imposed on Head Office staff (around 80 people). If those eighty people were on seats and fulfilling their duties then there would have been no loss faced.

Only three GMs and a few managerial staff were terminated as per the inside sources. The rest 70 people delibrately did not join in order to play a revenge game. So, how is it possible that without staff no operational issues are faced. This is a huge loss to PECO, caused by the protestors (backed by illegal ones)

A big no 🙂 On which grounds NAB can declared the board defunct?? During investigations? And once the board is cleared they can join. What a piece of shit it is.

Who is repsonsible for losses of this company? I guess NAB the institution you respect the most or the incompetant EX Md who is not able to hire 70 employees in last 9 months nor able to bring staff of head office back. Three GMs and few managerial staff? You know what does it mean to a company whose total number of GMs is 3? And all of sudden Ex md came to know that all three GMs and managerial staff are corrupt? I mean all of them? And then how 70 other permanat members of head office stand with culprits? I mean not a single person can trust your honest Ex Md?

Can you simple answer who is responsible for the losses if NAB gave clean chit to the board and than who should be penalized? And in presence of Board can a MD fired company secretary?

Dear waqar,

You have no inside picture actually. No offense. Just for your knowledge, the 70 people who as a protest stood by the GMs were actually delibrately and by threats made to protest as they all 70 thought that the Businessmen are powerful thus they will one day come back to join peco and wont let them enter again if they wont stand by them at this point of time. Years back such happenings occured in PECO and the private board members always won. So in view of past experience they thought that the same will happen this time and MD will be transferred or whatever and then same group will hold the reins of PECO.

Their assumptions did not work unfortunately and MD is still there. They lost their jobs and are now living a miserable life just because of their own foolish steps.

Now let me ask you a question here. Is it possible for someone to carry on all the activities and business without the players i.e. staff NO. And hiring 70 people all of a sudden in this scenerio is also not possible when you have continuous hurdles like blocked accounts, lost data, theft cars and laptops.

No loss would have been there if those 70 people would have patriotism and honesty. And if they were not threatened too.

So the root cause is the delibrate sabotage. If GMs and BoD are innocent and wanted peco to survive they would not have forced 70 others to do so.

Once they get themself declared innocent they could have rejoined peco with no operational lags in which today PECO is.

They all are accused now.

The staff was forced to give resigns in September’18. These all activities show that no one had honesty for PECO .

So, please give realistic statements. 70 people’s hiring is not an easy task when you have such hurdles.

Sources revealed that MD PECO had sealed the Head Office of PECO in October 18 and barred the entry of Head Office staff 70 to 80 people to enter into Head Office and even in Factory Premises at Kotlakhpat then how can the staff be responsible for any loss. The notices and reminders to rejoin the PECO are bullshits as they were never allowed to enter into their work place in response to notice/reminder but threatened by the blue eyed employees of MD and refused the entry of those 70 employees. Of course with the instructions of MD, issue notice to join and then not allow to enter in the Head Office or Factory. Moreover if PECO won the tender worth Rs700 million then why the sale is decreased to Rs350 million as per FBR record.

You need to have more authentic sources. They were sent letters via couriers to join their duties. But those culprits never came and they were never banned to enter peco. ONLY terminated ones were banned. 14 people were banned to be exact and 60 others delibrately did not come.

I would like to request the analysts and commenters to give only authentic words here.

Moreover, sale issue is linked with dollar surge. If you are a good analyst then you must know that there has been a huge dollar surge during past few months and it is not in favor of company to sale on loss.

NOTE: These all comments have been quotations of a really authentic source and does not intend to offend anyone but just to confess the actual situation.

P.s: Be well informed prior to giving comments on such forums. These forums are not meant to spread rumours.

By the way Mr. Anonymous, PECO employees terminated on the corruption allegations (by the Ex. Md) have been cleared by the NAB. You need to be well informed too.

Comments are closed.