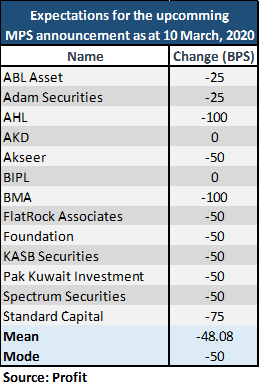

KARACHI: As the State Bank of Pakistan (SBP) is all set to announce its monetary policy later this week, almost all major brokerage houses and analysts have predicted that the current policy rate of 13.25pc will experience a cut.

Profit called 16 leading financial institutions and enquired about their stance regarding the upcoming monetary policy announcement. Fifteen responded while Al Habib Capital Markets reserved comments until the weekly Sensitive Price Index numbers are released.

Of the 15 that called, only two expect the policy rate to remain unchanged, while the remaining expect a policy cut. The mode is a 50bps cut. No house anticipates a rate hike.

The houses may change their stances if the Sensitive Price Index data released at the end of this week is different from their expectations.

The Monetary Policy Committee of the State Bank of Pakistan (SBP) will meet on Tuesday, March 17, 2020, to decide about the monetary policy.

The last rate hike was made in July 2019 to 13.25pc, following which the policy rate has remained unchanged. The cycle of monetary tightening was undertaken to control the rising inflation rate.

ANALYST COMMENTS

Adnaan Sheikh, the Deputy Head of Research at Pak Kuwait Investment said, “Given the recent change in macros fueled by coronavirus/oil prices etc. gives the SBP the chance to appease the businessmen community.”

Arif Habib and BMA Capital, however, expect a 100bps cut, bringing the policy rate to 12.25pc.

Saad Hashmi, Executive Director of BMA, said, “Sooner than expected fall in inflation due to lower energy prices is the reason behind our expectation of a 100bps cut. The primary reason is we did not expect oil to collapse the way it did, which is a positive for Pakistan.”

Sami Tariq, the Head of Research at Arif Habib Ltd., cited weak global economic outlook, lower than expected inflation and commodity prices, and lower rates by global central banks as the reason behind AHL expecting a 100bps cut.

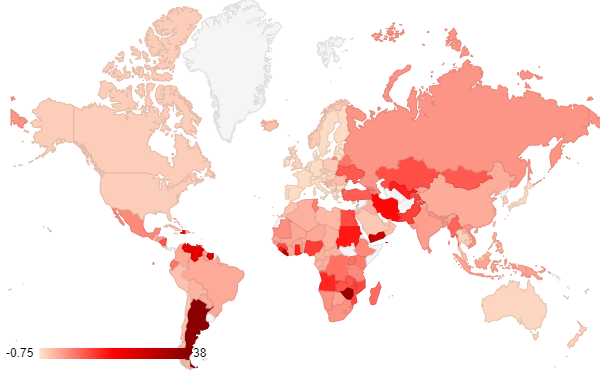

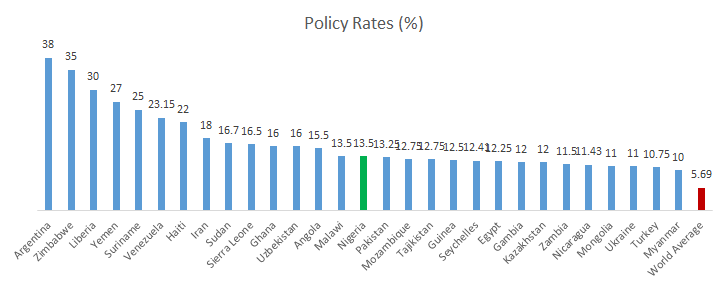

With policy rates averaging at 5.69pc, and only 29 countries in the world bearing double-digit policy rates, there is a global trend of monetary easing.

According to Fahad Khan, the Deputy Head of Research at Adam Securities, “We have the highest rate in Asia. Most countries have started to cut rates to support the dwindling economy due to the virus.”

CAN THE ECONOMY AFFORD A CUT?

With two of the world’s biggest oil exporters engaged in a price war, and the already dampened economic sentiments due to Covid-19, the global crude oil market its worst since the 2008 global recession.

As bears take control of the market, the Pakistani economy can now move toward a rate cut owing to reduced inflationary pressure.

Speaking at an event of English Speaking Union held at a local hotel earlier this month, Dr Reza Baqir said the monetary policy committee of the central bank had to increase the interest rates as inflation was rising. At the same time, the committee was confident that inflation would come down.

“We are confident that the combination of policies between the interest rates and the exchange rate is going to deliver declining the inflation and also it is going to keep the exchange market orderly”.

Analyst Tahir Abbas, in an earlier released report by AHL, said that for every $5/bbl decrease in oil price, our base case inflation (11.6pc for FY20) will be contained by 23 bps.

Abbas says for every $5/bbl downward movement in oil prices, there will be an annualized impact of around $1.1 billion on Pakistani imports, which may lead to a further reduction in current account deficit (CAD).

Pakistan imported $14 billion energy imports last Fiscal Year with Brent averaging at roughly $70/bbl. Pakistan will be able to save approximately $4 billion this annum if we average brent prices at $50 for the next fiscal year.

Considering how COVID-19 is not expected to impact Pakistan’s economy as devastatingly as it is around the world the COVID-19 outbreak could affect Pakistan’s import mix. Of the top 20 commodities imported to Pakistan in the fiscal year 2019, China is the top supplier for 18 of them. The industries most affected include fertilizers, synthetic yarn, semiconductors, medical instruments, and others.

A previous Moody’s report in February market volatility might affect countries that rely on foreign-currency borrowing, which will face tighter financing conditions. These would include frontier market countries with nearer-term funding needs, such as Mongolia, Sri Lanka, and Pakistan.

Earlier, Arsalan Soomro, Managing Director at KASB Securities, “Pakistan must capitalize on this once-in-a-term opportunity to fix the structural mess in the Power sector, build FX war-chest, increase tax-revenues, increase developmental spending – infrastructure, education, and healthcare – and reduce fiscal and external vulnerabilities for sustainable growth.”

Soomro further said, “PTI should think long-term and pass one-third of the relief to the masses. Save for the rainy days!”

WITH ADDITIONAL REPORTING BY MEIRYUM ALI.