Rewind to May 2020: out of seemingly nowhere, Shahzad Dada stepped down as President and Chief Executive Officer (CEO) of the Standard Chartered Bank Pakistan (SCB). The resignation was to go into effect from July 1, 2020.

Most of the attention at the time was on Dada joining UBL as CEO (which led to further speculation about where UBL’s outgoing CEO, Sima Kamil would end up). Dada had held the position of CEO at SCB since 2014, and there was much focus on how Dada would transition from the head of a medium-sized foreign bank (currently the only foreign bank in Pakistan with commercial and retail operations) to one of Pakistan’s largest banks.

But what about Standard Chartered Pakistan itself? At the time, several names were speculated to replace Dada, from within the Standard Chartered Bank (SCB) global network. These included Rehan Shaikh, the CEO of SCB Islamic Banking, based in Dubai; Aalishaan Zaidi, the global head of Digital Banking for Retail SCB, based in Singapore; and Arslan Nayeem, director of Global Corporates SCB, based in Pakistan.

It was Shaikh who won out, having been appointed as the Director and CEO of the bank in early June 2020. He received clearance from the State Bank of Pakistan on August 5, and formally took charge then.

This is not the first time Shaikh was working for Standard Chartered Pakistan; he was previously an employee at the bank’s Pakistan offices between 1998 and 2007, in various roles managing corporate banking and client relationships.

But a lot has changed between 2007 and 2020. What kind of bank did Dada leave for Shaikh to handle? What has Standard Chartered been up to in the last few years or so. Let us take a historical look at Dada’s tenure.

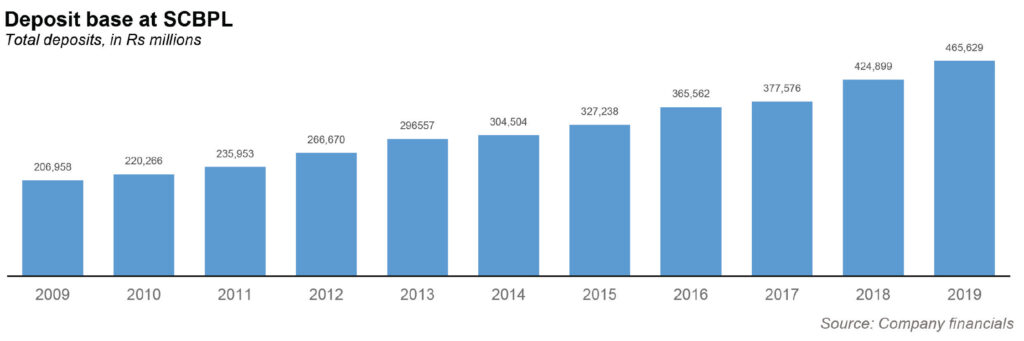

First up, the bank’s deposits have been steadily increasing since 2009, when deposits stood at Rs 206 billion. In particular, deposits grew 13% year-on-year in 2012, and at 11.2% year-on-year in 2013. Deposits crossed the Rs300 billion mark in 2014, and the Rs400 billion mark in 2018 (a year that also saw deposits grow by 12.5% year-on-year).

Yet while impressive, if one looks at the deposits as a share of the total deposits in the banking industry, Standard Chartered Pakistan’s share has actually fallen. In 2009, the market share stood at 4.8%; by 2017, it fell to 3.1%, before climbing marginally to 3.2% in 2019. Despite the bank’s deposits growing healthily, the total industry deposits have simply grown at a faster rate. One can also see this in the compounded annual growth rate for deposits for the five year period between 2014 and 2019: for Standard Chartered, that figure is at 8.8%, which is lower than the industry average for the same period, at 11.8%.

In absolute terms, the bank’s non performing loans have decreased, from the high of Rs27 billion in 2012, to Rs17 billion in 2019. However, when one looks at the ratio of the non performing loans to gross advances, the ratio has been consistently higher than the industry average every single year in the last decade except for 2019. The greatest discrepancies were seen in 2015 (18.4% compared to the industry’s 11.4%) and 2016 (16.4% compared to the industry’s 10.1%).

But in 2019, for the first time, non-performing loans were contained to just 7.5% of gross advances, or less than the industry average of 8.8%. And that is not all that happened in 2019.

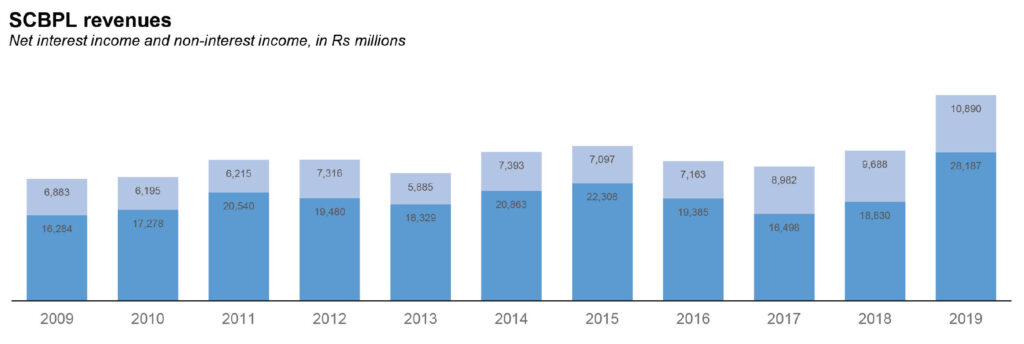

For the most part of the decade, particularly between 2011 and 2016, the net interest income has hovered in the ballpark range of around Rs20 billion. Non interest income has stayed remarkable constant, hovering around the Rs7 billion mark for most of the decade.

But in 2019, non interest income shot to almost Rs11 billion. But the real surprise was in the net interest income, that actually went up to Rs28 billion. That year, total revenue was nearly Rs40 billion–a whole $10 billion increase from the year before.

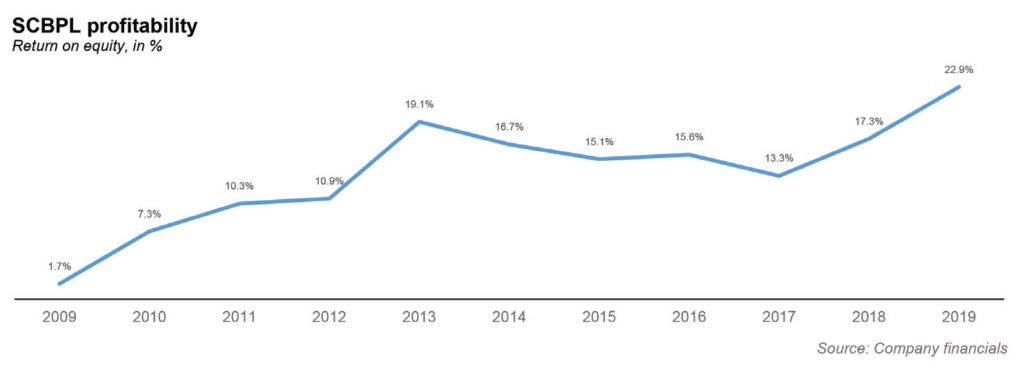

The return on equity, or the net income divided by shareholders equity, was also significantly higher that year. For the most part, Standard Chartered has enjoyed a high ROE, which is an indication of financial health (basically, how effectively management is using a company’s assets to create profits). While the bank suffered from an appallingly low ROE of 1.7% in 2009, it bounced to 19.1% in 2013, and stayed above the 15% mark for four out of the next five years. But in 2019, the ROE was a whopping 22.9%–a remarkably good year.

In its latest financials, the bank noted that it made a profit before tax of Rs27.2 billion, which was not only 47% higher than last year’s profits, but also the highest profit since incorporation. Let that sink in: Standard Chartered Bank has been present in Pakistan since 1863, so you could say it has been a while.

Can Rehan Shaikh pull off another 2019? Unlikely, since net interest income will decrease in 2020. And non performing loans will be a tricky matter in this Covid-19 pandemic climate. But either way, the bank has shown in the last decade that it has done reasonably well on these metrics (yes, even deposits). Shaikh should find it smooth sailing.