Minority shareholders are sometimes treated like step children in the capital markets. They are constantly ignored and are seen as being a necessary evil that has to coexist. Due to this, they have little to no voice in the corporate corridors while the regulators have few tools to resolve their issues.

A classic case of this mistreatment can be seen taking place in 2014. The Board of Directors of Fazal Textile Mills decided to sell off the Lucky One project it was undertaking. What followed can form a case study on the way minority shareholders are treated and how there is little to no regard for their rights in the corporate landscape of the country.

Editor’s Note: Profit tried relentlessly to contact any representative at the Lucky Group to reply regarding this story and questions in relation to them, however, no comments were given. This is an open invitation for anyone to come forward from the group to reply regarding this story and set the facts straight.

Fazal Textile Mills

Let’s start from the beginning and get some facts straight. The company was one of the top spinning mills that was set up by the Lucky Group in 1962 and was involved in production of cotton ring spun yarn on state-of-the-art machinery.

At this point in time, it is important to note that the company was primarily held by Y.B. Holdings, an associate company, which held 74.05% of the shares while the directors of the company held 18.49%. This constitutes to around 92.54% of the total shareholding leaving 7.46% shares in the hands of outside investors.

The production facility of the company was located on Plot No LA-2/B, Block 21, F.B. Area, Rashid Minhas Road. As the city of Karachi spread outwards, the production facility went from the outskirts of the city to becoming a part of it. Now that the boring part is out of the way, let’s get to the juicy part.

The company, in its Annual General Meeting (AGM) held on 8th October 2008, decided to establish a new production facility and move it towards the Super Highway, Nooriabad. What was going to happen to its existing facility? Well, as the piece of land was high in value and closer to the city, it was decided to construct a mega mall and luxurious residential towers. The existing factory was going to be scrapped.

This was going to be labelled as Lucky One Mall Project and was going to be a joint venture between Lucky Textile Mills and Fazal Textile Mills. As the company had little to no expertise in setting up such a large scale project, both companies decided to create an Special Purpose Vehicle (SPV) which would be tasked with construction, development and maintenance of the project. This led to the establishment of Lucky One (Private) Limited. This was carried out after approval from shareholders in August of 2010.

October 2008: Fazal Textiles and its shareholders decide to set up a mall in its existing production facility and move its operations to Nooriabad.

August 2010: All formalities are put into place and Lucky One Mall starts being built by Fazal Textiles and Lucky Landmark

September 2014: The shareholders of Lucky Landmark and Fazal Textiles decide to break Fazal Textile Mills by merging the Lucky One Project with Lucky Landmark (Private) Limited and the textile business of Fazal is merged with Gadoon Textiles Limited. This would lead to the Fazal Textiles being dissolved.

The first red flag

Does this raise any red flag yet? Well, it should. The fact of the matter is that a textile company is deciding to venture into real estate development. The shareholders who invested their money in the company seeing its stable performance were now being asked to have their investment diverged into a real estate business. It is true that shareholders get to vote the decision and approve it in the AGM, however, with a measly shareholding of less than 10 percent, it is obvious what will come to pass.

Which it did.

The only course of action available to the shareholders at this point is to vote through their cheque book and sell their shares as their actual vote in the AGM is symbolic at this stage. The only bright spot for them at this juncture is the fact that there can be investors who are willing to invest in a company expanding into the real estate business.

Even for someone who is willing to invest in such a company, what was going to be the mechanics of setting up the project?

Mechanism of investment

The project was going to be set up on the existing freehold land that the company already owned and for all the expenditure carried out, the company was going to create an asset in its own accounts classified as construction cost of the project. When the project started, the freehold land held by the company was worth around Rs. 6.6 million which included both the land for the project and the one held at Nooriabad for the new factory.

As the project developed, Fazal Textile Mill funded the project and even showed an increase in the freehold land as it increased in value due to the development work taking place. By the end of 2014, the freehold land stood at Rs. 545 million while the expenses carried out for the project were around Rs. 2.3 billion. So what happened in 2014?

Demerger and Merger

On September 24th 2014, it was decided by the board members of Lucky Landmark (Private) Limited and Fazal to essentially do two things. On one hand, the real estate project of Lucky One was demerged from Fazal and merged with Lucky Landmark and secondly, the remaining assets of Fazal were absorbed by Gadoon Textile Mills. Gadoon is another company operating under the umbrella of Lucky Group since 1988.

The rationale for this move was given that as Fazal had little expertise in real estate, the company should be broken into two parts. The real estate project should be taken over by Lucky Landmark (Private) Limited while the assets related to textile should be absorbed by Gadoon. On the face of it, the transaction seems simple and might even look lucrative to investors. What is actually happening here?

The second red flag

Even though the transaction should make sense, there is a lack of regard or concern of the minority shareholders yet again. As we saw previously, the decision to invest in the real estate project had little to do with the interest of the minority shareholders. It seems like the same was happening over here as well. The decision to demerge the project from the company was taking place with what can be seen as arm twisting by the majority shareholders to comply with the will of the Lucky Group again. The formality of an AGM would be held and the resolution would pass yet again.

Consider an investor who had bought the shares of the company after 2008 expecting the Lucky One project to prove profitable for the company. With a stroke of a pen, they would lose their investment in the project and it would be given over to Lucky Landmark. The investment which would have seemed attractive in 2008 would be snatched away from them before they get to reap any benefits.

Again the best course of action available would have been to sell the shares and recoup their investment by selling the shares to someone else in the market. The regulators can do little to change the situation as laws on the books are not designed in the interest of the minority shareholders in the first place. The only step that can be taken is to approach the courts.

It seems that the minority shareholders would not be able to raise their concerns at any platform when the corporate sector is willing to act in their own interest. And things get worse from here. Much worse.

For investors willing to hold

As the demerger was announced, it was obvious that Fazal would cease to exist as it would be merged with Gadoon. This cannot take place without compensation being given out to the current shareholders of Fazal. In such a case, it was decided to give out shares of Gadoon and Lucky Landmark as compensation to the investors who owned the shares of Fazal.

It would seem like a fair way to be compensated as investors would still have an interest in the Lucky One Project by being given ownership of shares in Lucky Landmark and in Gadoon as their investment has been broken and given to these two companies. To value the compensation to be given out, the valuation of assets and liabilities of Fazal needs to be carried out.

Can you hear that maniacal laughter in the background?

Well read on to find out why.

How was valuation carried out?

As explained earlier, two separate divisions were carved out from the existing operations of Fazal. The first division is focused on the Real Estate segment, which included the company’s land holdings that were to be transferred to Lucky Landmark. The valuation of this division relied on the fair value of the land determined by a valuator, while the liabilities associated with the real estate division were recorded at book value.

The second division encompassed the textile operations. The valuation of this division was determined by taking the weighted average results of three methods: Discounted Cash Flows (DCF), Net Assets (NA), and Market Capitalization. This division was amalgamated into Gadoon Textile.

DCF Valuations were based on the projected future cash flows prepared by the management of the company. These were discounted using an appropriate discount rate reflecting the economic, business and financial risk.

NA Valuations were based on the carrying values of assets and liabilities as per the portion of balance sheet attributed to the textile operations. The carrying values were adjusted for the fair valuation of items of property. plant and equipment based on the fair valuations carried out by the valuator.

Market Cap valuations are based on the weighted average market price of the equity shares of Fazl textile over a period of three calendar months prior to and up to the valuation date at all the stock exchanges where these are listed, based on the data reported by these stock exchanges at their web-sites, with adjustment for the value of the real estate division determined as mentioned above.

The valuation problem

Initially it was seen that as Fazal owned the piece of land, it was its own ownership and the valuation was recorded on its initial cost. Seeing the accounts, an area of 3.4 million square feet was valued at around Rs. 6.6 million which comes to around Rs. 2/sq ft. This seems low for the land that should cost much more than that. Why was that the case?

Well accounting standards dictate that assets should be valued at cost throughout the life of the asset. If there is a change in value, they need to be accounted for in other areas. This is why the land was valued at such a low cost by the company. But when the assets were being transferred, it was seen that Lucky Landmark transferred the cost of the land into its own accounts. Effectively, it seems like the land was “bought” or “taken over” at cost.

When the transfer of assets was carried out from Fazal to Landmark, the construction cost that had already been incurred by Fazal of around Rs. 2.6 billion was transferred with property of Rs. 0.5 billion transferred as well.

This leads to the assets of the company being valued at around Rs. 3.1 billion. This fails to take into account the value of the actual land which should have been transferred to Landmark. With liabilities of Rs. 1.7 billion that were owed, the net assets of the company came to around Rs. 1.4 billion which was to be paid as consideration by Landmark to Fazal. The land valuation and transfer was allowed to take place at its cost which is highly skewed.

How was this allowed to happen? Well, dear reader, you have reached where we were at the start of this story.

In simple words, this was a travesty. Fazal was being short changed as its land was not being given the true value at which it should have been valued at. If an outside concern was going to buy this land, they would have done so at the market value rather than the book value and considering that the book value was being used from 1962 only amplifies the unfair way Fazal has been treated.

It seems like Lucky Group found a new way to disadvantage the shareholders of the company. In essence, the shareholders of Fazal are being disadvantaged as they are not getting the true value of their investment in the first place. If the land was transferred at the right price, less than 10% of the minority shareholders would have gotten a fair compensation on their investment.

Swap of shares

Even when the compensation was given, it seems Lucky Group took a leaf out of George Orwell by creating a category of shareholders more equal than others. They did so by creating two categories of shareholders of Fazal. With a holding of more than 90%, the Yunus Brother Group (YBG) was made one category of shareholders while the other shareholders were kept separately.

What was the need for such a classification? Have a guess.

The rationale given by the company was that the real estate business was going to be separated and so Yunus Brothers would be given 2.9146 shares of Lucky Landmark for every share of Fazal that they held. Lucky Landmark was a privately held company and in order to keep their shareholding private, they were going to get shares of Lucky Landmark in exchange for their investment. In addition to that, they would only get 0.3347 shares of Gadoon in exchange for their ownership.

The other shareholders were only going to get a share in the textile assets of the company and were prescribed a ratio of 1.9555 shares of Gadoon for every share they held of Fazal. The swap ratio determined by the board was based on the fact that as the Yunus Brothers shareholders were getting all the stake in Lucky Landmark and the Lucky One Project, they could have less shares in the swap ratio as compared to the other shareholders.

Yunus Brothers was doing this all out of the goodness of their heart. Irony be damned.

Understanding the numbers

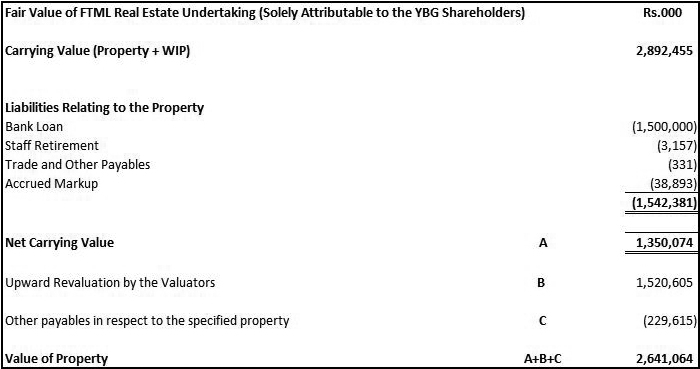

In order to gain an understanding regarding the swap ratio decided by AF Fergusson, it is vital to understand that they separated the two business, real estate and textile, into two separate entities. The land and the capital work in progress was valued at Rs. 2.9 billion from which a total of Rs 1.5 billion was subtracted attributable to liabilities and debt owed by the project.

This left net assets of Rs. 1.3 billion which were transferred to the company. After revaluing the project, an additional Rs. 1.3 billion was added and the final value of the property was considered to be Rs. 2.6 billion in total.

As there are few disclosures, it is difficult to understand whether this amount accounted for any additional or revaluation of land and what was the magnitude of that. It is important to note here that any revaluation would have gone to Yunus Brothers Group solely as they were the ones benefiting from the revaluation and swap that took place subsequently.

(Figures are rounded to the nearest whole number)

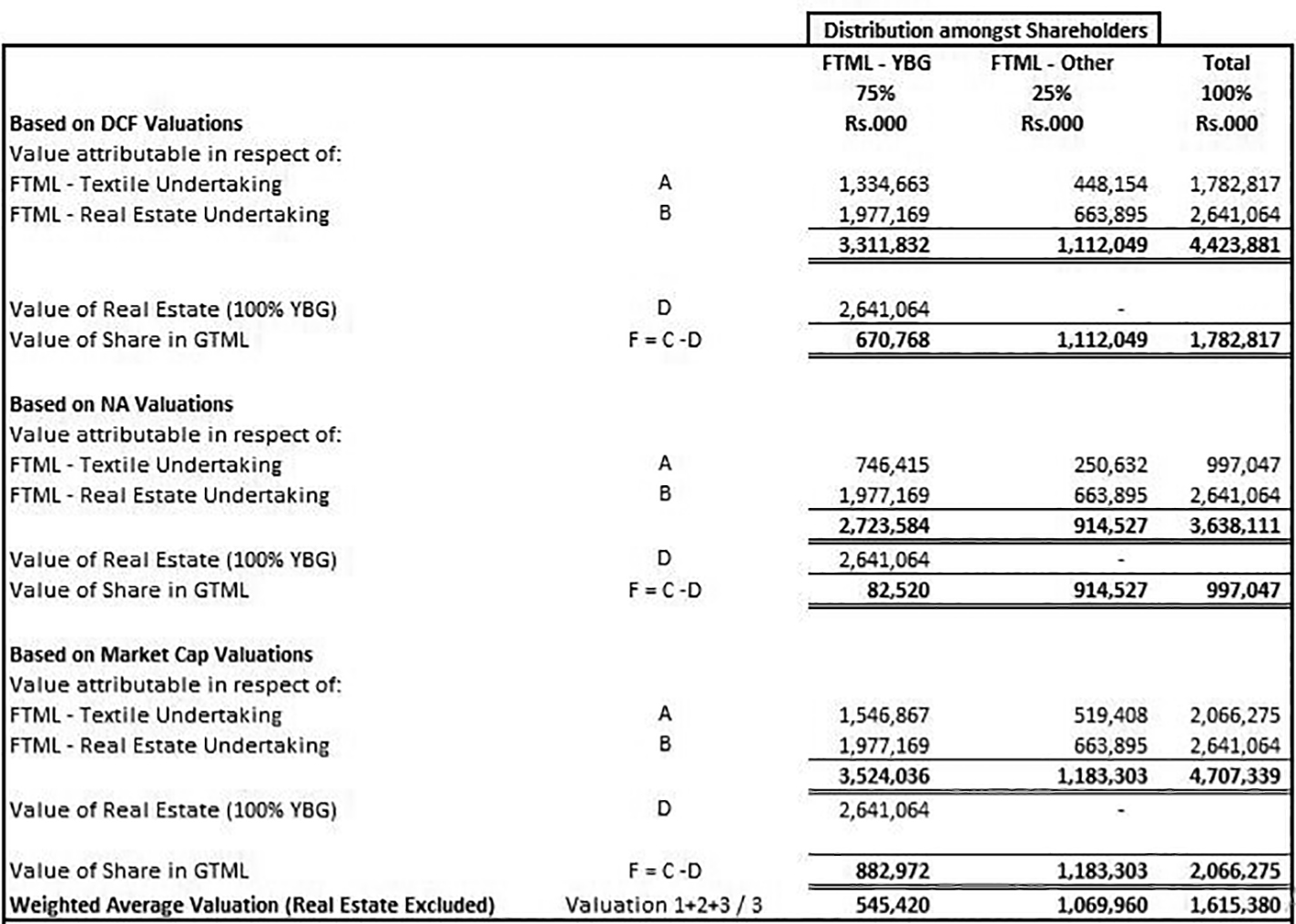

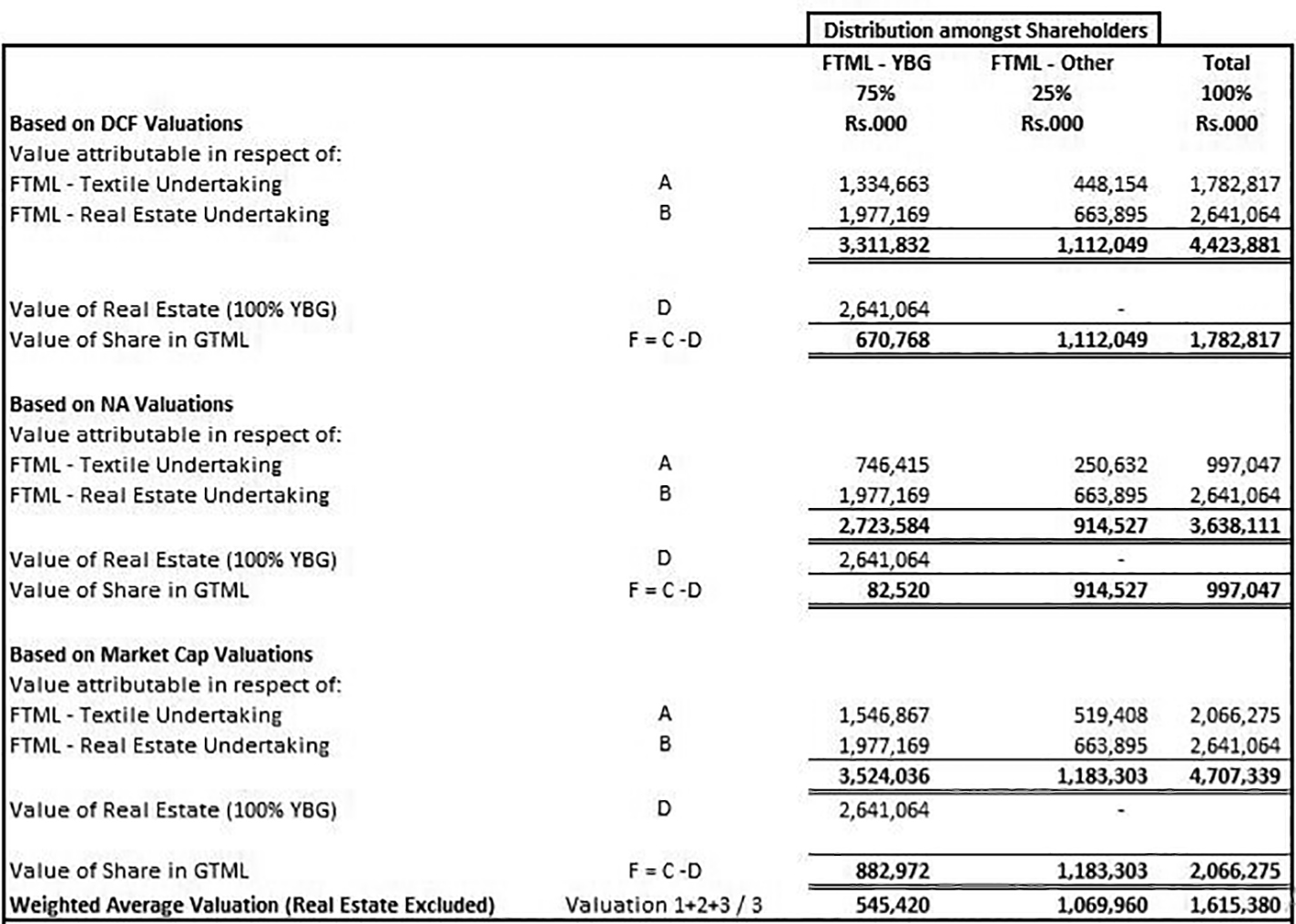

The valuation of the textile factory was different. It is the task of the valuator to determine the value of the assets on three metrics. The Discounted Cash Flow (DCF) method, the net asset valuation and the market cap valuations. The market cap is considered the upper limit while the net assets is considered the lowest or lower threshold. It is the task of the evaluator to take the weighted average of these three metrics in order to determine a more realistic value.

The valuator had also divided the company in terms of its valuation as almost 75 percent of the assets went to Yunus Brother Group while they owned 92 percent of the company and 25 percent went to other shareholders who held 7 percent of the company.

(Figures are rounded to the nearest whole number)

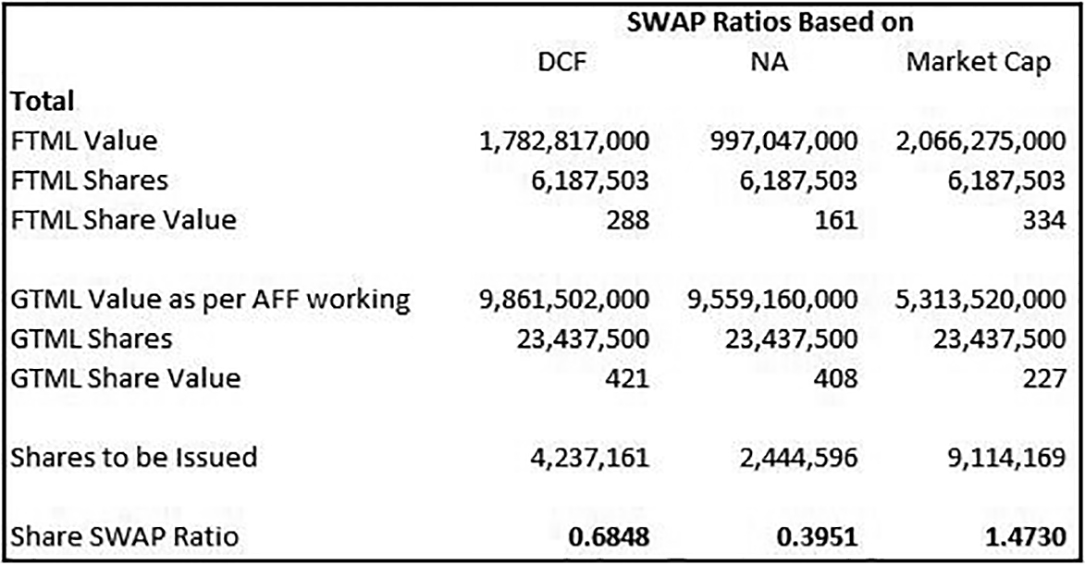

Once the valuation has been carried out, the last step is to determine the swap ratios to see how many of the shares will be given to investors of Gadoon and Lucky Landmark.

(Figures are rounded to the nearest whole number)

Based on the valuations, the swap ratio of Gadoon Textile shares given to Yunus Brothers Group and Other shareholders is determined and given out.

(Figures are rounded to the nearest whole number)

Exploiting shareholders 101

What did it really mean for the shareholders?

In order to see whether the swap was justified for the investors in the Yunus Brothers Group and other shareholders, we can consider that Gadoon and Fazal were listed companies while Lucky Landmark was unlisted. As Lucky Landmark is an unlisted, private limited company, an approximation can be taken of its book value at June end of 2014 which comes to around Rs. 101.15 per share.

The calculations that had been carried out by the consultants, AF Ferguson and Co., were based on the values at the end of June 2014. As those prices are considered, it was seen that Fazal was trading at Rs. 800 while Gadoon was trading at Rs. 250. Based on those figures, the Yunus Brothers Group shareholders got 291.46 in Lucky Landmark and Rs. 83.68 in Gadoon making their investment at Rs. 375.14 while they had invested Rs. 800. This is based on book value which gives an understated value. Their actual return must be much higher.

On the other hand, the other shareholders had an investment of Rs. 800 initially which was converted to 1.9555 shares of Gadoon making their investment worth Rs. 488.88 which is a loss in value almost 40%.

No one ever told you goodness of heart can be heavy on the wallet. The help was going to come from the most unlikely of places. Securities and Exchange Commission of Pakistan (SECP).

The SECP steps in

Seeing the blatant and open violation of rights of the shareholders, SECP swooped in. Based on the swap ratio announced, the SECP raised an objection to the approval of this consideration. The Joint Registrar of Companies at SECP, Muhammad Nasir, stated that there was a violation taking place here. The other shareholders of Fazal were not being given shares in Lucky Landmark and the methods used by the consultant had not considered discounted cash flows in their evaluation of the swap ratio in relation to the real estate undertaking.

The SECP also raised the issue that the minority shareholders of Fazal had not been considered in the principal choice of whether they wanted exposure to the real estate project meant that their voice was not heard. SECP filed these responses in the Sindh High Court where they contended that some shareholders were being disadvantaged for the sake of others.

For once the regulator stood up for the common man. Did it work?

The Court observed in this matter that the members or shareholders of the company have the right to pass any resolution they please and it is outside the purview of the court to dictate the workings of the company itself.

The most damning line in the judgement is that “it was further observed that the shareholders were best judges of their interest and were better informed with the market trends than the Court.”

This is a stinging rebuke for the rights of the minority shareholders who have to abide by the majority shareholders to either sell their position or take whatever is being given to them. Even the last resort available to the minority shareholders does not do anything to protect them.

The minority shareholder will stay the stepchild of the market. At this point, it is more likely that these Cindrellas will find their Prince Charming at a ball rather than have their voices heard.

we are with minority shareholders

I love this posting.

Dates of secp Investigation and Court judgment along with Judges names should be included

I fully support the rights of minorites in Pakistan. No difference should be among majority and minorities.

In Pakistan mafias is the authority

court case reference?

what is this systems minority and majority what it is I just say it’s bullshit everyone is equal in every place in country

the conversion of factory land (at Rashid Minhas Road ) from industrial to commercial was illegal either as law only allows conversion of plots at Rashid Minhas Road from residential to commercial. it was only with active corruption of MasterPlan SBCA KDA and Lucky Group that commercial project was got approved on industrial land.

behind every great fortune lies a great crime.