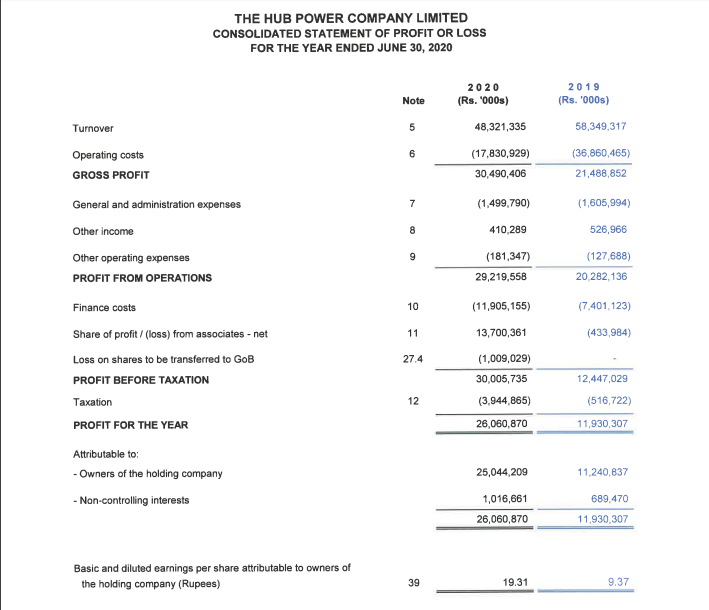

ISLAMABAD: Hub Power Company Limited (HUBC) posted its financial results for the year ended June 30, 2020, on Wednesday, showing more than two-fold rise in net profits to Rs 26 billion (EPS: Rs 19.31) year on year as compared to net profits of Rs 11.93 billion of the corresponding period last year.

Major chunk of this increase in profits has come from the company’s associate – China Power Hub Generation Company (CPHGC) along with PKR depreciation. During FY2019-20, the company’s net sales dropped by 17 percent compared to sales in the corresponding period last year, owing to shut down at HUBC’s Base plant.

According to the research of Intermarket Securities, Narowal (wholly owned subsidiary) operated at a weak load factor of 9 percent during 4QFY20 vs. 24 percent in the same period last year, while Laraib (hydropower plant) operated at 78 percent during 4Q vs. 73 percent same period last year. HUBC’s gross margins expanded from 37 percent to 63 percent on an account of higher PKR/USD indexation and penal income cash receipts, as per financial analysts’ reports.

The company also gained profits of Rs 13.7 billion from associates (CPHGC) which offset a 61 percent YoY increase in higher finance cost.