In the second quarter of 2020, Najam Sethi became the chairman of Mitchell’s. At first glance, it seems to make general sense: after all, Sethi is the husband of Jugnu Mohsin, who is the daughter of S.M. Mohsin, who is the son-in-law of Syed Maratib Ali. We explain this convoluted family tree because in 1958, Syed Maratib Ali,saw an opportunity. The famed businessman, who was the largest contractor to the British Indian Army troops in India during World War Two, bought Mitchell’s Farm from the Mitchell’s family. The farm had been present in the subcontinent ever since 1933, when Frances J. Mitchell decided to try his luck at making some money in India.

So, you could say the farm runs in the family. But it is precisely this fact – the farm has been run by the family over generations – that has led to Mitchell’s problems in the first place. As a previous Profit article mentioned, Jugnu Mohsin blamed her brother Mehdi Mohsin, and her father, S.M. Mohsin for the company’s problems. Her solution was her husband, who has tried his luck with the family business.

And so far, it has shown some promising results. To understand why the year 2020 is looking up for the company, it helps to have some historical context.

Throughout the 60s and 70s, the company focused on its fruit jams and marmalades, but in 1980, the company diversified into confectionery, making sugar candies, milk toffees and chocolate eclairs, which resulted in its annual sales being doubled. In 1993, Mitchell’s was listed on the Karachi Stock Exchange.

Five years later, in 1998, they became the first food processing company in Pakistan to get ISO 9001 accreditation. In 2001, the company began to produce its own chocolates. In 2008, the company went through a packaging upgrade, prompted in part by competitor National Foods’ entry into the jam and jellies segment.

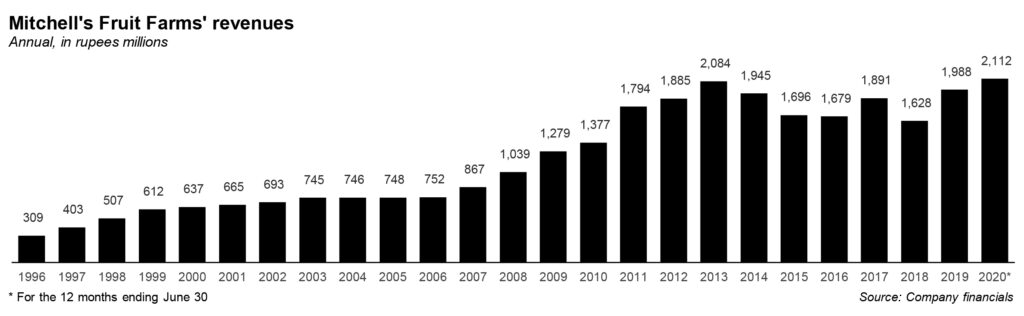

It was generally a good time: between 1996 and 2008, Mitchell’s had grown its revenues from Rs309 million to Rs1,039 million, at an average growth rate of 10.6% per year. The subsequent years were perhaps even better, led as they were by CEO Mujeeb Rashid, who had previously worked between 2004 and 2008 as the chief operating officer at Packages Ltd, also owned by the Syed Maratib Ali family.

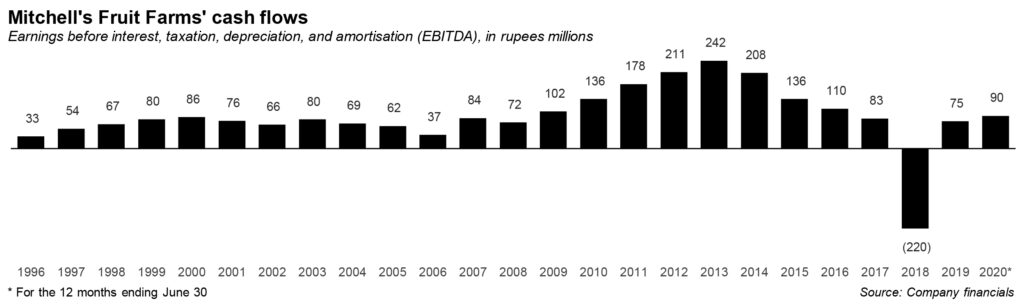

Between 2008 and 2013, Mitchell’s grew its revenues even faster, at an average of 14.9% per year, to reach Rs2,084 million by 2013. The company reported a profit every year he was the CEO, except 2016 (which was the first loss since 2006). The company had some exceptional years in 2012, 2013 and 2014, reporting a profit of Rs108 million, Rs132 million and Rs107 million, respectively.

But declining profits going towards definite losses in 2015 and 2016 meant that he was removed in 2016, in favour of Muhammad Zahir, the former director of marketing and sales at the Fatima Group. It turns out that Zahir did not end up staying too long, and was only the CEO between May 2016 and September 2018. Meanwhile, the company reported another loss of Rs30.8 million in 2017, and then another loss of Rs292 million in 2018.

Mitchell’s then replaced Zahir with Mujeeb Rashid, hoping he could bring back the growth spell. But the company still reported a loss of Rs80 million at the end of 2019.

What happened? Most point to Mitchell’s management’s lack of understanding of how to market their brand. They relied far too much on their product’s historical legacy, did not spend enough on ads (particularly in an era when other brands were investing in name recognition), and had a somewhat misplaced distribution strategy.

In fact, between 2007 and 2014, distribution costs rose at an average of 22.4% per year (distribution costs went from 7.8% of revenues in 2007 to 14.2% of revenues by 2014). Business operations were not improving during this period; instead, distributors were making money, which yielded no tangible benefits for the company in terms of increased sales.

As mentioned before, since 2016, Mitchell’s has lost money every single year, which has resulted in rising indebtedness for the company. As recently as 2013, the company had just Rs97 million in debt. As of June 30, 2020, the company has Rs805 million in debt, of which Rs150 million was pumped in by the Mohsin family itself.

It is in this tense climate that Sethi finds himself in. Sethi first set about hiring a new CEO in 2020, Naila Bhatti, who was previously the director of sales and marketing for the Pakistan Cricket Board, where Sethi was her former boss. The idea is that a marketing executive will know how to spend on ads, and create brand awareness.

And so far, it seems to have worked. In the latest financials for the year ending September 30, 2020, the company increased its revenues to Rs2,112 million, the highest it has ever been. The company’s losses, which had already narrowed from the peak of Rs293 million in 2018 to Rs80 million in 2019, have further decreased to Rs55 million.

Perhaps most excitedly, distribution costs have actually decreased. Distribution costs as a percentage of revenue declined from the 2018 peak of 25.1% down to 14.1% of revenues in 2019, and further narrowed to just 12% for the full year ending September 30.

Are the numbers fantastic? Not really. But are they worthy of praise? Yes. If Sethi and Bhatti can continue along this path, perhaps the storied farm will make it through. Not to forget, Mitchell’s is also cash rich now, having recently raised Rs750 million through a successful rights issue.

Articles doesn’t really discuss that how the numbers improved. How did they reduce their distribution cost for example? This should have been discussed.

Agree with Haq . Article seems like a PR attempt for Sethi rather then Mitchell

Najam sethi is a administrative/management genius. Throughout his career he has proven his ability to lay solid foundations