On the 26th of May, the Pakistan Stock Exchange (PSX) saw an all-time high daily trading volume. As usual, government ministers were quick to jump on the news to try and portray the big day at the stock exchange as an indicator for the economy. Federal Minister for Planning and Development, Asad Umar, attributed the development to the market reacting to signs of sustained economic recovery. Other government ministers and spokespersons joined in on the fanfare.

The traded volume clocked in at 1,560 million shares in today’s session, which is the highest ever in the history of the PSX, exceeding the previous record by a massive 39%. Carrying the lion’s share of gains for the investors was Worldcall Telecom Limited (WTL), which added volumes of 707 million shares to the overall trading activity — almost half of the total intraday volume, while achieving a steep gain of 41.23pc in its share price.

And that is where it gets interesting. You see, Worldcall has for years been a barey sinking ship desperately patched up and kept afloat in the hopes that a buyer is around the corner. Between 2014-2016, it leaked billions of rupees before making a surprising recovery in 2017 on the back of a huge surge in other income (income derived from activities unrelated to the main focus of a business such as the gain and sale of assets). While they did not get the same kind of other income in the following two years in 2018 and 2019, they still got more than they had in previous years and stopped turning over a loss. The only problem was that their profits were insignificant, and Worldcall was sort of just hanging around the PSX doing nothing. And even though the company has not yet posted financial results for the year 2020, the financial performance of the company for the half year 2020 is available and the numbers are not healthy.

At this point, it is natural to wonder what exactly happened that made Worldcall such a hot item all of a sudden to the extent that it single handedly led a record shattering day at the PSX in terms of volumes traded. The answer is simple: Salman Iqbal and the ARY group’s decision to buy the company. For at least the past two years, the ARY group has very publicly been trying to take over Worldcall, issuing notices each time but not getting to the part where they are supposed to offer a tender notice. Once again, it seems that ARY is trying to make a move for Worldcall. As a result, demand for stocks rose when news of the possible acquisition broke. The only question, however, was whether this was a pump and dump scheme by market participants. So what exactly happened with Worldcall, ARY, and the PSX? And could it be a scam?

A recap of the possible acquisition

Much like some of the television dramas that channels like ARY produce, the substantial acquisition of WorldCall Telecommunication Limited (WTL) has been a significantly stalled affair that dates back to 2019. In fact, when ARY communications Limited and ARY Digital FZ LLC made an intention to acquire 51 percent shares of WTL on 6 May, 2021, it was the third time ARY has made such a public announcement offer.

Following the announcement, the share price has risen from Rs. 1.53 to Rs Rs 3.24 today (Thursday), after attaining an intraday high of Rs 4.03, implying a 163% increase in a matter of few days. (Insert cumulative volumes before submitting). What has been going on with these announcements? Well, simply put, a public announcement offer is made when an individual or a company makes an intention to acquire voting shares beyond the prescribed limit of 30 percent or control of a listed company. They have 75 days to complete the process of public offer. This was previously 92 days, however, extensions can be granted. Despite that, once an extension has also lapsed, the acquirer can send another letter of intention to acquire the company.

On October 30, 2019, ARY made an acquisition announcement through their transaction manager Shajar Capital but did not go through with it. WTL announced its takeover, with the intention to disclose the takeover information on November 1, 2019. But as per PSX data, the announcement was made on October 31, 2019, and the next trading week saw a price upshoot from Rs1.22 to Rs1.70, implying a 39 percent increase during the period.

During an interview with Profit last year, Salman Iqbal, CEO of ARY Communications said his company was more than interested. “We’re still in the ring for Worldcall. I think it’s a good company. It’s dying. It’s the age of media, and we’re looking to acquire majority shareholding in the company.” As for a timeline on the deal, Iqbal optimistically chirped, “You’ll hear from the PSX very soon. It’s happening. We’re going through it.” Despite this, they did not go through with it.

A few months later, on August 7, 2020, ARY was back but with a new broker. AKD Securities issued a similar letter of disclosure on behalf of their client ARY communications Limited and ARY Digital FZ LLC to acquire 51 percent shares of WTL, and they did an entire technical audit of the company. On February 23, 2021 the SECP granted an extension to ARY Communications Limited & ARY Digital FZ LLC to make a Public Announcement Offer. The acquirer was granted until 5th May 2021. This transaction did not go through.

Suspicious, no?

The very next day, ARY made another intention to acquire WorldCall through its manager, AKD Securities. While the letter is dated 6th May, it was posted on the PSX on 17 May 2021 owing to Eid break. While Profit’s attempts to reach Salman Iqbal have been fruitless, WorldCall Company Secretary, Zaki Munawar said that the reason for these continuous delays was the laborious process of due diligence. “The company is pretty big and it takes time to conduct due diligence. The due diligence and technical audits have been done. If someone like Salman Iqbal, a famous entrepreneur, is investing time into this deal, there must be a reason,” said Munawar. The same excuse was given by Aqeel Karim Dedhi, who said “this is not an easy deal. It is a difficult subject. There are always issues that come through. That is why it is taking time.”

Those are both reasonable explanations for the delays. But the sheer numbers that Worldcall is seeing on the stock market are astounding and beg a deeper reckoning. Because let us get this straight, Worldcall is not doing great and for the year 2020, no one outside the company really knows if the company did great. Strangely, again, the WorldCall stock is doing great. While it is completely normal for share prices to rise when there is an acquisition intention, the word in the market suggests that the high volumes may be indicative of something else driving the WorldCall stock.

As Muhammad Sohail, CEO of Topline Securities pointed out a point to ponder, high volume is good. But abnormal volume is not. “Usually, when the volumes are significantly higher as a proportion of free float and total shares, it is constructed as pump and dump. Alternatively, if there is a material change in the business outlook or any corporate actions, the company gets rerated eventually at a higher price. Often, these volumes are not sustainable when the story, if any, is public,” says Arsalan Soomro, MD, KASB Securities.

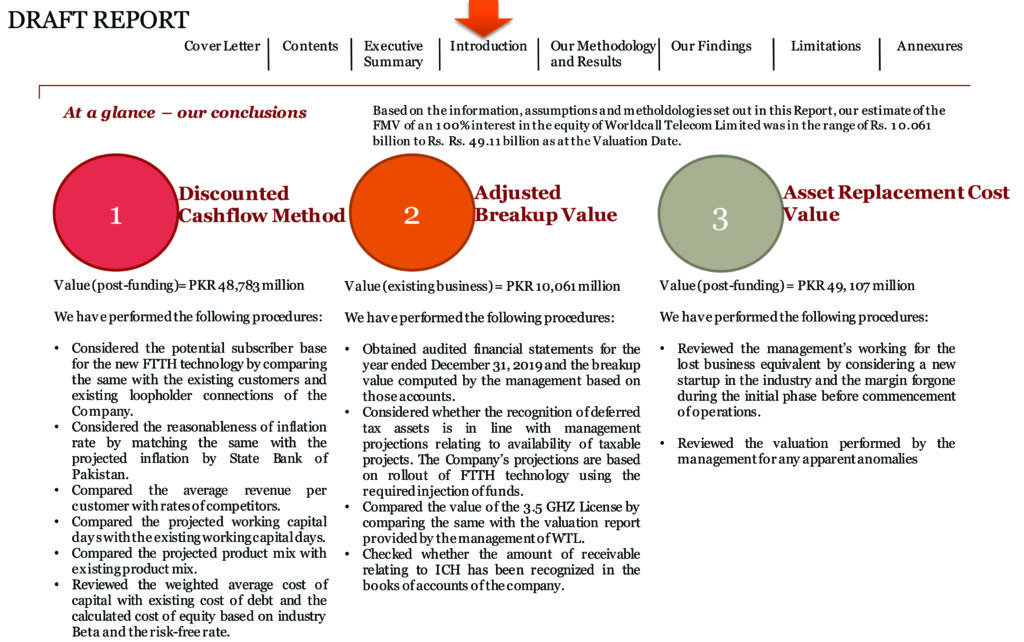

What is also interesting is the fact that an alleged Draft report by PwC has been floating on WhatsApp groups which contains WorldCall’s valuation. As per the document, WTL’s value post-funding using the discounted cash flow method is Rs 48,783 million, the value of the existing business using adjusted breakup value is Rs 10,061 million, and the value post-funding for the asset replacement cost value is Rs 49,107 million. Whether the document is authentic or not, it can also pump investors to buy WorldCall based on the valuation.

“All these stories generally move the stock prices first and then produce such hypotheses – true or not – to gain traction,” says Soomro when asked if the alleged PwC document had anything to do with the alleged pump and dump.”

Is there a pump and dump?

Let us get just a couple of things straight here. The first, is that we can never really know whether a pump and dump is happening while it is happening, because there is no real way to tell who is buying the stocks. And say, even if it is Salman Iqbal or anyone’s most trusted friends buying them, there is no way to know that they are doing it on his request.

A “pump and dump” is a form of securities fraud that involves artificially inflating the price of an owned stock through false and misleading positive statements, in order to sell the cheaply purchased stock at a higher price. In this case, the alleged pumping would be as a result of ARY’s repeated attempts to acquire Worldcall, and the dumping would be the selling of the stocks if it doesn’t work out again. This does not necessarily mean that ARY is pumping the stock, other market participants are capable of doing so too.

Again, we must also say that Salman Iqbal and ARY Communications are serious buyers. The ARY group does not have any publicly listed company (because that would involve being more exposed and out in the open than their top brass likes), but a company like Worldcall would make a fine addition to the group’s umbrella of portfolios. And while one cannot say so with certainty unless you see transactions running through for individuals, there does seem to be a pattern, and the indicators for a pump and dump situation are present. After all, if Salman Iqbal is this interested in getting his hands on Worldcall, then why has he not been able to up until now? More importantly, why does this create ripples in the market?

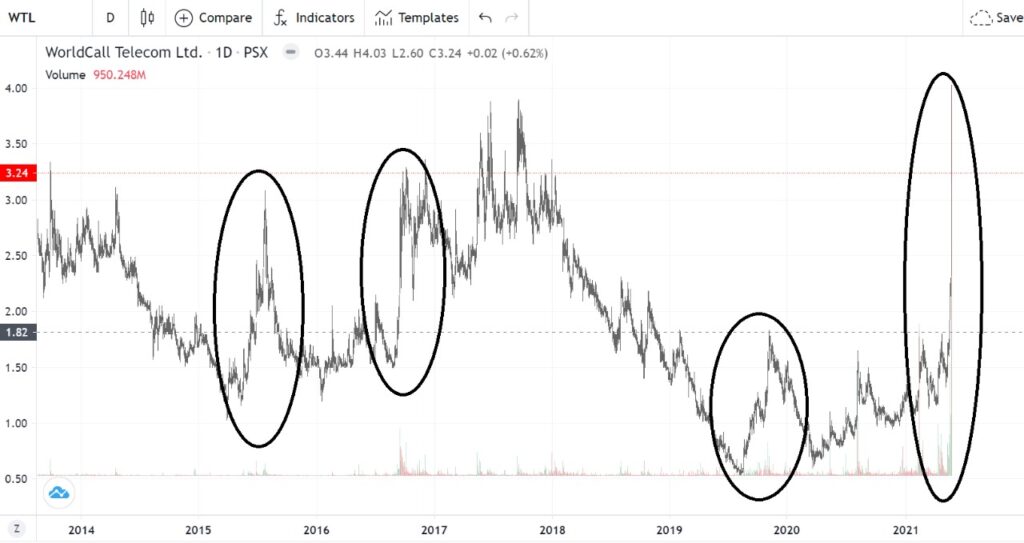

A key indicator of a pump and dump situation is where trading volumes for a stock will go from regular or low levels to extremely high levels right at the start of the price rise. While this circumstance does not always mean a pump and dump, this is one instance that draws attention to the possibility of a pump and dump. Based on the graphs above, one can notice a significant build-up in price over a short span of time and then a significant fall. These ups and downs coincide with acquisition intentions going through.

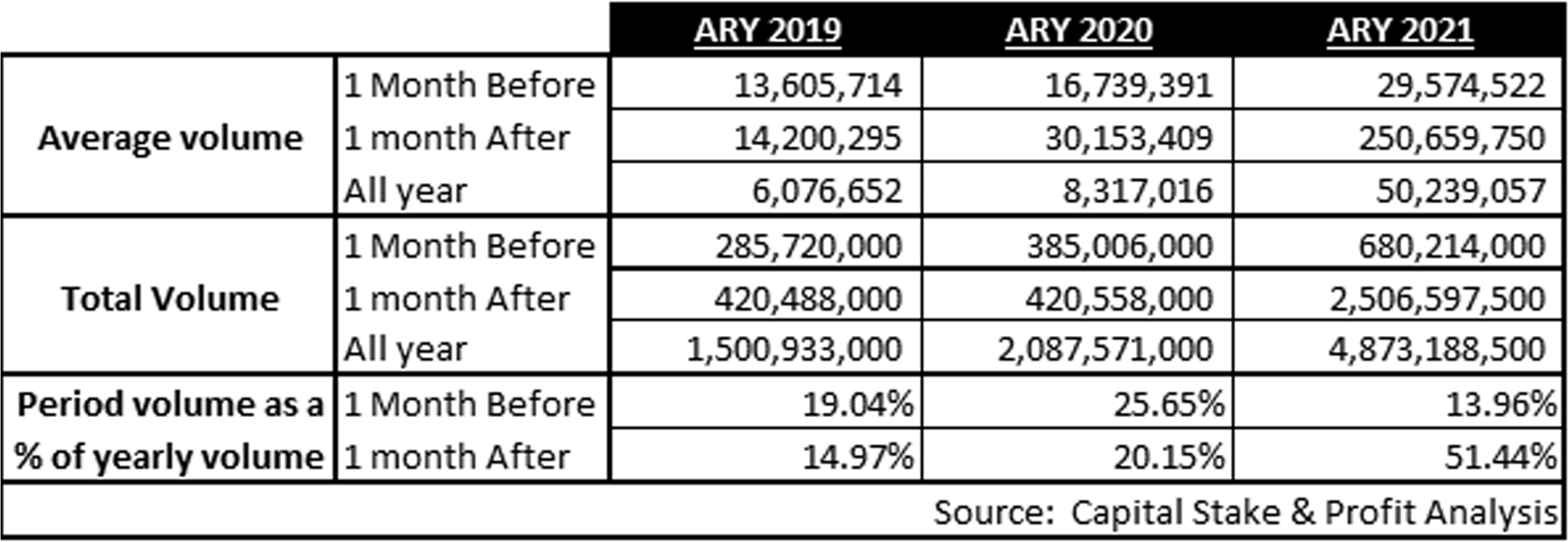

Moreover, to quantify this, the table above compares average and total volumes during news of the acquisition in comparision to the yarly volume. A year is taken as a calander year. It is important to note that nearly 40% of volumes in worldcall are witnessed within 2 months of a public announcment. For 2021, the volume witnessed in just two weeks after the announcement is equivalent to 51.44%

In WorldCall’s case, one can say it is relatively easy for a pump and dump because the share is very liquid, it has a significant free float, and most importantly it is a cheap stock. All these factors enable it to make significant volumes.

There were also rumors about AKD servers crashing at crucial moments today as WTL reached Rs 4, and on Wednesday preventing investors from selling. While speaking to Profit, Aqeel Karim Dedhi denied that and said, “There is no truth in it. The company (AKD) has zero interest/ standing in WTL.” It is also important to note that in February 2021, WTL issued a notice to PSX explaining that there was no material information to back the behavior in its share price following a period of rise in volumes and share price.

Who else is interested and why?

In addition to ARY Communications, the Dunya Group is another media company that has expressed interest in WorldCall in the past. So clearly there is interest in the potential of Worldcall, particularly from media companies. Then there is another entrant. As per a source that chose to remain unnamed, a foreign investor is interested in acquiring a stake in WTL and has asked a prominent name (Munaf Ibrahim) to accumulate shares.

However, Munawar comments, “I can neither deny nor confirm such news,” when asked if there were any other potential acquirers other than ARY Communication. While no material information has been made publicly available as of late, it is important to note the potential of the business.

“I do feel fiber to home business is moving the needle, it can be worth a lot. That is a big if and usually with high failure ratios. The fact that Facebook partnered with Nayatel for fiber networks in Pakistan acts as proof that Pakistan is a huge market for broadband services and aggregating user returns,” says Soomro.

While ARY has taken its sweet time mulling over the acquisition, Soomro also does not deny ARY’s interest in the company. “ARY Group does seem to be interested in WTL for a while now. In the long run, businesses would need to be publicly listed to fetch higher valuation and enact better corporate governance structures,” he opines.

As per sources, Salman Iqbal has been wanting to add a publicly listed company to his portfolio without having to make one of his businesses public. A source alleges that the deal has not been able to go through because of a lack of funds to complete it.

WorldCall with the entrepreneurship of Honorable Salman Taseer has seen days when it surpassed PTCL. WorldCall in the era before spectrum auction for cellular phones invaded the cities of Karachi, Lahore big cities in Pakistan, with multi-media, tv., phone services with free calls on Worldcall throughout Pakistan, dumped PTCL. When late Salman Taseer entrepreneur, with his command on media, Daily Times etc., was a star in its time, and his entrepreneurship. With the demise of late Mr. Salman Taseer things changed everything. The company a PLC with entrepreneurship had charged staff, high morale. PTCL started expanding with its laid ducts/pipes with Dhobi Ghat cable the thick aluminised cable with black plastic used for broadband/phone/data services in the conventional sales promotion from the field line staff to sell phone connections for Rs.500-00 installation, with access to Internet analog package, on analog Dhobi Ghat network/with IPTV Set Top Box cost Rs.5000-00 from China. The rapid deterioration of the network to analog/Dhobi Ghat Black insulated Aluminised Cable non Compliant to Covid-19 and slow speed internet switched most of the traffic for quality telecom., networks on Mobile Broadband by all Cellular providers on GSM. PTCL is shy from infusion of Capital to meet the OFC Broadband Giga Byte Optical Network G-Pon. Majority of the urban network in Karachi is Dhobi Ghat Non Digital, Non-Standardised, Optimised to satisfy customers from the service. With an average of outages for internet services Broadband in Karachi it is very difficult to continue with PTCL even for free. The good companies which has taken all Dhobi Ghat PTCL customers are all cellular services with excellent Customer Service, and Quality of Service with international standards of GSM. For the last about 4 years i have applied for Digital Service G-Pon, I’m told not feasible to the company. The company has to meet the Capacity Building Criteria from the MOITT regulator, in Pakistan to serve commuities, corporates, homes, schools, all ran to Wireless Mobile. The company which are best performers with their own Landing Point International from HawksBay are StormFiber, TransWorld and also some others with good digital service. It is likely when the regulatory authority will review their services likely suspended as they have not complied with the Capacity Building, QOS in Pakistdan.

Same situation as in pakistan…when company run by the speculators then speculation like this happen. Employees are sufering from the demise of managment who are not getting thier due salaries

Corrupt elite of the company enjoying at the demise of employees.

Dear Ariba Shahid,

PROFIT

Found the above report on WTL very interesting.

As an individual investor in WTL and MDTL, I wonder if you have an update on WTL as well as MDTL?

All data shared for valuation is in accurate, non justified and based on false contracts. WTL has no standing. All assumptions used in WTL valuations are in accurate. Most of revenue is based in writing off of liabilities that too with out any basis. Dont know if any auditor has himself ever tried to reach out to those parties to check what is claimed by WTL is accurate or false

Most of employees not being paid their dues, Most of employees demanding dues are forced to resign. Even there are employees with more then 24 salaries pending towards WTL. False rumors are shared to raise share price. internally companies have been managed to keep all cash. All shares are traded internally by directors to show surge in share pricing. Mr Azhar Saeed another Ishak Dar of WTL is behind all these matters. If ARY has not acquired WTL what role Mr Mubashir Luqman is playing being independent director of WTL one of former employees of ARY. ARY is never going to acquire single share of WTL, All these acquisition renewals are just to raise share price, and giving phakki to employees. Why should they acquire a company having only false revenue, fabricated contracts for justifying that revenue and fraud management. Actual value of WTL is nothing any interested party wanting to buy shares needs to consider how much revenue is actual.

My question is what was so much hype about telecard then when it rose from 1.5 to 8 in just 3 to 4 months? It is all based on how prices move remember.

correction from PKR 1.5 per share to PKR 18

Finally it is proved a fraudulent act of pump and dump