When the Covid-19 pandemic hit, countries around the world went into panic mode. Even advanced economies struggled to cope and deal with the virus. Considering Pakistan’s economic track record, citizens had prepared for the worst. And why wouldn’t they? The rupee had already depreciated massively right before the pandemic, inflation and interest rates were high, investment and output was low, and the business sentiment wasn’t too positive. Given the situation, anyone would feel things are only going to get worse.

And that is when the State Bank of Pakistan (SBP) stepped in. Helmed by Governor Reza Baqir, the central bank took a series of aggressively accommodative policies, covered in detail by this magazine in the past. At the time, even the bank’s strongest detractors couldn’t help but give begrudging respect for the bank’s decisions to slash interest rates and boost jobs as much as possible in a crisis.

Which makes the bank’s actions as of last week all the more interesting to follow. In the space of just five days, the bank increased the cash reserve ratio for banks, and increased the policy rate by a whopping 150 basis points. Evidently the State Bank was now rethinking the accommodative steps it undertook to keep the economy afloat. With the country no longer in survival mode, the bank could now focus on long term stability.

This is no routine policy rate decision; this is a SBP with a new directional approach. In an exclusive interview with Profit, the SBP Governor Reza Baqir laid out his thought process behind the decisions, and his vision for the country’s economic health moving forward. We have categorized that interview into four distinct threads.

Monetary Policy, CRR, and Banking Liquidity

In last week’s issue, Profit had examined the monetary policy decision, what economists have to say about it, and also the decision to increase the CRR. However, the monetary policy decision this time gives out a wider message. Essentially it is the first steps in a gradual reversal of the accommodative stance the SBP was able to take during the worst stage of the pandemic.

“The monetary policy committee had been looking at when to start the process off moderating the significantly accommodative stance. The policy is very accommodating because real interest rates are still negative. They are even more negative than before. And in several monetary policy statements, we discussed the timing to start moderating this. Monetary policy is still supportive of growth, but the extent of their support is something that is to be moderated. We have said this repeatedly in our previous monetary policy statements. In September, we took the first step in that direction,” says Reza Baqir.

Some have commented on the speed with which the accommodative stance is being moderated, but the governor attempted to provide some clarification. “The MPC expects monetary policy to remain accommodative in the near term with possible further gradual tapering of stimulus to achieve mildly positive, real interest rates over time.”

This obviously leads to the main question on everyone’s mind:if the moderation was not intended to be drastic, then why did the SBP feel the need to hike the interest rates by a whopping 150 basis points?

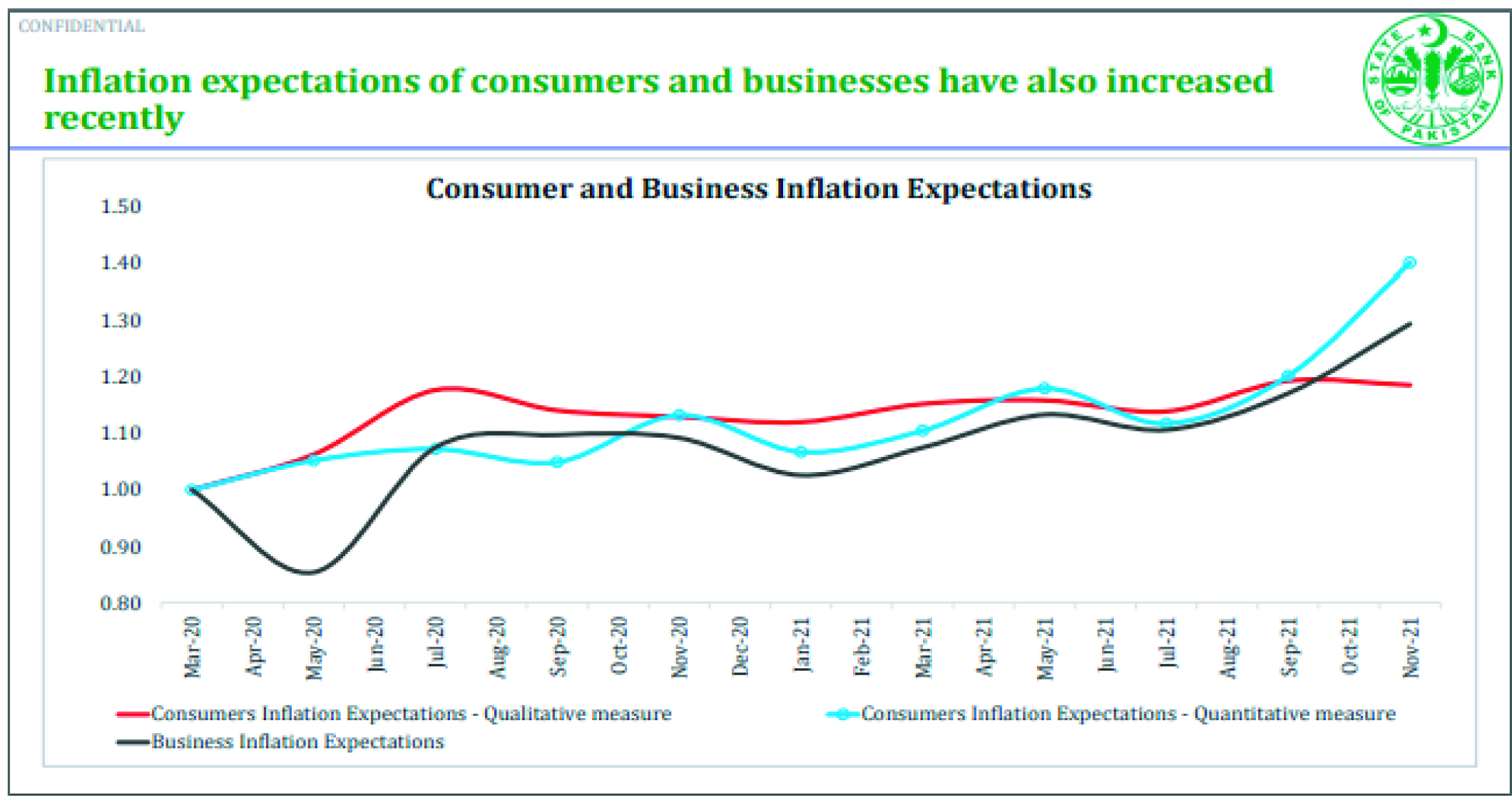

The answer to that is pretty simple. All sorts of factors – namely inflation, the current account deficit, and the USD/PKR parity – had worsened beyond expectations.

According to Baqir: “Between September 21 and November 19th, the developments that took place on three fronts were modestly more than what we had foreseen. We felt that there has been a significant worsening of developments on inflation and current account. [Then there was] the developments in the foreign exchange market. To date, primarily it is the rupee that has borne the brunt of the adjustment and the extent to which it was bearing the adjustment of was also a little bit more than what we had anticipated at the time of the September monetary policy.”

“After reaching that conclusion we had two options, pretend that nothing has happened or decide what actions are needed to respond to those developments. We started on a series of planned steps. The first of those steps was increasing the CRR on 13 November to moderate the money supply. As a central bank we need to look at monetary activities and monetary aggregates which has been growing a little above trend and therefore we wanted to mop up some liquidity. Secondly, we brought the monetary policy committee meeting earlier than planned. Even in the press release we issued, we were very clear that the meeting has been brought forward in light of recent unforeseen events.”

Investors and key stakeholders had been anxious as to why the monetary policy meeting had been held earlier than planned. The governor addressed that by saying, “Our goal was to provide clarity on that so that we reduce at least the uncertainty. On the basis of further clarity, at least decision-makers will be able to have the information to plan. So that is why we called the meeting earlier.”

Not only did the SBP call the MPC meeting earlier than scheduled, but they also announced a new calendar whereby the next meeting is in December because “the two month period proved to be quite long when the world is changing rapidly.”

“What we thought was that what would be best for us to do would be to be transparent in the way the MPC was thinking about what it can and cannot commit. Forward guidance was something we had previously introduced because we wanted to convey a sense of predictability, but it is conditional on developments, also occurring broadly in line with what we anticipate. Central banks don’t have crystal balls and sometimes developments do take place, which may be a little bit more than not anticipated in those circumstances.”

“I think it is best to be upfront. Now, when we give forward guidance, there were two parts of this. Originally one was, we had said that our goal is to achieve mildly positive, real interest rates. part was measured in gradual. It’s very important that we are successful in conveying our point, that the end goal is still the same. The most important part of our guidance regarding the end goal is still the same, and that has not been changed, which is ‘mildly positive, real interest rates’.

In such a situation, what is the right amount of a rate increase? This is a question that all central banks have to tinker with.

“If the rate increases too much, well above the hundred basis points that the markets were expecting, then that may be counterproductive, because it may signal something that we don’t want to signal. It may signal that the concerns about developments are actually very pronounced, which is not really the case. So the discussion in the MPC was to strike the right balance. And in the view of the MPC, 50 basis points more than what the market anticipated was considered to be striking the right balance in these considerations.”

If so, why did the SBP choose to go with a 50 basis point increase above market expectations, rather than, say, 25 basis points? To that Baqir says, “When policy rates are in the range of 7-8%, 25 basis points are fairly small movements that may not often be seen as clear a signal as you may wish to. Moreover, you want to ensure that you are leading in terms of the signals that you want to convey to the markets, as opposed to catching up to where the markets are. In that case you also want to send a signal that is reasonably clear. And in our view, this move still keeps monetary policy accommodative. A 8.75% policy rate is below inflation rates whether on a backward looking basis or on a forward basis. Monetary policy is still accommodative, but we have taken a step that was bigger than we had previously anticipated to reduce that moderation.”

The governor also held the view that a faster pace was necessary for the economic health of the country: “In terms of the stance of monetary policy has not been tightened, just the pace at which you want to reach that in our view is faster. The reason it should be faster is because the rotation of balance of risks from growth to inflation and the current account has been a bit faster than anticipated. Now that message has information that is positive and also contains information, which has prompted us to the fact that growth continues to be robust. Even with this policy action, we expect growth to 5% this fiscal year.”

Typically, a contractionary monetary policy and a fall in liquidity often prompt one to think that growth is set to decrease. But the governor seemed determined to dispel that myth, saying: “We are not doing this at a time when the economy is slowing down, there is a fundamental difference between this phase of monetary tightening, what I would say, reduction of accommodation and the one in 2019. At that point, the economy was slowing, but there was a much bigger problem of stabilization. This is a stage of moderating, the extent of growth. This is the stage of taking steps to prevent overheating. This is the stage to get out of the history of boom-bust cycles. We have had growth before, but where we have not been very successful in sustaining growth.”

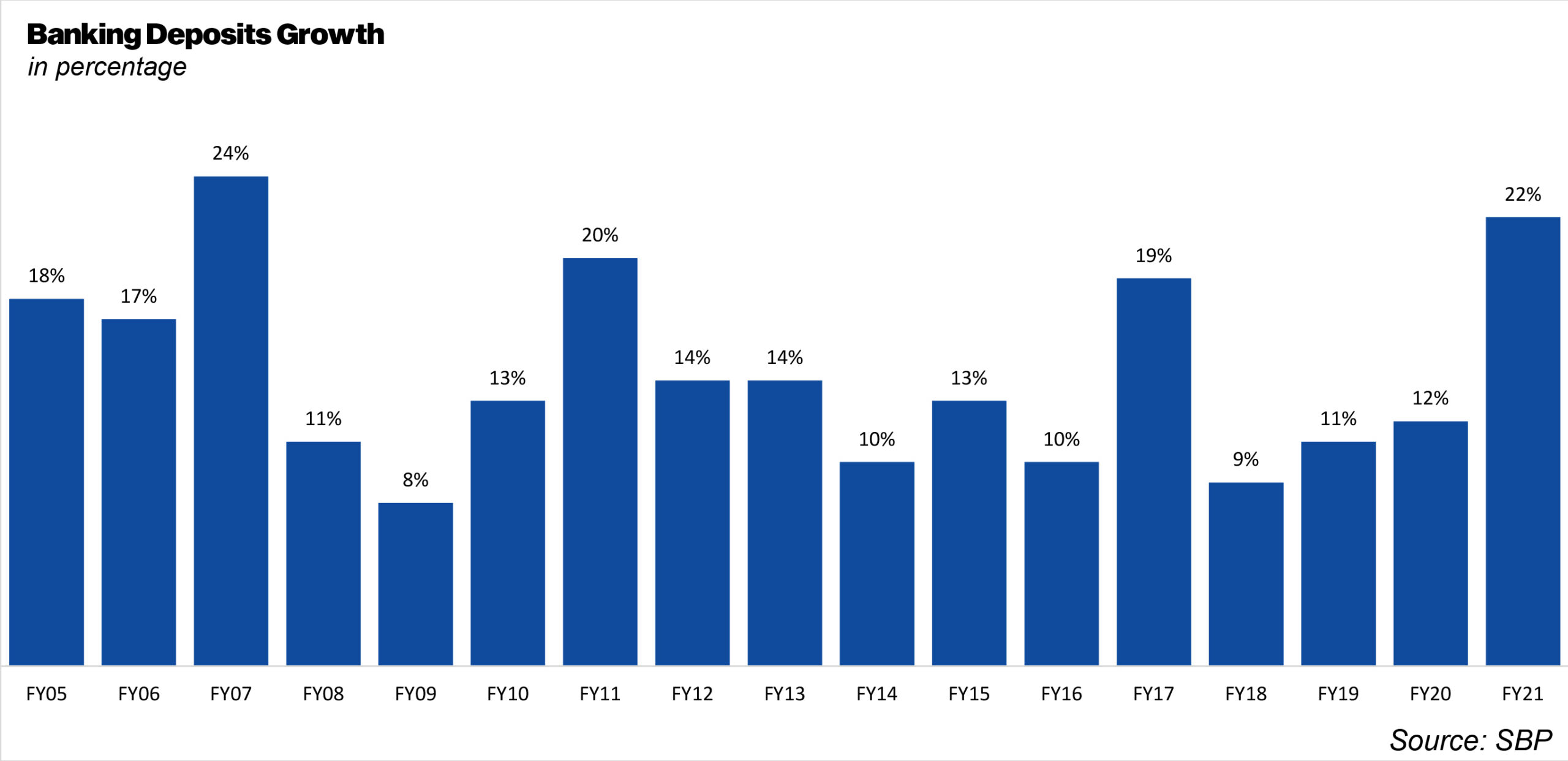

“Increasing the policy rate is going to increase the minimum savings rate by 150 bps. This will encourage keeping cash. Increasing the CRR is going to encourage banks to mobilize deposits because by definition, more of their liquidity is now locked up at the central bank. Therefore when they undertake more efforts to mobilize liquidity, they will also reduce cash because they are going to either offer better rates or undertake other measures to increase deposits which are good to reduce cash.”

However, with the CRR being increased and the introduction of TSA, there are concerns from the banking sector about wiping out liquidity. However, the governor says that the TSA is being done in stages and the SBP does not see a sudden impact on the banking sector.

Demand-pull inflation – now in Pakistan

Before moving on to what the governor has to say about inflation, some context might be useful. Central banks around the world manage inflation using monetary policy.

Econ 101 states that with higher interest rates, demand is dampened, leading to slower economic growth, and lower inflation. One could also reduce the money supply; though there is significant debate on how much money supply and inflation are correlated. Generally speaking, monetarists believe the two are closely linked, and therefore reducing the money supply will reduce demand which will bring prices down. Supply side policies can also be used to control inflation, however, these usually fall on the government instead of the central bank. Fiscal policy and wage control also impact inflation as less disposable income often leads to dampened demand which can bring down inflation.

In the case of Pakistan, our inflation is primarily driven by rising commodity prices around the world. ‘Imported’ inflation can’t be tackled with ‘local’ monetary tools. And supply side issues in Pakistan, like hoarding, can’t even be addressed through monetary tools.

So why is the SBP bringing a sword into a gunfight with the MPC decision to hike interest rates? That is because Pakistan’s economy is no longer restricted to supply side shocks, and is now also facing demand driven inflation.

As Baqir explains,“The drivers of inflation in our view right now are three. First are the international commodity prices. The monetary policy does not have control to bring international commodity prices down. However, the second and third reasons for inflation are reasons to use tools of the central bank.”

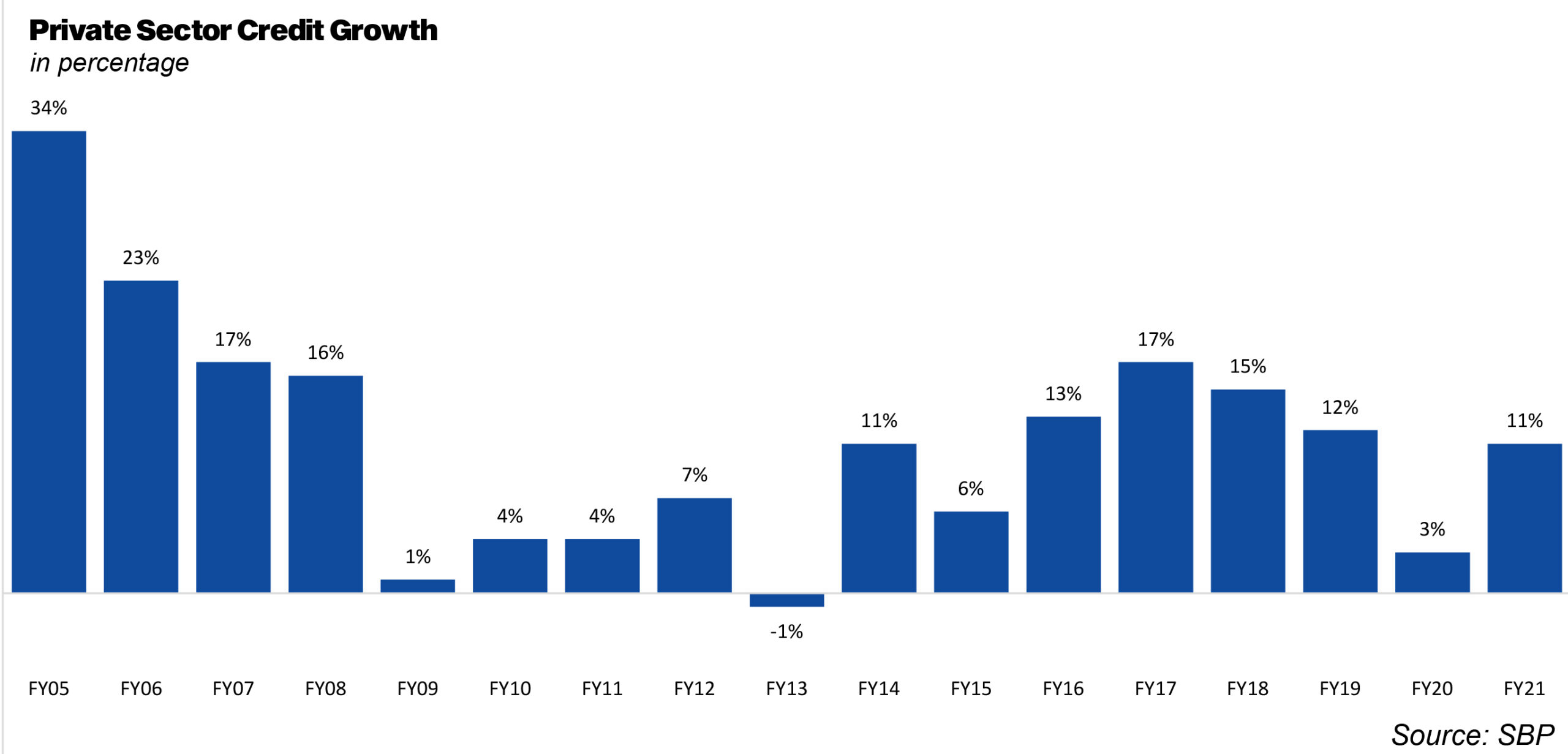

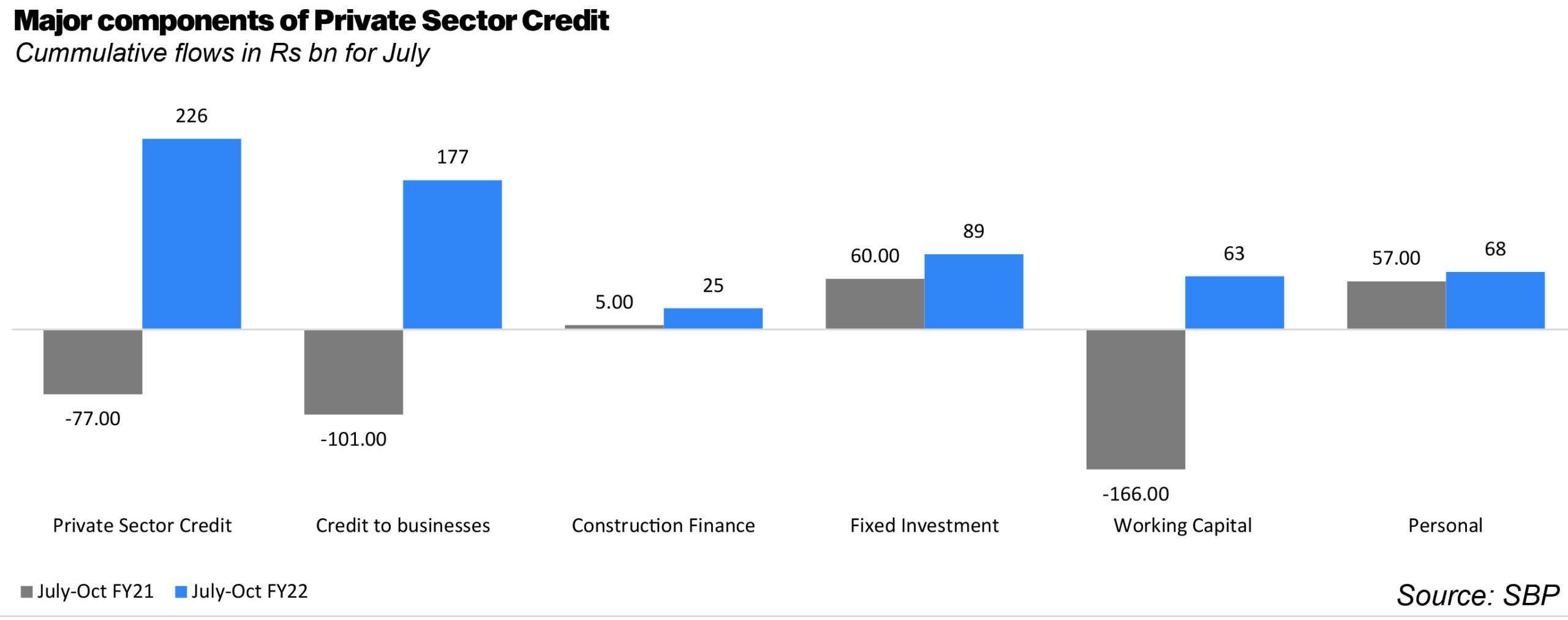

“The second factor is domestic demand growth, which is significant. And in our history, the best measure of domestic demand growth is import growth. Even if you look at non-oil import growth, it is a very brisk.If you look at indices of fast moving consumer goods, motorcycle sales, etc are rising. Consumption by broad cross sections of society are all growing very briskly. So we know domestic demand is growing very robustly. It follows therefore that in an economy, which already is not producing enough to meet its demands faces demand side pressure.”

The general principle in such a case is to increase the policy rate to curb money supply. The CRR being increased also reduces liquidity. Therefore, the MPC decision to increase policy rates in this environment makes sense.

‘The third factor, which affects the output and production, is the exchange rate. It affects inflation with the lag. The monetary policy, however, is forward looking.”

The rupee

Previously, the governor had been heard on multiple occasions saying if the rupee was able to withstand a global pandemic, it would be able to withstand anything. However, the recent rupee slide brings that stance into question.

Before addressing the reasons behind the decline in the rupee, the governor felt it was prudent to point out different ways to look at the rupee depreciation.

“The exchange rate on a peak to trough basis is what it is, but it is also important to look at it in terms of year to date which the average of the exchange rate for this calendar year is Rs 161, for the same period last calendar year it was Rs162. If we talk about the fiscal year, the average exchange rate for this fiscal year is Rs167 compared to Rs165 last year for the same period.”

As for why it declined:

“Number one is the current account development. The best way to look at it is that in May of this year is when you first see a current account deficit that’s exceeds 600 million. That is also the month when you begin to see a change in the direction of the rupee. There is greater pressure on the rupee. So that is point number one. And this comes back to why we think monetary policy actions help the outlook for inflation because monetary policy will moderate demand, moderate demand will moderate import growth. Moderating import growth will reduce the pressure on the foreign exchange and will therefore support the inflation outlook.”

The second reason might be a little unexpected: it has to do our neighbour, Afghanistan

“Second factor comes into play is starting in August. And that is developments related to Afghanistan because they cause additional pressure, especially in the open market. reports that foreign currency cash is being taken in large amounts to afghanistan. That adds pressure. It also adds some broader concerns and uncertainty on the part of the investor community about geopolitical developments in the country, when there is a desire to move into safe assets. In the local context that is either gold or dollar.

“We took measures as far as the movement of foreign currency is concerned. There are three in particular. One is the fact that we reduced the limit of cash that can be taken to a finest done by each person from $10,000 to $1,000. We began to require biometric for any transaction at exchange companies worth more than $500 biometric is to be done. It’s done at banks so there’s no reason why biometric cannot be done at exchange companies. We have also reduced the threshold at which a transaction can be underdone at an exchange company. Beyond that threshold, one has to go through banking channels as opposed to cash. So essentially, if there is a transaction you wanted to do at an exchange company, more than $35,000, you have to do it through banking channel.”

It is a healthy reminder that political problems like the Afghanistan issue have not just political repercussions for Pakistan, but also a direct impact on the rupee which drives inflation. It also has an impact on the investment climate in Pakistan especially if one is to take into account international sentiment towards the region.

And the third reason, of course, was

“The third factor is (was) uncertainty related to the IMF program. The fourth factor is self fulfilling expectations of the buyers and sellers of foreign exchange. Which is somewhat different from speculation? Speculation is a term that is not defined very clearly and different people mean different things from it. For the rupee, I want to be clear and say the movement is self-fulfilling expectations. If tomorrow, everybody comes to the view that the rupee is going to depreciate then many people will buy dollars or hold onto their dollars. The rupee as a result will depreciate. You will fulfill your expectations. Whatever you have expected is what transpired.”

“If tomorrow you expect that the rupee is going to appreciate, then whoever has foreign currency may sell considering they’d get a better rate today than in the future. For instance, the rupee strengthened significantly from 175 to 170, after the announcement of the Saudi deposit, we certainly saw a lot more inflows into the foreign exchange market because a few days, the expectation that got created was that the Rupee has hit the trough and now it’s going to strengthen. And so you begin to see the movement in the other direction. So that is the fourth factor in our view that also has contributed to the exchange rate depreciation.”

Roshan Digital Accounts and Remittances

“Overseas Pakistanis are tremendous asset for the country. It’s an asset that has not been as connected.”

The Roshan Digital Accounts is a means to make a permanent and safe connection between overseas Pakistanis and Pakistan.

“Each account is a connection,” says Baqir. The number of Roshan Digital Accounts have been growing for Pakistan, this means new connections are being made. This account opening process for overseas Pakistanis will have a long term impact because regardless of what the policy rate is, who is governor, or what’s happening in the country, overseas Pakistanis have a safe channel through which they can invest, remit, and consume.

Despite that, there have been concerns of hot money through the RDA, especially considering individuals are getting cheap loans from their home countries and using that money to invest in Naya Pakistan Certificates. Pakistanis are obtaining LIBOR based leverage to invest in NPC which they may withdraw when the leverage becomes too expensive to sustain. Considering the criticism Baqir has received in the past for bringing in hot money, some analysts have been weary of the inflows.

The State Bank’s stance on this, however, is interesting.

“Approximately 1000 new accounts are opening each day. Each account is a permanent connection and not all the money is being invested in Naya Pakistan Certificates only around 60- 70% is going to that. The remaining 25 -30% is actually sitting in a account balances, which is not earning that much of a rate of return, or is this being used for payments that people want to make.

‘So the right way to, think about the effective return that is being paid on the NPC is less because for every dollar that is in NPC, roughly $1.30 have come into the country so that, you know, 6.3% net of tax that is being paid is actually reduced by the factor, because more dollars that are actually coming in, because people see there are attractive savings opportunities as well.”

Moreover, as for gaining cheap credit from overseas to invest in Pakistan, the governor says, “Offshore banks are catering to their clients by lending to them so that they can invest more in Pakistan. That is a decision between the bank overseas and their clients. It doesn’t involve us over here.”

The governor also spoke on portfolio inflows, explaining that while NPCs are non-transferrable, portfolio inflows do not have a secondary market. The contrast between the two is clear and important. “This is retail money and is generally quite sticky. And ultimately what we have to demonstrate is that Pakistan’s economic prospects are stable and growing because as long as that is the case, even if LIBOR is increasing, it is going to affect the return on all investments that you may consider doing if you are in overseas,” he said. However, the governor reiterated that RDA is all about making connections, and all this is a bonus to it.

What is to come?

You don’t need to be an expert to know that the policy rate will increase over the next few months. However, with the IMF program coming into play, the uncertainty around economic reforms and plans has now been set aside. While supply side inflation still remains at the behest of international commodity markets and of course government control over prices domestically, the SBP’s decision to curb money supply and demand pull inflation may help the economy on its sustainable growth path. The SBP does not seem too aggressive with regards to austerity and is still in favor of maintaining an “accommodative” stance.

However, the SBP which was widely appreciated during COVID for its more than accommodative proactive measures may now find it difficult to please the business community, as it moves towards sustainable and fundamental driven growth as opposed to consumption and import driven growth which has been encouraged in the past.

What is the copyright situation for film stills taken from DVDs and used in academic articles?