On December 13, the State Bank of Pakistan (SBP) launched the Asaan Mobile Account (AMA) scheme at the central bank’s headquarters in Karachi. Those in attendance were the governor and deputy governor of the State Bank, CEOs of some of the largest banks in Pakistan, chairmen of the National Database Registration Authority (NADRA) and Pakistan Telecommunication Authority (PTA), officials from Virtual Remittance Gateway (VRG) and other officials from central bank.

The launch comes after a long and uneven ride for AMA and the parties involved, with unwanted delays in the launching of the scheme, wilted faces of some of the participants of the scheme and uneasy interactions. But this discourse is not about delays, wilted faces or uneasy interactions. It is rather about the scheme and what it holds for Pakistan.

The scheme is the embodiment of a rare cooperation between commercial banks, mobile network operators or telcos like Mobilink and Telenor, and a young fintech company, VRG, which is at the centre of making this cooperation possible.

The scheme is finally here, with ambitious targets of banking a massively unbanked population and a promise that if this population is banked, it can change the destiny of the entire nation.

Why is AMA the best bet to bank the unbanked?

The idea of AMA is to get banking services to the unbanked population on a USSD-based channel so that it can eliminate the need for the internet. The USSD code system is one most mobile phone customers are familiar with. Each time they use a prepaid card to load more money into their mobile balances, they are using a USSD code to conduct that transaction (that *786 or *123 or similar code followed by the scratch card code that you use is called a USSD code). In turn, it is expected to boost financial inclusion which comes with its own prize for the economy.

Talk to bankers and they will tell you how they avoid interacting with low-income people, say some shepherd in a village, and even deny them entry at a bank branch. These customers can create an image problem for the bank and its wealthy customers would feel uncomfortable with their presence at a bank branch. Banks also consider these customers hard to work with because of low literacy among such segments, and banks have long considered these segments a bad business case since the cost of serving these customers at a branch is high whereas the money banks can make on these customers is less.

But ignoring such customers because of their low literacy, how they look and how they speak is wrong on many levels, and criminal if done for long. Considering that the majority of the population belongs to the low-income group, it can have serious consequences for the economy due to a high rate of financial exclusion. So if a majority of the population is ignored by banks and they can not go to the banks, what do you do? You take the bank to them.

The case for having AMA is a simple one. Pakistan’s unbanked are not banked because of one or more of the underlying reasons: they either simply do not have enough income or work menial jobs to be able to qualify for a current account; documentation is a hassle and not everyone is literate enough to fill paperwork and open a bank account; and access to a bank branch is not easy for everyone especially women.

So how do you take the bank to these people? There are 187 million active cellular subscribers according to data from the PTA, so banking on phones is the most convenient way to get the unbanked bank accounts.

But not all cellphone subscribers have a smartphone to carry fancy banking applications or other wallets on. Until October 2021, 52% of the total cellphone users in the country were smartphone users whereas the remaining 48% use feature phones. The ones that do have smartphones, especially the ones in the low-income demographic of the country, are not likely to have internet access on these phones sometimes because of infrastructure constraints and sometimes because the internet would be too expensive to afford.

Whereas they would always have the USSD system of codes available wherever a mobile network operator (like Telenor, Jazz, Ufone and Zong) operates.

Operating a bank account on a USSD channel has been around for a while. Askari Bank, Bank Alfalah and Soneri Bank for instance allow bank account holders to operate their accounts on a USSD-based channel provided by Ufone. The problem, however, is that such arrangement is only restricted to one bank and a telco under a one-to-one model where one bank offers mobile phone banking services in partnership with a telco. The limitation here is obvious: only one telco’s outreach is being utilised by one bank. Therefore, the scope of banking is restricted to the customers of one bank and users of one telco.

Another model under which a telco can partner with multiple banks, a one-to-many model, can reach out to more users but it is still restricted to the outreach a telco has, that is the number of users of a particular telco.

The AMA scheme, however, is the embodiment of a different kind of model classified as a many-to-many model under which many banks and many telcos partner to offer services to almost all bankable customers, which is an estimated 100 million adults in Pakistan. Profit’s research into bank and telco partnerships for mobile banking on USSD channels does not show many banks in partnership with telcos to offer mobile banking. Only a handful of banks have partnerships with Ufone to offer mobile banking services, but they are restricted to financial transactions: you can not open an Askari Bank account or a Bank Alfalah account by dialing a USSD code and would have to visit a bank branch to do that.

On the other hand, telcos Mobilink and Telenor are the major players in branchless banking and operate JazzCash and EasyPaisa wallets and over-the-counter (OTC) mobile banking. Through branchless banking licenses of the banks that back them, both the telcos have been able to promote financial inclusion by providing access to banking to low-income demographics; the segment of population that is unbanked.

Under the National Financial Inclusion Strategy (NFIS) of the Government of Pakistan, a target of 65 million active digital transaction accounts has been set to be achieved until 2023. As of September 2021, there were 260,829 active branchless banking agents in the country providing OTC banking services, according to data from the State Bank of Pakistan. This is in stark contrast to only 16,308 bank branches in the country as of June 2021. So if the network of branchless banking agents is leveraged effectively whereby an HBL or a UBL customer can cash-in and cash-out or get assisted mobile banking services at an EasyPaisa or JazzCash branchless banking agent, financial inclusion can increase manifold.

Clearly there is scope; Pakistan has a huge unbanked population that needs to be banked to bear fruits of financial inclusion, digitise payments, curb money laundering and digitise the economy overall. There is also a way to do it through interoperable infrastructure sharing between banks and telcos for which the many-to-many model is the only effective one, and there is also the willingness to do it following the third-party service provider (TPSP) regulations creating that interoperability and the official launch of AMA last week.

Where is the convenience here?

So under the AMA scheme, a smartphone or a non-smartphone user, without any internet connection and without the need of going to a bank branch, can simply dial *2262# (the USSD code for AMA scheme available on all telco networks) and open an Asaan Mobile Account with any one of the 13 partner banks part of the scheme.

The interface on the mobile phone will take the CNIC number of the user and expiry date, following which identity verification will be done by NADRA which is connected with banks’ systems. An official connected with the scheme, choosing to remain anonymous, said that the actual account opening takes under or up to a minute only.

Once the account is opened with any one of the partner banks, financial transactions like funds transfers and bill payments can be done through the same phone on a USSD channel. And interoperability means that users will be able to carry out financial transactions between banks on the same USSD channel.

The frictions that earlier restricted a segment of the population from opening a bank account, the AMA account removes those. People will have the facility to transfer funds, make payments, pay bills and do mobile top-ups to begin with. The facility will, however, be open for banks to add new products and services such as disbursing loans into AMA accounts.

The success of AMA, however, is based on an assumption that people who were not literate enough to open a bank account at a branch, would be savvy enough to open and operate AMA accounts on their phones. That is at least what the skeptics in the banking industry have to say about the scheme.

The counter to that argument, and what is precisely the point of interoperability and which has been the mainstay of branchless banking business, is the vast agent network which provides assisted banking services to wallet users.

With all that in place, AMA looks promising to make a headway in financial inclusion. For women in particular, which have long been ignored by banks despite virtues for these banks.

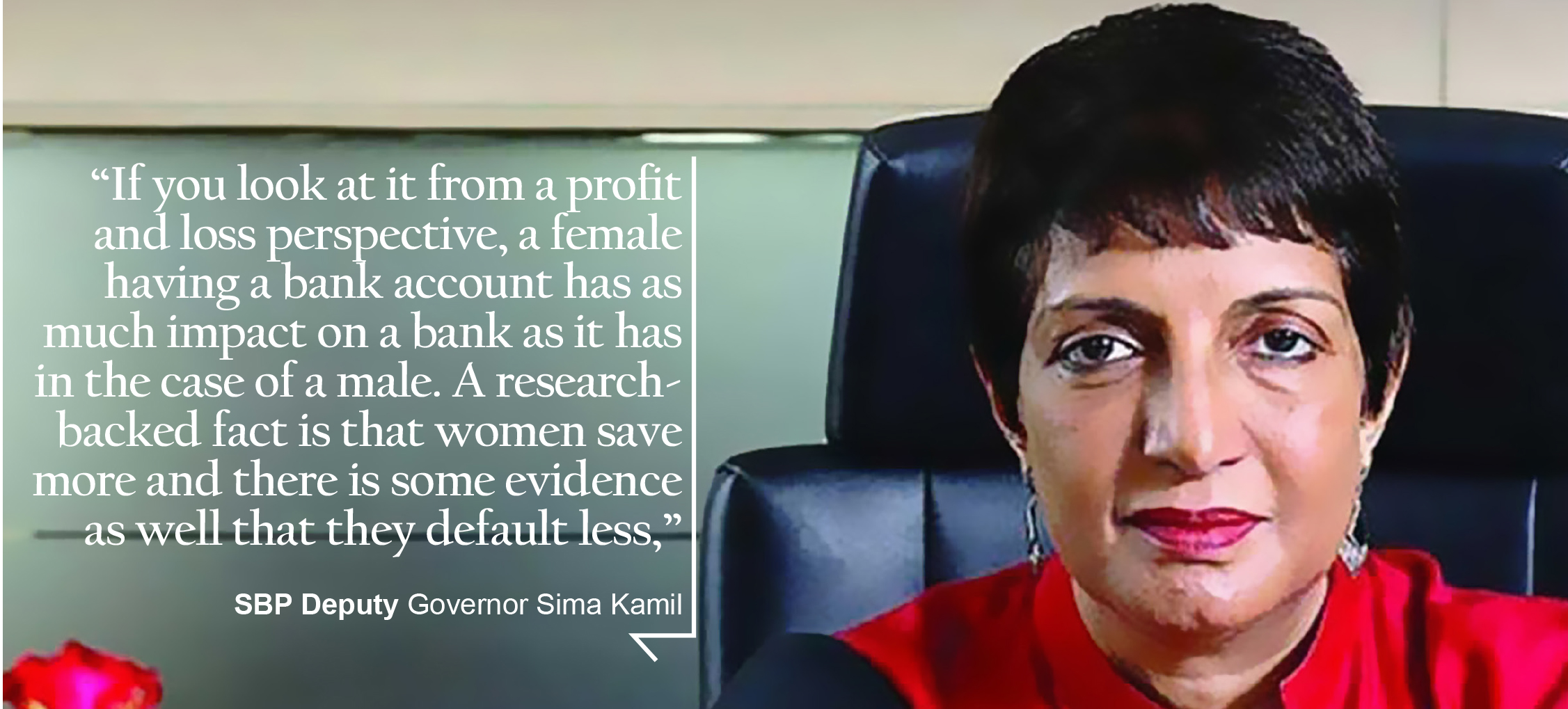

“If you look at it from a profit and loss perspective, a female having a bank account has as much impact on a bank as it has in the case of a male. A research-backed fact is that women save more and there is some evidence as well that they default less,” SBP Deputy Governor Sima Kamil had earlier told Profit in response to a question on bank’s lack of interest in financial inclusion for women. Add to that the SBP has planned to give targets to get more women into the formal financial sector, for which AMA can be crucial.

The central bank’s own target is to get 20 million women into the financial system by 2023 and for the AMA scheme, SBP Governor Reza Baqir said at the inauguration of the scheme that AMA can potentially add 50 million accounts.

The only question is if that would happen. An expert Profit spoke to said that it will all depend on how the scheme is marketed and people can be persuaded to join the banking net. “After a certain time, people stop signing up for wallets. But if Jazz or Telenor give a Rs100 top-up to a user if he signs up with JazzCash or EasyPaisa, they will likely sign up immediately. Even then it would be a sign up and not an active account so the key would be to keep AMA accounts active as well,” he said.

It all starts with an account

Profit has been a skeptic of the rhetoric of providing access to financial services to a population that perhaps does not need it. In an earlier critique, Profit argued that those that the country is trying to bank are likely better off by staying unbanked: a bank account changes nothing for them.

An official stakeholder of the scheme, however, said that it has to start with a bank account. “There are conveniences attached with making payments digitally. Billions of rupees worth of payments are done in Pakistan in cash, for example payments at vegetable and fruits markets all across the country are done in cash on a daily basis by millions of people. If you aggregate all of these payments, it is a massive amount of money that is cash-based and if digitised, this money is going to help the economy overall,” he said.

People that Profit spoke to said that right now, if people are skeptical about the conveniences of such an arrangement, it is because nobody has been able to show to them these conveniences at a mass scale, and the AMA scheme is just the beginning of that. “Getting active users is going to start with getting users first on AMA and that has happened. It is only a matter of time that they see it as a convenient mode of payments and use it as a priority over cash.”

“Under the AMA scheme, the use cases are what a common man needs. He sends money, he pays bills but without a bank account, it’s all cash-based. The convenience is there and AMA is there to ensure that they have this option,” another official said.

“Moreover, banks do have the option of offering value added products and services for this demographic and these products will also be interoperable: banks would be able to offer these to customers of other banks too through AMA,” he added.

Banks have long been ignoring retail consumers for financing, housing finance in particular. Their excuse, quite legitimately, has been that there are not many options available to assess credit worthiness of the demographic that needs to get housing finance facilities from commercial banks. There is a shortfall of 10 million housing units, according to the State Bank of Pakistan.

The Pakistan Tehreek-e-Insaf government’s housing initiatives like Naya Pakistan Housing Scheme and Mera Pakistan Mera Ghar for low-income communities. The problem at the centre again has been that the demographic targeted for this facility, there are not enough data points to assess their credit worthiness. And without proper credit assessment, the rate of default would be high.

Since AMA plans are meant to be for low income communities, transactional data on AMA accounts would provide data points for assessing credit and possibly make the housing dream a reality for low-income people.

Once billions of rupees worth of cash is digitised, banks’ deposits will also increase and then a better case could be made to push banks to offer better consumer products and services for low-income demographics. Banks would then tailor products, say loans, focused on a subset of such demographic, say women, just because they had an AMA account and they used it to make payments. Then, the willingness of banks will also be high and the low-income groups would be made to feel privileged by the very banks that once ignored them.

So far, the uptake of the AMA scheme has been encouraging. As many as 2 million AMA accounts have been created so far. These accounts have processed 14 million transactions worth Rs14 billion in value. If the uptake continues and AMA is able to get 50 million people into the banking net and there are active transactions on these accounts, it will substantially increase financial inclusion and lay the grounds for a country in which financial services and products would be available for the now financially excluded. Then, it will be a promise of a better financial life and uplift of the low-income households which will alter the course of their lives towards a better destiny.

I already have an account on my ID card and some way to close it

Asaan Mobile Acount

I already have an account on my ID card and some way to close it

Asan mobile Acount

Plzzz tel me sir

Hi

Good information

Kindly visit my website i have thousands of free SVG files and free theme, Plugins

freesvg.uk

I want to close my this account 03160385148

Hbl konnect aasan mobile account.

Plz. Do it,

i have apply asaan mobile loan from mcb