Today with greater socialization and peer pressure, individuals spend more than they save or invest. It has become challenging for many, especially the youth to either save or invest some part of the amount. Moreover, many tend to lack awareness of the financial assets and how the investment can prove to be fruitful for them.

The greatest method to manage funds is to make smart, disciplined, and frequent investments from a young age. Diversification is the key to smart investing. While investing for the long term, a diverse portfolio reduces risk. It allows for a certain number of high-return investments to be made while mitigating potential risks with more stable options.

“Don’t put all your eggs in one basket”, the most heard proverb warns about investing all your funds in one source. If the basket breaks, you would lose all your eggs. Therefore, investors must invest in various assets to mitigate the risk.

Why should you diversify?

The financial market has the characteristic of unpredictability. Many factors impact the financial instruments listed under the financial market; hence, this could result in varying levels of returns. Since one can never assure the returns on the assets due to various factors like war, liquidity issues, scarce resources, interest rates and other economic policies, the investors must diversify their portfolio to manage the funds.

For example, if there is a gas shortage and the company is unable to export to your country, the price of a commodity may fall but on other hand, your investment in technology equity does great due to increasing use of software along with receiving rental income from your real estate investment. Thus, these investments are said to be negatively correlated.

Strategies to manage your funds?

1.Individual Asset Diversification:

The first technique is to spread your funds among a range of assets within a single asset class. This can be as simple as purchasing a commodity, such as gold or oil to guarantee that your portfolio has a balanced mix of high- and low-risk securities across industries. It can also imply making strategic investments in industries that appear to be similar to each other.

2. International Market Diversification:

The second tactic is to assess the international financial market. If the market in your home country performs poorly, having some investments in international markets can help to limit risk and balance your portfolio. However, do ensure the rules, regulations and processes for investing in other countries as they may differ from your own.

3. Asset Class Diversification:

The third technique is to diversify your portfolio by investing in a range of asset classes. Traditional investments, such as equities, commodities, and currencies, operate in the public market, whereas alternative investments, which operate predominantly in the private market and are often unregulated, operate in the private market.

How to trade on a trading platform?

There are several online trading platforms that may assist you to trade, but Binomo is one of the most popular and user-friendly. The following platform is available in 133 countries including Pakistan. On this site, you may have access to over 70 high-yielding assets, each generating varying returns and accessible from different types of accounts. Individuals with less to no financial knowledge can access demo accounts to learn whereas experienced individuals can begin their trading with three different types of accounts – Standard, Gold and VIP. Each account offers upgraded benefits to the investor.

The concern for a secure trading platform is rising for investors as the risk of fraud increases. Binomo, on the other hand, has been designated as a Financial Commission member of category “A.” This attests to the company’s trustworthiness and ensures service quality and relationship transparency. In addition, if a member refuses to follow a Financial Commission judgment, he or she will be protected up to €20,000 per instance by the Compensation Fund.

A reliable platform is essential for trading, and Binomo succeeds in this area. With multi-platform compatibility, the trading app can be downloaded on Android and iOS mobile devices so you can virtually actively trade with confidence.

How to allocate your funds?

Investors must invest the amount carefully and wisely, including both safe assets and risky assets. Therefore, we have prepared a guideline to guide you and maximize your returns.

1. Risk-free Bonds:

A risk-free bond is one that is issued by a company that is guaranteed to pay back both the principal and interest with no risk of default. These are less risky as they are issued by the government. The investors receive the coupon payments along with interest payments and principal payments when the bond matures.

Pros:

Less risky

Receive Coupon payments

For risk-averse investors

Cons:

Fixed Income

2. Real Estate:

Purchasing and owning real estate may be a rewarding and profitable financial investment strategy in long term. One of the most common ways for real estate investors to profit is to become a landlord of a rental property. An investor can either earn by purchasing the undervalued real estate and sell after a few years when the value appreciates realizing the capital gains. Alternatively, the property can be used for commercial purposes as well and earn rental income. However, it requires substantial capital to finance the purchasing of real estate.

Pros:

Source of regular income

Can realize massive gains

Cons:

Lower liquidity

The cost of damage by tenants needs to be borne

The high initial capital required

3. Gold:

Gold has become a gleaming investment commodity for many investors as inflation rises. At the start of August 2020, gold reached fresh highs, surpassing $2,000 per ounce. This is gold’s most significant increase in the last ten years. As a result, gold is proven to be a safe investment — a shield of stability or the best hedge against inflation.

Pros:

Hedge against inflation

Less risky

Cons:

High investment required

4. Dollar:

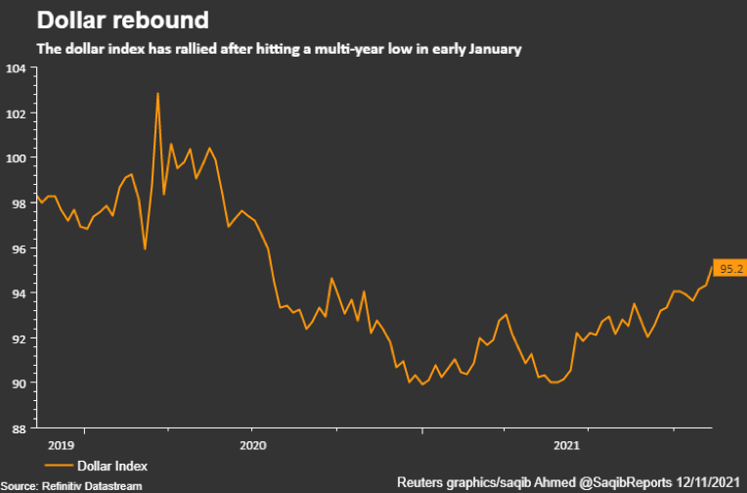

The dollar has risen as a result of rising inflation. The dollar has gained ground against the Euro and other major currencies. For the past few months, the dollar index has appreciated, reaching a session high of 95.197, its highest level since July 22, 2020. It was trading at 95.1630, up by 0.36 percent. The euro was down 0.28 percent at $1.1446, its lowest level since July 2020. Similarly, the pound fell 0.31 percent, while the Australian and New Zealand currencies fell 0.46 percent and 0.54 percent, respectively.

Pros:

Relatively less risk to securities

One of the strongest currencies

Cons:

Gain higher returns over the long term

5. Securities:

Securities are ownership holdings in publicly traded firms that allow investors to participate in the growth of the company. These assets, on the other hand, have the potential to lose value and perhaps go to zero. In either case, the investment’s success is nearly totally dependent on stock price movements, which are deeply intertwined with the company’s growth and profitability.

Pros:

Ability to generate higher returns

Can earn dividend income

Cons:

Can be riskier