The Karachi Interbank offered rate, simply known as KIBOR, hit a 13 year high of 14.1% on Tuesday. While it might seem so, the KIBOR is not trying to mimic petrol prices by being at a high, instead this is telling of a larger pattern that has been present in the money markets over a period of time.

The markets are pricing in for a policy rate hike. At this point, you’re probably rolling your eyes because we’ve been saying that for the past few months. However, while it has been true for the past few months, yet things aren’t really changing.

The buildup

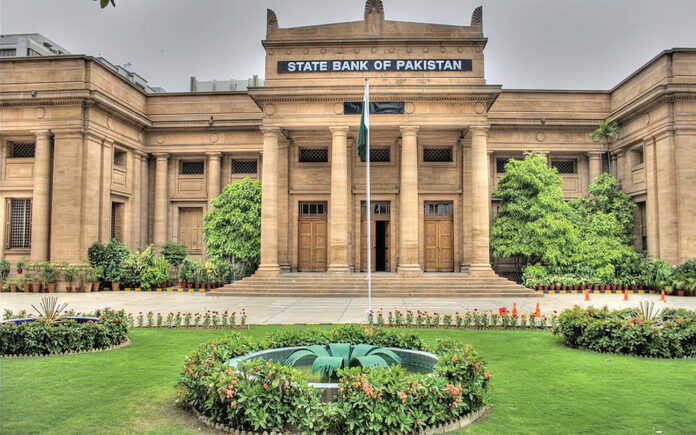

During COVID 19, in order to support the economy, the SBP decided to increase money supply by bringing down interest rates. This was to provide liquidity to businesses and the markets in order to keep them afloat during uncertain times. Although the move was inflationary, it was probably important at that time. Besides, Central Banks hadn’t really prepared for a virus that changes life as we know it. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

I found profit articles very useful and uninformative

Useful and uninformative??

Hmmmm…

Nice blog.Thank you so much for sharing this amazing information with us.

온라인 카지노

j9korea.com