ISLAMABAD: The National Assembly has approved a 10 percent super tax on income of more than Rs300 million.

As per the Finance bill 2022, for tax year 2022, persons engaged partially or wholly, in the business of airlines, automobiles, beverages, iron steel, LNG terminals, oil marketing, oil refining, petroleum and gas, cement, cigarettes, fertilizer, sugar, textile and pharmaceutical, the government has imposed a 10 percent super tax on 13 major industries with an income of over Rs300 million.

Further, in the case of banking companies for the tax year 2023, the rate of tax shall be 10% where the income exceeds Rs300 million.

The tax years are defined by the 12 months period between July to June. However, certain sectors follow a different tax year from the usual one. The financial sector is an example that follows the calendar year as its tax year.

Earlier, there was ambiguity on whether the super tax will be applicable on a retrospective basis or a prospective one. However, the finance minister has clarified that except for the banking, there would be retrospective application of the super tax. You can read more about it in profits news article: Super Tax to be applicable retrospectively from Tax year 2022

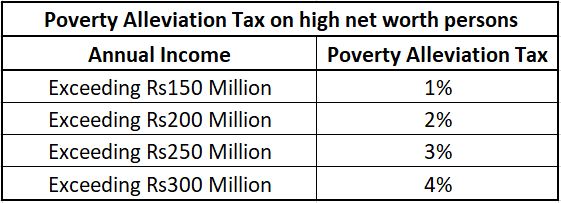

Meanwhile, there will be 1% tax on high earning persons where income exceeds Rs150 million but does not exceed Rs200. Similarly, there will be a 2% tax on income where income exceed Rs200 million but does not exceed Rs250.

Likewise, there will be a 3% tax on income where income exceeds Rs250 million but does not exceed Rs300 and 4% tax on income where income exceeds Rs300 million.

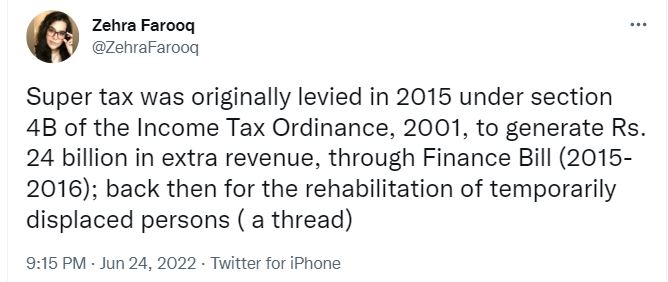

The government aims to raise Rs200 billion from the one time super tax and poverty alleviation tax. However, as per sources, the implementation of this tax is likely to be challenged in the court of law on the basis of it being part of a money bill. The same happened in 2016, when the super tax was charged for the rehabilitation of displaced persons. You can read more about it in Profit’s article: Is the ‘Super-Tax’ the need of the hour or an easy way out?

“Though it is hard for the sectors to sustain in such an aggressive tax environment, this is probably the need of the hour and a step required to protect the salaried class” Syed Talha Ahmed, a white collar Professional working for the Tobacco sector, commented on the situation.

Further, the National Assembly also announced that the retailers who do not connect to the commercial FBR computerized system will be penalized. In case of default for the first time, there will be a fine of Rs. 0.5 million. For the second time, after 15 days, a penalty of Rs. 1 million will be levied on default. Fifteen days after the second default, a fine of Rs. 2 million will have to be paid for the violation. The fine will reach Rs. 3 million 15 days after the third default, and non-compliant retailer businesses can also be sealed.

Ur Info Is Good & very helpful!

Al Kabir town has 4 phases, each phase has a few blocks like A, B, C, and D. In 2016 Phase I was sent off by the developers, and in March 2017, condos were sent off. Afterward, in May, Phase II was sent off by the developers, and afterward Phase III and IV was sent off otherwise called Kings Town and Maryam Town. The greatest aspect of Al Kabir town is that all phases are Lda-Approved. Society is the drive to give extravagance and present day living space to individuals of Lahore at a reasonable cost.