ISLAMABAD: Through the Finance Bill 2022 approved by the National Assembly on Wednesday, the federal government has imposed a levy on mobile phone imports during the fiscal year 2022-23.

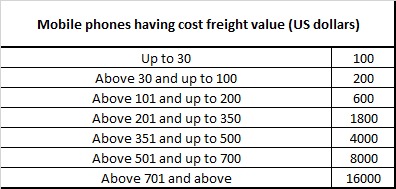

In the Finance Bill, the imposition of a mobile handset levy at the rates specified on imports of smartphones of different price categories ranging from Rs100 to Rs 16,000 was proposed.

It has been approved that a levy of Rs100 on $30 mobile phones, Rs200 on $100 mobile handsets, Rs600 on $200 handsets, Rs1,800 on $350 mobile phones, Rs4,000 on $500 handsets, Rs8,000 on $700 handsets and Rs16,000 on $701 handsets would be imposed during the next fiscal year.

The government has estimated a revenue of Rs10 billion from the levy on the import of mobile handsets.

The taxation on the smartphones falling at the lower end of the price spectrum is criticized particularly in the context of the digital Pakistan ambition. Around 97% of 117 million broadband users access the service through mobile. Further, they serve as the catalyst for the growth of multiple digital services including digital finance. GSMA, in its reports, has also stated that affordable smartphones are an indispensable part of Pakistan’s mission to a completely digitized connected economy,

Mobile

could you please stop taxes on mobile phones

you can impose tax on mobile trading companies

not everyone single users

specially overseas pakistani

you must not charge any tax on their personal mobile phone.. this is call looting

you collect tax from everyone .. in return what facilities you provide to public

Nothing .. stop it