Friday morning brought a bombshell for the business elites of the country. In a televised address to the nation, the Prime Minister himself announced that a new “super tax” will be applied on 13 sectors of the economy starting from July 1. As the news filtered through, and the inevitable rush of anxiety and panic wafted through their ranks, confusion began to prevail.

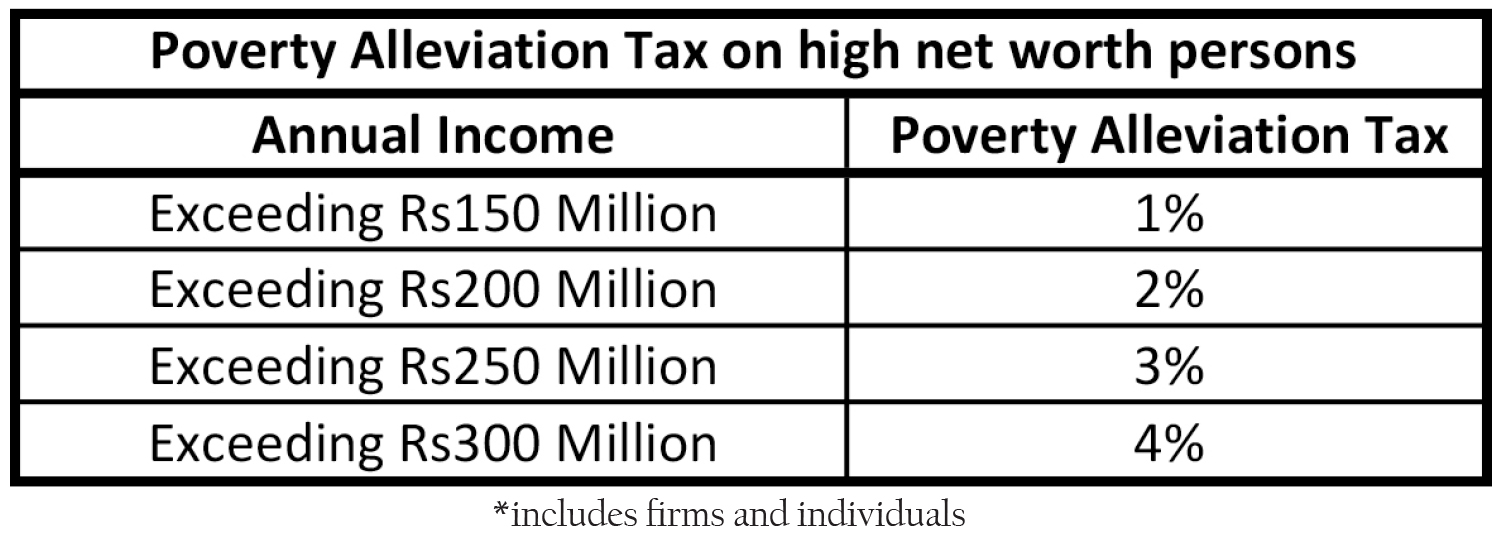

The budget had already brought a raft of new taxes, most importantly under the head of “Poverty Alleviation Tax” that was staggered to fall on all persons and firms with incomes in excess of Rs 300 million. But now an additional 8 percent “super tax” was being levied on top.

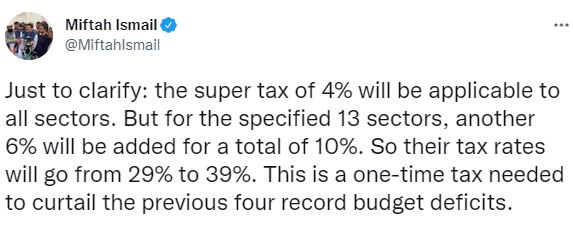

As confusion spread, the finance minister stepped in with a tweet clarifying the burden the new tax will place on the business elites.

As Ismail stated, the maximum amount of tax paid by the persons and firms would be 4%. However, 13 sectors – Cement, Steel, Sugar, Oil and Gas, Fertilisers, LNG terminals, Textile, Banking, Automobile, Cigarettes, Beverages, Chemicals and Airlines – will have to pay an additional tax of 6% over and above the 4% Poverty Alleviation Tax.

The incumbent government finds itself between a rock and a hard place. If not for the “Super Tax” and Poverty Alleviation Tax, the salaried class and low income class would have been taxed through direct and indirect measures to raise incremental revenue.

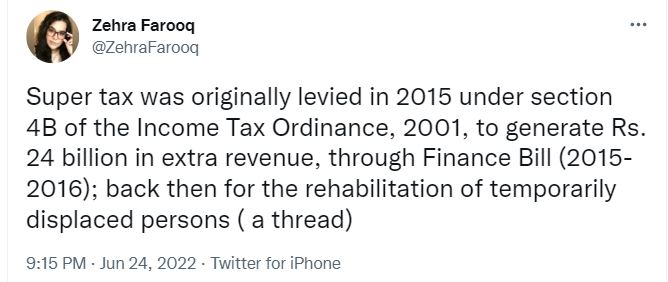

However, this is not the first time such tax measures have been introduced by the Pakistan Muslim League – Nawaz (PML-N) led government. In 2015, the then finance minister, Ishaq Dar, levied a one-time tax for ‘rehabilitation of temporarily displaced persons’. The tax was imposed on banking companies at the rate of 4% while other companies and persons having an income in excess of Rs500 million were slapped with a “super tax” of 3%. The government ended up extending the period for the “super tax” by three years for individuals and companies other than banks. However, the levy became a permanent feature for the banking sector.

The business community went to court against this measure and challenged the government’s rationale to levy a tax for a specific purpose through a money bill. The case regarding the issue is still pending in the Supreme Court of Pakistan.

The business community went to court against this measure and challenged the government’s rationale to levy a tax for a specific purpose through a money bill. The case regarding the issue is still pending in the Supreme Court of Pakistan.

“If the government has to impose a special tax for deficit financing, it should not be named as poverty alleviation tax as its implementation can be challenged due to being a part of the money bill and not being presented to the parliament for approval.” Asif Haroon, senior tax partner of AF Ferguson & Co, said, addressing the matter in a post-budget conference held by the Institute of Chartered Accountants of Pakistan, on June 13.

It is likely that the business community will again challenge this tax in court on the basis of faulty legislation.

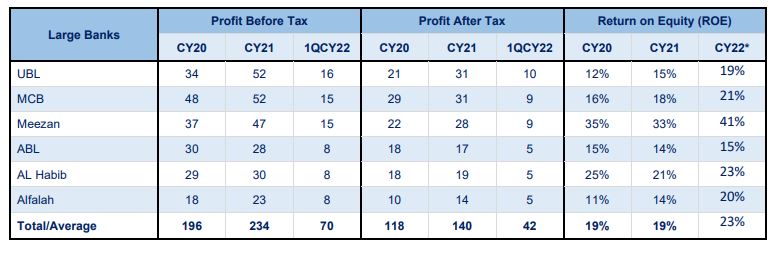

As an immediate aftermath of the Prime Minister’s address, the Pakistan Stock Exchange crashed, as expected, due to a large portion of the total market capitalization held by the 13 sectors facing the highest taxes. Tahir Abbas, Head of Research at Arif Habib Limited, told a private publication that the “super tax” will have around a 10%-12% impact on the profitability of the companies.

The additional taxation comes as a blow to industries struggling amid an economic slowdown and high inflation, which is expected to shoot higher still in coming months. Compounding matters, the country is also experiencing a low level of foreign direct investment and, according to the business community, ad hoc tax measures like the one proposed would only deter investor confidence.

Then, there is also the likelihood that this Poverty Alleviation Tax will encourage people to split their declared incomes to avoid crossing thresholds beyond which these taxes would be imposed. This could increase “creative accounting” practices and may push those who are already paying taxes to start evading them.

However, part of the business community does acknowledge the fact that these are hard times and some measures such as super taxes are inevitable but shouldn’t be imposed on a few businesses while sparing others.

Dr. Ikram ul Haq, a Senior Tax and Corporate Law practitioner, while talking to Profit stated, “The super tax is another way to punish those who are compliant with the tax regime. It is against the fundamental principles of a balanced tax regime that demands equity in taxation. The retail and trading sector has been given a jail pass while the documented sector pays a hefty price for it.”

“The government is handing out exemptions on income tax worth Rs 1.5 trillion and if there is a financing need then these exemptions should be removed first rather than taxing the existing tax base. Such measures are detrimental to the efforts of increasing the tax base,” Dr Ikram added.

“If these taxes are for poverty alleviation, then the government needs to be transparent about how much is being collected and where the money is being used. However, the reality is that all this goes towards debt financing and there is not much poverty alleviation happening,” he said.

The criticism of the additional taxes is primarily based on the argument of an equitable tax regime. The canons of taxation presented by Adam Smith, widely acknowledged as a basis for a fair tax regime, include equity and certainty which are not characteristics attributable to Pakistan’s system.

“Pakistan was de-industrialised in the past and now that industrialisation is picking up pace, such tax measures will halt the process. The industry already contributes 56% of the total revenue and the sectors that will bear the brunt of the super tax contribute around 70% of the industry’s tax revenue. Therefore, this approach of taxing the already compliant taxpayers is not sustainable,” said Ehsan Malik, CEO of Pakistan Business Council.

Another problem with these taxes is the fact that they are retrospective in nature. For example the companies who have a financial year ending in December 2022 will have to revise their yearly projections and related policies including dividend payments to shareholders.

However, Malik did acknowledge that the government was in a fix as it has to comply with IMF requirements as well as look after the underprivileged and salaried class: “The IMF programme is a front end programme that looks at the short term and usually doesn’t provide space for sustainable solutions. The government is forced to take such measures as the revenue needs are immediate.”

On the other hand, the sectors being taxed have long enjoyed subsidies and government handouts to churn out profits, especially in the aftermath of COVID-19 in the name of economic revival.

The textile sector, for instance, has been given subsidized loans to increase scale. However, many players in the industry just reinvested the amounts at a higher rate to earn through arbitrage. The fertilizer sector has also received government support in form of gas subsidies, which are supposed to be passed on to the farmers. Yet, a substantial portion of it ends up being absorbed by the companies in their profits.

Source: PACRA

Fertilizer sector margins analysis by PACRA

There is consensus amongst economists that difficult times such as these further emphasize the need to broaden the tax base. The country is dependent on less than 1% of taxpayers for more than two-thirds of its collection. Some might blame PML-N governments pointing out that they have historically been inclined towards the trading sector and have failed to bring them into the tax net. However, data shows that no government has done enough to document the economy and if this trend continues, the salaried and tax paying class will continue to be leant on while those evading taxation will be incentivized.

As Ismail stated, the maximum amount of tax paid by the persons and firms would be 4%. However, 13 sectors – Cement, Steel, Sugar, Oil and Gas, Fertilisers, LNG terminals, Textile, Banking, Automobile, Cigarettes, Beverages, Chemicals and Airlines – will have to pay an additional tax of 6% over and above the 4% Poverty Alleviation Tax.

I dеfinitely loved every little bit of it and I have you book marked too check .

온라인 카지노

j9korea.com