On Thursday, Hascol Petroleum Ltd announced a meeting of creditors to be held on December 22 to seek approval for its plan to revive the company through “restructuring/ rescheduling settlement and repayment” of its financial obligations.

The cash-strapped company and also the country’s biggest private sector default has filed a “scheme of arrangement” with the Sindh High Court. In its scheme of the arrangement, the company has outlined various options, the creditors (in this case, the financial institutions) have to recover their dues.

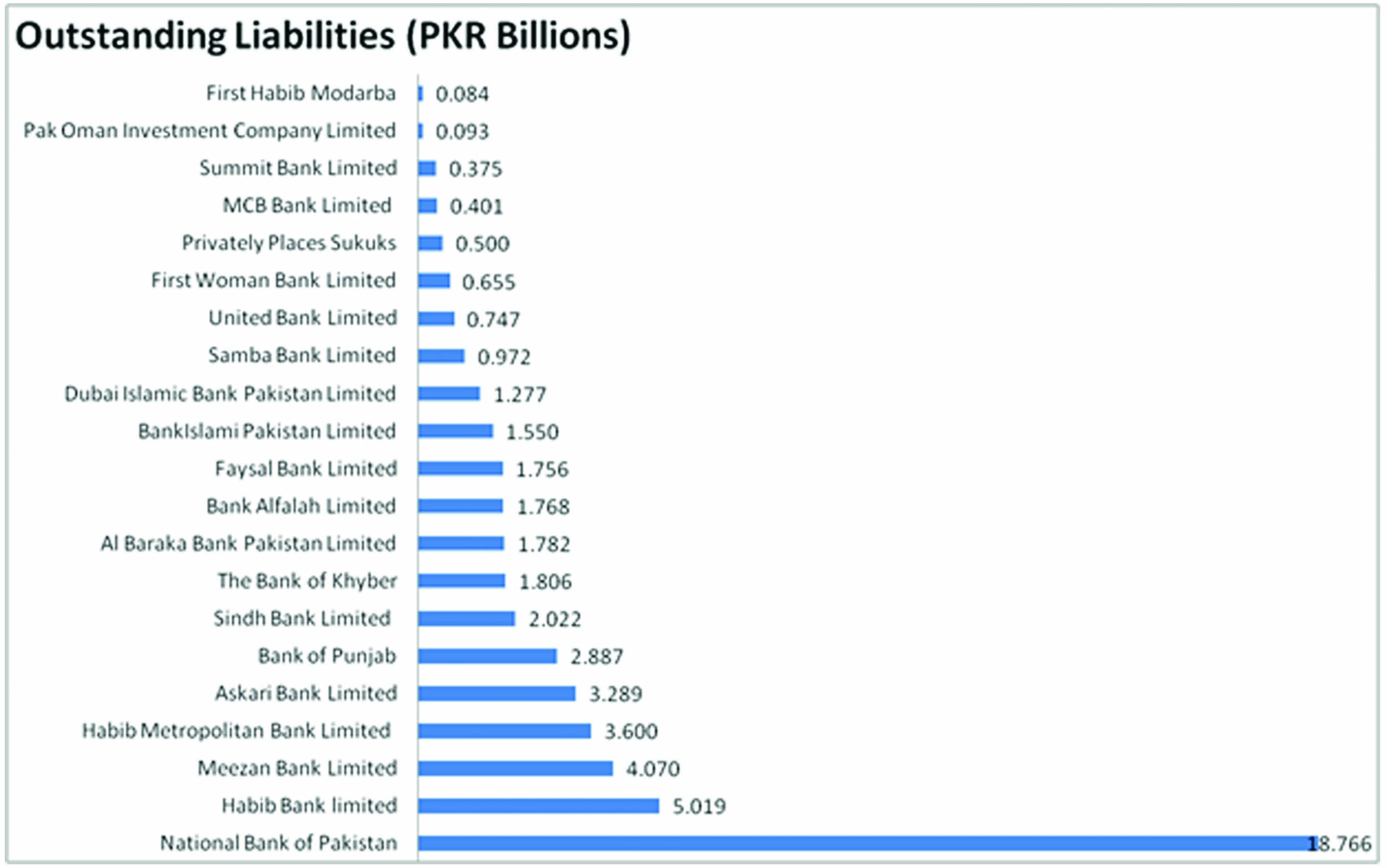

Hascol’s current woes have been quite publicised. The OMC had accrued a debt of more than a whopping Rs 54 billion, with clear signs of foul play on the OMC’s part. Assets overvalued, profit numbers exaggerated, some domestic LC facilities misused, all to get more loans than the company would on merit qualify for. Apparently all of this is not too uncommon in the corporate and commercial banking scene in Pakistan. To cut a long story short, since the collateral, it now transpired, was much less than what the books suggested, some banks were keen to cut their losses and look into some sort of settlement.

Hascol has provided three options to its creditors. And those three options are starting to look an awful lot like the options a deadbeat spouse offers their divorcing partner. Which option will Hascol’s creditors go for? It is a question of philosophy. Are they going to push back and try to come back for all of it or follow the old maxim from English common law that a bird in the hand is worth two in the bush? Or will they mix and match the options on offer and go for some combination of the three?

Option A: Long-Term Restructuring Option (Divorce and alimony over 12 years)

Outstanding liabilities shall be converted or rescheduled into a term loan payable for a period of 12 years from the completion date. The repayment of the loan will be made in 10 equal annual instalments, with a grace period of 2 years from the completion date. The collective repayment/ payment instalment amounts per year for all the creditors that choose option A shall not exceed Rs 2 billion.

The outstanding term loan will not bear any markup, profit, interest, or return of any nature. Hascol also adds that no additional costs, fees, or any other amounts may be charged to them. Once a creditor chooses option A all other liabilities to stand irrevocably waived.

The loan will be secured against specific fixed assets with a margin of 10%. Any creditor that selects Option A and has already taken charge over current/ moveable assets of the company will be required to discharge all such encumbrances.

Option B: Working Capital Restructuring Option (marrying your abuser)

Liabilities owing to creditors, both short or long-term will be converted or rescheduled into new short-term working capital lines for the company equivalent to the full portion of the outstanding liabilities. These working capital lines will be utilised by the company for the procurement of petroleum products and for managing the day-to-day affairs of the company.

The company will make payments in a rundown manner over a period of 60 days horizon to open letters of credit for its business has a 60 day usance period.

“The same will be carried out in a phased manner such that the full amount of the Working Capital Lines are activated against which regular payments are made on the respective due dates,” read the document.

The working capital lines will be structured as one or more running finance or LC facilities. Creditors that choose option B agree and commit that the working capital lines will be renewed or rolled over annually for a minimum period of 10 years from the date of execution. Upon the completion of 10 years, Hascol claims that it will settle the entire outstanding working capital lines if required by the creditors.

Hascol asks that the working capital lines be made available through a minimum of 60 days import usance LC with zero margins. The lines will be secured by the hypothecation of stocks and a ranking charge over all fixed assets with a 10% margin.

The maximum outstanding liability available to be restructured under this option is limited to Rs 21 billion, with cash outflow for down payment limited to Rs 10.5 billion. This shall be decided on a first come first serve basis.

Option C: Settlement Option (severing all ties and leaving with what you can get)

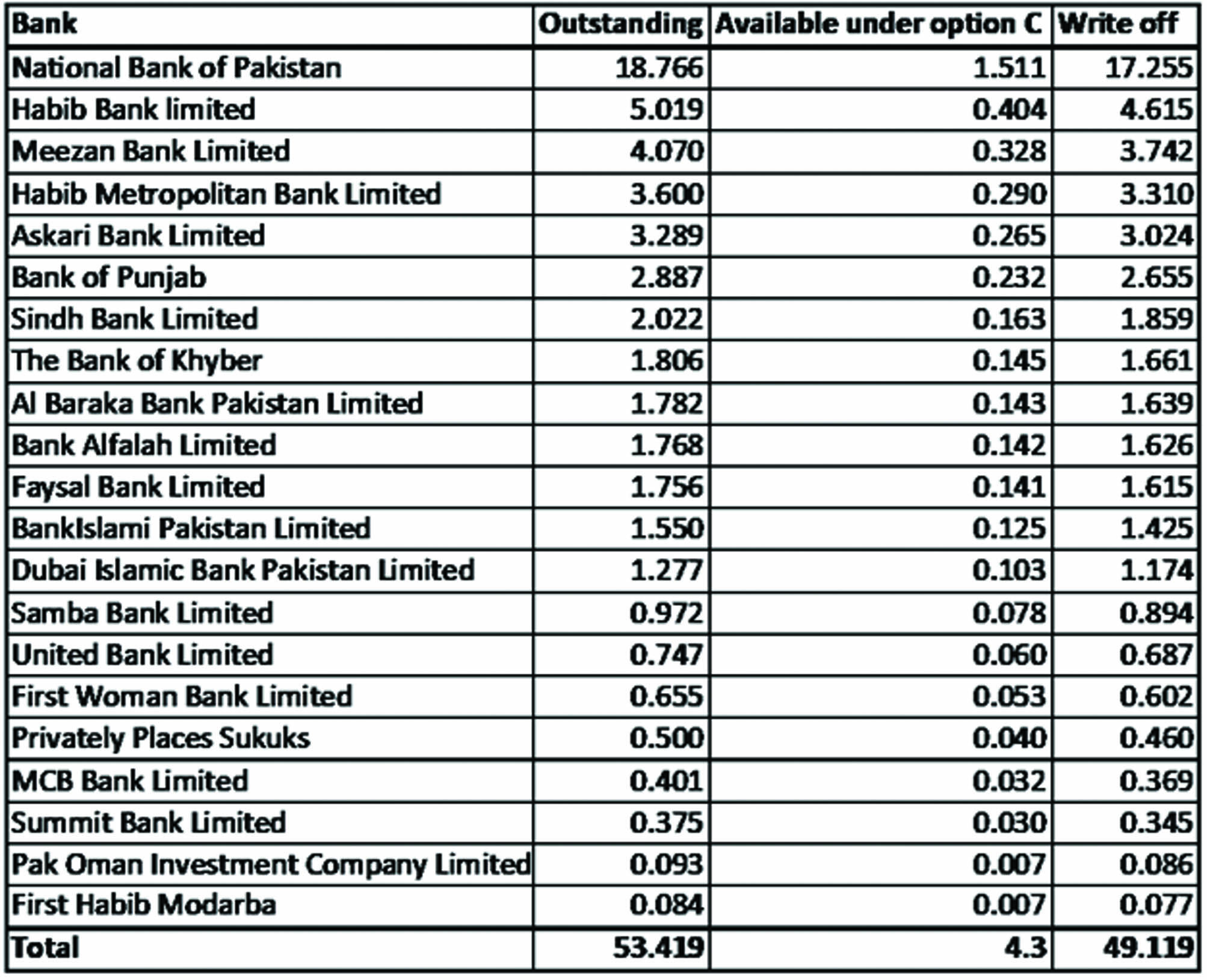

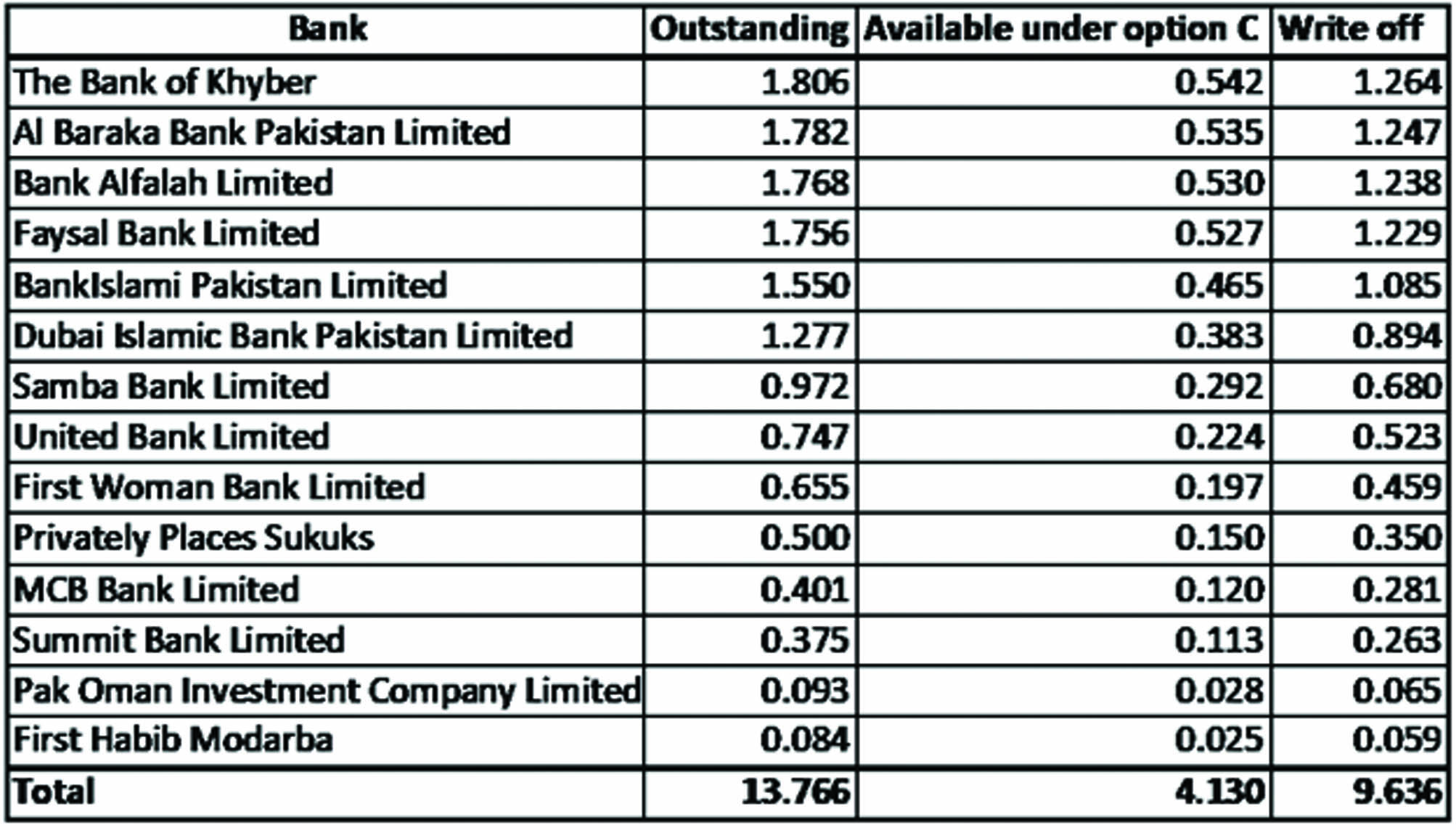

Creditors choosing this option will be paid up to 30% of their respective portion of outstanding liabilities as a settlement amount. This will be the full and final settlement. The company only has Rs 4.3 billion to offer under this option. If the outstanding liabilities of all creditors choosing option C exceeds this amount, Hascol will distribute the available cash at pro-rata to all creditors. This means a lower percentage of outstanding liabilities will be paid, which will still be considered their full and final settlement.

Hascol claims to make payments for this before the long stop date based on the settlement agreements made. Once paid, creditors will need to release, vacate and discharge all security interests of the company. All other liabilities will be waived off.

What does this mean for the banking sector?

Option A essentially means being patient and waiting to get back the entire amount. Option B essentially means getting into business with Hascol to keep it a going concern and hoping the company operates successfully. Option C, however, is ridding yourself of the company and leaving.

“Hascol clearly has the upper hand in this, this is exactly why it was able to offer a 70% haircut to banks,” says an investment banker on the condition of anonymity.

“Pakistan’s ranking in the global judicial system is low, so it makes sense to settle with a big defaulter today at whatever discount is offered or to negotiate and move on with your life than years of unending litigation,” he adds.

If all banks choose to take option C, it will result in Rs 49 billion right off for the sector as Hascol is only willing to pay Rs 4.3 billion under this option. The table below shows the amounts available if all banks choose this option.

However, if only the smaller financial institutions take this option equivalent to or less than Rs 4.3 billion, the write-off for the sector will be Rs 9.636 billion. The chart below gives an example of this.

Hascol has been in hot water since 2018. Its net consolidated loss amounts to Rs 9.4 billion in the first three quarters of 2022, growing from Rs 4.3 billion a year ago. Things however seem to be looking up with the company posting Rs 1.3bn in earnings before interest, taxes, depreciation, and amortisation.

Irony. an individual borrows a few lakhs and the banks will be after him like anything in order to recover the amount. But if you’re a corporate and default on billions, the banks will negotiate a settlement and take pennies to the dollar!

Where does Cynergico stands in it? and how does this impact the relationship between entire industry and financial institutions?

I was looking for another article by chance and found your article related to the one I am writing on this topic, so I think it will help a lot. I leave my blog address below. Please visit once.

온라인 카지노

j9korea.com