‘Buying local’ no doubt has a strong emotional appeal. Supporting one’s community can have many positive spinoffs, including the development of local talent and the local economy. When it comes to investing in financial markets, we also often have greater comfort deploying our investments in assets with which we have greater familiarity.

As is often the case with investing, though, the intuitive response may not always be the best one. Is a strong home bias hurting your investment portfolio?

How much home bias do investors have?

Home bias, or the preference of investors to allocate heavily to their home financial markets rather than diversify globally, is a phenomenon demonstrated by investors across most markets.

A study by the Atlanta Fed measured the extent of home bias by looking at actual investor allocation to domestic equities relative to that market’s weight in global markets from a market capitalisation perspective. For example, US equities constituted about 50% of global market capitalisation at the time of the study, but data showed US investors allocated about 90% of their equity investments to US markets. This gap was even wider for other major markets. The bias for investors to invest primarily in domestic financial assets is clearly significant.

Various studies have attempted to understand why investors demonstrate this preference. One possibility is the cost of investing globally. This can be prohibitively high in some markets, though for many major markets it is often not high enough to outweigh the benefits in terms of investment returns and volatility reduction.

A second possibility is information asymmetry. Investing locally comes with the appeal of adding exposure to ‘what I know’. While having a sufficient understanding of one’s investments is a fair ask, the same Fed study noted that the implicit ‘information’ cost of missing the benefits of diversifying globally appeared to be very high.

Third is an avoidance of taking on excessive currency risk. While this may be less of a challenge in equity markets, where FX volatility tends to be a smaller portion of returns over time, this can pose a bigger share of returns in asset classes such as bonds.

Is home bias a problem?

An excessive home bias can hurt one’s financial health due to unintended concentration and from missing the benefits of diversification.

For example, someone working in the energy industry who limits his/her investments to a domestic equity market which happen to have a large weight in the energy sector would be doubling up on the concentration risk in one industry. Even a normal cyclical downturn in the industry would pose a risk to such a non-diversified investor as his/her personal earnings and investment portfolio declines at exactly the same time.

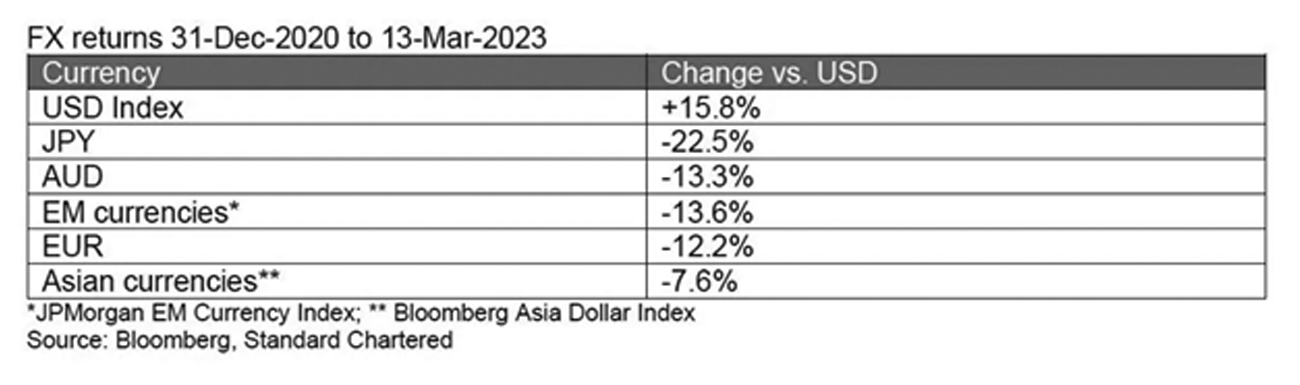

We can see this impact in terms of currency exposure as well. As the table below illustrates, over the past two years, many major currencies, including those of Emerging Markets, weakened in the face of the unusually strong US Dollar. While this could partially reverse should the USD weaken in 2023, as we expect, even a small allocation beyond local market assets would have helped smoothen one’s investment performance.

Need for international diversification

Research shows that having an excessive home bias (ie. investing primarily in one’s home market alone) leads to sub-optimal outcome for investment portfolios. One can find many examples over the past few years of how investors would have benefitted from a globally diversified portfolio, whether from an industry or currency exposure perspective. The optimal balance between home and foreign assets is likely to vary in each individual situation. However, we believe investors should make a conscious decision to diversify globally as the benefits of international diversification far outweigh the risks.

We are here at your service. You can call us for Best Escorts Service in Agra or Local Busty Housewife Call Girls in Agra. Young College girls Independent Escorts are also here. These girls are young and are fresh.