LAHORE: As expected, automotive lending has continued its perilous descent. Figures provided by the State Bank of Pakistan (SBP) reveal that outstanding automotive loans have plummeted for the tenth consecutive month from July 2022 to April 2023, resulting in a staggering contraction of Rs 58.7 billion. Total outstanding automotive credit now stands at Rs 309 billion – its lowest level since July 2021 when it was Rs 308 billion.

In December of last year, as part of our year-end review of the automotive industry, Muhammad Iftikhar Javed, the Business Head of Secured Lending at Bank Alfalah, imparted his wisdom to Profit: “The fate of automotive lending is inextricably linked to the automotive market. Quarter one of 2023 will maintain the status quo. However, we anticipate a resurgence in quarter two if there are favourable developments on the economic and political front or even if there is a relaxation in automotive imports. We remain optimistic that lending will pick up even if the State Bank does not reverse its prudential requirements. Quarter four of 2023 is when we expect a return to normality; however, our predictions are contingent upon numerous variables.”

Read more: A tale of two halves of a calendar year

What’s happened to the automotive lending space?

“A significant factor contributing to the current situation is the surge in car prices, compounded by the elevated cost of borrowing. The majority of customers have loans that incorporate variable interest rates as part of the lending product to which they subscribe, resulting in a subsequent escalation in their repayment costs due to the increase in rates,” Javed elucidates.

“Our observations indicate that individuals have chosen to terminate their loans entirely by settling them in full, as they had initially purchased their car at a considerably more affordable price relative to the present. They have achieved this by selling the car outright to absolve themselves of the loans or by opting to sell the car and subsequently downgrade to more economical vehicles. These more cost-effective vehicles have been purchased with cash from the sale of their previous vehicle, rather than resorting to financing once again,” expounds Javed.

Is there hope on the horizon?

“Despite the tumultuous ride over the past two to three weeks, experts predict that on a macro level, we can anticipate political and economic stability later in the year. They also foresee promising developments in Pakistan’s geographical and geopolitical vicinity. This will undoubtedly have a positive impact on Pakistan itself, even if our domestic crises remain unresolved,” declares Javed.

“The situation in the automotive lending space is clear for all to see. The current trend will persist. We’re anticipating a slight uptick, albeit an insignificant one, to materialise in the fourth quarter of this calendar year. However, this will be minuscule, barely perceptible. Apart from that, the current trend will endure,” Javed continues.

Why isn’t there a default crisis in the automotive lending space?

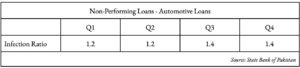

While the SBP’s data does not divulge information about non-performing loans (NPL) beyond 2022, it is safe to surmise that the economy was in a precarious state by the end of 2022. Despite this, the infection ratio for NPLs remained relatively unchanged.

“Despite the mounting inflationary pressures, escalating cost of living and borrowing, banks have managed to maintain remarkably stable automotive lending portfolios. Admittedly, the repayment structure has been disrupted, but the risk of a default crisis remains negligible,” asserts Javed.

“The explanation for this is twofold. Firstly, the meteoric rise in car prices has resulted in a corresponding increase in their value as assets. Customers have been compelled to maintain their loan in some capacity because the car they purchased for Rs 3,000,000 is now valued between Rs 5,500,000 to Rs 6,000,000,” he expounds.

“The second reason is the evolution of risk architecture at banks, particularly among seasoned players with over 20 years of experience in the lending space. Many banks exhibited prudence as early as October 2021, anticipating the potential onset of a crisis,” continues Javed.

Have the banks noticed any interesting patterns amidst the current demand collapse?

“A perusal of the data reveals a conspicuous contraction in the demand for vehicles with lower engine displacement vis-à-vis their higher displacement counterparts. An extrapolation based solely on automotive sales indicates an upsurge in the sales of premium vehicles, thereby corroborating the notion that the affluent strata in Pakistan have become increasingly prosperous,” explains Javed

This supposition is substantiated by data from the Pakistan Automotive Manufacturers Association. An analysis of data until the first quarter of 2023 divulges a 60% decline in sales of vehicles with an engine displacement of 1300cc or above, a 72% decrease in sales in the 1000cc category, and an astounding 81% plummet in sales in the 800cc and below segment on a year-on-year basis. In stark contrast, sales in the light commercial vehicle, SUV, and jeep segment witnessed a year-on-year augmentation of 14%.