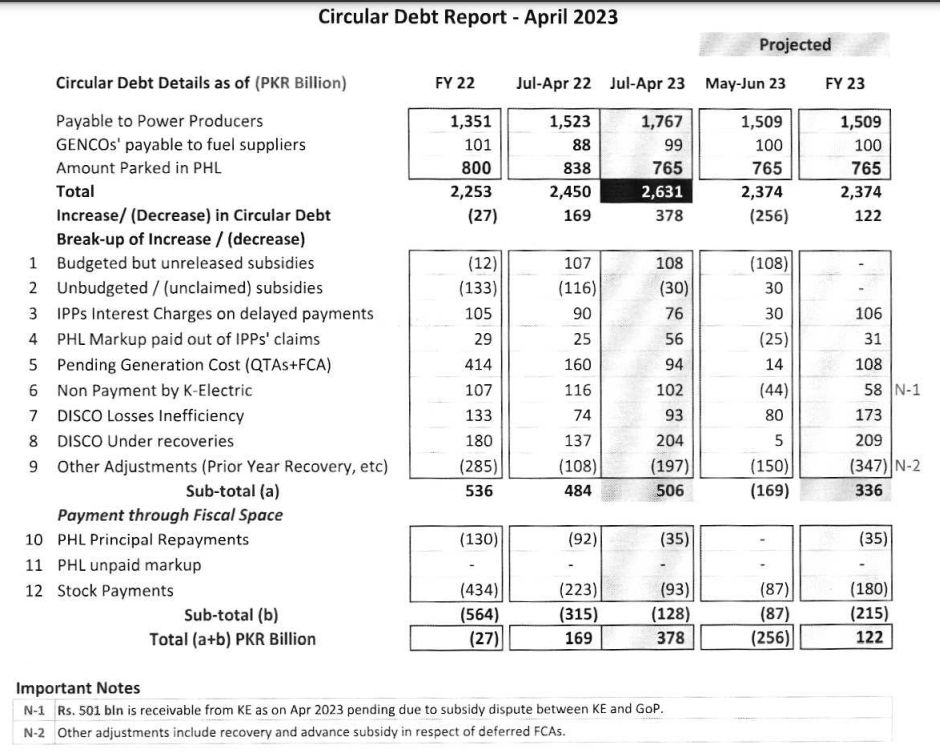

Pakistan’s circular debt has continued to rise, with the total payables for the July-April FY23 period clocking in at Rs 2,631 billion.

This is an increase of 7.38 percent from the same period last year, when the circular debt stood at Rs 2,450 billion. However, it is expected to decrease to Rs 2,374 billion by the end of the current fiscal year.

Circular debt is racked up when power purchasers fail to pay power producers and is also known as a cash shortfall across the power supply chain. A mounting circular debt is a serious problem as it means power companies may be unable to pay for fuel, infrastructure maintenance and upgradation, thus putting the viability of the entire energy system at risk.

A major reason behind the increase in the circular debt is unreleased and unclaimed subsidies, along with interest charges payable to independent power producers (IPPs) for delayed payments. A budgeted subsidy of Rs 108 billion for July-April FY23 has remained untouched, while unclaimed subsidies amount to Rs 30 billion, straining the energy sector.

Besides this, interest charges on delayed payments to IPPs have reached Rs 76 billion in July-April FY23 and are projected to further increase by Rs 30 billion by the end of the fiscal year. Moreover, Rs 56 billion has been utilized from IPPs’ claims for FY23 to cover Public Holding Limited (PHL) markups.

The circular debt crisis is exacerbated by non-payment of K-Electric dues which stand at Rs 102 billion, and losses caused due to inefficiencies of and under-recovery by distribution companies (DISCOs), which are Rs 93 billion and Rs 204 billion, respectively. Outstanding generation costs, including Quarterly Tariff Adjustment (QTA) and Fuel Cost Adjustment (FCA) stood at Rs 94 billion during the July-April period and are expected to reach Rs 108 billion by the end of FY23.

Efforts by the government to mitigate the circular debt crisis include allocating Rs 35 billion for principal repayments to PHL and projected stock payments of Rs 180 billion for FY23.

The escalating circular debt crisis necessitates immediate and decisive action to address key challenges and restore stability in Pakistan’s energy sector. Priority must be given to resolving subsidy disputes, ensuring prompt payments to power producers, and improving the efficiency of distribution companies. These measures, combined with comprehensive reforms, are crucial to curtail the mounting circular debt, stabilize the energy sector, and create a sustainable foundation for economic development.

It is imperative that stakeholders come together to implement effective strategies that promote transparency, accountability, and fiscal discipline in order to overcome the current crisis and pave the way for a resilient and prosperous energy industry in Pakistan.