Islamic banking, often known as Islamic finance or Shariah-compliant finance, encompasses financial activities that are in harmony with the principles of Shariah (Islamic law). At its core are two pivotal principles that set it apart: the prohibition of engaging in interest-based transactions and the emphasis on sharing both profits and losses. This financial paradigm, rooted in religious convictions, has experienced a remarkable surge, particularly in recent years according to a report by PWC.

Pakistan is the second-largest Muslim nation after Indonesia. With religious factors leading the way, Pakistan’s Islamic banking industry has received overwhelmingly positive responses from the populace.

Beyond mere statistics, Pakistan’s Islamic banking portfolio has triumphed in capturing a substantial market share, significantly altering people’s financial inclinations. In a nation where deeply held religious beliefs shape lives, Islamic banking isn’t a mere financial alternative; it symbolizes a genuine alignment of personal values and economic choices.

Islamic Banking Industry in Pakistan

Up until December 2022, the Islamic Banking Industry comprised 22 Islamic Banking Institutions which include 5 full-fledged Islamic Banks (IBs) and 17 conventional banks, which make for approximately 80% of the total banking industry, having Islamic Banking Branches (IBBs). The five completely Islamic banks included Meezan Bank, Bank Islami, Al Baraka Bank, Dubai Islamic Bank and MCB Islamic Bank.

In early 2023, Faysal Bank converted into a full-fledged Islamic bank increasing the number of full-fledged Islamic banks to six.

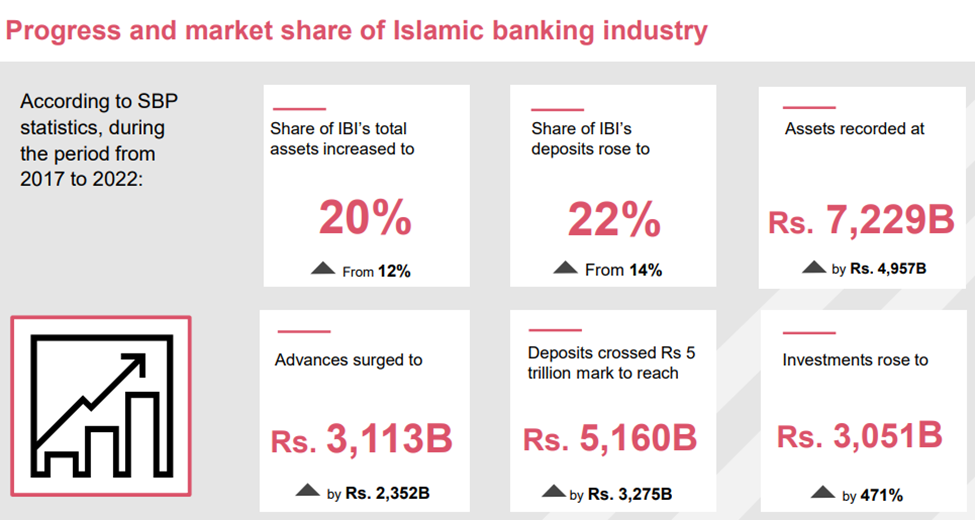

The concept of Islamic banking was introduced roughly two decades ago. Since that pivotal introduction, the Islamic banking industry has grown remarkably. In terms of its footprint, Islamic banking holds approximately 20% of the total assets within the financial sector. This translates into a figure of approximately Rs 7 trillion. This influence extends even further, claiming a substantial 25% share in advances (loans to the private sector), around Rs 3 trillion. It also accounts for a 22% share of deposits of the overall banking industry, amounting to around Rs 5 trillion.

Demand for Islamic Banking

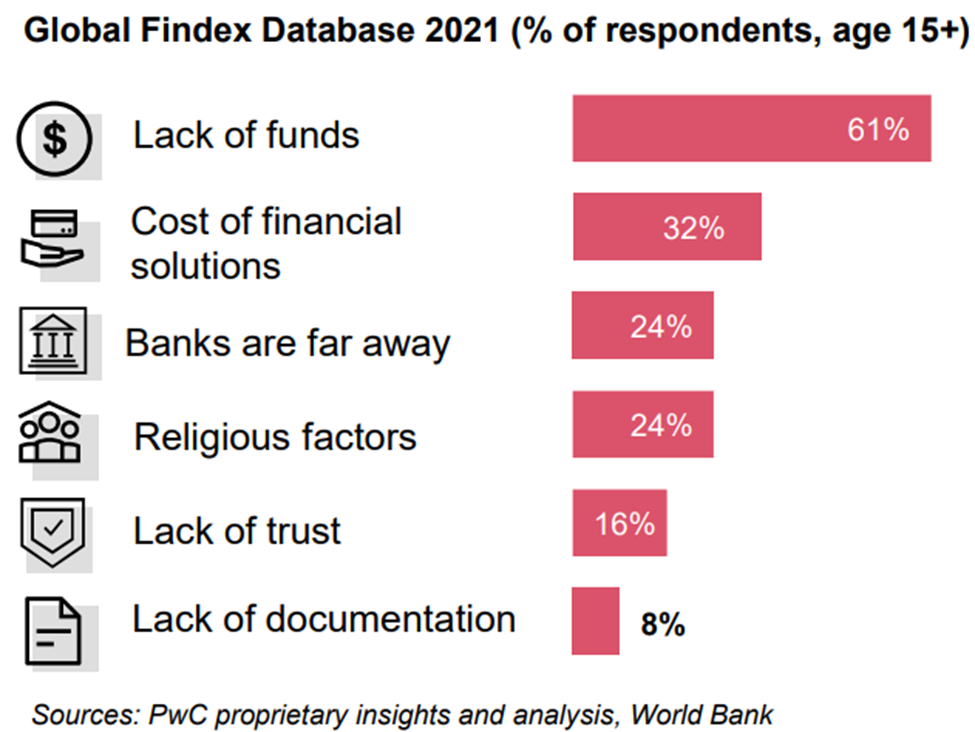

Religious sentiment plays a huge role when it comes to availing banking services. In fact, the Global Findex Database 2021 reveals a fascinating insight – for many, opening a bank account isn’t just about economics, but about staying true to one’s faith. One of the commonly cited reasons for not opening a bank account was religious factors. That is, people avoided opening bank accounts because they wanted to avoid interest rates.

The present trajectory of deposit accounts in Pakistan’s banking landscape is a direct reflection of this phenomenon. A commanding 41% of total deposits are held by current accounts, a fact deeply rooted in the religious fabric. These accounts refrain from offering interest, aligning seamlessly with the prevailing beliefs of the majority populace.

Irfan Siddiqui, President and CEO of Meezan Bank Limited asserted that Islamic banking has resulted in financial inclusion. He said, “Islamic banking has added considerably to financial inclusion. As the pie is getting bigger, this does not mean the share is being taken away from the conventional banking system, it is actually adding new deposits to the industry.”

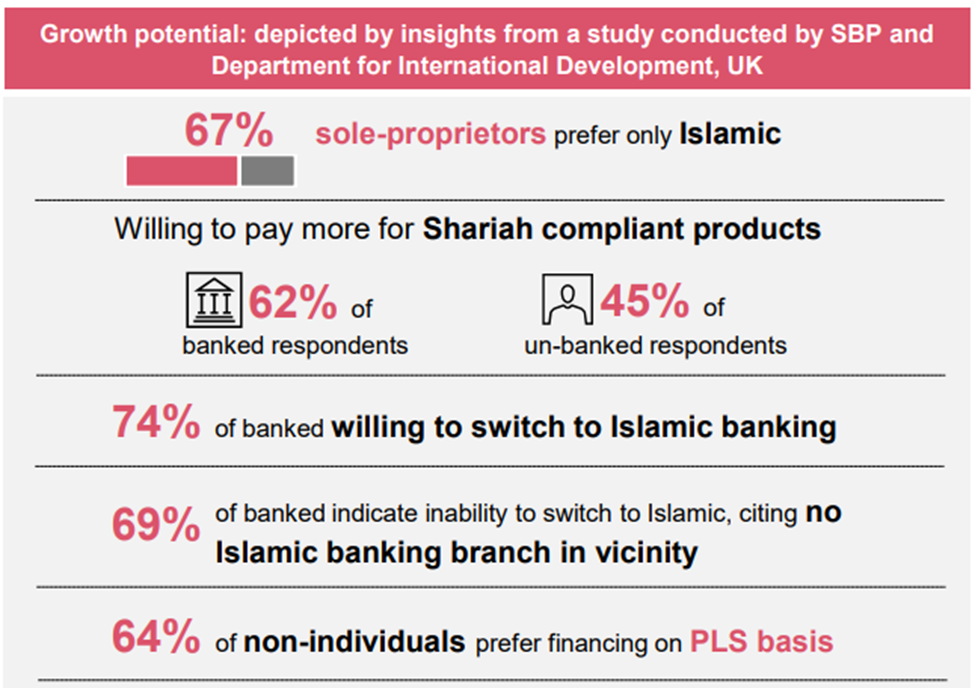

A comprehensive study orchestrated by the State Bank of Pakistan and the Department for International Development, UK, unravels fascinating insights. It paints a portrait of preference among sole proprietors, with a notable inclination towards Islamic banking. Impressively, 62% of the banked population and 45% of those not yet incorporated into the banking fold express a willingness to invest more in Sharia-compliant products. An astonishing 74% of those already within the banking ambit display openness to transition to Islamic banking, underlining the allure it holds.

Finally, 64% of businesses prefer financing on a Profit and Loss Sharing (PLS) basis. PLS-based financing is a Sharia-compliant form of equity financing such as mudarabah and musharakah. Mudarabah refers to “trustee finance” or passive partnership contract, while Musharakah refers to equity participation contracts. The premise underlying PLS is the concept of shirkah (similar to a joint venture) in which the partners share in the profit and loss based on their ownership.

These research findings along with an increasing share of Islamic banking in the banking ecosystem of Pakistan indicate not just receptiveness but also support for the Riba-free banking system, reinforcing the promising prospects of the industry. “There is an inherent customer preference for switching to Islamic banking. Not only is the unbanked market available, but the conventional market is also transitioning to Shariah-compliant banking,” commented Mr. Yousaf Hussain, President & CEO of Faysal Bank Limited.

Role of Central Bank

One factor contributing to the strong growth momentum is the State Bank of Pakistan’s (SBP) crucial role in creating an enabling environment. SBP is actively involved in the promotion and capacity building of IBIs in addition to establishing an accommodating regulatory and supervisory framework. SBP has also taken the initiative to issue rules and guidelines to level the playing field for IBs. Along with these activities, the government has put up a variety of regulations and rewards to promote Islamic banking.

The SBP’s Islamic Banking Strategic Plan 2021–2025 is one such initiative. This plan calls for increasing the Islamic banking sector’s share of assets and deposits to 30% of the overall banking sector. It also calls for increasing the total Islamic banking sector’s branch network to 35 percent of the total banking network. Moreover, it also requires raising the private sector financing for Small and Medium Enterprises (SMEs) to 10 percent and for agriculture to 8 percent within the Islamic banking sector.

Federal Government’s Push to Islamic Banking

In April 2022, the Shariah Court handed out a historic verdict that declared the prevailing interest-based banking system as against the principles of Shariah, directing the government to facilitate all loans under an interest-free system. The court further instructed the government to enact and amend laws to implement Islamic banking within the country and issued directives that the banking system of the country should be free of interest by December 2027.

This decision came after years of petitions against Riba (interest), with the Supreme Court referring the case back to the court in 2002 following appeals against the decision of the Federal Shariat Court (FSC).

In February 2023, Finance Minister Ishaq Dar reiterated the government’s commitment to implementing the Islamic financial system in Pakistan. He also revealed that a high-level three-member committee comprising key stakeholders such as the Ministry of Finance, SBP, Securities and Exchange Commission of Pakistan (SECP), and Shariah scholars, chaired by the Governor State Bank, has been formed to plan the financial system of Pakistan to operate on an Islamic basis. This committee would be directly monitored by him.

As part of its strategy to increase the share of Islamic banking from 20% to 35% in the next two years, the State Bank of Pakistan (SBP) has announced that it will facilitate banks that have plans to convert their business into a Shariah-compliant mode.

Conversion to Islamic banking

In addition to the judiciary’s ruling, banks recognize the potential of Islamic banking in offering lucrative returns through its low cost of deposits and the significant potential for market share enhancement due to pent-up demand. Therefore, many banks have jumped on the bandwagon of converting themselves into Islamic Banks.

In early 2023, Faysal Bank successfully completed its transition to a full-fledged Islamic bank after being issued an Islamic Banking License by the SBP. This license has elevated Faysal Bank to become the second-largest full-fledged Islamic bank in Pakistan after Meezan Bank. The bank began its journey of transition back in 2015. At the time it already had the second largest Islamic banking window in the country with 53 standalone branches.

In line with this trend, Summit Bank’s board of directors has also approved a plan to convert the bank’s operations from conventional to a full-fledged Islamic bank. It also changed its name to Bank Makramah to accentuate its identity as an Islamic bank. Other banks that followed similar suit include Zarai Taraqiati Bank Limited while many other banks have also contemplated transitioning into Islamic banks.

Undoubtedly, the verdict from the Federal Shariah court has profound implications for the banking landscape. If the interest-based banking system is to be fully abolished and replaced with a fully shariah-compliant banking industry by 2027, conventional banks don’t have much time. As mentioned earlier, it took Faysal bank eight years to complete its transition.

Besides, conversion to Islamic banking comes with its own challenges. Sharing his insights on the matter, Hussain said “Transition to Islamic banking must be planned meticulously. Every aspect, be it systems, products, processes, HR, or business feasibility, needs careful evaluation from an implementation perspective. The customer is imperative to the process whose sentiments must be in focus at all times. One of the biggest challenges is mindset conversion. We had to transform people through conversion-oriented capacity augmentation. Mindset and culture transformation that we were able to achieve was the most significant.”

Most banks in Pakistan already have an Islamic banking window, so they have some experience with relevant products, services and technology. However, the intensity of complications with conversion would depend on the scale of Islamic banking windows. For banks having a larger window, the conversion would be smoother and vice versa.

Converting to Islamic banking requires the introduction of new policies, processes, and products, aligned with Shariah principles and relevant regulatory requirements. This metamorphosis necessitates substantial investments and unwavering efforts. It might also involve talent augmentation through a combination of induction and upskilling measures to support operational readiness.

Navigating portfolio conversions adds a layer of intricacy, necessitating meticulous accounting adjustments and bearing consequential financial repercussions. It may entail complications arising from customer consent requirements, risk of churn in different products/schemes, level of readiness to contain this and strong governance on the conversion process, targets, and achievements. Portfolio exits through divestment or other options may also have to be explored where no product alternates are available or where commercial feasibility is challenged.

Way forward

Pakistan’s Islamic banking landscape has risen as a vibrant and dynamic force, sculpted by the tenets of Shariah and propelled by unwavering religious convictions. This financial framework surpasses being a mere substitute; it mirrors a profound convergence of individual ethics and economic decisions. With the conducive environment orchestrated by the State Bank of Pakistan and recent governmental impetus towards a comprehensive Islamic financial system, this industry is on a trajectory of expansion.

I appreciate you providing this insightful information; I believe it will be beneficial to everyone.

This is a very insightful and well-researched article. I commend the author for highlighting the growth and potential of the Islamic banking industry in Pakistan. I think this article provides a balanced and objective overview of the factors that drive the demand and supply of Islamic banking products and services in the country. I also appreciate the author’s use of relevant data and statistics to support the arguments and claims. Thank you for this excellent article!

apperciate your info about islamic banking in Pakistan

This article offers valuable insights and thorough research. I commend the author for shedding light on the growth and potential of Pakistan’s Islamic banking industry. The piece presents a fair and objective assessment of the factors influencing the demand and supply of Islamic banking products and services in the country. The author’s incorporation of pertinent data and statistics to substantiate their arguments is noteworthy. I am grateful for this exceptional contribution!