Last week, the Bank of Punjab (BoP) made an announcement that made anyone holding US dollars at their homes, or in their bank lockers pause: people could book a foreign currency term deposit and get returns as high as 9% per annum.

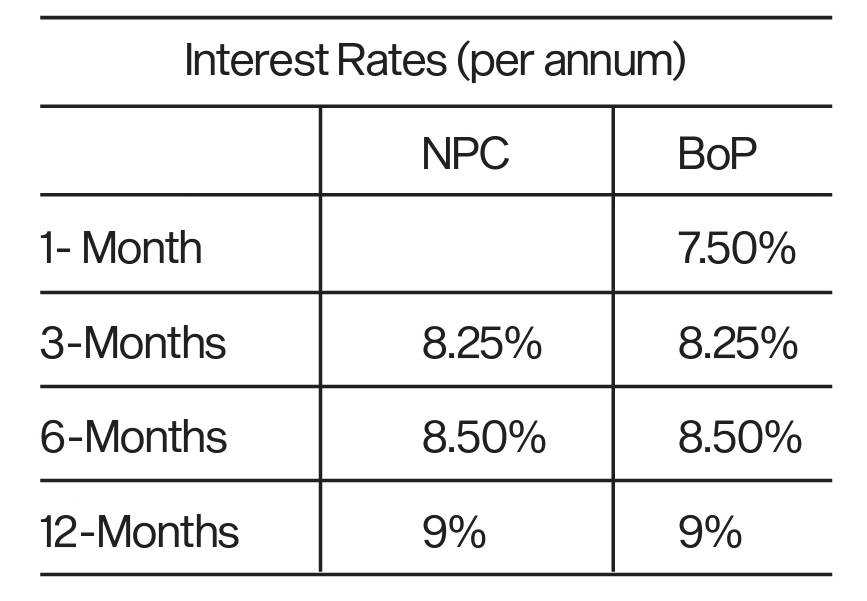

The rates announced by the BoP are much higher than what other banks are offering for the same product; in fact, they are the same as those offered on Naya Pakistan Certificates (NPC), which are available exclusively to overseas Pakistanis or residents with declared assets abroad. In fact the BoP offer is even better in one aspect — while the minimum amount for the Naya Pakistan Certificates is $5,000, the BoP has no such requirement.

Why does this matter? Because when the NPCs were launched by the PTI government in 2020, there was significant criticism, including in this magazine.(‘Naya Pakistan Certificates are ridiculously attractive for investors. But here is why that is bad for Pakistan’).

The NPCs were unfair to resident Pakistanis – the lucrative rates were unjustifiable considering the state of interest rates elsewhere in the world back then. They were and are available only to expatriates and not to an ordinary Pakistani who actually lives, works, and pays taxes.

So, for BoP to offer rates akin to the NPCs to Pakistani who do reside in the country is a major development.

The issue with NPCs

Before discussing the BoP’s offering, let’s discuss what certificates of deposit, such as the NPC, are. A certificate of deposit or term deposit is a product through which people can earn interest on an amount deposited for a fixed time period. They usually offer a higher interest rate compared to savings accounts to make up for the loss in liquidity; in savings accounts, people can withdraw their money but with a certificate of deposit or term deposit, they cannot withdraw the money without paying a penalty or losing interest.

The Naya Pakistan Certificates were launched by the PTI government in 2020. They were aimed at shoring up foreign exchange reserves and financing the budget deficit.

The rates offered were extraordinarily lucrative. And some overseas Pakistanis and banks managed to leverage them to earn much higher profits (more on this later). Even for resident Pakistanis, the returns were great; according to Topline Securities, investors holding dollar-denominated NPCs made gains of 36% in rupee terms, making the certificates the second-best performing asset in 2022, one spot below gold at 41% and above the dollar at 28%.

In September 2020, when the NPCs were launched, the five-year US Treasury bond had a yield-to-maturity of approximately 0.27% per year. The Naya Pakistan Certificate was paying a yield of 7% — 6.73% above a comparable US Treasury bond. That difference in the spread between comparable US bonds and the government of Pakistan’s debt was staggering.

That, in itself, was a red flag.

But then there is the fact that the Naya Pakistan Certificates are not – strictly speaking – bonds, but rather certificates of deposit. More specifically, they are (almost) no-penalty certificates of deposit, meaning there are no penalties for early withdrawal if one withdraws after the first three months.

That means that the depositors’ assets are more accessible – liquid, in finance parlance – than a typical government bond. Liquidity typically means that investors are willing to pay a higher price, and thus get a lower yield, for a fixed-income investment like a certificate of deposit. That is why certificates of deposit typically tend to have lower yields than bonds of similar risk and tenor.

So, the Naya Pakistan Certificates should have had considerably lower interest rates than they did.

The fundamental problem was that the government of Pakistan was raising financing at rates akin to a distressed debt investment, which only makes sense to investors when the entity raising that debt promises to fix the structural problems that got it into that distressed financial situation in the first place.

Beyond the fact that the Naya Pakistan Certificates are a likely less competent way of implementing a bad policy objective, there was a more fundamental problem with them: they were unfairly generous to expatriate Pakistan and, by implication, render resident Pakistanis second-class citizens in their own country.

BoP term deposits and NPC

Aside from the accessibility for resident Pakistanis and no minimum deposit, what sets apart the BoP’s term deposit from the NPC? For starters, while investors can prematurely encash NPCs after a period of three months, the rate of return will be equivalent to the nearest shorter maturity. For example, if the investor decides to encash it in the 7th month, he will get the rate of interest applicable on the six-month tenure. If he encashes it before three months — the shortest tenure — he will not get any profit.

On the other hand, the BoP’s shortest tenure is one month. The bank also allows premature encashment. While no penalty will be charged on the principal amount, the investor will get the bank’s savings rate for the number of days the deposit is held with the BoP.

Another major difference is that investors cannot pledge the BoP’s term deposit with a bank to get a loan. However, under NPC Rules 2020, the certificates can be pledged to get a loan from an international bank.

Overseas Pakistanis (and the banks they were using) exploited this to earn returns that were more than double those being offered by the government. For example, an overseas Pakistani would invest $1,000 in NPC at a rate of 9%. He would then pledge it to a bank such as Standard Chartered Bank or Samba Bank and borrow $900 at a rate of 5%. He would reinvest it in NPC (again at a rate of 9%). This means he would get a return of 9% on the $100 and 4% — 9% profit from NPC minus the 4% he would have to return to the bank — on the $90. After repeating the process multiple times, the overseas Pakistani was able to get a return of up to 2.5 times. This is something an investor would not be able to do with BoP’s term deposit.

BoP vs other banks

BoP’s term deposit offering is unique as the rates offered for smaller amounts — less than $100,000 — are much higher than other banks. For instance, one large bank is offering around 2% on deposits of $50,000 and higher, while another large bank is offering around 5.5% on deposit tenures six months and longer. How is the BoP offering such attractive rates?

The BoP said this is because other banks have large foreign currency deposits in low-interest-rate accounts. If they were to offer higher interest rates on term deposits, this might result in “cannibalisation” of their current low-rate accounts, i.e., customers might move their money from the low-interest-rate accounts to the higher ones, which would cost the bank more money. In addition, this would result in a much higher overall cost on their liability portfolio. Compared to such banks, the BoP is better positioned to offer higher interest rates because it has a smaller foreign currency deposit base.

“That is why the BoP is trying to capitalise on the current high demand for liability products and build up its individual foreign exchange deposit; hence, the offering of this product and rates. For that, we will even operate on a cost-to-cost basis if required,” the BoP stated.

For now BoP is the only bank offering high rates to retail customers, however, other banks are also known to offer similar rates on dollar deposits to their high net worth customers. So a customer of say Habib Metropolitan Bank with $500,000 to deposit may also be able to negotiate a rate of 9% without having to go to BoP.

But how do the banks make money on this?

For it to make financial sense for the banks to pay 7-9% return on dollar deposits, obviously they must be able to deploy these dollars at an even higher rate. They can not park these funds in US treasuries as the offered rates would be much lower. So what do the banks do then?

In general, banks deploy foreign currency deposits in US Treasury bonds and Pakistani government securities. The latter is done through foreign currency swaps with the State Bank of Pakistan (SBP).

The bank sells the US dollars to the SBP at a pre-agreed exchange rate. In return, the SBP provides the bank with rupees that can be invested in government securities. It charges a fee – let’s say 5-6% – for the swap. Under the agreement, the bank will buy back the dollars from the SBP at a later date. If the return on government securities is 22% and the fee is 6%, the bank still makes a profit of 16%. If the bank is offering a rate of 9%, the bank will still earn a spread of 7%. The foreign currency swap is still a profitable bet since the SBP returns the dollars.

Who is the BoP’s product aimed at? And would they bite?

As stated earlier, investing in NPCs was limited to overseas Pakistanis and residents with declared assets abroad. In comparison, the BoP’s USD term deposit is aimed primarily at ‘ordinary’ residents.

And it comes at an opportune time, according to officials at the BoP. In a written response to Profit’s questions, the bank said, “With the recent crackdown on USD cash holdings and transactions, there is a need for avenues that can be provided to the holders of foreign exchange cash deposits — who are keeping them for saving purposes — to deposit them in a safe environment with decent returns.”

Atlas Asset Management CEO Muhammad Abdul Samad said given the recent appreciation, there would be pressure on people holding hard dollars to deposit them in banks and get returns. “It is a good initiative from a financial inclusion perspective,” he said.

But while the BoP’s rates are much higher than what other banks are offering and without a cap on the minimum amount, as already mentioned, other banks also offer comparable rates if the amount of dollars deposited is large (in the several hundreds of thousands). This means the BoP is specifically targeting retail investors. It also means the BoP may be offering even higher rates to high-net-worth individuals.

But people hold dollars at their homes or in lockers for two reasons. First, the dollars were acquired with money that was not declared, or the dollars were bought through informal means, ie, the people concerned do not have a valid receipt from a licensed exchange company.

Second, people do not keep their dollars in foreign currency bank accounts because they are afraid they may be frozen if the country defaults, similar to what happened in 1998 following the imposition of sanctions by the US on Pakistan for nuclear tests in the 90s.

In January 2023, when there were already reports of shortages of physical cash dollars in the banking system, then Finance Minister Ishaq Dar said in an interview that the country’s foreign exchange reserves stood at $10 billion — $4 billion with the SBP and $6 billion with commercial banks. And that both were “Pakistan’s deposits.” This created a bit of panic with the depositors. While Dar later clarified that his statement was taken out of context and the government would not take over foreign exchange reserves of commercial banks, this raised fears that the government might again freeze foreign currency accounts. The fears were exacerbated by the economic situation at the time; foreign exchange reserves dwindled to a critical level and a deal with the International Monetary Fund (IMF) for a crucial bailout was in limbo.

But with better macro economic optics now, will the BoP’s high returns be enough to entice these people into keeping their dollars in bank accounts again? You will have to wait a few months for our follow-up story to find out.

Story updated with new information on 8th Oct, 2023.

1. What will happen at the time of encashment? Will the bank pay back in $, or will it convert it to PKR and pay PKR.

2. Will the bank guarantee that it will return deposit and interest in USD?

3. Where is the bank making this kind of money from?

4. Pakistan needs to pay around $25b next year. I see hysteria after one year.

NPC was not profitable when I calculated at that time, there were bank transfer fees, intermediary bank charges, FBR taxes and if there is repatriation then again transfer charges. OPs could invest same FX in host country and can avail more than 6% of pure profit not interest without loosing exchange value.

Most OPs even didn’t know and banks opened their Bank Accounts/RD Accounts in PKR which was again with loss in terms of currency exchange over time.

Now BoP or other banks directly or through their ECs open FX accounts and pay interest on it at the same rate of NPC then I can say the NPC was of a deal of loss to Overseas Pakistanis.

there is no official confirmation of thia news on BoP website or on their helpline and the bank itself is oblivious of this. Profit Pakistan is spreading false news