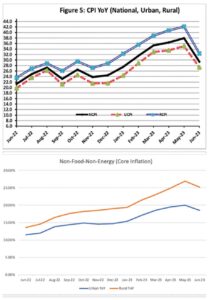

The inflation rate in September 2023, went up by 31.4% on a year-on-year basis. The CPI at the end of September 2023 stood at 2% higher than August 2023. While this is an alarming statistic in itself there is something that deserves a little more attention.

For the last few years, Pakistan’s rural areas face a higher value of inflation. The effect trickles down significantly even in core inflation, something that was not the case a few years ago. In a country where rural areas have historically had a higher food security and less reliance on energy, why is the inflation higher?

Inflation and Core Inflation:

As some perceptive readers may already know, inflation is the rate of change in the prices. Consumer Price Index (CPI) is a widely accepted “bucket of goods” that is used to measure this change.

However, as seen in recent times, exogenous shocks such as international fuel prices or the shortages in supply of a certain commodity can have a huge impact on inflation. In fact most of the inflation that happened in Pakistan in the last 2 years, can be attributed to increase in taxes and oil prices in the international market (underscored by the falling value of the rupee) which makes imported fuel expensive, increasing the cost of production and eventually cost of living.

But what is core inflation and why is the calculation of core inflation important? Core inflation is crucial because it provides a stable measure of an economy’s underlying price trends. By excluding volatile components like food and energy, it helps policymakers make informed decisions about monetary policy, guides financial planning for businesses, shapes inflation expectations, and aids in risk assessment. It offers a clearer picture of persistent, structural inflation pressures, ensuring that economic policies are well-targeted and that individuals can better navigate their financial landscapes.

Coming to our scope, it was interesting to note that core inflation was also recorded at a higher level in rural areas than in urban areas. At the end of September, core inflation in rural areas increased by 27.3 % and in urban areas the increase was recorded at 18.6%. Similarly, core inflation for urban and rural regions, at year end- FY23 was at 18.5 % and 25.2% respectively. In the graphs below, it can be seen how rural inflation has differed from urban inflation over the course of the year.

So if the changes in the prices of fuel due to the rupee value or an increase in levy is not the reason for the price increase, then why is rural inflation higher?

Reasons:

Talking to Profit, renowned economist and Deputy Executive Director at the Sustainable Policy Development Institute (SDPI), Dr. Sajid Amin states that in the past few decades, this trend has been observed in most of the agricultural countries.

He says that since the numbers of inflation were small, and are still small in the neighbouring countries, they go unnoticed. But since the inflation numbers have started crossing the 20% mark in Pakistan, it has become really apparent.

Apart from the general lack of accessibility, rural areas have also become increasingly reliant on technology. Contrary to popular belief, the rural population is much more reliant upon energy and fuel for their occupational and daily needs. Large distances and less public vehicles means that people will use fuel. Ever since “tractorisation”, the agricultural sector runs on electricity and fuel. From tractors to tube wells, everything reflects price increase in the fuel. Since the prices of fuel increase, the price levels will also increase, making it expensive to produce and cultivate.

But why is the core inflation on the rise then? Since it is devoid of energy prices. Answering this question, Dr. Amin states that “Even though core inflation does not have energy prices, it does not mean that it does not have an impact. A doctor charging a patient, or a barber charging his customer will always be cognizant of his cost of living and will price his service accordingly. SImilarly, any seller will include a factor of risk that comes with doing business in such an environment. This automatically raises the core prices. Since the risk is also higher in rural areas, the premium on the prices is higher.”

Another main reason is the absence of competitive markets. A major misconception that comes with villages is that they have food security. “Majority of the small farmers, (upwards of 86% amongst total farmers), only cultivate 2-3 major crops. For everyday food a villager also has to go to the market” says Dr. Amin.

However, unlike his counterpart in the cities, he does not have the luxury to buy from multiple shops and fix-price supermarkets. Rather the limited shopkeepers inside the village act as middlemen who go to the cities, buy food and vegetables and bring it back. Not only do they include the additional cost in the prices of the goods, the risk of operating in the current high inflation environment is also reflected in the prices that they set.

Supply Chain Challenges: Rural areas may face logistical challenges in accessing goods and services. This can result in higher transportation costs, which are often passed on to consumers in the form of higher prices for essential goods, as explained earlier. Limited infrastructure and distribution networks can exacerbate supply chain inefficiencies. The decrease in access is hence one of the main reasons for the difference of price.

Income Disparities: Rural areas often have lower average incomes compared to urban areas. This means that even moderate price increases for essential goods can have a more significant impact on the cost of living for rural residents.

Impacts:

Inflation might just be numbers, but to put it into context, the average rural inflation based on CPI for the last 3 years (FY20-FY23) is upwards of 80%, a bulk of which came during the last year.

According to a recent world bank report, more than 40% of people are now living under the poverty line. If reconciled with the findings with the last household income survey of Pakistan Bureau of Statistics (PBS), the percentage of rural population is almost a quarter above the average Pakistani. This means that the amount of people living below the poverty line in rural areas, crosses almost 50%. Compare this to the average inflation in the last 3 years and one realises how much worse the inflation is for the rural population.

What this essentially means is that there are people who have become really poor fairly recently and are not on the radar of the government.

Another impact of increased rural poverty is increased fear amongst businessmen. Under a high future expectation for inflation, prices are hiked, goods are hoarded and over profiteering becomes rampant. This becomes even more amplified in areas which are away from regulatory centres, i.e. rural areas. According to Dr. Sajid Amin, “At least 1/4th of the current inflation is due to bad governance. People are setting prices based on perception and the government is not doing anything to regulate that.”

Overall the impact is so severe that the bottom 40% in the rural areas are under extreme risk according to the World Bank report.

The increase in energy prices does not just make food and energy expensive, and is not just related to transportation, rather its impact is across the board.

Talking about a solution:

What can be done to make sure that the financially vulnerable of the rural areas get the same security as the urban population? While talking to Profit, Dr. Amin paints a rather gloomy picture.

“The government is going to need another IMF program in the coming years. It is easy to guess by the debt payments of Pakistan in the coming 2-3 years. This means that a contractionary monetary and tight fiscal policy is going to be in place for the short term” he says. What this means is that the government cannot expand capacity, create jobs or for that matter, bring inflation down below the 20% mark in the near future. The economy will move forward with slower growth and high inflation. According to Dr. Amin, the inflation is going to average between 20-25% for both FY24 and FY25.

With a high inflation it is important for the government to cover the bases especially for the vulnerable section. “First and foremost, we need to expand the social protection and social safety nets beyond urban areas. Especially for the people who have recently fallen below the poverty line. The government has data for targeted subsidies, called the NSeR (National Socioeconomic Registry), that needs to be updated.”

Typically in Pakistan, Social Safety Nets (SSN) comprise direct cash transfers and various services, encompassing both budgetary and non-budgetary programs. The budgeted social safety net programs encompass the Benazir Income Support Program (BISP), Pakistan Bait-ul-Mal (PBM), and Social Security & Welfare. Additionally, Zakat, Employees Old-age Benefit Institution (EOBI), and Workers Welfare Fund (WWF) form part of this framework. The non-budgetary part includes microfinance loans through private partners and INGOs.

“We have to relieve the bottom 40% now, from the price shocks through cross-subsidies.” he adds. “Secondly, the price control committees under the secretariat need to be reinstated. A lot of people think that these committees enforce prices like the bureaucracy itself, which is not true. Rather they keep the over profiteering in check that happens on a regular basis in the rural areas where there is lesser check and balance. These administrative measures also need to be implemented in cities under current circumstances.”

“Thirdly, I believe that agriculture and livestock are going to be a major generator of economic activity and exports in the near future. Manufacturing industry is underscored by the cost of fuel imports, which is a burden that is not borne by agriculture. The government needs to invest, not only in agriculture but also the SME sector affiliated with agriculture and livestock.”, exudes Dr. Sajid Amin.

This step can not only play a part towards reducing rural poverty but can also act as a saving grace for Pakistan. The preliminary interest in free trade with the Gulf region last month opens up a big opportunity for trade that is not reliant on imports. And in such capacity, agriculture, livestock and related industries can be some of the most attractive businesses, if they are supported by the government.

Be careful of crypto platforms promising huge returns. They lure people into fake programs. I was scammed of 398,450 USD last year. While researching on how to recover my funds, I came across several recommendations on Bitcoin Abuse Forum about RecoveryChef. I contacted him via his email on recoverychef@techie. com and he helped me recover my stolen funds. If you’ve also been a victim of financial scams, don’t hesitate to get in touch with RecoveryChef.