This is a topic that interests me a great deal. For some time I have been meaning to dive into this but have been preoccupied with other things. It’s been investigated a few times but the best work on it remains to be a paper written by Khilji and Zampelli in 1991! The paper investigates the fungibility of US assistance to Pakistan and its impact on our expenditures.

Fungibility here means if resources meant for purpose A can be directed for purpose B. Aid or Foreign assistance received for development purposes can be directed towards military purposes and vice versa. This can happen if external and internal resources are fungible.

The paper finds evidence for fungibility of external and internal resources in Pakistan. But that isn’t the only interesting finding of the paper. I think the most striking feature of the paper is another result that has skipped the attention of most (if not all) researchers! Khilji and Zampelli find that:

“Pakistan’s marginal propensity to spend internal and external fungible resources on public sector goods and services is approximately 0.26 implying that an additional Rs. 1 in fungible resources will raise public spending by Rs. 0.26 with Rs. 0.08 going to defense and Rs. 0.18 to nondefense. The remaining Rs. 0.74 goes into private sector consumption.”

This is remarkable. 74% of the additional Rupee raised by the government whether in external or internal resources goes to support consumption of the private sector.

Now link it with what I wrote in my previous post on consumption led inflation in Pakistan. The top 20% own 50% of our national income and the top 10% are able to capture 24% of any growth in income in the country. What Khilji and Zampelli findings imply is that the rich seem to benefit disproportionately from foreign assistance as well. Again, it’s something that we all kind of know but it is always good to get some pointers in the right direction.

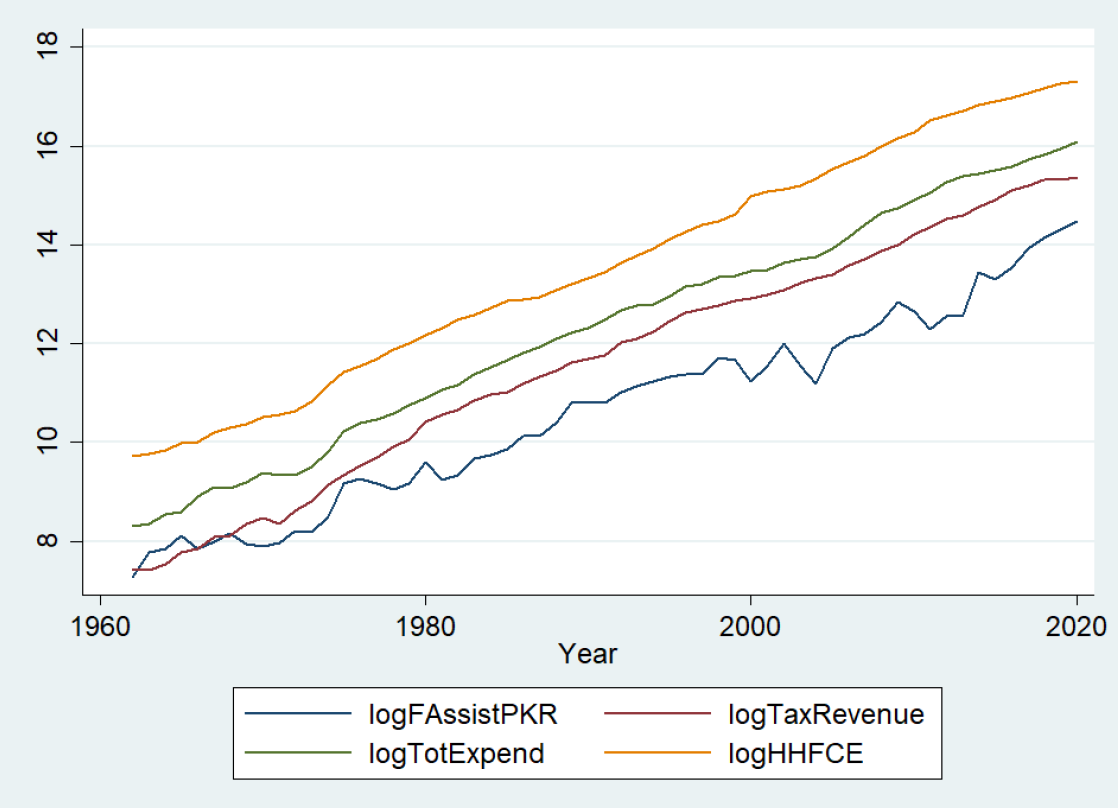

This particular finding in their paper has bothered me for a very long time. I am also surprised that people haven’t really picked it up and we haven’t seen any solid work on it so far. I made a couple of graphs after revisiting Khilji and Zampelli paper. Figure 1 below shows log of four different variables. Don’t worry about Logs – it’s just an easier way of showing/representing large numbers. The four variables are:

- Average Annual Foreign Assistance Received by Pakistan (logFAssistPKR; includes both loans and grants)

- Annul Total Expenditure (LogTotExpend),

- Annual Tax Revenue (logTaxRevenue),

- Household Final Consumption Expenditure (logHHFCE).

We can see how beautifully the three series move in the same direction. But there is no need to get uber excited. All this shows is a trend in the same direction. This may or may not be interlinked. There is some fluctuation in the Foreign Assistance series, which is understandable.

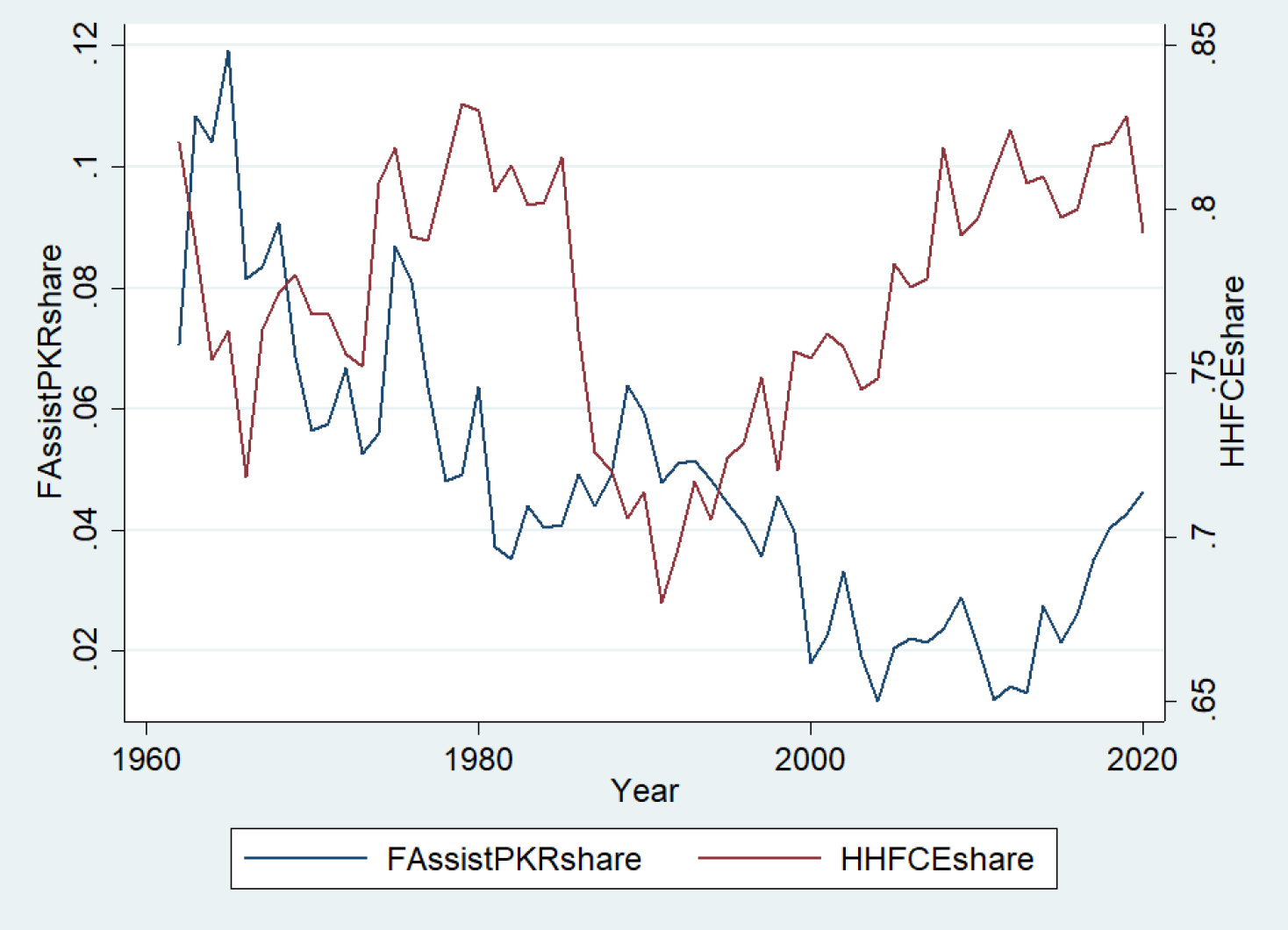

Foreign Assistance to Pakistan would change from year to year depending on the international situation. We can see these numbers in another way. I took the original series of two of these variables (the ones that were not changed into log form) and scaled it down (another way of saying dividing) by Gross Domestic Product (GDP). The result is shown below in Figure 2.

So before this makes your head spin, let me quickly explain what I have done there. There are two vertical axes shown here. Read the Foreign Assistance Share on the right vertical axis and the HHFCE share on the left vertical axis. This way you can see their movements together easily. Keeping them on one axis would not have conveyed the information that you can see right now.

We can see that there are time periods when the two series seem to be moving in the same direction and then there are times when they don’t. Again, we can’t get too excited by it but can still rejoice in the fact that there might be something there.

After pondering over this Khilji and Zampelli paper and wondering why everyone seems to have missed the most interesting finding of the paper, I have decided to take this up as my next project. This is the new project that I mentioned in the start of this post.

Maybe people didn’t take it up because there was nothing there but I won’t find out without trying for myself.

Stay tuned to this space for more updates!

I always like your posting.