Necessity is the mother of invention. Take, for instance, the Ford Model T. It is acclaimed as the first widely affordable automobile in history, and anyone who dared to compete with it would essentially have been confronting the car that revolutionised mobility. Yet, Alfred P. Sloan did precisely that. He forged ahead, and pioneered automotive credit and thereby enabled car buyers to circumvent the need to save for years to purchase the Ford. He had his eureka moment.

Pakistan’s automotive industry may be on the verge of its own eureka moment — albeit only for perhaps a few months.

In a bid to attract customers, Lucky Motors and Honda have launched their own indigenous financing plans with no interest. Zero. These plans for the KIA Sorento, Peugeot 2008 Allure, Honda BR-V, and Honda HR-V respectively, are unprecedented. This is the first of its kind in the automotive industry. Thus, in an attempt to make sense of the chaos across the industry, the companies have offered customers a bargain. But more importantly, they may have inadvertently created a test case for whether banks can be circumvented from the lending process altogether to go directly to the customers.

A page from the two wheeler market

Direct customer financing for vehicles is by no means a novelty in the automotive sector. However, it’s a concept that’s relatively alien to the four-wheeler market. This strategy is, in fact, a cornerstone of the two-wheeler industry — a catalyst for its initial growth and a continuing emblem of its success. It appears that Lucky and Honda have taken note of this trend, seemingly drawing upon it to make sense of the chaos in their respective industries.

“The automotive market finds itself in a precarious predicament, grappling with a profound affordability crisis. In response to this, we endeavoured to adopt an innovative and empathetic approach, viewing the situation through the lens of the customer,” explains Muhammad Faisal, the President of Automotive at Lucky Motors. “Our exploration led us to devise strategies that could offer affordability to prospective customers in a manner that would alleviate their financial burden, shielding them from the exorbitant costs of finance, all whilst requiring minimal equity commitment. Thus, our scheme was born,” Faisal further elaborates.

In a similar vein, “The market turbulence has left customers feeling unnerved. Their financial resources have dwindled, prompting us to formulate this scheme with dual objectives — to not only bolster our market presence but also to provide them with tangible benefits,” articulates Amir Nazir, the General Manager of Sales and Marketing at Honda.

The underlying rationale for both companies remains consistent. Automotive prices have ventured into uncharted territory at a time when the State Bank of Pakistan (SBP) has clamped down on automotive lending in an effort to stem foreign exchange outflows. Those who dare to venture beyond these factors and contemplate partaking in vehicle financing are confronted with the harsh reality that Pakistan’s policy rate and subsequently the Karachi Interbank Offered Rate (KIBOR) are at an all-time high. This presents a rather sombre image. However, it’s not just customers who are grappling with the harsh reality of being priced out of the market. The media, including this publication, have been relentless in reporting the record lows automotive companies are hitting each month in terms of sales.

Our duo of protagonists have ventured beyond what the two-wheeler industry ever dared to do. “I don’t recall the two-wheeler industry ever offering zero-markup plans. In fact, markups skyrocketing to 40%-50% were far from rare,” explains Fahad Iqbal, Managing Director of Ravi Automobile. “The markups were indeed steep, but the long tenures effectively reduced the instalments to a pittance, which was a major draw for customers,” Iqbal adds.

This is precisely what sets this approach apart in the market — its unparalleled singularity.

The savings from the lack of a cost of borrowing

What do these financing plans offer? Lucky Motors has devised a 12-month and 18-month repayment scheme for the Peugeot 2008 Allure and KIA Sorento respectively. Honda, meanwhile, has settled for a consistent 24-month repayment scheme for both its BR-V and HR-V models. The Sorento demands a 30% down payment, whereas all other vehicles necessitate a 50% down payment.

You might be curious as to why these particular models were selected by both companies. This is a valid question, as both have deliberately excluded their most popular models — Lucky with its Sportage and Honda with its Civic — from this scheme.

“The Sorento was chosen because we thought customers would need financial assistance due to the vehicle’s price point, and the higher withholding tax as part of this year’s budget. As for the 2008 Allure, we expected it to generate more volume through the scheme,” Faisal elaborates. Likewise, Nazir remarks, “We had formulated this scheme for a certain number of vehicles as the backorders for both were comparatively fewer than our other models.”

Upon closer examination, it seems likely that both companies have surplus inventory that they want to dispose of. There is potential conjecture that these vehicles are lagging behind in sales and perhaps selling at discounted rates in the secondary market — but then again, that is the case for the entire industry. The existing stock of inventory seems to be the most convincing explanation for our protagonists’ choice.

However, this article is not about their sales. It is about their savings.

The savings from this scheme are straightforward: the cost of financing. It’s imperative to explicate this term first, because anyone unfamiliar with car financing might presume that it’s merely the KIBOR you are paying. This is a misconception. The cost of financing for any vehicle encompasses the KIBOR and a rate of profit, known as the margin, levied by the bank. The current minimum is KIBOR+3.5%. This implies that you will incur 25.5% in interest payments for financing any vehicle.

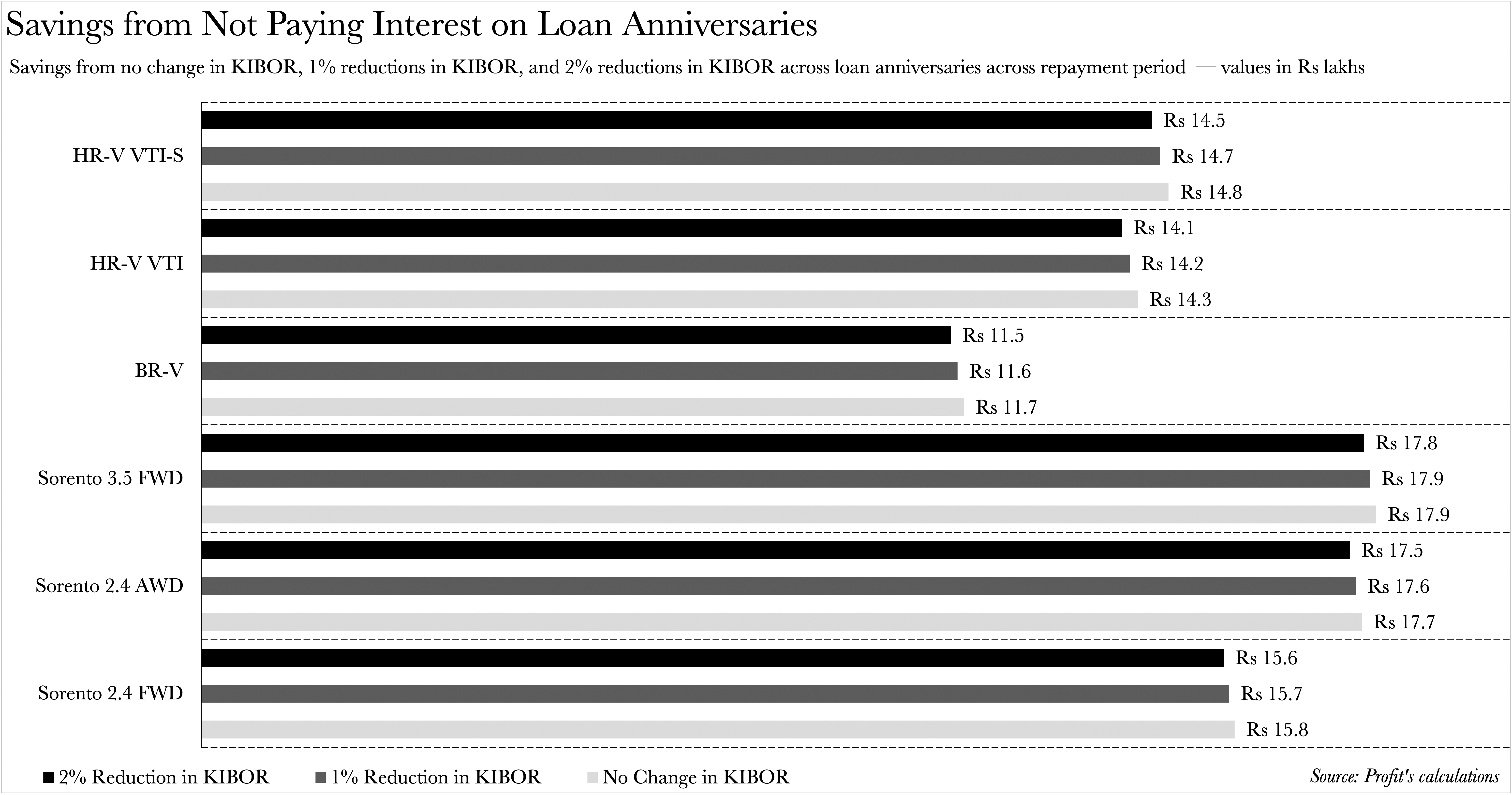

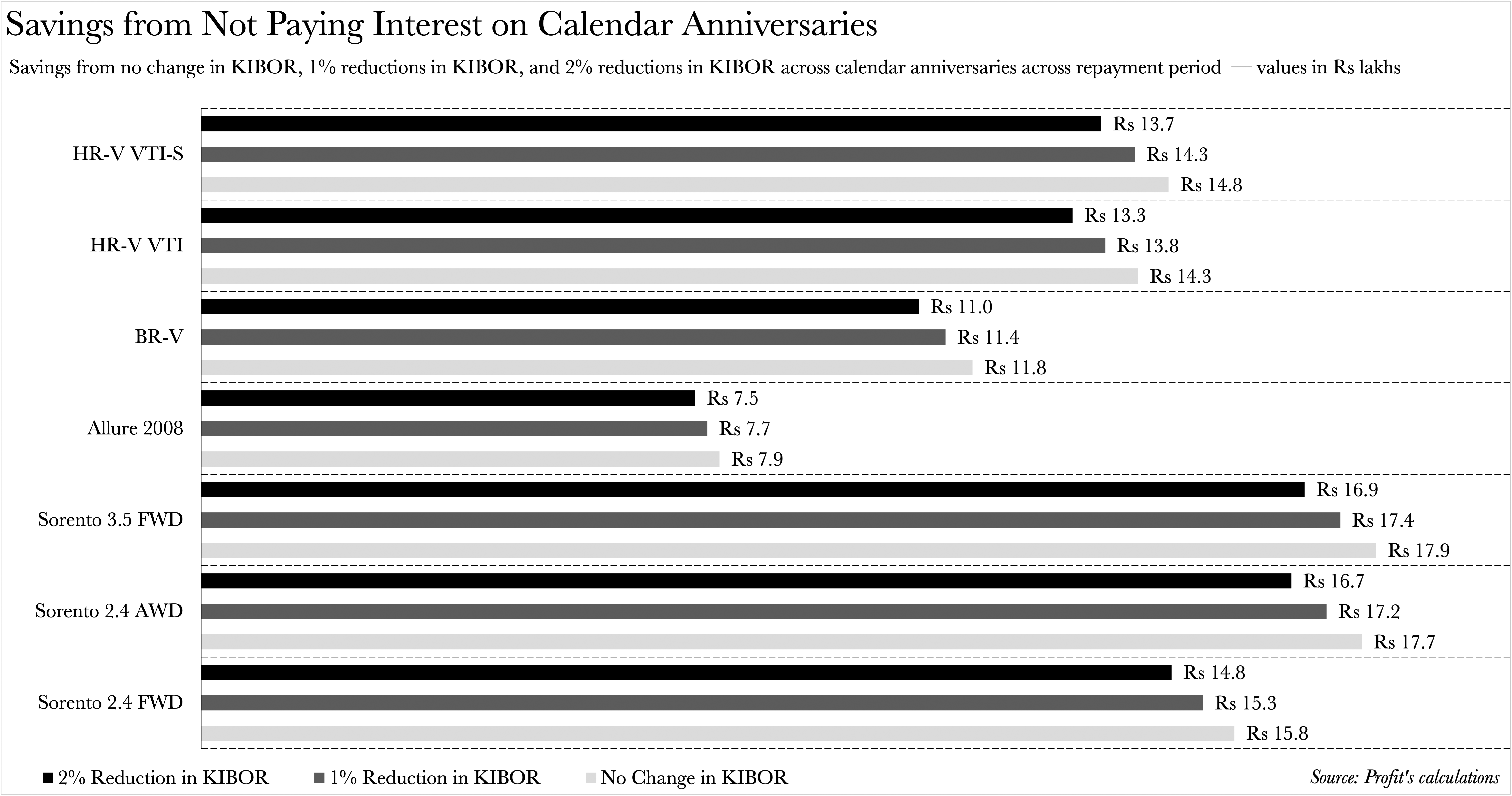

So what savings can you anticipate? At the bare minimum, you can expect to save Rs 7.9 lakh, while at the maximum, the savings could reach Rs 17.9 lakh. Lucky’s vehicles command both ends of this spectrum, with the 2008 Allure offering you the smallest savings, and the Sorento 3.5 FWD providing you with the largest. Naturally, your savings could vary depending on the alternative bank financing you are contemplating.

In estimating the savings, we formulated an automotive loan that a bank would propose if you were to purchase these exact vehicles through traditional banking channels. We employed the KIBOR+3.5% rate as our benchmark. It’s crucial to note that this is merely the minimum. While banks will not charge less than this, they will undoubtedly charge more.

Furthermore, we considered three distinct scenarios: we assumed there would be no change in the KIBOR throughout the loan duration; we assumed there would be a 1% reduction on successive anniversaries of the loan; and we also assumed there would be a 2% reduction on successive anniversaries of the loan. Regarding anniversaries, we used both loan and calendar anniversaries. The loan we devised commenced in October.”

We endeavoured to encompass a broad spectrum of scenarios that a prospective buyer might encounter if they were to finance these specific vehicles from the bank, and that too, immediately. However, we did not factor in the upfront costs associated with the vehicle such as insurance, registration, and the tracker. While the latter two are standard, your insurance plan will hinge on your bank. Consequently, we focused solely on the interest payments that would have been necessitated based on the portion of the vehicle that the bank would have financed. We operated under the assumption that all vehicles in our calculations had made a standard 30% down payment. For the Sorento, a 30% down payment was not feasible as it exceeded Rs 3 million, hence our down payment for that was capped at Rs 3 million.

Our model represents an optimistic, bare-bo loan from the bank that an average buyer would accept without much contemplation. You are certainly welcome to devise your own, but even within our scenario, the savings highlighted earlier are significant.

While this strategy appears logical for customers in the market, one wonders if the two companies can successfully execute this without the repossession mechanism typically available to banks?

Stress testing the lending

Faisal and Nazir echo each other in expanding upon their strategies for implementing the scheme. Both strategies hinge on company dealerships and the dealers therein. These dealers will conduct their own rigorous assessment of potential customers, leveraging their networks to identify suitable clients. Moreover, all vehicles will be subject to registration, insurance, and the installation of a tracking device.

The reliance on dealers to assess the risk associated with potential customers is reminiscent of practices in the two-wheeler industry. At first glance, this seems reasonable given the industry’s remarkably low default rates and high recovery rates — near perfection in some instances. These achievements are attributed solely to the dealer’s involvement in the lending process.

However, it’s important to note that dealers across both segments may not necessarily be identical. “Dealers in the two-wheeler industry are predominantly regional. In many instances, they are influential local figures who utilise their personal connections and patronage networks to sell motorcycles,” Iqbal adds. “They cater to a tightly-knit network, and even today, it remains largely regional. In the industry’s nascent stages, dealers would even station themselves outside a customer’s residence to repossess the vehicle. It’s the personal guarantee of the dealers and their wielded influence that ensure 100% recovery rates,” Iqbal continues.

Are four-wheeler market dealers identical to their two-wheeler counterparts? It’s challenging to ascertain. What we do know from our interactions with dealers is that their personal ‘influence’, in relative terms, is somewhat diminished compared to their two-wheeler counterparts. However, this is where additional safeguards such as insurance and trackers come into play.

“For an automotive company, insurance integration offers a safeguard against potential losses or damages. Concurrently trackers significantly bolsters the calibre of collateral — from a recovery and theft risk standpoint — in a remarkable way. Trackers are the reason why motor insurance has transformed from a loss making portfolio to a lucrative venture,” explains Norez Abdullah, former Chief Financial Officer at Hyundai. The vehicles themselves also serve as a form of insurance. With monthly instalments ranging from Rs 1.6 lakh to Rs 4.6 lakh, these are not vehicles within everyone’s financial reach. Only a select group of individuals will be able to sustain cash flows of this magnitude month after month.

Cars also represent a distinct type of collateral in the non-banking lending sector. Unlike microfinance loans disbursed for consumption goods whose utility is quickly maximised post-loan origination, vehicles are everyday use-case products. The gratification doesn’t immediately cease, thereby incentivising customers to maintain access to the product. This is further compounded by how vehicles are treated as assets in Pakistan.

Read more: The lopsided market structure of the automobile industry

Since its genesis in the 1990s, Pakistan’s lending market has evolved considerably, now featuring specialist agencies that manage credit collection on behalf of the principals. Furthermore, companies have the option to mitigate risk entirely by enrolling other firms into these schemes. However, this doesn’t imply that such ventures are free from risks.

Keeping in perspective the current maturity level of the industry, it’s hard to picture the automotive industry venturing into algorithms for automobile lending — this is an advanced stage of understanding lending, ensuring there are no ‘skip throughs’ or ‘straight skips’,” expounds Shahzad Ishaq, Group Head Digital Banking & Chief Digital Officer at MCB. While automotive companies can avail services of third-party bureaus like DataCheck, they are prohibited from using the SBP’s bureau or any bank’s proprietary one without either complying with the conditions of a formal lender or partnering with a bank.

“Lending is a field that requires expertise. It’s not as simple as initiating it, refining it, and assuming it will be fine. No, you need specialists for the process,” Ishaq adds. The automotive companies seem to align with Ishaq’s perspective as there are no indications of this becoming a long-term trend — at least not at present.

The long-term question

Honda is very clear about their stance on the matter. Their scheme will come to an end once they hit their desired sales target for their vehicles. So much so, that they emphasise they could cut this off any day. Whilst the urgency may perhaps be a marketing ploy, it also shows that their level of interest (no pun intended) in this is minimal.

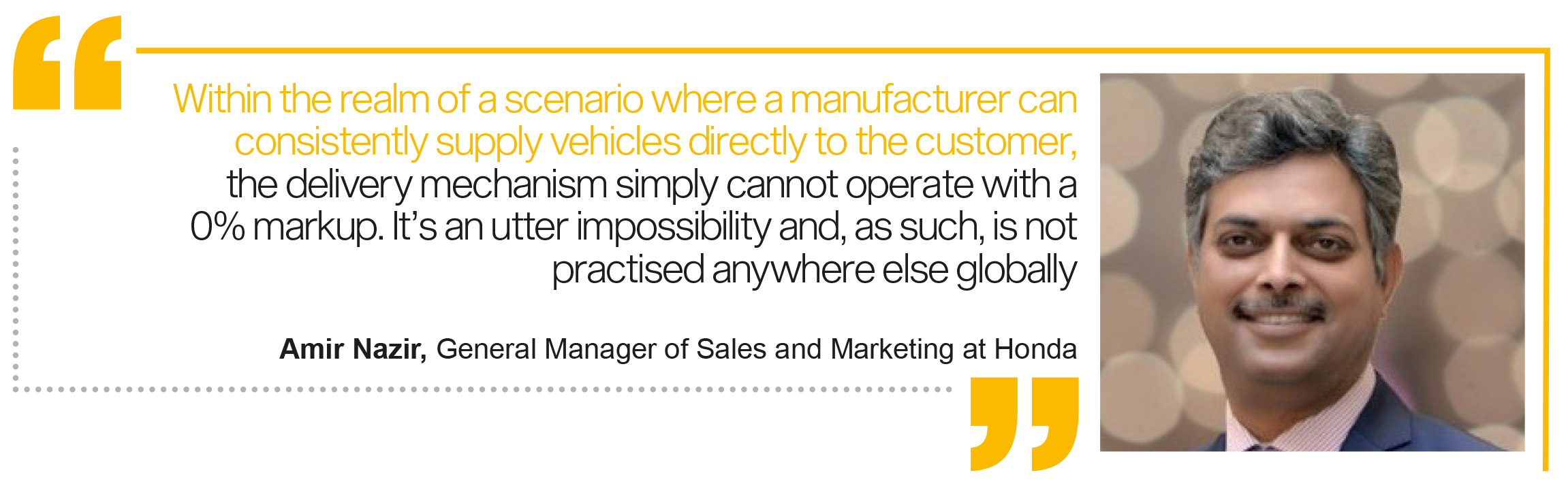

“Within the realm of a scenario where a manufacturer can consistently supply vehicles directly to the customer, the delivery mechanism simply cannot operate with a 0% markup. It’s an utter impossibility and, as such, is not practised anywhere else globally,” Nazir proclaims with conviction. Echoing a similar sentiment, Abdullah exclaims, “Predicting and ascertaining the extent of benefit one can reap from such an initiative is exceedingly challenging. There will undoubtedly be a benefit, I harbour no doubts about it. However, whether you attain the desired benefit or not, considering the cost of money involved in dispersing it over 12, 18, and 24 months, remains to be seen.”

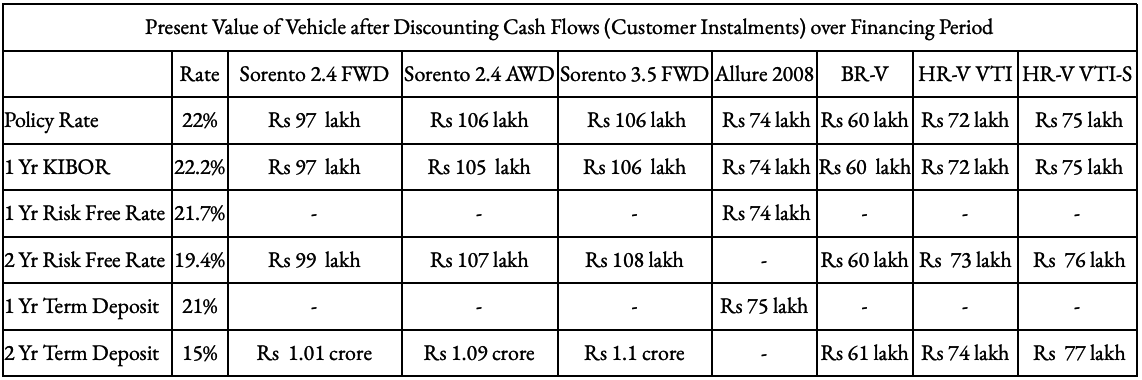

The magnitude of the discount is not fixed; it fluctuates. To compute the discounted cash flow, we scrutinised the policy rate, the one-year trailing KIBOR, the one and two-year risk-free rates, and the effective interest rates for one and two-year term deposits. We selected these diverse discount rates to consider all potential opportunity costs that the companies might incur.

The selection of the policy rate and KIBOR was standard, and these were applied across all vehicles. We adopted the Pakistan revaluation rate as the risk-free rate. We utilised these rates for both one and two years. The former was applied to the 2008 Allure because its financing period did not exceed 12 months. The latter was used for the remaining vehicles whose financing periods exceeded 12 months. We followed a similar approach by taking one and two-year term deposit rates. With the deposit rates, we opted for the effective interest rate rather than the simple interest rate. In discounting the cash flows, we refrained from discounting the upfront payment and the initial cash flow. Through this exercise, we discovered that all vehicles are effectively offered to customers at a markdown by the end of their financing period.

When we refer to a discount, we also factor in the price reductions that Lucky and Honda have implemented this October. Ceteris paribus, these markdowns from the financing scheme outstrip the current price cuts.

This is also why companies are unlikely to adopt this route long term. While Honda has no inclination to maintain 0% markup rates, we are cautious of Lucky. This is not because they have remained silent on when this scheme will expire but because their pricing strategies are simply eccentric and now that they’ve embarked on this once they could potentially sustain this for an extended period or implement it more frequently.

The banks, surprisingly, are more optimistic about automotive companies actually implementing this than automotive companies themselves — albeit with certain reservations.

“This is a highly productive and happy development. Moreover, it is a significant and valuable development. It is truly worthwhile to test the waters and see how this entire proposition shapes up,” Ishaq proclaims. “Ultimately, it hinges on the objective of the programme. Do they merely want to evade the cost of holding inventory and generate profits, or do they aspire to create a sustainable model for the future? For the latter, they will require a bank by their side, even if it is in a diminished engagement than the current ones – for instance, a white label arrangement,” Ishaq elaborates.

Ishaq’s comments are, in fact, a nuanced nudge towards the wider automotive sphere, particularly beyond Pakistan. It’s quite ubiquitous for banks to function behind the scenes while automotive firms manage the customer-facing aspects of operations. Such arrangements have been in place for decades in North America and Europe and have gradually gained traction in the Middle East as well.

While automotive firms inherently lack the authority to levy interest rates on any form of financing, they are also not bound by SBP’s regulations. One can liquidate surplus inventory, but then one might deplete their running finance. It presents a conundrum. As it currently stands, in merely the pilot stage, both companies are poised to profit and customers stand to gain from discounts. The crux of the matter is what ensues after this. Lending is fundamentally a cyclical business. Interest rates may not plummet significantly in the next six to twelve months, but they are unlikely to remain static for the subsequent twenty-four to thirty-six months either. The question simply is whether these companies wish to capitalise on the insights gleaned during this phase.

Pakistani auto companies have been standing on higher profit or greed since long and ignoring the fact, buyers are loosing purchase power due to cost of living and rupee depreciation. The cars in neighbor country is alot cheaper and export standard. Where as Pakistani auto companies have been launching world,s discontinued models at higher orice and sub standard quality, not qualified for export at all.

Greed have its own consequences. Rest in peace pak auto companies.

Where are these offers being advertised? I have not been able to track them down.

thanks for this article.

need detail and any contact number

Pakistan does not have an Automotive Industry, it has Automotive Assembly. Import 4 boxes and join the contents into one item like Lego. Neither what makes a car go forward (engine) nor what makes a car stop (brakes) are manufactured in Pakistan. Other than the seat covers and a few basic nuts and bolts, nothing auto is made in Pakistan. Without understanding and correcting this basic structural flaw for consumers and structural benefit for the assemblers, no auto policy, leasing scheme, interest rate, marketing, import policy can fix the absolute disaster this trading business has become for the country.

Dear Sir.

Is there an option for a cash discount instead of taking interest free loan.

I can support the full payment but not sure I wouldn’t qualify due to my age.

Speaking of Peugeot Allure.

Tariq

please drop financing calculations

I am interested in BRV buying for 0% markup

I am interested in your financing project in Honda BRV contact:-03000030109