Typically, you buy the stock of a company which you think is doing well. If company X announces it has made a lot of profit, more people will buy the stock, inflating the share price. Similarly, if it has made a loss, the share price will fall.

Which is why one pays attention to when the inverse is happening: when a company has been publicly making losses for years, and yet its share price seems to be soaring.

Thus is the case with Mitchell’s. Whether it’s jams or beverages, Mitchell’s has been a ubiquitous brand for generations. It has also been notorious for the last few years for failing to keep up with its competitors, losing market share, and struggling to turn a profit.

In its latest annual report for the year ending June 30, 2023, the company incurred a loss of Rs 59 million, and its short-term liabilities exceed its short-term assets by Rs 371 million. That’s not all: the accumulated losses are such that the company’s reserves are depleted, and it is in the middle of negotiating with banks to renew loans.

This is why the company’s auditors said, “These events or conditions…indicate that a material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern.” This is how auditors speak when they want to say that a company might have to be closed down.

This is hardly the picture of health. And yet: the company’s share price has more than tripled in a matter of two months, from Rs 78 on October 2, 2023 to Rs 264 on December 1, 2023. As of December 7, the share price stood at Rs 200, translating into a 150% return (900% annualised) if one had invested in early October. It’s the kind of sharp increase that has left onlookers baffled. Mitchell’s own auditors are concerned that the company might not exist. But the share price rise is as if Mitchell’s has announced a successor to its famous Chilli Garlic Sauce.

What’s going on? Is it because Mitchell’s financial turnaround is imminent? Or is it because it was severely undervalued before? Or is it about to be bought? Profit breaks down what’s going on with Mitchell’s stock.

Trip down memory lane (feel free to skip)

Mitchell’s was initially founded as Indian Mildura Fruit Farms Ltd in 1933 by Frances J. Mitchell, the namesake of the company. The company underwent a significant transformation in 1958, when it was acquired by Syed Maratib Ali. He in turn wanted to settle his son-in-law, S.M. Mohsin, as the head of both orchards and the Mitchell’s brand.

Throughout the 60s and 70s, the company focused on its fruit jams and marmalades, but in 1980, the company diversified into confectionery, making sugar candies, milk toffees and chocolate eclairs, doubling its annual sales. In 1993, it became a public limited company, listed on the Karachi Stock Exchange. In 1998, Mitchell’s achieved ISO 9001 accreditation, and in 2001, it established the first moulded chocolate line. It started the production of enrobed chocolate bars in 2004.

However, challenges arose as competitors like National Foods entered the market, leading to a struggle for Mitchell’s to keep pace. While National Foods makes significant revenue from its spices business, both Mitchell’s and National compete in the jams, jellies, and marmalades business as well as the tomato ketchup business.

In 2008, recognizing the need for modernization, the company underwent a revamp, upgrading facilities and distribution strategies. Yet despite some revenue growth driven mostly by general inflation, Mitchell’s faced financial stagnation from 2013 to 2020, experiencing losses each year since 2016. As new competitors entered the packaged foods industry, Mitchell’s grappled with legacy costs.

Management changes occurred, with Mujeeb Rashid appointed as CEO from 2009 to 2016, who was succeeded briefly by Muhammad Zahir, who was CEO until September 2018.

The farm commands political clout in the region. Yet, despite their influential role, the Mohsins reached an impasse in 2018, looking for a buyer for Mitchell’s. Blaming poor management and financial woes, their efforts to sell encountered obstacles amid family discord. By mid-2018, the family recognised the challenges and opted for a sale, appointing Habib Bank Ltd as sell-side investment bankers.

By July 2019, negotiations with Bioexyte Foods – a sister company of Getz Pharmaceuticals – to sell management control of Mitchell’s approached fruition. However, the coronavirus pandemic struck in early 2020, and the deal collapsed. Mitchell’s stock price, which had skyrocketed by 77% during the deal announcement to Rs 345 per share, nosedived after the collapse (though did stay slightly above pre-announcement levels).

Following the botched sale, Najam Sethi took charge.

Chairman Sethi’s report card (2020-2022)

Let’s take a look at how the company has financially fared the last few years. Since 2020, Mitchell’s fortunes have been run by one man in varying capacities: Najam Sethi. This can further be subdivided in two periods: Sethi the chairman (2020 to October 2022), and Sethi the CEO (October 2022 to present).

To recap, following the failed attempt to sell Mitchell’s to Bioexyte Foods in 2019, Jugnu Mohsin stepped in. She is the granddaughter of Syed Maratib Ali, who acquired Mitchell’s in 1958, and she along with her husband, Najam Sethi, took over from S. M. Mohsin and Mehdi Mohsin in 2020. Sethi opted to take a less active role for himself, as the chairman of the board of directors of the company. Instead, he brought in Naila Bhatti as the chief executive officer (CEO), who had previously worked with Sethi at the Pakistan Cricket Board.

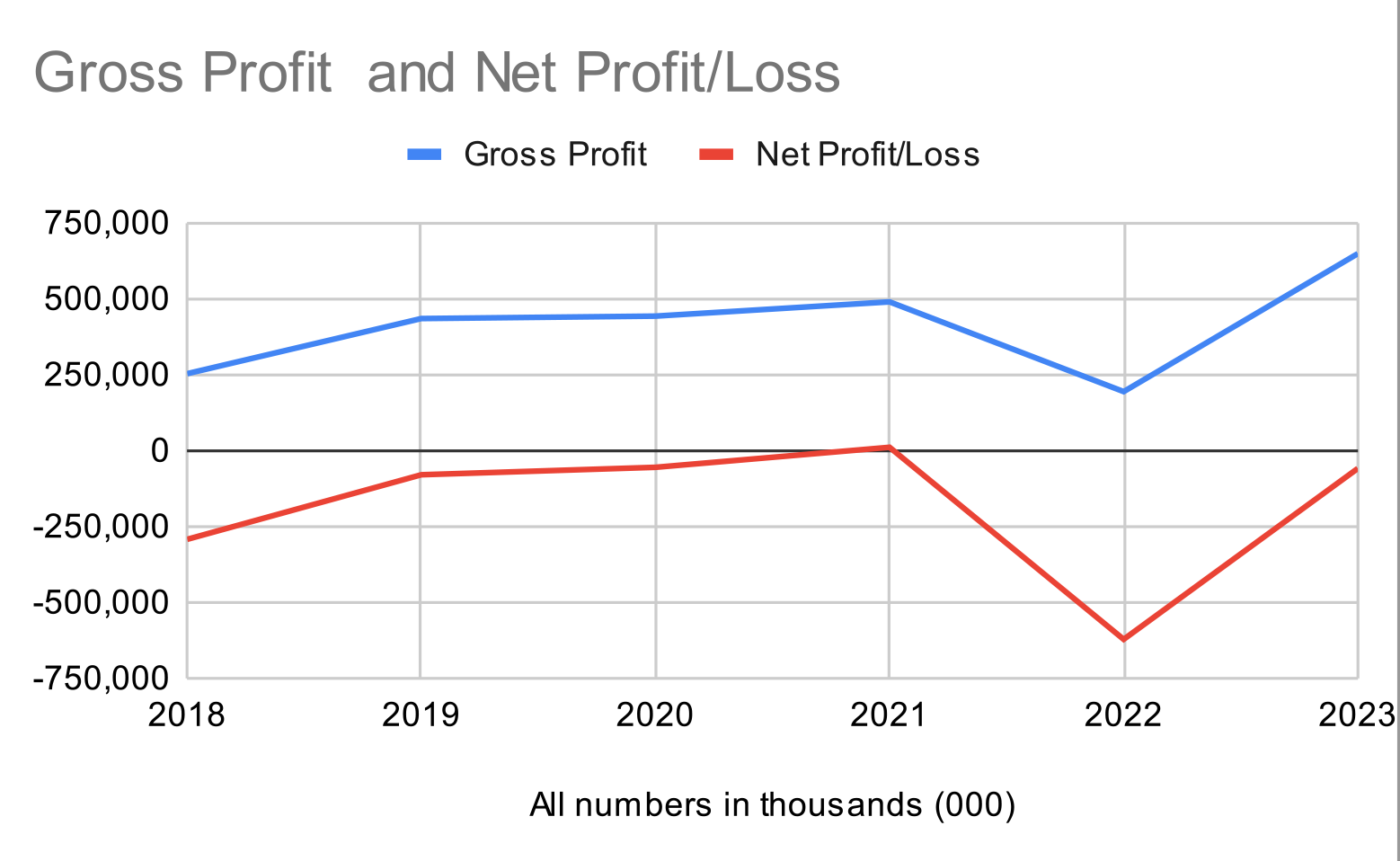

The results were erratic. In 2020, net sales stood at Rs2.1 billion, while cost of sales stood at Rs 1.7 billion. Consequently, net loss stood at Rs 55 million.

The next year, in 2021, Mitchell’s actually managed to experience a bright spot. Net sales increased to Rs 2.2 billion, while cost of sales stayed around the Rs 1.7 billion mark. Additionally, a slight dip in administrative costs that year meant that Mitchell’s just managed to scrape a profit of Rs 10.4 million.

It was not to last. The next year of 2022 proved to be the worst year in Mitchell’s history. Net sales slightly increased to Rs 2.4 billion, but the cost of sales ballooned to Rs2.3 billion. Other costs like distribution costs and administrative expenses also ballooned, leading to a net loss of Rs 622 million – the greatest in the company’s history. This loss proved to be the last nail in the coffin for Bhatti, who was replaced in October 2022.

CEO Sethi’s report card (2022 to present)

This brings in Sethi as the CEO directly in charge. How does he fare? Let’s take a look at each quarter.

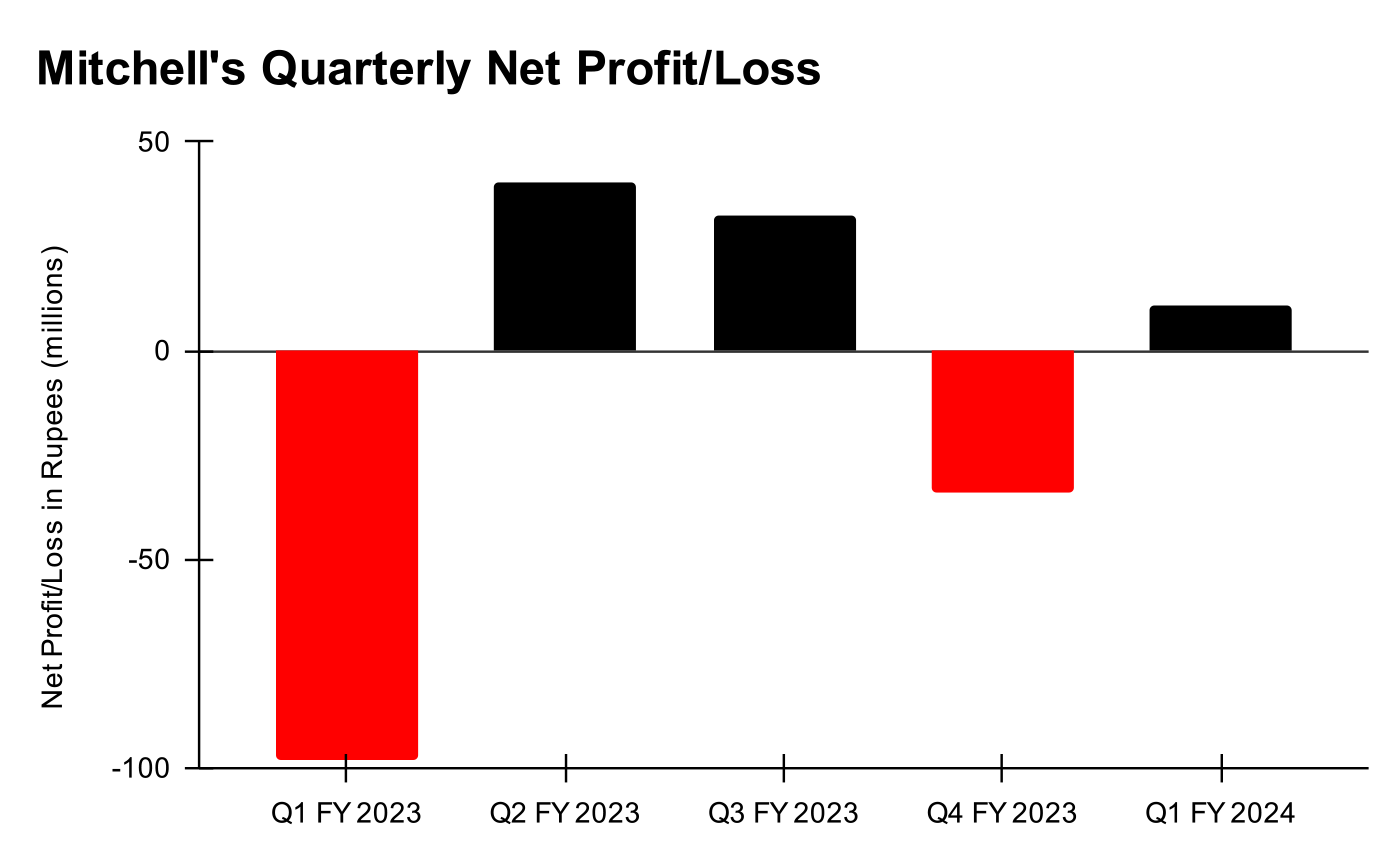

According to the annual report 2023, in the first quarter, the company experienced a loss of Rs 98 million (this was before Najam Sethi assumed the role of CEO in October 2022).

Following his ascension, the subsequent two quarters showed profitability: profit in the second quarter stood at Rs 40.5 million, and in the third quarter stood at Rs 32.4 million.

However, despite the positive trajectory in the second and third quarters, the company faced challenges in the last quarter. This suggests that even with a change in management and profitability in the middle two quarters, the losses in the latest quarter – at around Rs 34 million – do not bode well for Mitchell’s. The year’s total annual loss stood at Rs 59 million, or roughly where Sethi had initially found the company in 2020.

Still, there are some bright spots in the year. For instance, revenue climbed to Rs 2.7 billion, and gross profits managed to rise from Rs 193 million in 2022 to Rs 648 million in 2023. “This diminution in losses demonstrates the impact of strategic and operational improvements,” a Mitchell’s spokesperson asserted.

So then, what gives? The main factor that led to the company’s net loss in 2023 was that finance costs more than doubled, owing to increased interest rates.

Additionally, Mitchell’s is still struggling with legacy baggage. According to the spokesperson, “While the operational and administrative costs have declined, discrepancies compared to certain industry players might exist due to unique operational intricacies or legacy systems. Addressing these factors to align with industry standards remains a priority for us.”

Fix that gross margin

Ok, so the overall financials of the company are not great. But another way to think about Mitchell’s is that it is also poorly run. In the face of runaway inflation in Pakistan, where almost every manufacturer under the sun was raising its prices, Mitchell’s forgot to do a very basic act: raise its prices.

This severely affected its gross profit margin. To recall, gross profit margin is the revenue left after subtracting the cost of goods sold, and it is expressed as a percentage of total revenue from sales. Roughly speaking, the higher the gross margin, the more efficiently a company is being run.

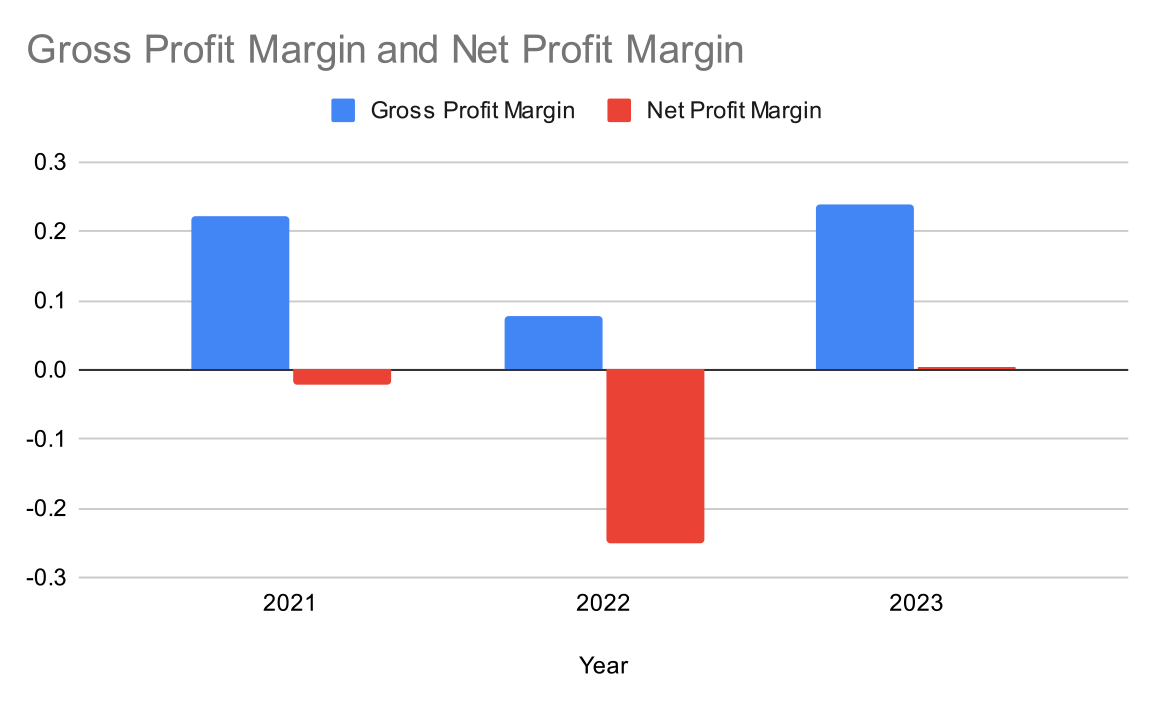

Mitchell’s typically maintains a gross profit margin between 20% and 23%. However, in 2022, its gross profit margin experienced a significant drop to 7.8%. This decline was attributed to the company’s failure to adjust product prices in response to an increase in raw material costs.

Now, this drop doesn’t necessarily have to be a bad thing. Companies often intentionally undergo a period of low gross profit margins to gain market share. But Mitchell’s was not making a strategic decision in this case. In fact, the company’s own chairman Shazad Ghaffar noted in the 2022 annual report that not increasing prices for the final product was a ‘misstep’.

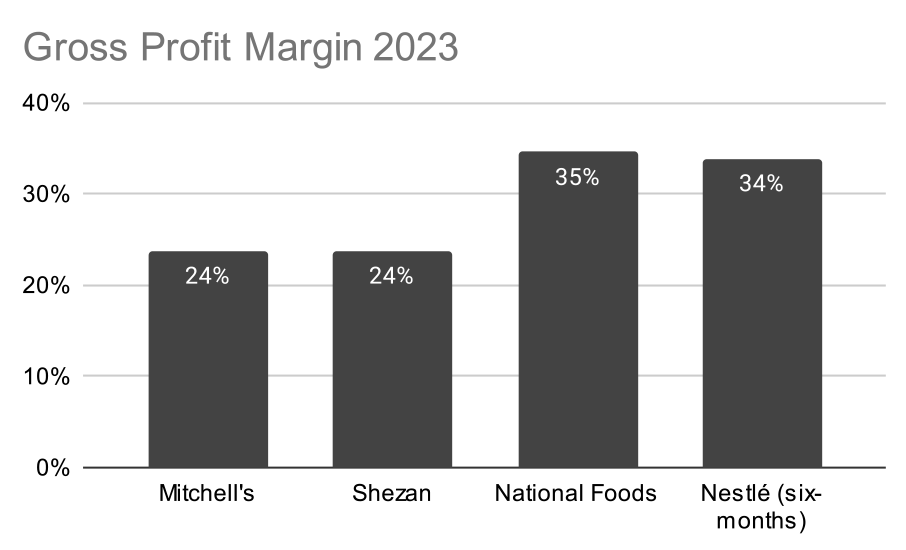

In 2023, the gross profit margin returned to a more standard level at 23.8%. This figure aligns with competitor Shezan, which maintained a gross profit margin of 23.8% in 2023. Meanwhile, both National Foods and Nestlé boasted gross profit margins exceeding 30% in 2023, suggesting that Mitchell’s might need to either increase prices or further reduce the cost of sales to enhance annual gross profit margins, ultimately leading to a better net profit.

That is because Mitchell’s still has an abysmal net profit margin: at -2.1% in 2023. In contrast, companies with gross profit margins above 30%, like National Foods and Nestle, enjoy a net profit margin of around 10%.

The analysis indicates that maintaining a gross profit margin in the 20% range barely breaks even, as observed in Mitchell’s 2021 performance with a 22.1% gross profit margin, which in turn led to a minimal net profit margin of 0.5%.

For Mitchell’s to become significantly profitable, it needs to elevate its gross profit margin to levels comparable to those of National Foods and Nestle. As mentioned earlier, quarterly reports show that the company approached a 30% gross profit margin in the second quarter but faced challenges in the third quarter, leading to a loss in the fourth quarter.

When questioned about the fourth quarter loss, a Mitchell’s representative attributed fluctuations in gross profit margin to various industry factors, including seasonal variations in specific product ranges and raw material costs.

The Mitchell’s representative said: “The shifts in gross profit margin may be a result of adapting pricing strategies for managing costs differently in different quarters.” The representative added, “Factors like fluctuations in raw material expenses, operational costs, and market competition can influence our ability to consistently sustain or increase gross profit margins.”

2024 first quarter

Seeing the fluctuating efforts of Sethi the CEO, and some glimmers of hope in the quarterly results of 2023, perhaps the market was expecting a change in the company’s outlook come the new year?

If so, the market must have still been sorely mistaken. On November 29, 2023 the company announced the quarterly results for the first quarter of fiscal year 2024.

The first good news: it was an improvement from the previous quarter, with a profit of Rs 11.1 million, and a gross profit margin of 24.9%. But that still translates into a paltry earnings per share of Rs 0.49. Projections estimate that this will be approximately Rs 2 by fiscal year end. Consider the price to earning ratio, a measure of the company’s share price to the company’s earning per share. The higher this ratio, the more overvalued one can consider a company’s stock. In the case of Mitchell’s (taking the approximate values of Rs 200 and Rs 2) that ratio is a clean 100 – an absurdly high indicator.

Valuation conundrum

Profit would like to now point your attention to another odd figure when analysing Mitchell’s financials. That would be the book value per share, or the ratio of equity to against the total number of shares outstanding. This indicates a company’s net asset value per share. In theory, it is the amount that shareholders would receive in the event that the firm was liquidated, all of the tangible assets were sold and all of the liabilities were paid. The higher this figure – and if it’s greater than the share price – then it indicates that perhaps the stock is undervalued.

That is obviously not the case at Mitchell’s. The book value per share is reported at Rs 6.29, which is very low. But it is also a bit too low. Are Mitchell’s assets fairly valued?

That’s because Mitchell values its asset on an historical cost basis. A quick recap: in accounting standards one can decide how to value assets. Either you can value your assets on a historical cost basis, which is the value of the assets, the plant, and equipment at the time you purchased them. Or, one can use fair market value, which is that every year your company gets fixed assets reevaluated, so that the correct value is reflected on the balance sheet.

So why is this relevant here? Recall that Mitchell’s has extensive farms in Okara, encompassing 47-acres as outlined in the financial reports. Reputable evaluation firms have assessed the farms to be valued currently at anywhere between Rs 40 million to Rs 70 million per acre. This could represent a severe potential undervaluation in the company’s financial reporting.

Buyers on the horizon?

But when in fact would it even be relevant to figure out whether Mitchell’s land is correctly valued? Well, if a buyer came along and decided to figure out what to offer Mitchell’s. They would have to assess what value to assign to the land, plant etc. and also what value to assign to the brand of Mitchell’s. After all, the company has been around in Pakistan for decades, and has cultivated an image over the years. That brand value is an intangible assets ie. it is not something that can be reflected on a balance sheet.

A source within Mitchell’s told Profit that even if the land was correctly valued and a buyer was willing to pay also for the value of the brand, it still would not justify the very high current share price for Mitchell’s. But then again, that would depend on if news has spread already within the market that buyers are on hand.

That is because the spike in share price is reminiscent of the company’s situation between 2019 and 2020, when the stock price experienced a stunning 77% leap, which raises questions about the driving forces behind the recent surge. Investors and analysts are puzzled whether this surge signals an impending market boost deliberately orchestrated before a potential sale, as seen in the past when the deal with Bioexyte Foods was in the pipeline.

According to an insider linked to the company, there was a notable ‘buzz’ surrounding the interest of major players looking to acquire a majority stake. These potential buyers were reportedly expressing a willingness to offer a premium for both the company’s land and brand, in addition to the listed assets.

Was the market reacting to rumours in the market? The top four contenders for the potential buyer role were: the dairy conglomerate ShakarGunj, the snacks and chocolates company Mondelez, the spices and snacks company Shan Foods, and finally industrialist Abdul Razzak Dawood’s engineering company, Descon.

Profit reached out to all four. Sources within ShakarGunj said they were not in a financial position to buy another company at the moment, to the extent that they are having difficulty paying their employees’ salaries on time. Mondelez explicitly denied any such reports. Profit was unable to receive comments from Shan Foods by the time this story was filed. Finally, Descon issued a ‘no comment’, and sources within the company said it was not actively pursuing this option.

To be clear, there has been no official confirmation yet on whether there is an active deal on the horizon. During a November 10 board meeting, the management at Mitchell’s emphasised that considerations for raising funds shouldn’t hastily be construed as a pursuit for investors or a sale. The spokesperson of Mitchell’s also denied the existence of any potential deal.

However, one source close to Mitchell’s confirmed to Profit that the sponsor shareholders are actively looking to find a buyer again. “The owner of one of the potential buyers walked away from exploring Mitchell’s acquisition, because he was uncomfortable in negotiating with Najam Sethi. But that doesn’t mean the family is not looking for other buyers”, the source said.

What’s next for Mitchell’s?

Poor gross margins, failure to raise prices, and consistent losses: it is very clear that there has been no such turnaround in the fortunes of the company. And talks of potential buyers also seem dim. So what can the bubble possibly be attributed to?

Some of it has nothing to do with Mitchell’s. A source linked to the company said that the market had generally been optimistic. The prevailing optimism had been fueled by the resurgence of IMF programs and an influx of foreign funds, and it was casting a favourable light on companies operating within this economic climate.

Additionally, Mitchel’s has made some attempts to rectify the situation. In the annual report for 2023, the company noted that it has taken some steps, including disposing of selected assets, improving its pricing and discount structure, and exploring new geographical markets for increasing export sales. It was also expanding new business avenues like toll manufacturing. Mitchell’s is also negotiating for the continuance of the existing capital lines and exploring the possibility of entering into further loan agreement with the sponsors of the company.

The same was reiterated to Profit : that new strategies could involve debt restructuring or exploring growth opportunities, with the specifics outlined in the forthcoming corporate plan.

Will it be too little too late? Sethi as CEO still has to actually make the difficult decisions to revamp pricing and sort out revenue streams to get Mitchell’s into a marginally healthier position. To recall, the auditors are not particularly optimistic about the company’s future. The share price bubble will burst – as it has already shown of dropping – and when it does, the buzz will die down, the rumoured buyers will exit imagination, and the management will be left picking up the pieces of an half-century old company, to see if it can make it in this century as well. Unless, there is something that “the market” knows, that no one else does.

a lovely article. very well written in a very narrative style. Do keep them coming especially regarding MCSI stocks.

a very beautiful piece. extremely well written in a narrative fashion. Please continue, especially with regard to MCSI stocks.

Detailed and informative article. Thank you for sharing insight of my favorite childhood company.

very well covered from every angle !

Great insightful article