On 14th December, a leading English newspaper published an opinion piece by the title “What’s up at the stock market?” The fact that the write-up showed little understanding of the stock market needs no mention. But it becomes alarming when an attempt is made to understand a larger-than-life scenario in a few words. It would be like trying to write a page length summary of War and Peace expecting to get all the nuance and significance of the literary masterpiece.

What is in the op-ed?

Let’s start off by trying to understand what the writer has tried to say. The writer admits outright that he rarely writes about the stock market and that he has a pessimistic view even when he does write. This already sets the expectation that he is not going to laud the market for its recent rally.

The skepticism shown here is warranted to an extent. Too many times in the past, the rally and gains in the stock market have been artificial in nature and have left retail investors holding the short end of the stick. This publication recently did a series on the three stock market crashes seen in a span of nine years at the Karachi Stock Exchange.

So it is no surprise that the op-ed’s central theme is that the current rise needs to be seen with some suspicion. The rise is seen as being made up of 22,500 points which have primarily been made up of two sectors: banking and energy, where energy includes the fertiliser sector. Banks and energy have a high weightage in the KSE 100 index, and as these companies will see an increase, so will the index.

Is the increase justified by the rise in earnings of these two sectors? The writer highlights the fact that out of Rs 417 billion of profits after tax seen for the first quarter, more than a third are from banks totalling Rs 149 billion, while Rs 30 billion are from oil marketing companies alone. Even based on their past results, this is a huge increase for both sectors. Banks have earned due to high interest rates, while oil marketing companies have profited from the depreciating currency and inventory gains.

The op-ed also mentions this idea of the ‘bad broker’, who is seen as being an agent of only a few clients and high net worth individuals. He is responsible for pumping the market in the direction which one or two clients want, while the broker is able to disadvantage all his remaining clientele to benefit a few. There is little economic relevance to the market turning the corner – instead, it is funded by a few brokers and their clients.

What is not in the op-ed?

The writer leaves out some key insights from his piece which need to be mentioned.

First, let us address the earnings question. As mentioned earlier, banks have earned due to high interest rates, while oil marketing companies have profited from the depreciating currency and inventory gains. The writer is correct in regards to the main factor behind the earnings of these two sectors – but there is a need to widen the scope of the study. The market has still seen a further rise in profits, and the writer fails to take into account the other Rs 238 billion that have been earned in after tax profits. These make up more than 57% of the remaining profits.

Secondly, and more importantly, let us examine the short-term view. It is true that the market has increased from 40,000 points on June 23, 2023 to 66,500 on December 12, 2023, which is an increase of 66.3%. Out of this total increase, 45% is contributed by the banking and energy sector including the fertilizer sector. The remaining 21% has come from the remaining index constituents. Is the writer correct?

Not quite. The KSE 100 index is weighted in such a manner which means that 60% of the weightage is given to the banking and energy sector while the remaining is made up by the rest of the index. This would mean that when index increases by 100 points, 60 points are expected to come from these two sectors while the remaining will come from the other companies. When things are put in that context, it can be expected that the whole index has gained and rather than just a few sectors, the whole index has seen an increase.

What is the analysis company wise? Considering the increase seen in individual shares, 18 companies have seen an increase of more than 70% which are part of the banking and energy sector in the period analysed. An additional piece of information that is needed here is the fact that there are also 16 other index constituents which have seen an increase of more than 70% which are not part of these sectors.

| Company | Sector | Weightage | Return |

| K-Electric Limited | Energy | 0.70% | 176.83% |

| Service Industries Limited | Leather & Tanneries | 0.65% | 166.30% |

| Fauji Fertilizer Bin Qasim Limited | Fertilizer | 0.64% | 155.70% |

| National Refinery Limited | Energy | 0.41% | 150.63% |

| Pak Elektron Limited | Cable & Electric | 0.50% | 148.46% |

| Interloop Limited | Textile | 0.90% | 116.68% |

| Bank AL Habib Limited | Bank | 2.68% | 112.70% |

| Attock Refinery Limited | Energy | 0.66% | 108.41% |

| Pakistan State Oil Company Limited | Energy | 1.98% | 107.88% |

| Askari Bank Limited | Bank | 0.49% | 106.27% |

| Habib Metropolitan Bank Limited | Bank | 1.19% | 106.25% |

| International Steels Limited | Steel | 0.54% | 105.62% |

| International Industries Limited | Engineering | 0.43% | 105.57% |

| Thal Limited | Auto | 0.52% | 105.26% |

| Meezan Bank Limited | Bank | 3.32% | 104.55% |

| Pakistan Petroleum Limited | Energy | 3.79% | 104.04% |

| Pakistan Tobacco Company Limited | Paper & Board | 0.68% | 94.51% |

| National Bank of Pakistan | Bank | 0.83% | 93.89% |

| Unity Foods Limited | Food & Personal Care | 0.49% | 91.31% |

| Pakistan Telecommunication Company Ltd | IT | 0.41% | 90.81% |

| The Bank of Punjab | Bank | 0.50% | 89.66% |

| The Hub Power Company Limited | Energy | 5.42% | 87.89% |

| Pak-Gulf Leasing Company Limited | Financial Services | 0.00% | 83.45% |

| Habib Bank Limited | Bank | 3.38% | 81.49% |

| Cnergyico PK Limited | Energy | 0.46% | 79.57% |

| Bank Alfalah Limited | Bank | 1.67% | 79.34% |

| Kohinoor Textile Mills Limited | Textile | 0.23% | 79.13% |

| Yousaf Weaving Mills Limited | Textile | 0.01% | 76.32% |

| Sui Northern Gas Pipelines Limited | Energy | 1.02% | 74.15% |

| Pakistan International Bulk Terminal | Transport | 0.30% | 73.57% |

| Standard Chartered Bank (Pak) Ltd | Bank | 0.32% | 73.10% |

| Frieslandcampina Engro Pakistan Limited | Food & Personal Care | 0.33% | 72.58% |

| Pakistan Stock Exchange Limited | Financial Services | 0.27% | 71.14% |

| Fauji Cement Company Limited | Cement | 0.80% | 71.08% |

Similarly, once accounting for weightages, 23 companies from the banking and energy sector contributed more than 0.5% each and 13 other companies also increased by more than 0.5% each. In short, it can be seen that it is not only these two sectors which have contributed to the gain but other sectors have also contributed to the increase.

| Company | Sector | Weightage | Return | Weighted Return |

| The Hub Power Company Limited | Energy | 5.42% | 87.89% | 4.76% |

| Pakistan Petroleum Limited | Energy | 3.79% | 104.04% | 3.94% |

| Meezan Bank Limited | Bank | 3.32% | 104.55% | 3.47% |

| Bank AL Habib Limited | Bank | 2.68% | 112.70% | 3.02% |

| Habib Bank Limited | Bank | 3.38% | 81.49% | 2.75% |

| United Bank Limited | Bank | 3.99% | 68.02% | 2.71% |

| Oil & Gas Development Company Limited | Energy | 3.72% | 68.20% | 2.54% |

| MCB Bank Limited | Bank | 3.56% | 68.74% | 2.45% |

| Pakistan State Oil Company Limited | Energy | 1.98% | 107.88% | 2.14% |

| Lucky Cement Limited | Cement | 3.46% | 57.58% | 1.99% |

| Millat Tractors Limited | Auto | 2.55% | 64.47% | 1.64% |

| Engro Fertilizers Limited | Fertilizer | 3.11% | 43.33% | 1.35% |

| Bank Alfalah Limited | Bank | 1.67% | 79.34% | 1.32% |

| Habib Metropolitan Bank Limited | Bank | 1.19% | 106.25% | 1.26% |

| K-Electric Limited | Energy | 0.70% | 176.83% | 1.24% |

| Mari Petroleum Company Limited | Energy | 2.61% | 44.34% | 1.16% |

| Engro Corporation Limited | Fertilizer | 3.98% | 27.37% | 1.09% |

| Service Industries Limited | Leather & Tanneries | 0.65% | 166.30% | 1.08% |

| Interloop Limited | Textile | 0.90% | 116.68% | 1.05% |

| Fauji Fertilizer Bin Qasim Limited | Fertilizer | 0.64% | 155.70% | 1.00% |

| Fauji Fertilizer Company Limited | Fertilizer | 3.83% | 23.83% | 0.91% |

| Colgate-Palmolive (Pakistan) Limited | FMCG | 1.82% | 49.68% | 0.90% |

| National Bank of Pakistan | Bank | 0.83% | 93.89% | 0.78% |

| Dawood Hercules Corporation Limited | Fertilizer | 2.01% | 38.16% | 0.77% |

| Sui Northern Gas Pipelines Limited | Energy | 1.02% | 74.15% | 0.76% |

| Pak Elektron Limited | Cable & Electric | 0.50% | 148.46% | 0.74% |

| Attock Refinery Limited | Energy | 0.66% | 108.41% | 0.72% |

| Pakistan Tobacco Company Limited | Paper & Board | 0.68% | 94.51% | 0.64% |

| National Refinery Limited | Energy | 0.41% | 150.63% | 0.62% |

| Systems Limited | IT | 3.60% | 16.35% | 0.59% |

| International Steels Limited | Steel | 0.54% | 105.62% | 0.57% |

| Fauji Cement Company Limited | Cement | 0.80% | 71.08% | 0.57% |

| D.G. Khan Cement Company Limited | Cement | 0.82% | 67.17% | 0.55% |

| Thal Limited | Auto | 0.52% | 105.26% | 0.55% |

| Askari Bank Limited | Bank | 0.49% | 106.27% | 0.52% |

| Maple Leaf Cement Factory Limited | Cement | 0.92% | 56.17% | 0.52% |

When the context of all share index is considered, the situation gets more interesting. From the period of June till December, there were 48 companies which saw a return of more than 100%. Banking and energy only made up 10 of these companies while the remaining were companies that trade on the stock market but are not part of the KSE 100 index..

The writer posits that most of the index has seen a rise which is based on just two sectors. But in fact the stock market has actually seen a much wider sale increase in both index related and shares not part of the index.

This can lead to additional worries of bubbles being created, and that can be addressed with mechanisms developed by the stock exchange. However, this does not mean that the index has only increased due to movement in these two sectors.

The evil stockbroker

The second part of the op-ed deals with the notion that the evil stock brokers are able to dictate the movement of shares. These are stock brokers who are able to game the system for some of their clients, and benefit a few among them.

I strongly disagree with this notion. The fact of the matter is that no broker in the market is so large that he can cause and sustain a rally of this magnitude for this long. As already shown, the movement is taking place all across the board and no broker has the resources to be able to lead to such a sustained rally by themself. Even if they are able to join forces, they still do not have the capital to be able to lead to a rally like the one seen recently.

Even if it is agreed upon that clients are being disadvantaged by selling snake oil to smaller investors, how is this model sustainable? Once this rally is over, and one is able to dupe retail investors in losing their money, how will the broker sustain himself in the future?

Here, let us recap what the market is and who its participants are. On the face of it, the market is made up of buyers and sellers. In order to buy from the market, there has to be someone who is willing to sell their shares.

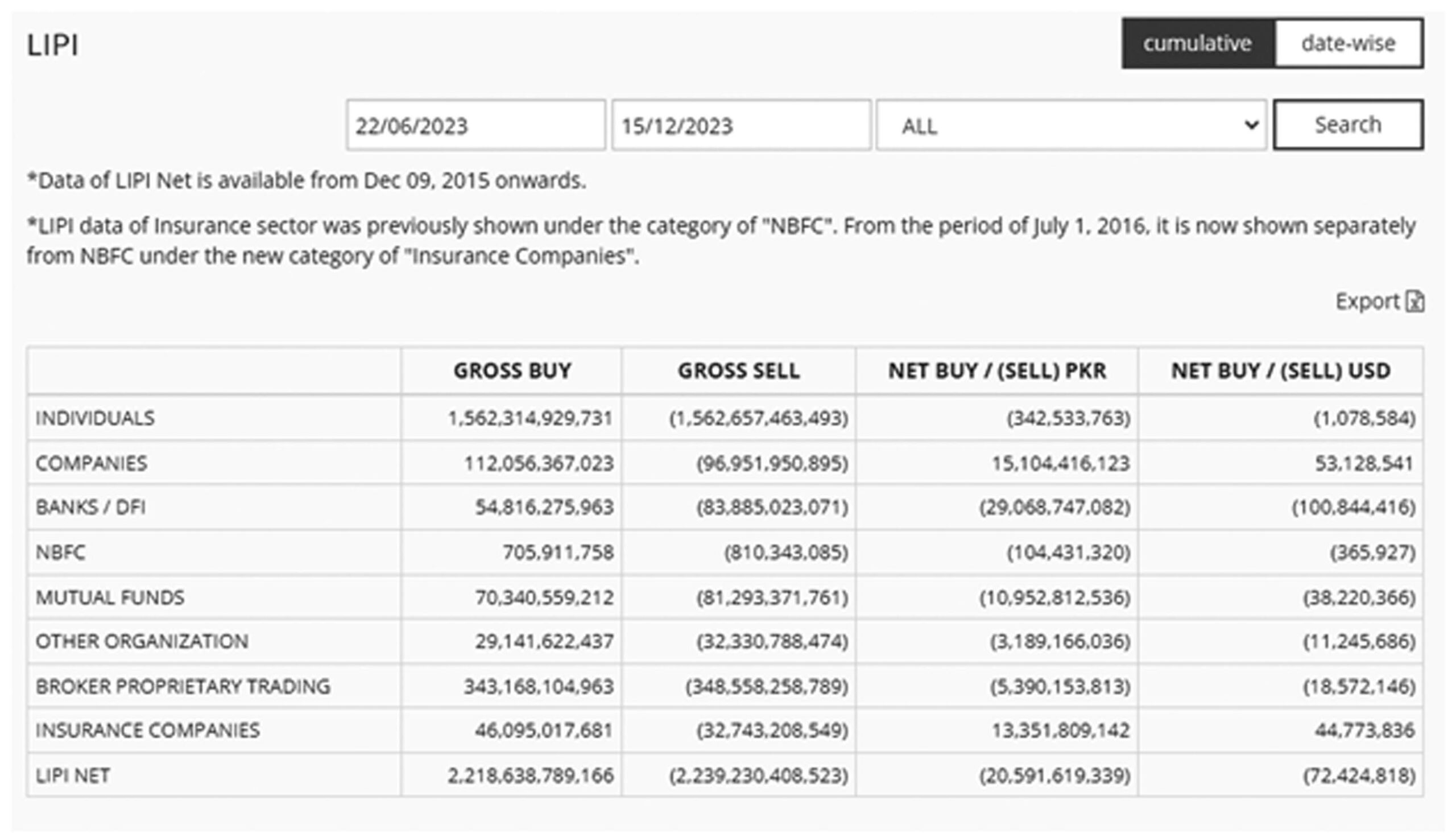

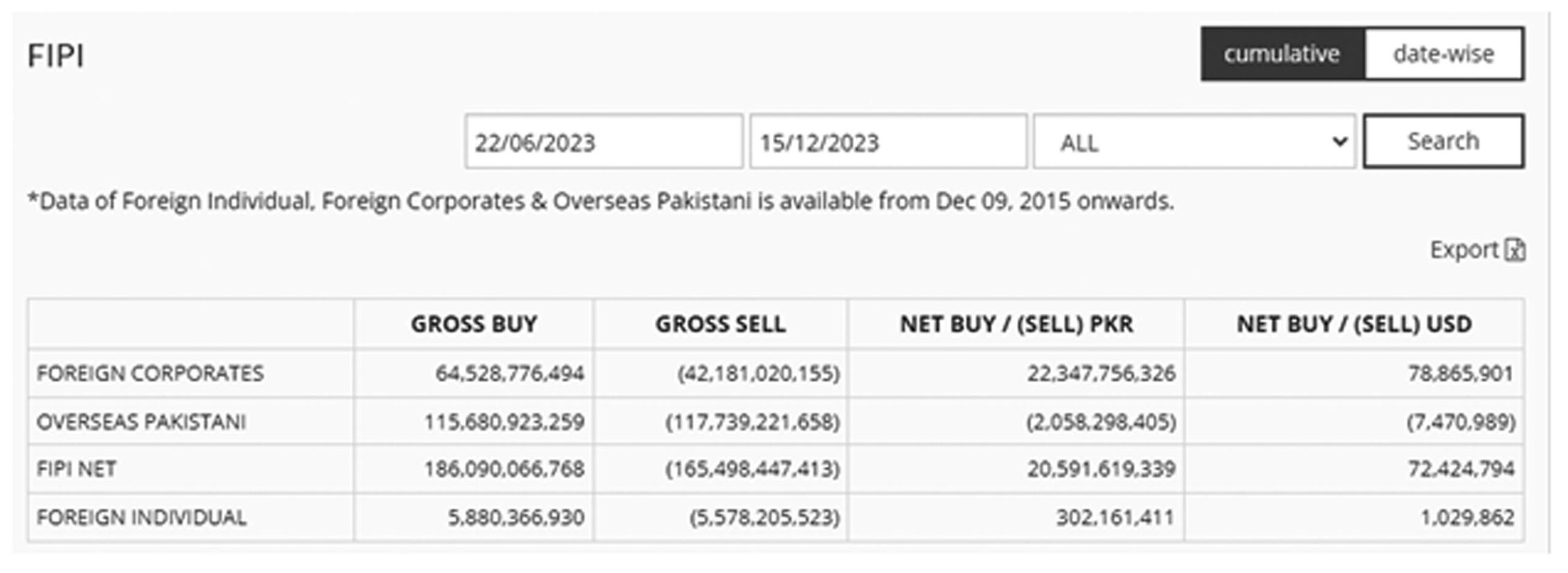

But it is important to understand who is buying and who is selling. Pakistan is able to get investments from outside its own borders where foreigners can trade in the stock market. This is known as Foreign Investors Portfolio Investments (FIPI). Similarly, when local investors invest in the market, these are known as Local Investors Portfolio Investment (LIPI). Both these categories are made up of individuals and corporations who invest and divest their shares in the market. In terms of LIPI, trade data is also broken down for individuals, companies, banks, non-banking financial companies, mutual funds, brokers themselves, insurance companies and other organizations that might wish to invest in the stock market.

The trade data for FIPI from June 23, 2023 to December 15, 2023 shows that foreigners were net buyers of $72 million. This means that foreign investors, who have their own research to back their decision making of investment, invested in the market. Brokers can have the best manipulative powers in the world but to make a foreign investor fall for your trap would seem highly unlikely. Foreign investors have a long term view towards investment and have to justify their investment rather than say ‘the broker asked me to invest’.

In terms of LIPI, most of the buying was carried out by companies and insurance companies, while individuals and brokers sold their shares. Again, seeing only the sale would point towards shares being offloaded but the shares were bought by companies and insurance companies who have investment committee and advisory bodies who dictate how investment has to be carried out. The investment committees have to rationalize every investment decision before they follow through on it.

The need for a better understanding

It might seem like a good idea to have someone to blame and someone to target when a rally is going on in the market. After all, if an asset bubble is being created, the best course of action would be to point it out to investors beforehand.

The problem begins when an incomplete picture is used to make a judgment. Just like the tail of three blind men seeing something different rather than the elephant in the room, there is a need to take all factors into consideration before a judgment is made.

The real winners, losers and the one left ‘holding the bag’ will be revealed in due time. Even I don’t feign to know the actual reasons behind this rally and am able to separate the fact from fiction. However, the op-ed feels like a knee jerk reaction on the basis of few facts, and it fails to take into account all factors relevant in this rally. This rebuttal is a small attempt to provide some reason to the recent rise.

Highly Recommended!

Very insightful, i will also say this here. Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto at some point not until saw a recommendation on Elon musk successfully success story and I got a proficient trader/broker Mr Bernie Doran , he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony; I have made total returns of $10,500.00 from an investment of just $1000.00 within 1 week. Thanks to Mr Bernie I’m really grateful,I have been able to make a great returns trading with his signals and strategies .I urge anyone interested in INVESTMENT to take bold step in investing in the Cryptocurrency Market, you can reach him on WhatsApp : +1(424) 285-0682 or his Gmail : BERNIEDORANSIGNALS@ GMAIL. COM bitcoin is taking over the world, tell him I referred you

It`s a fantastic posting.