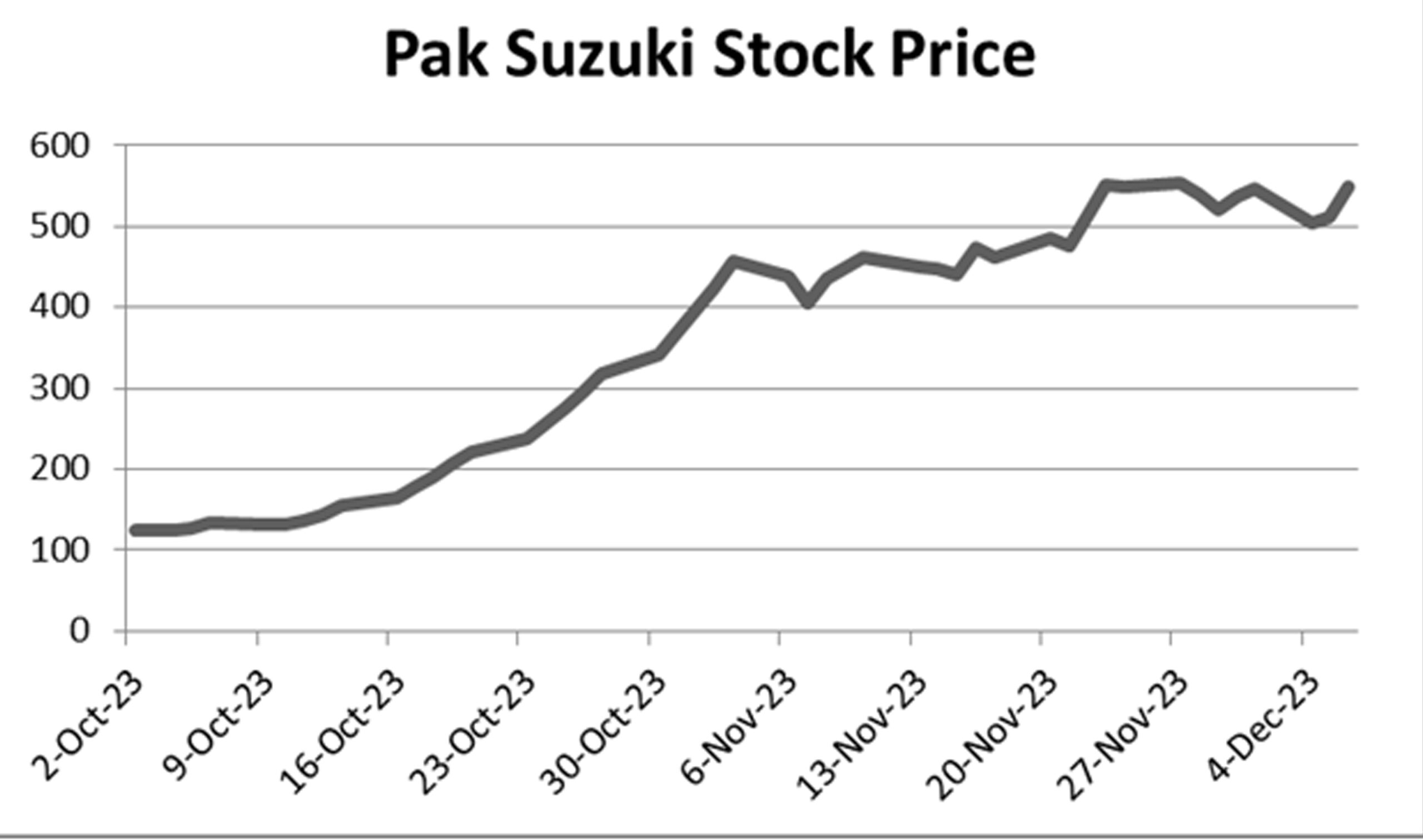

For those who follow the stock market, Pak Suzuki Motors Company Limited is the talk of the town. The share price of the company jumped from Rs 136 on 11th October 2023 to Rs 673 on January 6, 2024. This is a return of 400% in a period of less than three months.

So why did the price soar? In simple terms, the company announced a buyback and voluntary delisting, which means that they are offering to buy the remaining shares held in the market and delisting the company. The market has responded positively, to put it mildly.

What is the issue then? Well, it is a case of valuation discrepancy. Ever since the buyback and voluntary delisting was announced, the market waited with bated breath to see what was going to be the rate at which the buyback would take place. On December 4, the company set the minimum purchase price at Rs 406 per share.

This leads to the main conundrum: why are investors willing to purchase the shares from the market at Rs 673, when the company has announced a minimum price of Rs 406 per share? Or put another way, why is there such a huge discrepancy in the two valuations, and which valuation is correct?

A mixed financial performance

The company’s recent performance has been mixed, to say the least. The problems stem from the fact that the company – and the whole industry – faced a multitude of challenges. These included historically low vehicle sales and import restrictions by the State Bank of Pakistan (SBP) due to lower exchange reserves. As raw material became scarce, the company saw rising raw material costs eating into its gross margin and the companies had to carry out frequent non-production days.

As the policy rate soared, it led to higher auto financing rates. The year also saw relentless depreciation of the Pakistani rupee against the US dollar, imposition of tariffs and additional GST as part of the government’s efforts to tighten policy. All these factors compounded and translated into declining sales and high operational costs, leading to low valuations for major listed players operating in the segment.

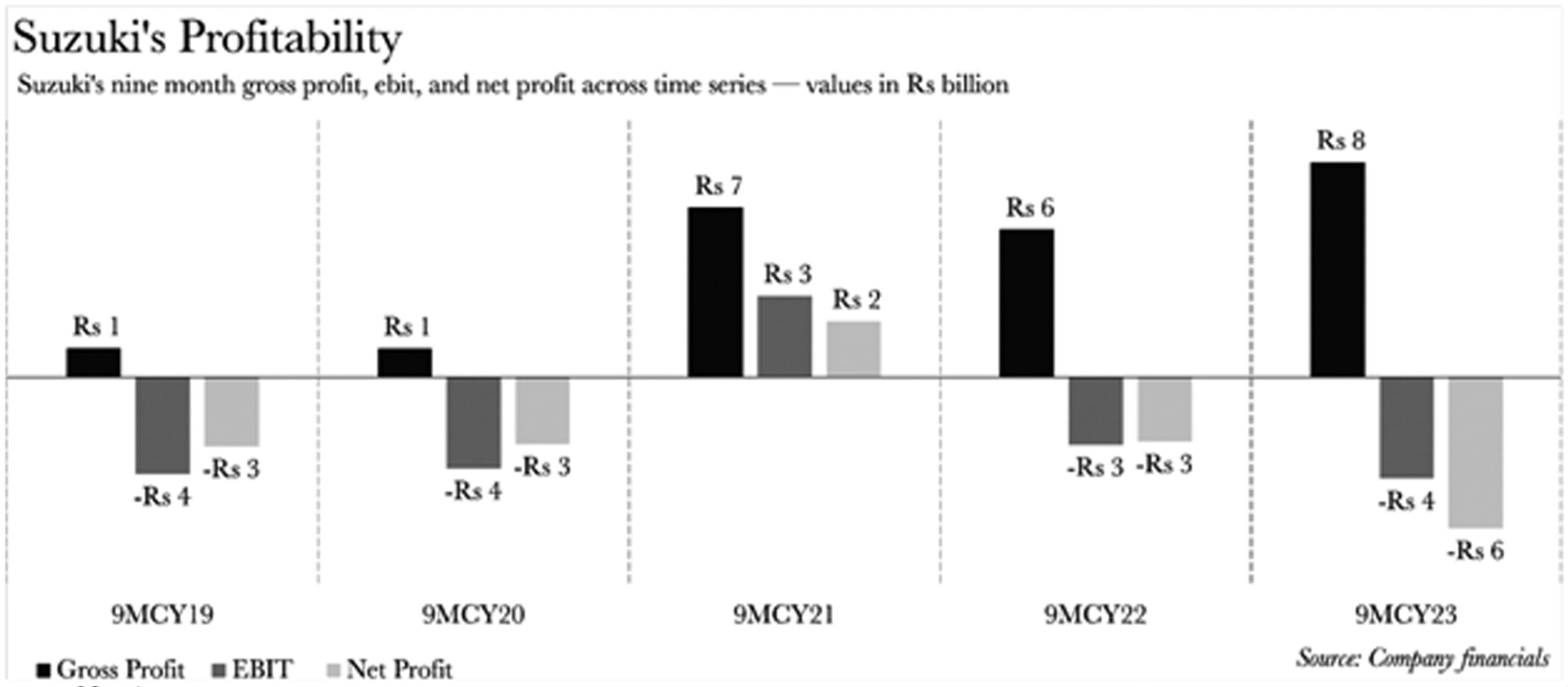

The story for Suzuki wasn’t any different. Recent annual statements for 2022 show that the company was able to increase its gross profit margin from 2.8% to 5.7% by year end, due to average operating losses shrinking. However, the net profit margin declined from -1% and grew to -3%, owing to rising interest rates and markup being paid to customers.

The last quarter of fiscal year 2023 has been much more promising for the company, where the gross profit margin went from 9% at the end of first quarter to 14.5%, which coincided with an increase in sales. The company was able to grow its margins due to stable currency. Similarly, operating margin increased from 1% in the first quarter to 11% in the latest quarter, while net profit margin improved from nearly -59% to 13%. The dramatic shift in net margins was due to the fact that the company booked much of its cumulative exchange losses in the first quarter of 2023, easing off the operating cost pressures in the recent two quarters.

Additionally, the working capital situation for the company also improved as the cash margin restrictions were removed by the SBP, which allowed Pak Suzuki to free up a significant amount of capital.

The buyback being announced

Suzuki announced on October 12, 2023, that it was going to hold a board meeting in a week’s time to voluntarily buy back its own shares. The board of directors were going to consider the request made by the majority shareholder who wanted to buy back all the shares available in the market after which they would be able to delist the company from the market. The biggest shareholder in Pak Suzuki is the Suzuki Motor Company in Japan.

In response to this notification, the share price shot up from Rs 136 to trading at Rs 589 as on December 7, 2023. This indicates the market realized that the shares were trading at a price lower than the fair value at which the company would be purchasing the shares back.

At this juncture, it is important to understand that the PSX has set out certain rules which dictate how voluntary buyback and delisting has to be carried out.

The reason given for the buyback (to be carried out by the majority shareholder, Suzuki Motor Company Japan) was that the company had been making losses for three of the last four years, and the share price was recorded at lowest levels in its history. This would be a good way to provide a fair exit to the minority shareholders who made up 26.9% of the shareholding (Suzuki Motor Company Japan holds 73.1%).

The process of voluntary delisting

After the company announced to the PSX that they were interested in a buyback, the next step is to determine the price at which the buyback has to take place. Clause 5.14.2 of the PSX regulations states there are five criterias for this. The price should not be less than:

- Weighted average closing market price of the last five days preceding the date of board meeting in which the company resolved to delist. This would have meant the price would have been around Rs 135.

- The three year weighted average market price one day preceding the date of the board meeting in which delisting is resolved. This would have made the price equal to Rs 201.

- Price to earning multiple approach which can be used based on the recent earnings of the company and price to earning multiple of other comparable companies in the market to determine a market price. This is not applicable in this case as the recent annual and quarterly accounts show that the company made a loss.

- The highest price at which the sponsor bought the shares of the company in the market. This is not applicable as the sponsors did not buy any additional shares in the last year or so.

- The intrinsic value of share after the revaluation of assets has been carried out by an independent valuator which has been chosen by the PSX and shall not be older than three months from the date of application of delisting. The purvey of the auditor and the assets being assessed can include any factor that is seen as being relevant by the auditor. This value cannot be determined as there are many assets, like freehold land, held by the company which will need to be revalued before a definite figure can be given.

The last point is the most important one as it seems that this measure is being used by the company and the market in order to determine the purchase price that will prevail in the end. The company is providing for a purchase price as a lower end of the spectrum and it seems that the market is valuing the shares at a much higher rate using this method.

Independent valuation and need for transparency

After carrying out its due diligence, the company announced on December 4, 2023 that it was going to buy the 22,145,760 shares floating in the market, which made up 26.9% of the total shareholding at a minimum purchase price of Rs 406 per share. Arif Habib was made the purchase agent who would be tasked with carrying out the process, and the company was looking for an approval from the PSX.

In the documentation and formalities that have to be provided by the company, one requirement is the valuation report by an independent valuator and an auditor’s certificate that certifies the intrinsic value per share. The valuation was carried out by Iqbal A. Nanjee & Co. (Pvt) Limited.

Even though the annexures have been filed with the PSX, these are not available for the market. Why is this a point of concern? Disclosures are integral for the market to know what is going on inside the company. The company can feel that this is arbitrary and the final number will be determined by the PSX after its own valuation. Still, the fact that this number is not being disclosed should raise some concerns. Just like when the company needs investors to invest in the company, they need to be transparent, this transparency is not evident in this case.

This is one of the reasons why the purchase price determined is shrouded in some secrecy. If these annexures were made public, it could be seen how the valuation had been carried out by the company and whether there are items which have not been included in the final calculations. As these annexures are not made public, there can be some speculation and distrust in regards to the valuation being carried out. If these are made available to the public, it will help them connect a few of the dots in terms of how the company is valuing some of its own assets and how the valuator sees these assets in terms of their valuation.

The final valuation to be carried out

The final verdict in this tug of war still lies with the PSX. According to Clause 5.14.4, the exchange shall determine the minimum purchase price which cannot be less than the buyback price criteria. This clause also gives the power to the PSX to add in any additional factors that they feel should be accounted for when the price of the shares is being determined.

Based on its own accounts, the company saw that the book value per share was at Rs 240 at the year end 2022 and subsequent losses in the nine months since then have dragged down the value further to Rs 169 per share. This is based on the fact that if the company decides to close shop and sell everything, this is what the value of the shares should be. Another fact to be considered is that the accounts have not revalued certain assets which will be revalued for the delisting.

The freehold land that the company bought in 2008 is one example of asset which is being shown at its cost when it was purchased and needs to be revalued upwards. The land was bought for Rs 373 million in 2008 and is located at Tragga Manga Mandi, Multan Road, Lahore. This land is over an area of 247 Kanals, 19 Marlas and 200 square feet. The current cost this asset was shown as at end of fiscal year 2022 was at Rs 371.5 million.

In addition to that, there are other assets like buildings on the freehold land and the leasehold land under Pak Suzuki’s control which will be revalued which will drive the book value further upwards. Once all this is taken into account, it is not wonder that the book value per share will increase. Speaking to some industry experts, there is a view that the actual value of the buyback should be between Rs 500 and Rs 600, based on how the valuation of the assets is carried out. The annexures and calculations have been filed with the relevant authorities.

Quantum Leap

The PSX has set a quantum or threshold that needs to be crossed. Clause 5.14.5 states that if a sponsor initially had a shareholding of less than 90%, they need to at least increase their holding to 90% to qualify for the delisting. In cases where their shareholdings are above 90%, they do not need to carry out any mandatory additional purchase to qualify for the delisting.

This is an important rule for two reasons. The first reason is that it gives the minority the assurity that purchase will be carried out and the sponsor will have to make a bid higher than the minimum purchase price in order to get the shares in the market. A band of investors can join together and demand a higher purchase price if they seem it is reasonable. This action can also make the exchange take notice and take this as a factor under consideration when they are determining the purchase price themselves.

This is one of the reasons that investors who already hold the shares or are willing to buy the shares as they feel that they can get a higher price for their shares as they have bonded together. Once the majority shareholder starts to buy these shares, the signal from the market will show that the investors are not willing to settle for a price lower than the one prevailing in the market.

The second reason this is an effective regulation is the fact that companies cannot be blackmailed by a small portion of the minority shareholders into paying through the nose for the buyback. As the threshold is set at 90%, the majority does not have to buy all the shares in the market and can ignore a small part of the minority shareholders who are holding out. In this case, one percent of the shareholders cannot force the company to pay Rs 1000 for shares which other shareholders are willing to sell for much less.

What happens from here?

It needs to be understood here that there is a tug of war that is initiated with a voluntary buyback and delisting is being carried out. The market can feel a certain way, while the company can itself look to respond in their own manner. In this war, the first salvo was fired by the market when the share price increased by four folds over the course of two months. In response, the company also gave a purchase price which was much lower than the market value on the day.

The purchase price spooked the market so much so that the announcement of the price came at 2:52 PM, and before the market closed at 3:30 PM, the share went from its upper lock to its lower lock which is a price movement of 15% in a day. The next day, sanity was restored when the market stabilized and the price started increasing again. Why was this the case? The market came to the realization that the company was low balling as the first move in the negotiation and that either the PSX or the company will end up increasing the price eventually.

Just like when you go to a shop and are told that something is for Rs 500, there is a natural instinct to bargain and say that you will buy it for Rs 100. This tells the shopkeeper that you are willing to buy but the price is too high. What ends up happening is that a compromise is reached where the shopkeeper decreases his expectation while you increase what you are willing to pay. This will happen in this case as well as the company and the market will end up meeting in the middle somewhere.

The reason for delisting

Even though this story is mostly about the valuation carried out by the company and the market, a side note needs to be made for the company’s reason to delist. The company feels that it has made losses in three of the last four years and that it has not given out any dividend. In addition to that, the share price of the company is trading at an all time low and that due to low volumes, shareholders do not have a chance to exit the market.

The company also states that it wants to buy back all the shares of the company while committing its future to the Pakistani market in the long term. They feel that they need to stay in Pakistan as part of its long term strategy.

At first sight, this might seem like a credible enough reason, but this seems like a slap in the face of the investors themselves. The company is saying that they feel they know what is better for the shareholders themselves and that rather than giving a choice to the shareholders whether they want to stay invested in the company, they are making a decision for them. In addition to that, the shareholders might feel that the company will turn around and have a belief in better days to come, however, the company is strong-arming them into making a decision.

There are three possible reasons for this buyback. One possible reason could be that the company feels that, due to lack of chances to repatriate their earnings or dividends, it is better to leave the country as the State Bank of Pakistan has restricted foreign currency to be sent. They can do so by buying back all of its shares and then finding a buyer who would want to buy the whole company from Suzuki Motor Company Japan.

Another reason could be that the company wants to limit dissemination of information to the market and lessen its compliance workload by delisting from the market. Now every small development will not have to be disclosed when it takes place. Companies have been known to delist as they feel the burden of compliance and cost of listing is too much for a company and they can opt to delist in order to get rid of this burden.

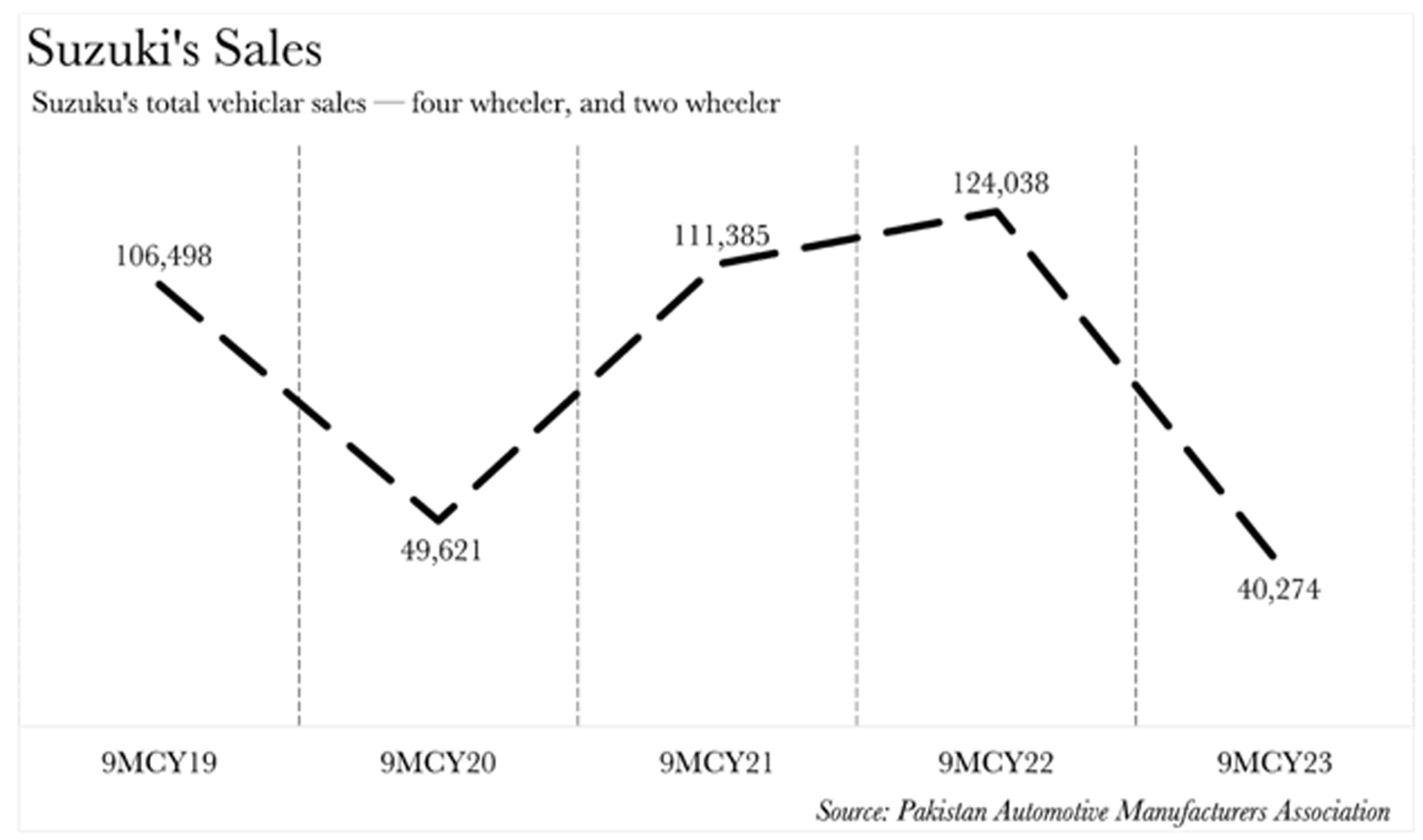

Lastly, the company may feel that they are going to turn a corner. Recent accounts show that exchange losses, markup on booked vehicles and other loss making heads in the accounts have been realized and booked. The first quarter of the company saw a loss per share of Rs 156.9 in March 2023. These losses turned into profits of Rs 39.4 per share by June, and increased to Rs 46.2 by September. The losses the company was making have reversed and due to exchange losses being realized, the company was able to bear fruit from the stable exchange rate in the last two quarters. The same upswing has also been seen in terms of sales of vehicles and motorcycles which are now back to their 2018 levels, while motorcycle sales have increased by more than two folds from their low in 2020.

The increase in sales and the stabilization in the currency shows that the company might have turned the page financially speaking, and expects better results in the coming months. Additionally, as the policy rate is expected to gradually decrease over the coming months, lending at the auto front might accelerate. This will ultimately reflect through an uptick in Suzuki’s sales volume.

“Suzuki, along with other automobile players, was adversely affected by the increase in the policy rate, which effectively hampered the auto lending segment. Furthermore, the significant depreciation of the rupee and rampant inflation have eroded the disposable incomes of the urban middle-class population, which constitutes the target customer base for Suzuki. However, as the policy rate gradually decreases, there is the potential for a rebound in lending and auto sales, benefiting the company. Suzuki still maintains its dominant position in the 1000cc and below segment. Additionally, incomes are expected to adjust upwards in the next year or two, partially restoring the purchasing power of Suzuki’s target customers,” remarked, Yousuf Farooq, director of research at Chase Securities.

The company might want to earn those profits directly and take them into their own records by buying back all shares from the market as well.

Whatever the reason for the delisting will become evident in a few months time. What needs to happen right now is for the disclosure of the proper valuation, and all workings and annexures given to the market so they can make a more informed decision for themselves going forward.

Pak Suzuki Motors is making headlines with a 400% stock price jump in less than three months. The buzz is due to a buyback and delisting move, and the market loves it!

Please everyone should be careful and stop being deceived by all these brokers and account managers, they scammed me over $350,000 of my investment capital, they kept on requesting for extra funds before a withdrawal request can be accepted and processed, in the end, I lost all my money. All efforts to reach out to their customer support desk had declined, I found it very hard to move on. God so kind I followed a broadcast that teaches on how scammed victims can recover their fund, I contacted:[email protected], the email provided for consultation, I got feedback after some hours and I was asked to provide all legal details concerning my investment, I did exactly what they instructed me to do without delay, to my greatest surprise I was able to recover my money back including my profit which my capital generated. I said I will not hold this to myself but share it to the public so that all scammed victims can get their funds back.

Contact:[email protected]

WhatsApp: +1(580)447–0130.

I’m surprised at the limited intellect shown in this article. Buy back and delisting are two different matters. Buy back is company buying. Sponsor buying is different. Delisting is sponsor buying to delist. It has nothing to do with remittances. The issue is that the majority shareholder has made serious policy mistakes, almost wiped out capital, is at risk of being answerable. There is a conflict where they want to buy more and delist so that they get a good price after massive losses due to policy error and shut the potential liability of mismanaging the company when Pakistan imposed currency controls. Yes they are positive on Pakistan because we are a high ROE market in good times, Suzuki Japan is a only 4.5% ROE market. Suzuki Japan is buying back its own shares to improve ROE, so naturally they’ll do the same in Pakistan. They are having to support the Pakistani operation because of their policy errors so they may as well buy equity instead of loaning or replenishing the losses if found negligent.

The analysis is too sketchy for anyone to read. Should have been brief and to the point.

The company might need to gain those benefits straightforwardly and take them into their claim records by buying back all offers from the advertise as well.

suzuki japan should be kicked out of Pakistan as they are ruining the notorious name pakistan has earned.

Suzuki Japan is using PSX’s weak, poorly drafted delisting rules to their favour. These delisting rules value any company on short term profitability which was affected due to peculiar circumstances of Pakistan. Minority shareholders should be paid current replacement price of Suzuki’s assembling plants plus a fair goodwill price.