On Thursday, February 1, 2024, the Pakistan Bureau of Statistics (PBS) released the inflation figures for the month of January. The price levels saw a rise of 28.34% compared to the same period a year ago, providing a slight relief from December’s figure of 29.66%.

Still, the country’s inflation rate continues to remain elevated and is currently the highest in Asia. This highlights a significant trend that every political party is promising to address once they assume office after the upcoming general elections, which are scheduled on February 8.

The economic fundamentals and the ground reality, however, suggest that the claims might be mere lip service and sloganeering as the country’s economic future hangs by a thread awaiting the transition from the existing International Monetary Fund’s (IMF) Stand-by Agreement (SBA), ending in March, to a long term Extended Fund Facility.

The Inflation Conundrum

Keeping track of price levels has proven to be a challenging task for policymakers in recent years. The State Bank of Pakistan (SBP) has not met its medium-term inflation expectations since 2020. From 2020 to 2023, the SBP had anticipated a medium-term inflation rate of around 5-7%.

Moving into 2024, the central bank continues to base its decisions on similar expectations. According to the SBP’s Monetary Policy Statement released on January 29, the committee believes that the real interest rate will remain significantly positive over the next 12 months, as inflation is expected to decrease. Additionally, the SBP has maintained its medium-term inflation target of 5-7% aiming to achieve it by September 2025.

However, the recent energy price hikes remain a significant threat.

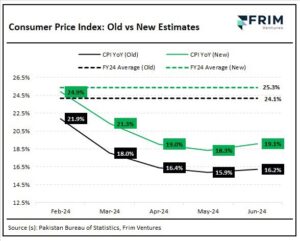

“Inflation expectations have shot up (the average inflation rate of the fiscal year 2024 is now at 25.3% against 24.1% earlier) following a petrol price hike (Rs 12/ per litre) and an expected gas tariff hike of 30% in February. This also includes a higher fuel cost adjustment of Rs 4.66/kWh in February (+20bps impact to Feb CPI),” tweeted FIRM Ventures, a venture capital firm based in Karachi, Pakistan that invests in startups and public equities.

Similar concerns are echoed by Amreen Soorani, head of research at JS Global Capital. “Going forward, energy-led inflation is a key risk to our fiscal year 2024 expected CPI average of ~25%. While the impact of the latest petrol price increase amounts to 10 basis points (not including second-round impact), every 20% gas price hike would have an incremental impact of 20 basis points (also due in February 2024)”, she writes in her recent analysis note published on February 2.

IMF Chief Kristalina Georgieva has recently emphasised that central banks worldwide should refrain from implementing premature rate cuts solely based on “market expectations” as it could lead to a resurgence of price pressures.

In Pakistan, however, expectation of a rate cut around March or April remains high as analysts see inflation subsiding.

“We maintain our call of the first interest rate cut since 2020 materialising in March/April 2024 where spot inflation is expected to clock in lower than current policy rate; providing policy markers added comfort to the 12-month forward inflation already being comfortably lower than current policy rate. Any sharp increase in global oil prices and/or sharp rupee depreciation against the dollar remain key risks to our CPI forecast,” remarked Soorani in her analysis.

Political discourse

The election campaigns of the political parties are currently in full swing, with manifestos being released and leaders making promises of a better future for citizens.

Central to the discourse is the economic challenge that Pakistan has been grappling with for the past two years. During this period, the country has faced one of its worst episodes of inflation and a foreign exchange crisis.

Naturally, many promises are being made regarding the revival of the economy, as it remains the primary concern for voters. However, the proposals being put forth are, to say the least, lacking in substance.

Source: Tellimer

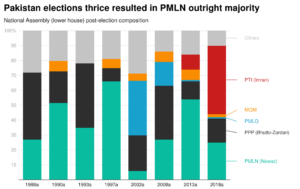

The political parties are certainly aiming for lofty goals, from subsidising the agriculture sector to achieving single-digit inflation without being cognizant of the fact that post-elections, the priority would be a smooth transition into a new IMF program. This transition would necessitate fiscal consolidation by phasing out subsidies and implementing additional austerity measures.

“Fiscal policy is entirely being driven by the IMF’s engagement with authorities. Any finance team knows that there will be contractionary fiscal policy transferring expenditures to provinces and reducing subsidies, sovereign guarantees and unwarranted infrastructure spending,” remarked independent economic analyst AAH Soomro.

“Similarly, at the monetary front, the policy is likely to remain tight, complemented by controlling imports to avoid consumption-led growth and burgeoning current account deficits to manage external debt. Whoever takes the baton from the caretaker government would have little room to manoeuvre,” he added.

Additionally, there has been a notable increase in the involvement of the military-intelligence establishment in economic decision-making through the Special Investment Facilitation Council (SIFC), as highlighted by Hasnain Malik, managing director for emerging and frontier markets equity strategy at Tellimer. This development suggests a potential decrease in their reliance on the civilian government when it comes to large-scale foreign direct investment. The military-intelligence establishment has shown its willingness to collaborate with the IMF and implement the necessary policies to meet the conditions of the IMF loan program.

As per Malik’s analysis, the upcoming election is anticipated to allow any political consequences stemming from unpopular economic policies to be attributed to the civilian government, while the signing of the next IMF program is likely to be facilitated by an elected government, at least in theory.

Moreover, there is a valid concern that the potential return of Ishaq Dar, who is still Nawaz’s preferred candidate for the position of finance minister, could result in a resurgence of an inflexible foreign exchange regime and the controversial “Daronomics” policies, which have been widely criticized as ultimately detrimental.

In the midst of the prevailing chaos, the general public remains susceptible to any additional rise in price levels. The rapid diminishing of purchasing power over the past two years has transcended classes and whatsoever the result of these elections be, the public will eye for a relief in price levels.

Interest rate should be kept at 12% & heavy taxes shall be applied on real estate sector and unproductive sectors to curb dollar flow.

if we are to keep inflation low & central bank needs to be lowered.

very good