For a while there, we weren’t even sure if elections would happen. But after weeks of muted campaigning and bluster that proved premature, the Pakistan Muslim League Nawaz finds itself in an unenviable position. Beaten, bloodied, stripped of its electoral symbol, and with its leader in jail the PTI has managed to sweep the elections despite all the odds. Even in the face of massive irregularities, it seems Imran Khan’s party has emerged the victor.

But that hasn’t quieted the PML-N. Nawaz Sharif on Friday gave a victory speech despite his party being well-clear of winning. And while the noon supremo tried to strike a conciliatory tone, the weeks to come will show just what shape the next government takes. But whether Mian Nawaz returns for a historic fourth term or the PTI is able to cobble together a government with their growing lead, the challenge will be massive. So what is the task a new government will have to take on?

The economy was a major issue in this election

Perhaps more than ever before the economy was a hot topic in this election. The PML-N will perhaps be regretting their decision to lead the PDM coalition government for the last year-and-a-half of the last national assembly. At the time when he was ousted through a vote of no confidence, Imran Khan and his party were deeply unpopular due to increasing inflation. But the situation worsened in the PDM government and Mian Shehbaz Sharif ended up taking the political brunt for the state of the economy and rising cost of living.

As many analysts, including former Finance Minister Miftah Ismail, have reiterated multiple times that the voting trends have indicated that PML-N has borne the burden of poor governance, particularly in the economic sphere. In the lead up to the elections, the crackdown on PTI and attempts to disenfranchise the party has enabled them to garner massive public support.

“The people of Pakistan have spoken, loudly and clearly; any attempt to manipulate their mandate will result in unsustainable chaos. The heat of the electoral process has passed; it is time to allow the country to heal. The political leadership – Mian Nawaz Sharif, Asif Ali Zardari, Imran Khan, Maulana Fazal ur Rehman, and others – must rise above petty politics and work together to confront the immense challenges our country is facing; they need to recognise that history is not kind to selfish politicians,” said former Prime Minister, Shahid Khaqan Abbasi.

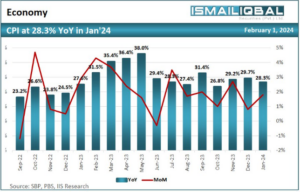

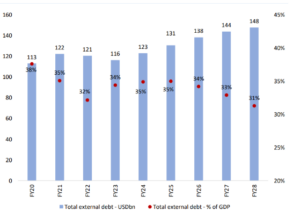

Additionally, the elections have come at a time when the country is at economic crossroads. The inflation levels have been hovering at an average rate of around 28%-29% in the first seven months of the fiscal year of 2024. Similarly, economic growth has slumped, external debt has exceeded more than $100 billion. At the same time, the country’s reserves are less than $10 billion.

Source: Ismail Iqbal Securities Limited

“Elections determine public mandate. A government backed by strong public support can enact vital reforms for economic stability,” remarked Mustafa Pasha, chief investment officer at Lakson Investment Limited. “Conversely, a government lacking public support tends to resort to populist measures like keeping the rupee artificially overvalued, decreasing petrol prices, leading to adverse economic consequences,” he added.

Hence, transparent elections are crucial for countries like Pakistan to ensure the formation of governments capable of making tough economic decisions for sustainable growth. S&P Global’s analysts have echoed similar sentiments in their February 4 report stating that a government with popular support and the ability to work with key institutions will have a better chance of securing financing from the International Monetary Fund (IMF).

Moreover, according to S&P, Pakistan’s credit rating could improve if the elections result in a government that can push for tough reforms. Currently, Pakistan has CCC+ which signifies that the country is ‘vulnerable’ to a default.

Regardless of who succeeds in assuming power now, one thing is certain, the road ahead is bumpy with economic challenges posing the biggest threat.

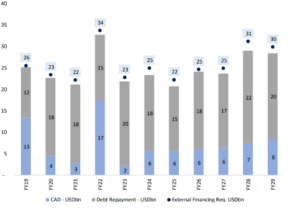

The country is anticipating a transition from the current IMF stand-by agreement to a long-term Extended Fund Facility (EFF). Moreover, the high inflation, and consequently high-interest rates, are putting the patience of the masses to the test. The external sector also poses a significant challenge. With low foreign reserves and massive repayment obligations in the next 12 months, the government has been constrained from allocating funds for public spending.

Securing a new IMF deal

The elected government is likely to take charge in March. This timeline coincides with the expiry of the $3 billion IMF bailout program which is expiring on March 30. This means that following elections, there is mounting pressure on the upcoming government to swiftly secure a new IMF deal to prevent a sovereign default.

Pasha anticipates the formation of the new government by early to mid-March. “The expectation is that the government will likely require some form of coalition setup, hence it might take a few weeks to form the government, possibly by early or mid-March.”

As per analysts at JS Global, “Any unfavourable developments such as Pakistan’s inability to secure a fresh IMF program owing to lagged reform-related measures, delayed support from friendly countries backed by changing geopolitical preferences etc, are expected to bring the State Bank of Pakistan (SBP) foreign exchange reserves back to concerning levels, as witnessed in the first half of 2023. The same would likely lead to a negative impact on investor confidence in the country’s macroeconomic outlook.”

Therefore, the upcoming government needs to be decisive and able to take tough decisions to secure a deal with the IMF. This would require further austerity measures which include phasing out untargeted subsidies, increasing direct and indirect taxes to increase revenues, reducing expenditures, letting rupee take its course, and lastly circular debt reforms.

Additionally, Pakistan’s external debt which has soared past $100 billion, presents a constant threat. In the monetary policy meeting held on January 29, the SBP informed that outstanding payables in the fiscal year 2024 amounted to $5 billion. Of the remaining amount, $6.2 billion was paid in the first seven months of fiscal year 2024 while $12 billion had been rolled over.

Source: Akseer Research

Nevertheless, the external financing need remains high for the cash-strapped nation. The reserves held by the SBP as of February 2 stood at $8 billion and is sufficient for an import cover of 2 months only, increasing the need for EFF from IMF.

Source: Akseer Research

At the domestic front, the debt is around Rs 41 trillion. The government’s significant appetite for deficit financing through short-term domestic borrowing, coupled with record high interest rates, has resulted in a dual crisis of elevated interest expenses and short maturity terms.

In his article published in Dawn, Shahid Kardar, former governor of the SBP stated that the debt servicing on domestic debt consumes 90% of the annual budgetary allocations for interest payments, requiring mobilisation of a primary surplus of more than 7% of GDP.

The balancing act: policy rate and inflation

The timeline of the upcoming monetary policy committee meeting which will be on March 18 also coincides with a new government taking on the baton from the caretakers. A coalition government, which is the most likely outcome as per the election results, will have pressure from the business community voter base for a rate cut but they will also have to be mindful of the inflation rate.

The policy rate was hiked in June 2023 to 22% in an emergency meeting as the PDM-led government made last-minute decisions to secure a deal with the IMF. The policy rate has remained at 22% since then. The aggressive monetary stance of the SBP has been influenced by the conditions set forth by the IMF which required an appropriately tight monetary policy to curb inflation.

“Private-sector borrowing costs have gone up due to high interest rates. Financing availability from banks has been reduced because banks are less willing to lend to the private sector and prefer lending to the government. Demand and supply for financing have gone down, squeezing private-sector credit. This also means that greenfield projects and new investments have decreased while working capital requirements have increased,” Pasha told Profit.

The downside to the rate cut is that the inflation numbers may spike up as demand and hence consumption increases. According to the Pakistan Bureau of Statistics (PBS), inflation increased in January by 28.3% as compared to the corresponding period a year ago. This figure, albeit high, was slightly relieving as compared to December’s figure of 29.66%. Still, the country’s inflation rate continues to remain elevated and is currently one of the highest in Asia.

Keeping track of price levels has proven to be a challenging task for policymakers in recent years. However, the SBP hinted at monetary easing from March 2024. Consequently, analysts expect a rate cut in March or April as inflation levels subside.

Globally, inflation has also been on a declining trend. However, according to the Financial Times, central banks around the world are taking prudent steps of holding back rate cuts because of external risks that can spike up the inflation rate.

Pakistan is not an exception. A premature rate cut could potentially stimulate domestic demand, leading to a rise in imports and worsening the current account deficit. This, in turn, would impact inflation, and the currency’s value, and exert pressure on the exchange reserves.

A pretext for reforms

According to analysts at Akseer Research, the next IMF program is likely to be much tougher. One of the focus areas of IMF’s SBA was structural reforms in the energy sector. The circular debt at the end of January stood at Rs. 5.7 trillion, with the power sector accounting for Rs. 2.7 trillion and the gas sector contributing Rs. 3 trillion.

Phasing out subsidies in the energy sector would result in higher energy prices, adding inflationary pressure on the general public. Moreover, the Fund would push for tax reforms to improve revenue generation. Recent attempts were made by the Special Investment Facilitation Council (SIFC) to reform the Federal Board of Revenue (FBR). However, Islamabad High Court restrained the caretaker government from restructuring FBR.

Initial unofficial results of elections have started emerging, with PTI-backed independent candidates leading in many National Assembly seats. PML-N candidates have started winning in some seats as well while PPP candidates’ performance has also exceeded expectations. The prospect of a coalition government in a hung parliament set up looms large, where no single party commands a majority, often leading to a constitutional deadlock hindering reforms.

“The vote bank of the former PTI has withstood the suppression of its leaders, including the incarceration of Imran Khan, the inability to hold rallies, and the absence of its symbol on the ballot paper. That marks a moment of institutionalised mass political awakening — a shift from mass mobilisation in protests under the charismatic leadership of Imran to a participation in a national election with almost no organised traditional campaigning. That is very positive for the long-term trajectory of Pakistan but comes at a very uncomfortable moment for investors, whose consensus expectations were of a PMLN victory, an alignment of military and civilian forces, and a smooth negotiation of the next IMF programme. That may still be an outcome but not without a mix of horse-trading, floor-crossing, legal challenges, and protests,” writes Hasnain Malik, managing director for emerging and frontier markets equity strategy at Tellimer.

Regardless of who comes at the helm, the involvement of military-intelligence establishment in economic decision-making through the Special Investment Facilitation Council (SIFC), as highlighted by Malik in his strategy note for Tellimer, is expected to stay significantly high. Similar sentiments were echoed by S.H. Irtiza Kazmi, an ex-banker, said the forthcoming government will likely be a hybrid arrangement.

This means that while the civilian government theoretically leads in engaging with the IMF and enacting tough reforms, the establishment, via the SIFC, will collaborate with the IMF and ensure reforms are in place to fulfil IMF loan program conditions and secure the crucial deal.