The year 2023 was no short of a roller coaster for the telecom industry in Pakistan. The industry painted a very different picture at the end as opposed to what it presented at the start. The shift in the industry’s dynamics comes with a huge thanks to one major player, Pakistan Telecommunication Company Limited (PTCL). And as the year has closed, so has the financial endeavours of PTCL. However despite having one of its most action packed years, PTCL has not been able to turn things around in terms of profitability.

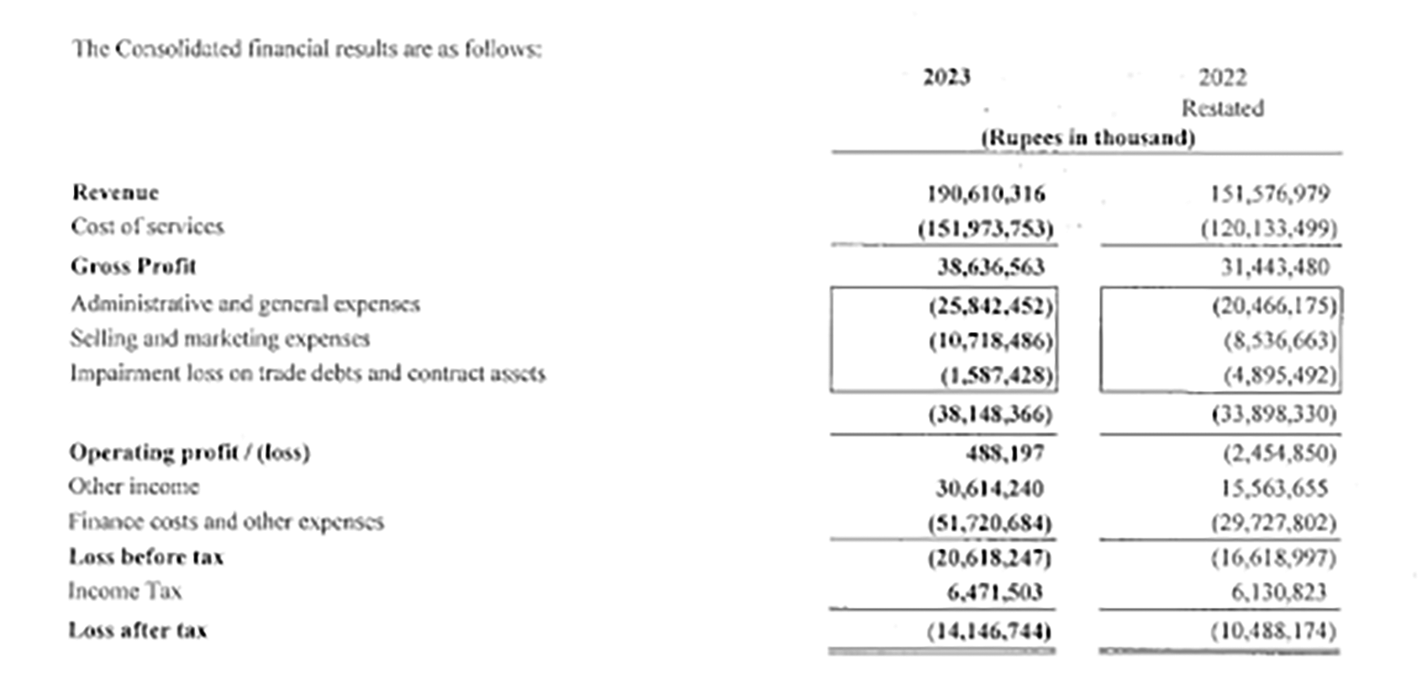

PTCL reported its financial results for the calendar year 2023 and despite a 25.75% surge in revenue to Rs 190.61 billion, up from Rs 151.58 billion in 2022, the company faced an elevated after-tax loss, reaching Rs 14.15 billion compared to the previous year’s loss of Rs 10.49 billion.

The revenues grew on the back of a robust performance in the consumer segment, particularly in fixed broadband, mobile data, and wholesale & business solutions, along with the positive contribution from the microfinance subsidiary. Even though the gross profit witnessed a commendable rise of 22.88% to Rs 38.64 billion, the company showed a slight decline in gross margins, from 20.74% to 20.27%.

Escalating costs of sales, rising administrative and general expenses (up by 26.50% and 26.27%, respectively), as well as significant jumps in finance costs and other expenses (73.98%), impacted the group’s overall financial health.

While this is enough to gauge the consolidated finances of the group, Profit delves deeper into the group companies and their financial health to dissect this loss.

The PTCL company:

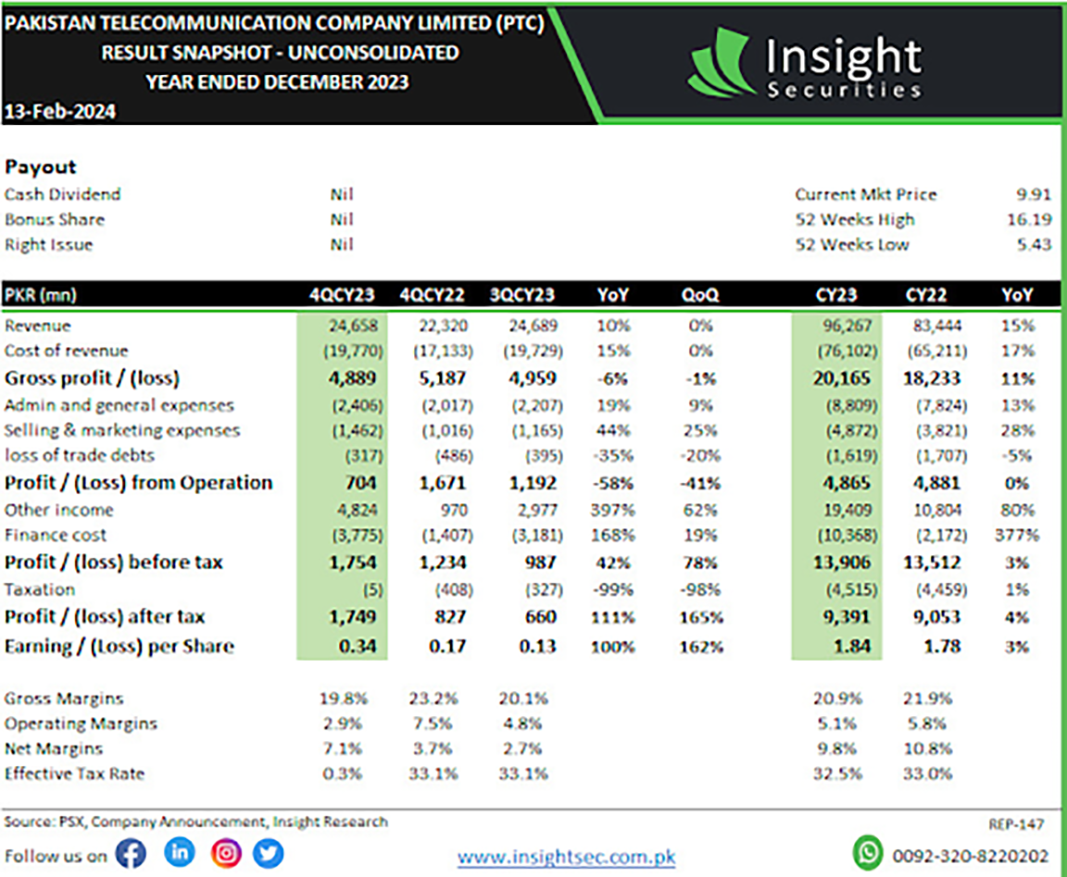

PTCL itself (Landline and broadband) enjoyed a profitable year. According to the financials of the company the revenue marked a 15% increase at Rs 96.27 billion. This in turn left the PTCL company with an eventual profit of Rs 9.4 billion, its highest ever since 2013. However the telco, while a significant part of the group, could not carry the weight of the other enterprises. These enterprises include Ufone and ONIC (PTML) and U microfinance Bank.

PTCL operates as a significant provider with a broad spectrum of products and services. Their offerings encompass voice services, broadband internet, Fiber to the Home (FTTH) services, CharJi wireless internet, Smart TV (IPTV) service, Smart Link App, Touch App, digital-content streaming through Starzplay, and enterprise-grade platforms like Smart Cloud, Tier-3 Certified Data Centers, Managed and Satellite Services.

It holds a prominent market position in Fixed-line Voice and Wireline Broadband & IPTV, as reflected in their ratings. The company has initiated the migration of existing customers to premium FTTH services, expanding its fibre footprint to 60,000km, making it the country’s second-largest FTTH operator. This strategic move has resulted in a revenue growth of 102.7% over time, constituting 56% share of the industry’s net additions.

As PTCL’s rating report issued by VIS credit rating, the broadband & IPTV subscriber base, a significant revenue source, saw a slight increase closing in on 1.88 million by the end of CY23 (CY22: 1.86 million; CY21: 1.78 million). Meanwhile, the retail subscriber count remained unchanged at 4.23 million during the rating review period at end-1HCY23 (CY22: 4.24 million; CY21: 4.23 million). Not only did the company perform well, it contributed the lion’s share in the group’s profit.

PTCL’s current focus lies on the wholesale and corporate business segment as part of their growth strategy for the future and as of now, the strategy seems to be working for PTCL. The company is working on an asset monetization strategy whereby 12 commercial properties are planned to be sold and expected to bring sizable cash inflow over the next three years. Moreover, few other properties are also being considered for monetization in the long-term.

U Microfinance Bank:

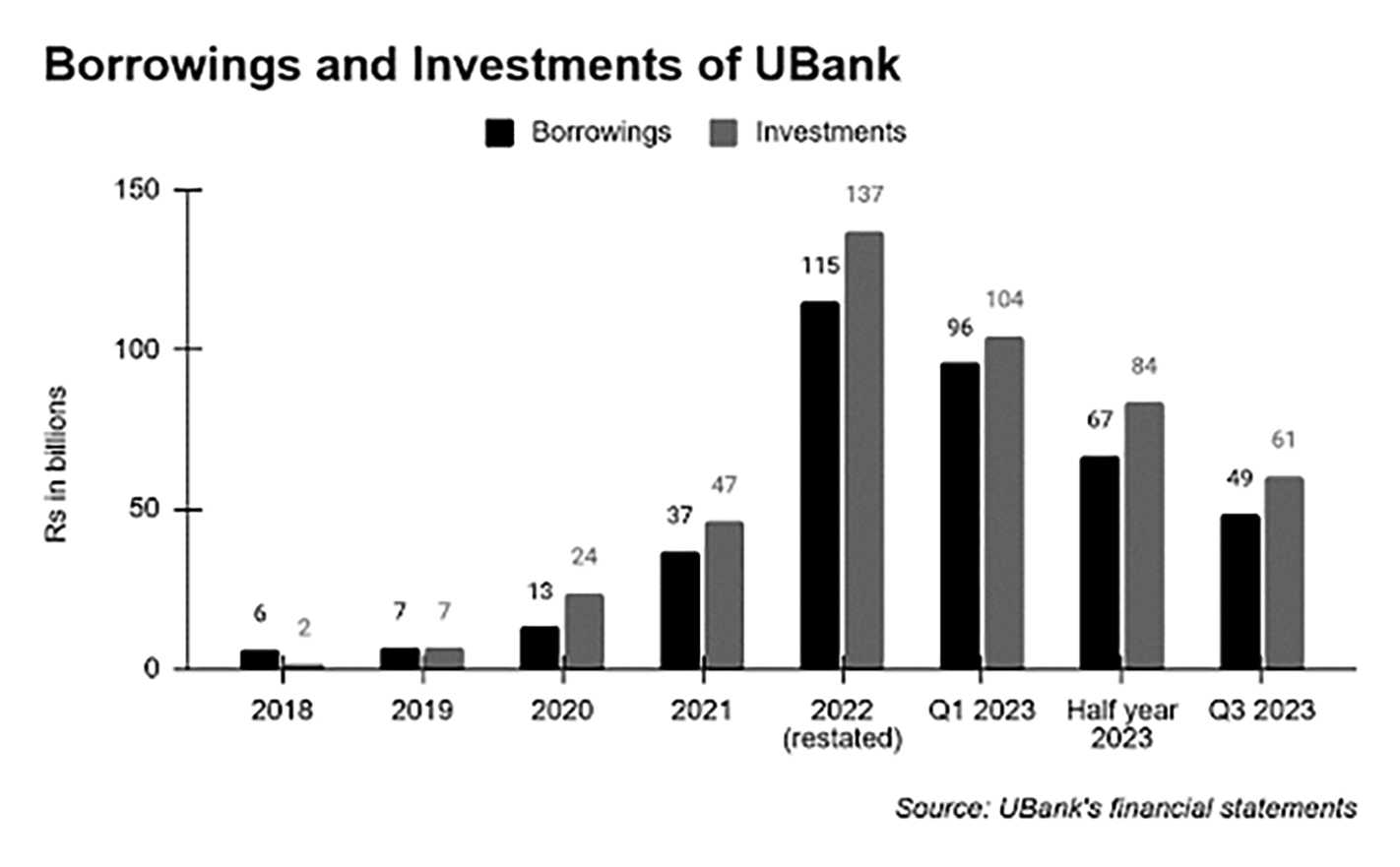

Ubank, a subsidiary of the group, was surrounded by controversy during the last quarter of CY 2023. Right before former CEO Kabeer Naqvi left Ubank, the bank took a sharp U-turn from its unconventional approach, labelled as overly aggressive, which led to an astonishing threefold growth in its balance sheet amidst industry turmoil in 2022.

Previously, Ubank significantly increased its balance sheet through a reciprocal arrangement, with a major portion of deposits coming from other financial institutions. These funds were reinvested in the same institutions, creating a concentration risk ranging from 25% to 77% of the fund’s assets.

Despite credit rating concerns, UBank wasn’t acknowledged as the primary investor. Financial entities like Faysal Asset Management orchestrated a strategy, involving depositing funds, purchasing securities, and pledging them back to borrow more against treasury bills, inflating UBank’s balance sheet threefold.

Investments grew from Rs 46.5 billion to Rs 137 billion, borrowings rose from Rs 36.8 billion to Rs 115 billion, and deposits increased from Rs 55 billion to Rs 92 billion. UBank’s unique approach aimed to mitigate risks by heavy borrowing while actively managing investments, leveraging interest rate fluctuations.

CEO Naqvi also clarified the strategy, focusing on shorter-term instruments to capitalise on rising interest rates. Even if treasury operations incurred losses due to economic uncertainties, the goal was to secure the bank against a liquidity crisis, ensuring board and shareholder satisfaction.

The new status quo in the last two quarters has dialled back on the aforementioned approach and has decreased borrowings and in turn, investments. The brunt of this decrease is likely to have translated in the annual financials of the PTCL group. As per a report by Profit based on the latest financial reports of Ubank (Q3 CY23), a significant investment, upwards of Rs 2 billion has been withdrawn.

From the same reports of Ubank, one can find out that the bank made a profit of Rs 1.7 billion in the period ending on 30th September and might still end the year in profitability, albeit a low one.

This achievement is noteworthy as it occurred despite a decrease in interest income derived from government securities. Simultaneously, there was a reduction in interest expenses linked to borrowings.

As per the deposit rate sheet of UBank, markup on deposits ranged between 5% and 24%, while earnings on markup ranged between 30% and 50% on the advance book. On average, this implies the bank maintains a spread of about 25%.

According to the latest statement by the PTCL group on the yearly financials, the ‘U Microfinance Bank’, posted a remarkable 76.5% revenue growth during 2023, showing positive signs.

But if, despite their circumstances, both PTCL and Ubank were profitable, where did the PTCL group bleed?

Ufone: The loss carrier

According to PTCL’s statement, Ufone (PTML), the telecom subsidiary of PTCL Group, (also) achieved substantial revenue growth of 25.6%, attributed to the ongoing network modernization activities of Ufone 4G, as per the company. However, the financials reveal that this was indeed the company that drove the losses for the PTCL group. Even though these results aren’t publicly available yet, a total loss more than the group’s losses of Rs 14.1 billion seems appropriately possible.

The financial risk profile paints a bleak picture of the company with decreased margins, persistent losses, limited cash coverages, and a highly leveraged capital structure.

During the financial year, the telco experienced a decrease in gross margins due to an increase in power tariffs and currency devaluation. Additionally, elevated policy rates and incremental debt procurement have resulted in higher finance costs for the company, causing the loss to widen. The increase in PTML’s debt can be attributed to the acquisition and prepayment of 4G spectrum, as well as heavy capital expenditures incurred for network expansion.

However, according to the VIS credit rating, PTML is on the path to improvement since the acquisition of the 4G Spectrum in September 2021. The company has witnessed improvements in its topline and Average Revenue Per User (ARPU) levels.

To address other issues, the management has implemented cost-cutting measures such as technological optimization, vendor negotiation, and initiatives focused on revenue diversification and price increases. However, the effects of these are still to materialise in Ufone’s performance.

The road to recovery, as per its management, goes through enhancing gross margins while maintaining service quality and financial stability through the aforementioned initiatives. The management has also reiterated to the rating agency that any future financial assistance will be in the form of equity injection, ruling out additional long-term debt from commercial banks. The company’s ratings are supported by sponsors’ equity injection, contingent upon the restoration of profitability and improvements in liquidity and gearing indicators in the medium term. This strategic approach reflects the company’s commitment to addressing its financial challenges with a focus on sustained growth and stability.

Another move that was made by PTML, earlier this year was the launch of its digital telecom brand ONIC, with a diversified portfolio of brands, PTML aims to improve consumer retention and improve service quality.

One significant development in 2023 for PTCL Group was the signing of a Share Purchase Agreement with Telenor Pakistan B.V. (Telenor) to acquire a 100 percent stake in Telenor Pakistan (Pvt) Ltd. The enterprise value of this acquisition was Rs 108 billion on a cash-free, debt-free basis. The transaction value, though not translated in the group’s consolidated 2023 financials, makes PTCL group the biggest Telecom player in Pakistan, inspiring confidence in its operations.

With the recent acquisition of Telenor Pakistan’s infrastructure and consumers, Ufone hopes to make the comeback that it needs to contribute to the group’s profitability as opposed to dragging it down.

According to PTCL, the Group’s overall revenue growth was driven by the strong performance of PTCL in both retail and business segments. These increased losses at the individual company level, primarily due to escalating expenses and external economic factors, also highlight the importance of effective financial management and strategic planning for sustained success in the dynamic telecommunications industry. Experts suggest that with only 3 major telecom players left, the industry might converge to solving some of these problems.

The Group’s overall profitability also shadows the country’s tough economic climate. PTCL, much like any other company, faces huge challenges due to rupee devaluation and high-interest rates during the year. The rupee devaluation decreases the company’s ability to make future capital expenditure in dollars, while the high interest makes access to credit extremely hard. Topping it off with higher direct and indirect taxes, these financials underscore the complex economic landscape impacting the telecommunications sector in Pakistan.

excellent article.