K-Electric is old enough to know better. It is, in fact, over a century old and has witnessed its fair share of ups and downs. Yet, its lack of foresight is astonishing. As the world shifts towards sustainability and renewable energy, Pakistan is not even late to the party, it never made it to the party!

Pakistan’s sole vertically integrated power utility, K-Electric, remains reliant on thermal power generation. The country’s dependence on non-renewable sources stands in sharp contrast with the global trend towards greener energy solutions. Renewables can offer a lifeline to developing countries like Pakistan, promising reliable and affordable access to electricity while mitigating the environmental impact of traditional energy sources.

But K-Electric continues to fumble the opportunities Pakistan’s high wind and solar resources have to offer. And missed opportunities don’t come without costs.

Renewables First (RF), an Islamabad-based think tank, in collaboration with the Policy Research Institute of Equitable Development (PRIED) published a white paper titled, “Examining K-Electric’s Cost of Inaction in Deploying Renewables”. Using the insights from RF’s report, this article will take you through a journey of K-Electric’s phases of organisational development, strategic decisions, challenges, and the road ahead with renewable energy integration.

Of course, KE has rejected this claim and raised questions on the report. As part of their plans the company has “committed to achieving 30% renewables by 2030 in line with our submitted, publicly available plans developed based on ground dynamics, resources, and demand growth.”

In response to the report, the company said they could not comment without review of the white paper by Renewables First, “which was shared with us only last night after repeated requests. Curiously, KE input or consultation was not sought in developing this study, which the organizers have mentioned in disclaimer. We stand by our decision not to participate in events that lack constructive intent and deliberately exclude key stakeholders, including those the study is about, from making a fair contribution.”

So what exactly does the report say? And more importantly is there any credence to it or is KE’s defence correct? To begin, we look back at everything that has been going on at KE for the past century or so.

From KESC to K-Electric

Back in 1913, in a small port town called Karachi, the Karachi Electric Supply Company (KESC) was born. Back then, Karachi was just a tiny fishing village, and not the metropolis that it is today. Fast forward four decades, in 1952, the government took over KESC so they could keep up with the city’s growing population.

Then in 2005, KESC was once again privatised, with most of the ownership going to a group from Saudi Arabia, while the government maintained a minority stake. The majority stake, 73% to be specific, was acquired by a consortium led by Kanooz Al-Watan of Saudi Arabia. Three years later, in 2008, The Abraaj Group took over 50% of the company and appointed Tabish Gauhar, a Karachi native in his late 30s, as CEO.

Over the years, different companies came and went, with new bosses and big changes. Around 2013-14, to celebrate its centenary, KESC had a reinvention, with a new approach and a new name. The company became K-Electric Limited. In 2016, Shanghai Electric Power (SEP) entered a Sale and Purchase Agreement (SPA) with K-Electric’s holding company, KES Power, with the aim of acquiring up to 66.4% shareholding in the Company.

In August 2023, K-Electric once again underwent a change in ownership, however, this time a discrete one. Majority stakes were transferred from the Abraaj Group to AsiaPak Investments, based in the Cayman Islands, under the stewardship of Shaheryar Chishty. The new owner also happened to be the owner of Daewoo in Pakistan and mining rights in Thar Coal Block 1.

Today, K-Electric serves power across a vast 6,500 square km service area encompassing Karachi, Uthal, Bela, Vinder, Hub, Dhabeji, and Gharo. Since its privatisation in 2005, KE has invested a staggering PKR 474 billion across the power value chain, as outlined in the Company’s Investment Plan 2030.

However, K-Electric has yet to adopt a cheaper and environmentally friendly source of energy, but it seems renewables are still not a priority for the company.

K-Electric’s Existing Power System

K-Electric is the biggest and only power company in Pakistan that handles everything from making electricity to delivering it to customers. According to the whitepaper, K-Electric’s current infrastructure is heavily dependent on non-renewable energy sources, with thermal power plants constituting 97% of its installed capacity. The utility serves over 3.4 million customers across a network spanning 6,500 square kilometres, with a total capacity of 4,485 MW, including imports from the NTDC system. The peak demand for fiscal year 2022 was recorded at 3,670 MW.

The company has expanded exponentially since when it was founded to lighten up the small town of Karachi.

Since privatisation in 2005, K-Electric has invested around 474 billion rupees in the power value chain, with a significant portion, approximately 204 billion rupees, directed towards generation functions. Over the past twenty years, K-Electric has made significant strides in enhancing its generation capacity, adding a substantial 2,132 MW to its fleet and doubling its power generation capacity since 2009.

However, something has still been missed. Even though growth is good, most of K-Electric’s expansion has relied on fossil fuels.

They have notably lacked substantial contributions from renewable sources, with only a modest addition of 100 MW of solar photovoltaic (PV) capacity under the Independent Power Producer (IPP) mode.

As a consequence, K-Electric currently relies heavily on imported electricity, sourcing nearly half of its 1,100 MW demand from the national grid. The remaining portion of its demand is met by K-Electric’s existing thermal generation fleet, which despite its reliability, comes at a considerable cost.

A cost that could have been reduced had K-Electric diversified its energy sources and embraced renewable alternatives to reduce its dependency on costly thermal power and bolster its sustainability efforts.

Let’s consider the potential and ease of integrating renewable energy in Pakistan.

Pakistan is sitting on a goldmine of renewable energy sources

According to the Pakistan Economic Survey FY22, Pakistan possesses a vast potential for generating electricity from wind, estimated at approximately 50,000 MW. These wind corridors are conveniently located in close proximity to K-Electric, particularly in Karachi and Balochistan.

Similarly, Pakistan also boasts a high solar power potential. Leveraging these abundant renewable resources to produce cost-effective power could alleviate the burden on consumers grappling with inflation. This would also strategically aid K-Electric in achieving its target of 30% renewable energy (RE) by 2030. On a broader scale, embracing renewables would also align with Pakistan’s sustainability objectives.

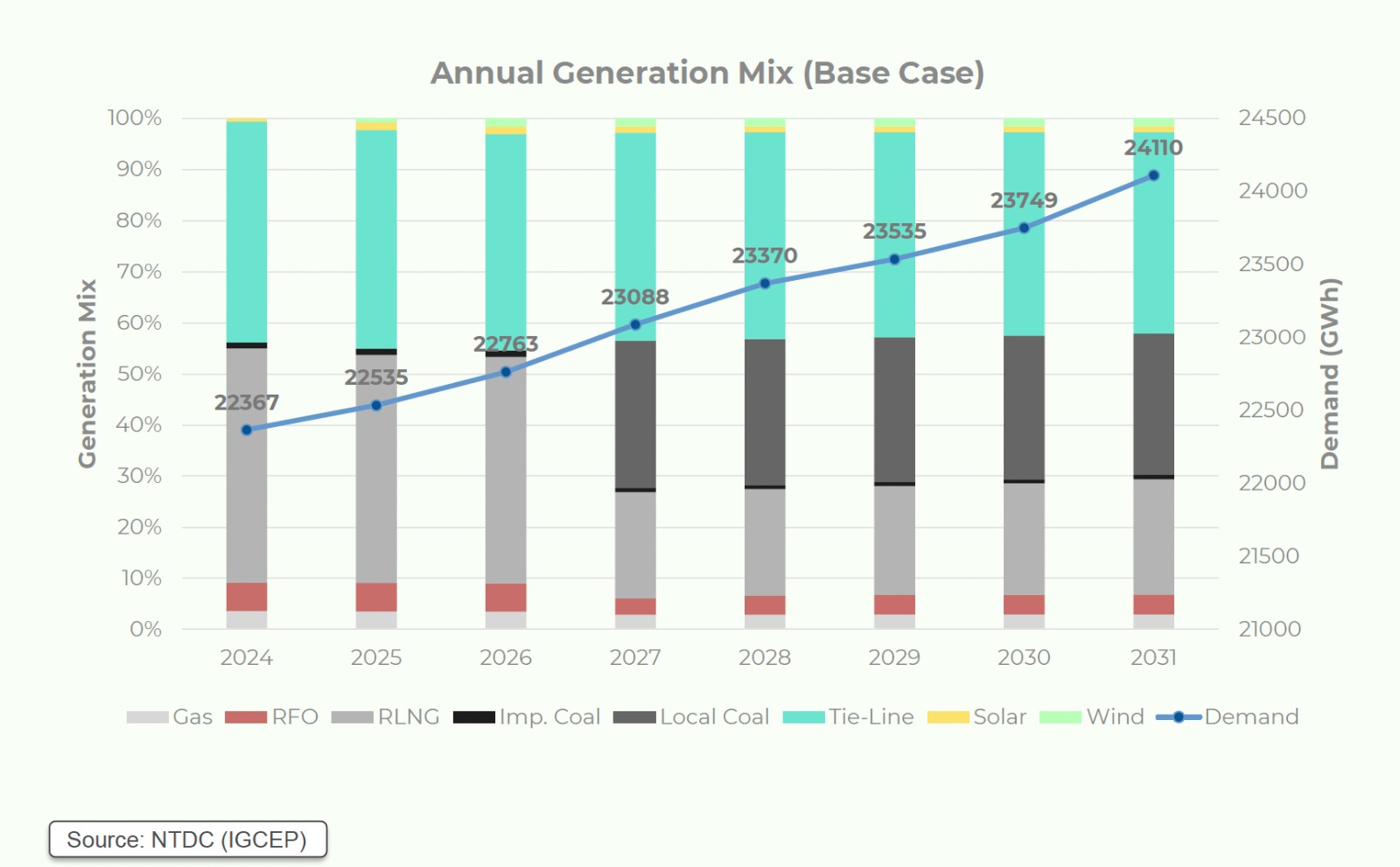

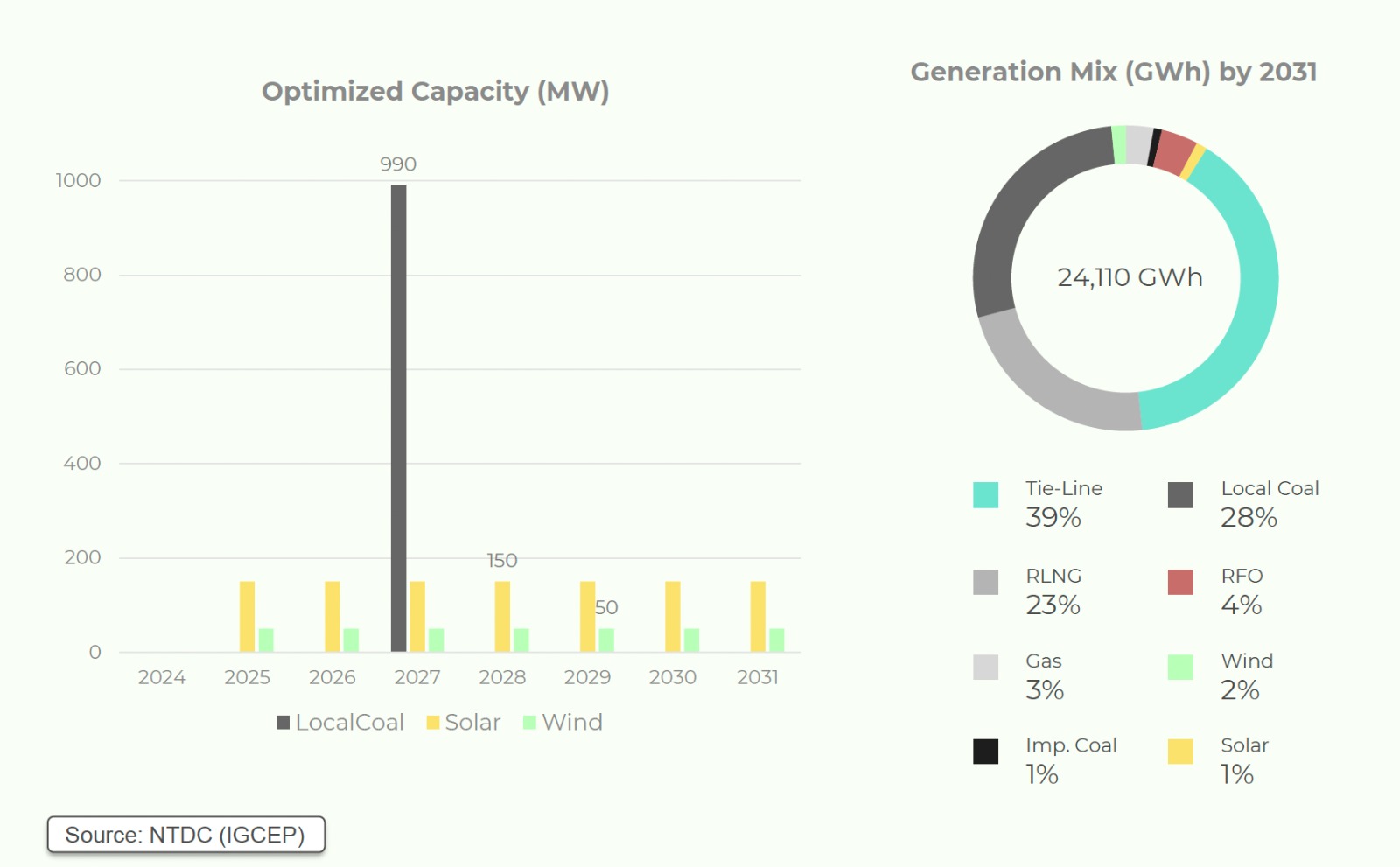

Despite this potential, K-Electric’s current plans indicate a hesitance to capitalise on renewable energy sources, with approximately 50% of its future capacity additions projected to be fossil-fuel based. This is concerning to say the least because 97% of the company’s existing fleet already comprises thermal power plants.

Operating in a region rich in wind and solar potential, K-Electric’s utilisation of renewable energy remains minimal, with only 100 MW of solar capacity and no operational wind plants in its system.

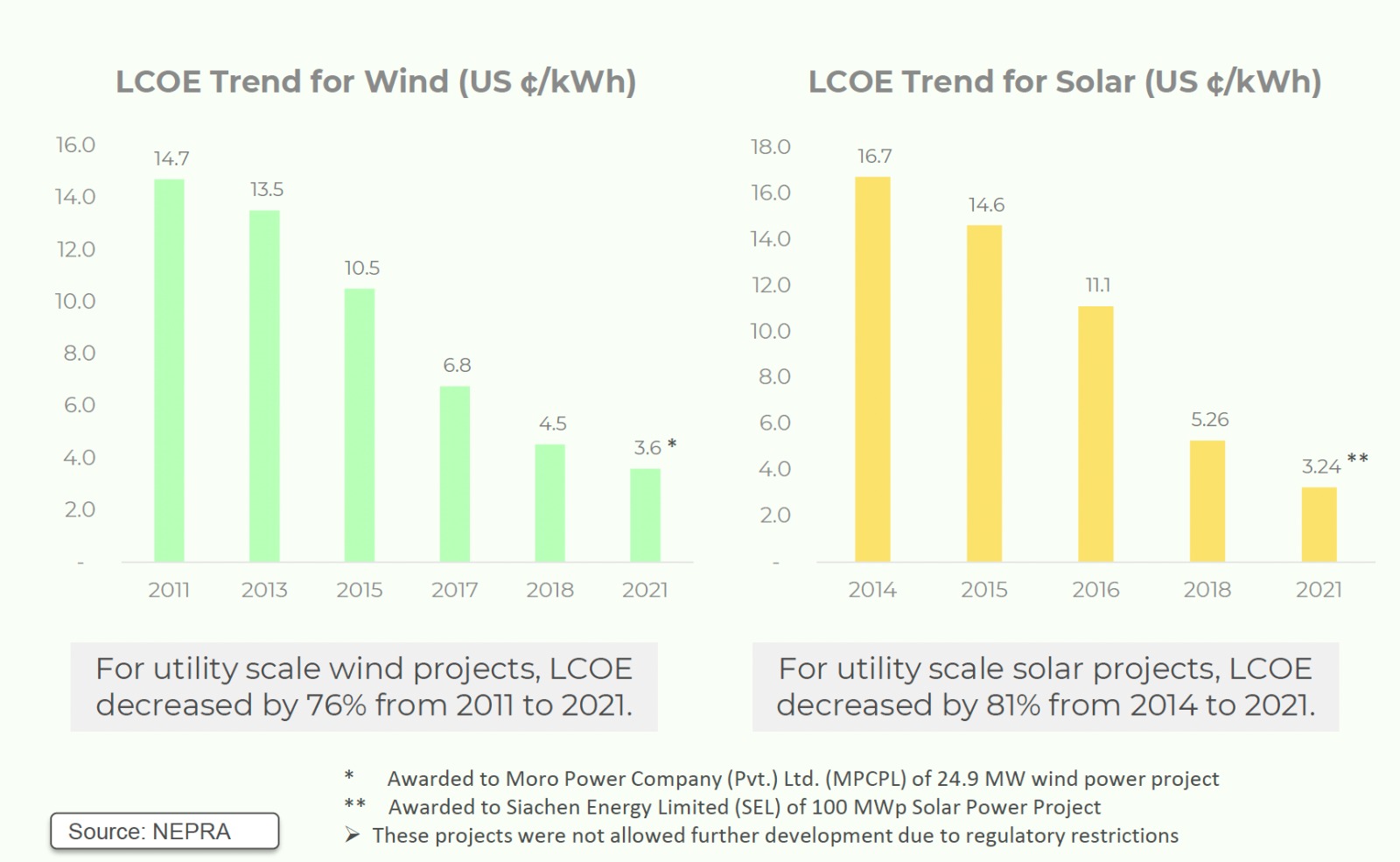

In the past decade, there has been a significant decline in the global Levelized Cost of Energy (LCOE) for utility-scale wind and solar projects, a trend mirrored in Pakistan with substantial cost reductions in renewable energy (RE) sources. RF reports that specifically, levelized tariffs for wind energy have plummeted by 76% from 2011 to 2021, while solar photovoltaic (PV) projects have seen an even more dramatic reduction of 81% from 2014 to 2021.

Despite the favourable cost trends in renewable energy, K-Electric failed to capitalise on this opportunity, opting to remain reliant on fuel-based power generation. This inaction has led to financial losses for the company and increased electricity costs for consumers, unnecessarily burdening them.

Although K-Electric has set an ambitious goal of achieving 30% renewable energy by 2030, its projections for the FY 24-30 period, inclusive of hydro, fall short at 28%. The company’s plan lacks a specific target for reducing fossil fuel usage within its system, indicating a gap in its strategy. In a region abundant with wind and solar potential, K-Electric’s continued reliance on fossil fuel-based generation and emphasis on coal projects for future capacity expansions represent a missed opportunity to transition towards cleaner, sustainable energy sources.

Timely integration of renewable energy could have mitigated these issues and provided a more sustainable solution for K-Electric and its consumers.

The cost of K-Electric’s failing to integrate renewables

K-Electric’s has collected significant financial losses and missed opportunities from its decision to extend Power Purchase Agreements (PPAs) for two inefficient thermal power plants, Gul Ahmed and Tapal Energy, in 2019, instead of integrating low-cost renewable energy sources. These plants, along with the Korangi Power Complex, have been operational despite their low merit order.

By not capitalising on renewable energy, K-Electric has incurred substantial costs for its consumers, amounting to up to US $204 million in fiscal years 2022 and 2023 alone.

Analysis conducted by RF and PRIED indicates that renewable energy plants could have replaced the generation of these thermal power plants without compromising system operations.

The report highlights, for instance, a 200 MW wind power plant could generate about 736 GWh annually, comparable to the output of these thermal plants. Similarly, a 200 MW hybrid power plant (3:1, wind to solar) could produce around 650 GWh per year.

A two-year lead time for the development of renewable energy projects was also considered in PRIED’s calculations. The scenarios factored in the replacement of thermal power generation by equivalent renewable energy generation, allowing substantial cost savings.

The white paper presented two cases.

The first case proposed adding 400 MW of renewable energy in fiscal years 2020 and 2021 combined could have resulted in savings of up to US $204.03 million. Similarly, in another case they showcased how adding 600 MW of renewable energy during the same period could have led to savings of up to US $253.03 million.

The projections emphasise the potential of K-Electric to prioritise renewable energy integration in its future plans, which would not only mitigate financial losses but also contribute towards a more sustainable energy landscape for Pakistan.

RF-PRIED’s Model for Future Power Expansion

RF and PRIED presented a PLEXOS model-based analysis in its white paper, to assess the viability of K-Electric’s generation expansion choices. The analysis contrasted K-Electric’s planned capacity expansions against optimised scenarios favouring renewable energy.

Despite all this effort by external entities, can K-Electric do anything now?

Well, yes. The paper proposed the RF-PRIED’s Model for future plans of capacity expansion.

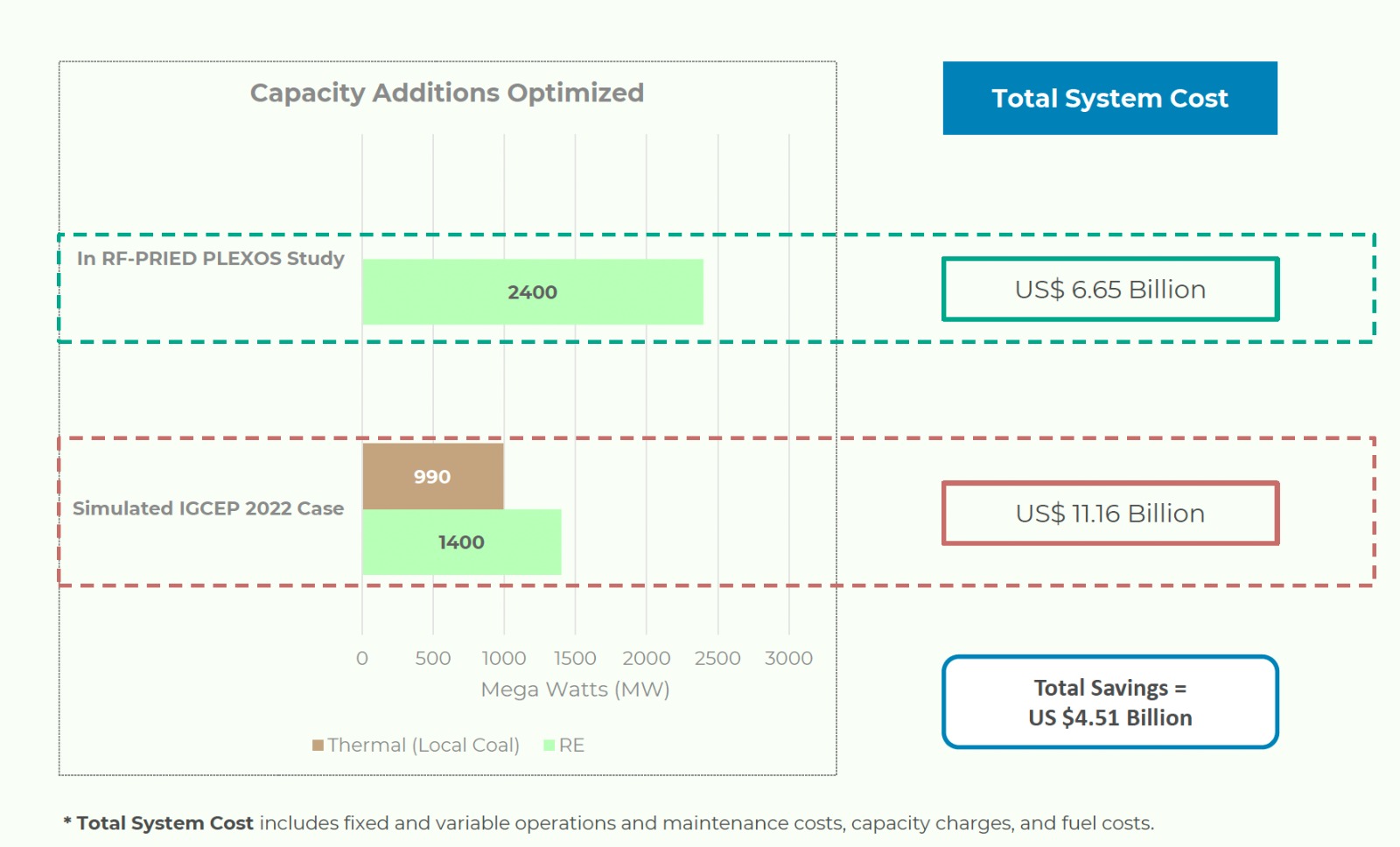

RF-PRIED’s alternative modelling approach advocates for removing caps on renewable energy capacity additions, demonstrating potential for K-Electric to save up to USD 4.51 billion from FY24 to FY30 by proactively integrating renewables into its system.

How?

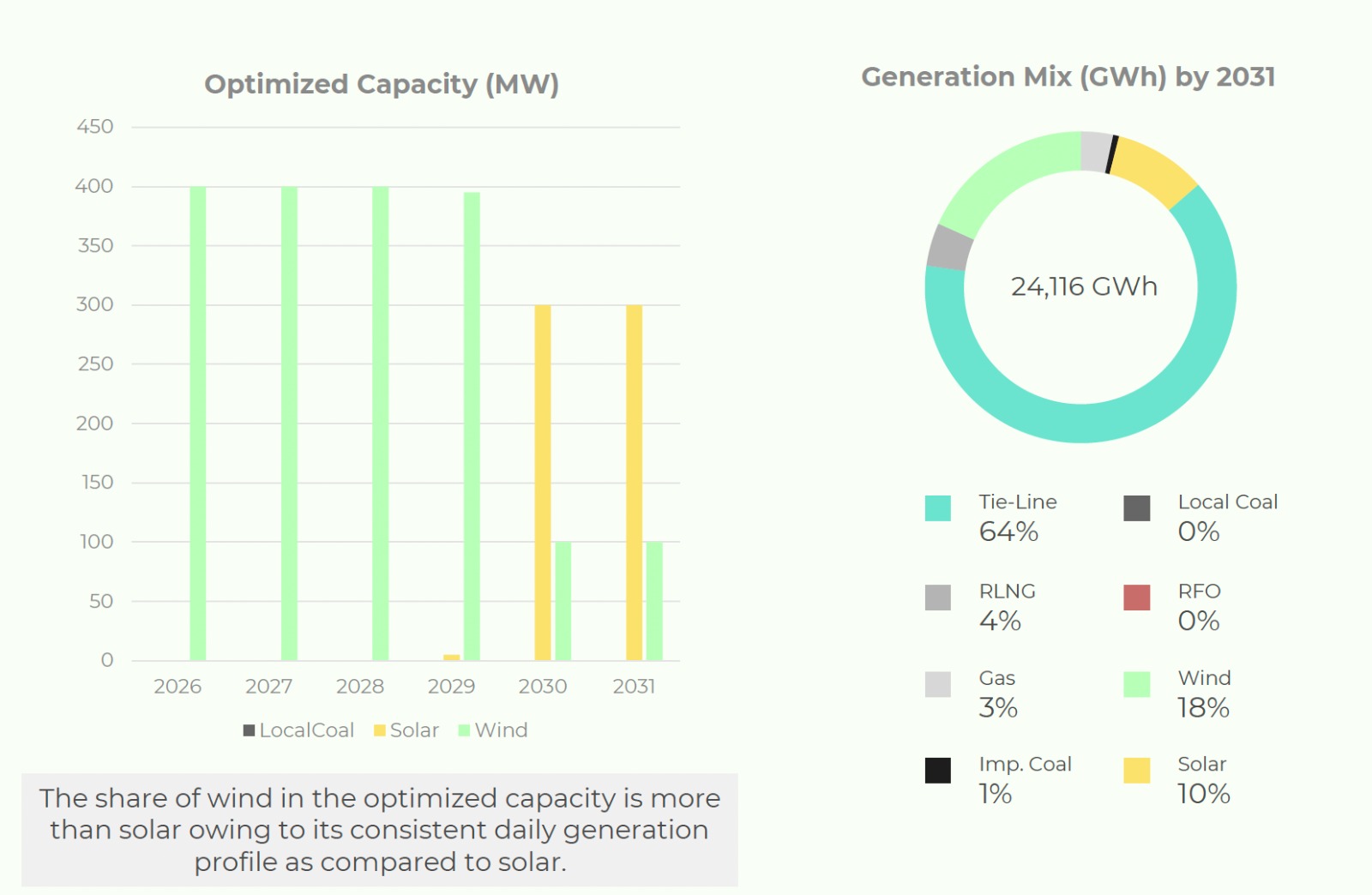

The study conducted by RF demonstrates how. It was observed that in the optimised capacity, wind energy surpasses solar by over 10%, benefiting from its consistent daily generation profile compared to solar. With the removal of the 200 MW capacity build cap per year for renewable energies (REs), no thermal capacity is optimised in the system. Solar and wind energy are consistently optimised throughout the study period based on least-cost criteria, resulting in a total optimised capacity of 2,400 MW for REs, evenly split between solar and wind at 1,200 MW each.

This optimization signals a notable shift in K-Electric’s system towards wind, solar, and electricity imported from the NTDC system, diversifying the generation fuel mix. By 2031, solar and wind collectively contribute 28% to total generation and account for 38% of installed capacity.

Moreover, there’s a significant increase in the share of affordable electricity imported from the NTDC system, reaching 64% of total generation by 2031, minimising the need for new local coal plants.

The current overreliance on the national grid raises concerns about the affordability of electricity generated by K-Electric’s own system and questions the utility’s planning decisions. And this presents an urgent need for specialised research to investigate the implications of the supply from the national grid to K-Electric through the Tie-Lines thoroughly.

Can this potential translate into progress?

According to RF and PRIED’s analysis, a decisive shift towards renewable energy has the potential to enhance sustainability, reduce operational costs, and diversify the energy mix, making it less reliant on imported fuels.

This could be a chance for K-Electric to rectify its past oversights. Costly Power Purchase Agreement extensions have burdened the company financially, requiring proactive measures to alleviate future strains on consumers. And embracing renewable energy integration might just be the answer.

By leveraging optimization tools like PLEXOS, K-Electric can strategically integrate renewable energy into its system based on least-cost criteria. This shift towards renewables aligns with global sustainability goals and offers significant cost-saving opportunities.

RF and PRIED’s model forecasts substantial savings of up to 4.51 billion US dollars from FY24 to FY30 through proactive renewable energy integration. The report projects that solar and wind could collectively supply 28% of the total generation and 38% of installed capacity by 2031.

Finally, the report presented some strategic recommendations for K-Electric, including ceasing extensions in PPAs for costly thermal power plants, ensuring consistent integration of least-cost wind and solar projects, and avoiding new fossil-fuel-based generation additions. By committing to adding 30% renewables in its generation fleet by 2030, K-Electric can achieve sustainability targets and provide economical and reliable power to its consumers.

There is a much needed strategic shift, which not only aligns with global sustainability efforts but also promises significant cost savings and operational efficiencies for K-Electric, and a more sustainable future for the country.

KE’s stance

So what does KE have to say about this? Back on the 2nd of March this year, in a significant development, the National Electric Power Regulatory Authority (NEPRA) has granted approval for two of the three Requests for Proposals (RFPs) submitted by K-Electric (KE) for the addition of renewable energy to its power generation fleet.

These approvals are a milestone in KE’s strategic plan to integrate renewable energy into its operations; thereby, contributing to a cleaner and more sustainable energy future. Under the approved RFPs, solar projects would be installed within KE’s territory, aligning closely with the power utility’s commitment to diversify its generation mix with renewable energy resources.

Moonis Alvi, CEO of KE, emphasized the importance of these approvals, saying, “As we strive towards the goal to incorporate at least 30% renewables into our fleet by 2030, the approval of these RFPs by NEPRA serves as a cornerstone of our ambitious plan. The impending commencement of the installation process signifies a tangible step forward in KE’s journey towards a greener energy ecosystem.”

“With the necessary regulatory approvals in place, KE is poised to initiate the implementation phase promptly, aiming at expediting the integration of renewable energy solutions into its system, he said, adding that this initiative underscores KE’s unwavering commitment to sustainability and environmental stewardship, while also contributing to the broader national agenda of transitioning towards clean energy resources.”

This means that while the whitepaper has pointed out what KE has let go of by being slow on this, the management is aware of the opportunity and would like to take a crack at it. After all why would they not?

As we’ve mentioned earlier KE has been at the centre of an ownership struggle as well with the acquisition in the Cayman Islands by Shehreyar Chishty. Even Chishty’s plans to revamp KE heavily involve renewable energy. The new owners have pointed out that one of the failures of the company has been the inability to develop renewable power (except for 100 MW solar IPPs) at a time when the federal government has managed to secure over 1,100 MW of wind power right on Karachi’s door-step.

Everybody is in agreement that renewables are the way to go for Karachi’s power generation woes. The question is, when will anyone step in and do something about it?

K electric must read this article to get the guidelines.