There are few mysteries in the world that are assumed to be unravelable. UFOs, Loch Ness Monster and our purpose on this planet are just to name a few. Maybe we can add Ishaq Dar and his cockroach-like ability to never die or fade into oblivion to the list as well. Winston Churchill once famously said that Russia was like a riddle wrapped in a mystery inside an enigma. This Matryoshka doll of a conundrum can also be used to describe the Pakistan Stock Exchange.

Or more particularly certain stocks that are listed on the PSX.

Take, for example, the case of Dewan Farooque Motors. In the past 10 years the company has gone through litigation, their auditor raising red flags, and consistent losses. Despite this, their stock has remained surprisingly strong on the market. That means individuals that have invested in this particular company have made profits. So why does something like this happen on the stock market?

A company overview

Dewan Farooque Motors is part of the Yousuf Dewan Group which is involved in manufacturing of cement, textile, spinning, fiber and sugar. Dewan Farooque was established in 1998 as a publicly listed company and entered into contracts with Hyundai Motor Company and KIA Motors Company. The company assembles, manufactures and sells Hyundai and KIA vehicles in Pakistan. For the Gen-Z, know that both these companies were already introduced to the Pakistani Market back in early 2000s. In the earlier version, cars like Santro, Shehzore, Sportage, Spectra and Classic were launched.

The production plant was set up in 2000 and operations started in 2001. Initial sales and profits from the company were nothing short of remarkable. With sales growing steadily from Rs 5.5 billion in 2003 to Rs. 10.6 billion in 2006, the company was able to maintain a steady stream of profits. The company made a profit of Rs 6.63 per share in 2005 and had a track record of giving out healthy dividends in the form of cash and bonus shares as well.

The luck of the company started to turn in 2008 when it saw its first loss since 2003 and these losses grew exponentially till 2010. The reason for the loss making was a disastrous 2009 and 2010 where the company made a gross loss. This meant that the company was not even able to recover its direct cost of production from its sales and the decision was taken to shut down production before more losses could be incurred. The company actually saw its break up value per share fall to Rs -5.3 in 2009 and further deteriorated to Rs -8.4 in 2010.

In simple terms, the break up value of shares is the value of the company if all its assets are sold today and the proceeds are used to pay off all its liabilities. A negative break up value suggests that even if all the assets are sold, the liabilities will still be pending on the company. This situation arises when the company makes a loss which decreases the value of assets and equity while the liabilities stay the same. A negative break up value should ring alarm bells for any of the creditors that have lent funding to the company.

Facing dire straits, the company decided to shut down production in 2010. It stated in its 2011 annual report that as liabilities exceed assets, the company was not able to sustain any working capital in order to continue production and could not even provide for the markup for the loans it had taken. The creditors also started litigation against the company in order to recover an amount exceeding Rs 7 billion and they refused to renew or extend any of the credit facilities they were providing. In 2011, the company expected that the situation would get better and a restructuring proposal had been submitted in order to allow for the company function while paying back its debts.

This never happened.

The company was able to restart production in 2014 and 2018, however, the company still made a gross loss and further added to the misery of accumulating losses on its books. From 2010 onwards, the company was only using its trading line of business in order to generate any sales or revenue which meant that losses kept accumulating and break up value per share kept deteriorating. Things have gotten so bad that for the financial year 2022, the company recorded net sales of only Rs 144,000 which had once touched Rs 9 billion in its heyday.

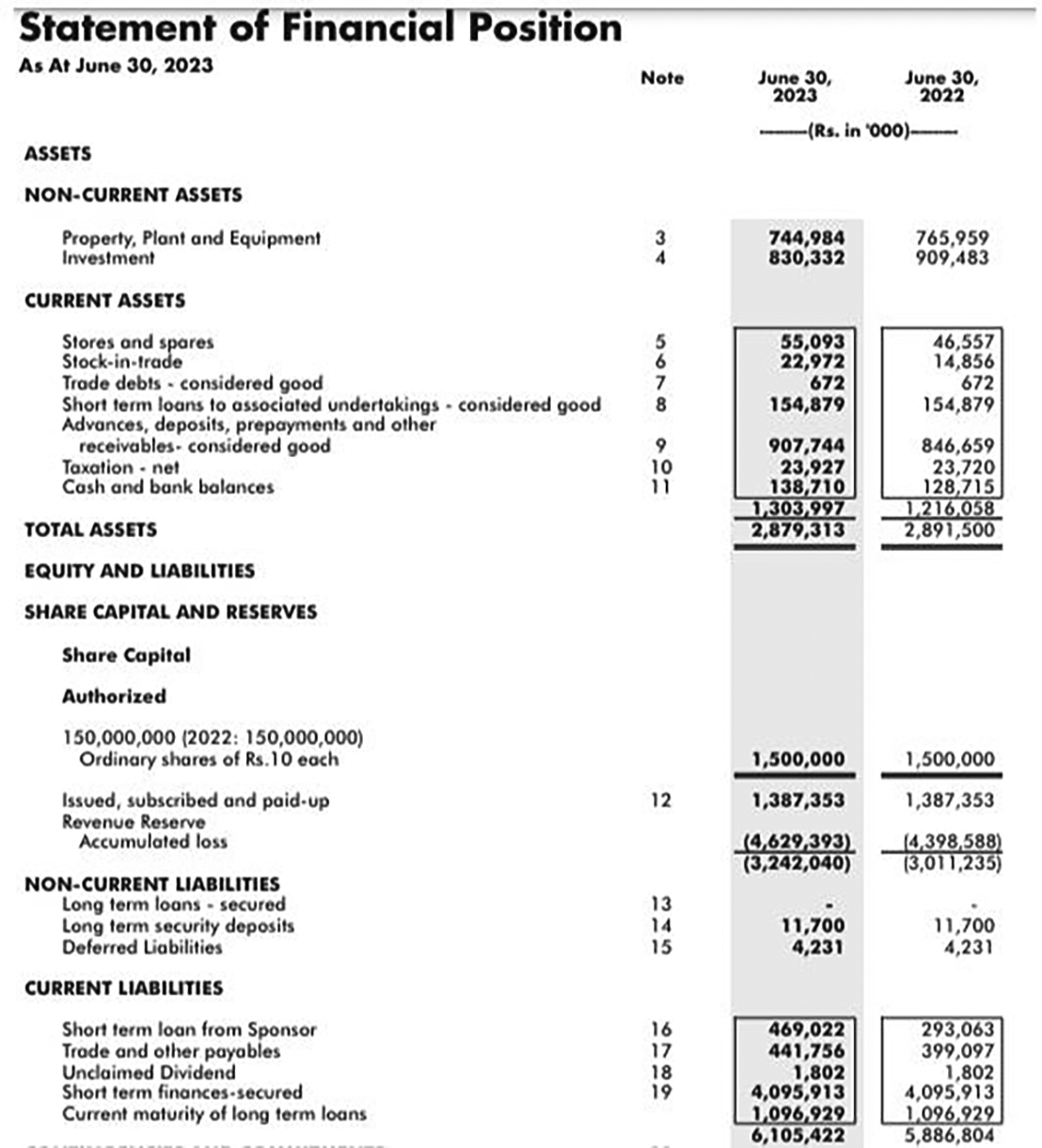

At the end of financial year 2023, the break up value hit rock bottom of Rs -24.3 per share as shareholders equity stood at Rs. -3.2 billion.

In addition to that company making a loss, some of the loans given out to associated companies like Dewan Mushtaq Motors, Dewan Motors and Dewan Automotive Engineering Limited also became unrecoverable as each of these companies started to see losses in their accounts. The loans that had been given to these companies became defunct once these companies started to make losses which meant even the assets of Dewan Farooque were becoming worthless.

Gatekeepers ring the alarm bell

As the company was facing distress, the auditors of the company raised some concerns and placed a qualification on the accounts they had prepared in 2012. They saw that the company had not set a provision for markup against loans that it had taken amounting to Rs 890 million and the company expected that their restructuring plan would be accepted which would waive off the markup that was due on the company currently. The auditors stated that rather than accepting the proposal, a case had been filed by the lenders which meant that the proposal was going to be rejected. As the provision had not been made, they stated that the shareholders equity should be further lowered to reflect this.

The auditors also stated that as the lenders had gone into litigation, there was a high probability that the assets used as mortgage against the loans would be sold and cast a shadow over the financial statements and the ability of the company to continue to operate into the future. There was a high chance that the company was not a going concern anymore as it had no working capital and could not even pay off its lenders due to the constrained liquidity position at the company.

The auditors at the company can be seen as being the canary in the coal mine and the first indication that things are all is not well with the company. Based on the negative break up value, accumulating losses and litigation being pursued by the lenders, it was felt that the company would not continue to be operational into the future. As the situation at the company stayed the same from 2012 to 2023, each and every auditor’s report stated that they were putting a qualification on the financial statements they were auditing. They kept stating that the company was not recognizing the markup interest that was due on it and as the liabilities were growing with little change in assets, there was a high chance that the company would not be able to operate in the future. The only facts that changed in the auditor’s report were the numbers which kept getting worse and worse as the company looked to grapple with its situation.

The auditors were basically saying that buyers should be aware when they considered the financial accounts.

With a company facing such huge losses, having an uncertain future and creditors knocking the courts’ doors, what has actually happened to its share price?

Well that is where the enigma starts.

The enigma of its share price

From June 2014 to June 2023, it has been seen that the price of the share has been range bound between a low of Rs 2.69 to a high of Rs 57.61. When this is compared to the book value of the share, it is seen that the break up value had a high of Rs -15.28 per share and a low of Rs. -24.3 per share. Essentially what the market is saying is that for a company that is making a loss, is being litigated and whose auditors are raising red flags consistently from 2012 till 2023, the company is a good investment and should be looked into. And investors are lining up to invest Rs 30 per share to own a piece of the company.

It boggles the mind that a company suffering through a disastrous period would be seeing such a distortion in its price. In a perfect world, this disparity in the price and the break up value of the company would not exist. Better understanding of the whole background behind the company would mean that investors would not be willing to invest in such a company unless the company starts to get its affairs in order. But show investors the graph of the price movement and they will drool over the returns being offered.

Seeing the difference between the market price and economic situation ring true in the immortal words of Nusrat Fateh Ali’s “Hairaan hai magar aqal kai kaisay hai tu kia hai, kuch samajh main nahin aata kai yeh chakkar kia hai, khail kia tum nai (shuru) sai yeah racha rakha hai. Tum aik ghorakh dhanda ho”

Ghorak dhanda is something which is not easy to understand or something that is complicated or convoluted. In other terms, the mechanisms that drive the prices at the stock exchange.

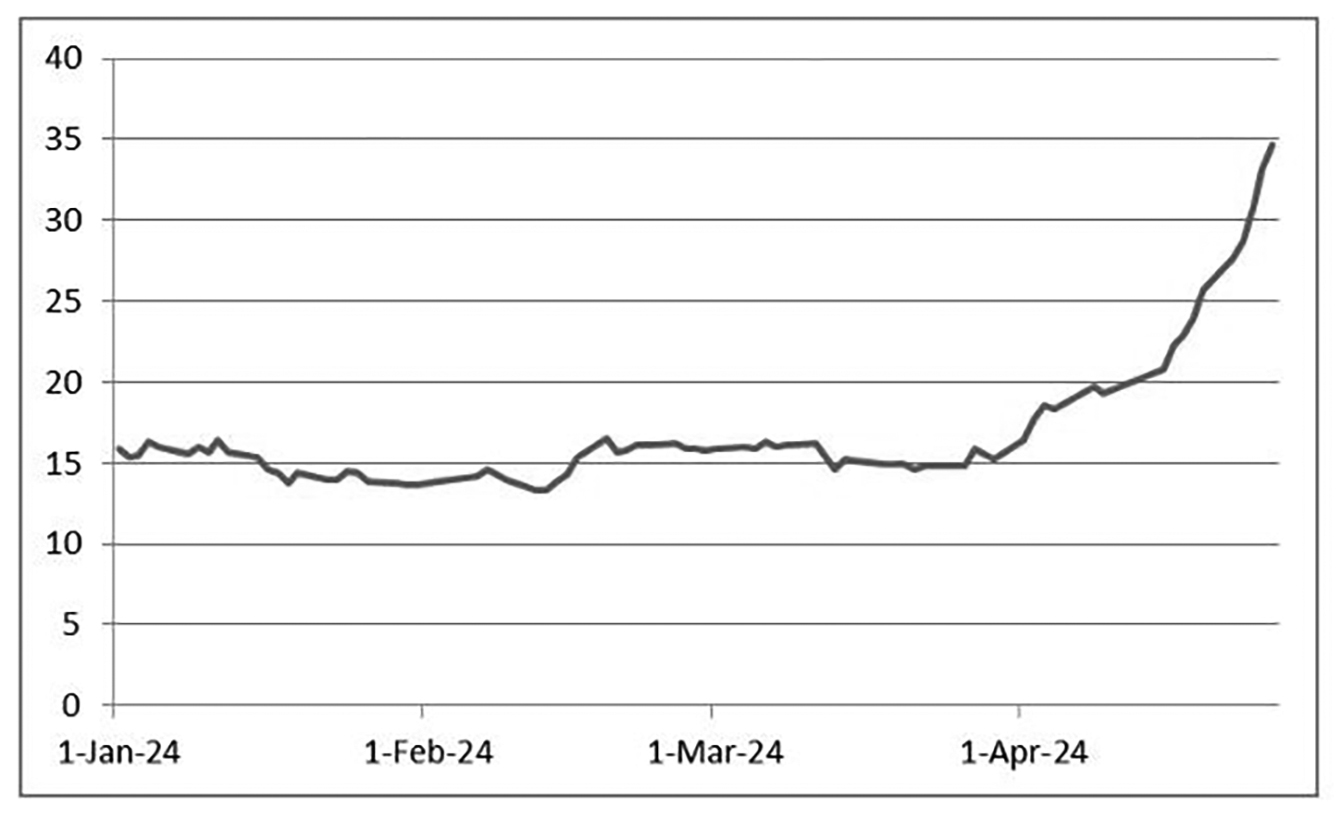

The company has seen a recent rally in its share price where it has gone from Rs. 11.04 to Rs 34.63 from July till April. The rally can be broken down into two parts where the share price went from Rs 11 to Rs 19 from July to December after which it took a breather and decreased to Rs 14 by March end. The second rally was mostly in April where the share price shot up by 127% in a span of a month.

Latest accounts show that the company owns assets worth Rs 2.9 billion while liabilities are around Rs 6.1 billion. These figures fail to account for accrued markup which stands at Rs 1 billion by itself and once that is done, the loss for the year increases by Rs 1 billion while the shareholders equity falls by Rs 8.193 billion. With the company being seen as being down in the dumps, what is the reason for the price increase?

Reasons behind the price increase

The first reaction in such a situation would be to look towards the company itself. The response in this situation is generic and is used by every company when they see an increase in their share price and movement. When asked by Pakistan Stock Exchange (PSX) on the unusual movement in the price and volume of the shares, the company gave the same old response that they had made all material information public and that it had no control over the trading that was taking place in the market.

To their credit, the company had made the necessary disclosures to the market regarding the latest material information. The company announced that they have started local assembly operations of special purpose KIA Commercial Vehicles in Pakistan under the name of KIA Shehzore and that they would start production in 2024. Based on this announcement, some movement in the share price is to be expected. This is a positive development and the market needs to respond in a positive manner to this piece of information. The dissonance is created when it is seen that the share price did nothing when the production restart was announced. It took more than a month for the market to respond to the news.

When reached for comment on the announcement being made, representatives at Dewan Farooque stated that production is expected to start at the end of May and a production capacity of 36,000 is expected to be reached in due course. It is expected that the company will need one year before they reach their full capacity. The company feels that it has strong contacts and the production plan will come to fruition as expected. There are no plans to carry out any additional investment at this point in time and the restructuring plan has been successful. When pushed to share this plan hashed out within the company or the creditors, it was stated that no such plan can be shared.

The company feels that it will be able to turn around its fortunes successfully. In relation to carrying out rights share issue, getting a loan from associates or additional investment in order to finance working capital, the company is considering these options for the future.

The wave of optimism is justified. But go back six years and the same thing happened there as well. In a lavish ceremony at Mohata Palace, Yousuf Dewan announced that the company was going to start production in February 2018 and production did start in March of the year. But it was closed in June 2018 as production was not sustainable. The share price also rebounded and it was hovering around Rs 40 based on the optimism but then it fell to Rs 11 by June 2023. It seems these announcements are made from time to time and then production is not able to affirm the confidence that is shown by the stock market.

Recent financials also state that the company is developing a restructuring plan that will be shared with the creditors and it is expected that it will be agreed upon by the banks. This was shared in the recent 3rd quarter accounts of the company and the optimism can be driven due to that fact. The only problem is that it was stated in the annual accounts of June 2023, 2022,2021 and before that as well and it seems the plan is still to be formulated to be shared with creditors. Also, due to its liquidity situation, the company cannot start production before any such plan is approved by the banks and in case any such plan is approved, it will be shared by the company with a huge pomp and circumstance. No such announcement has been made till now.

In terms of the stock market reaction, the company feels that the market is resonating with the optimism being seen at the company as the company has seen its letters of credit open and production restart. There will be an affirmation of the confidence shown by the market as the company will attain its long lost glory. One way to explain the rally in the market is the fact that a small piece of information is being used to increase the value of the share. It was done 6 years ago and it is being done again. Until actual changes take place, these announcements will soon become the cry of wolf for the company. The market is over reacting to the news of operations restarting and this time the company needs to follow through on its promise to make this price increase credible.

Other than that, is there news that part of the market knows or some piece of information that has not been made public? Based on the laws that exist on the books, there is nothing more the company can be mandated to disclose or needs to tell the market once they have disclosed all material information that is available to them. This is a get out of jail free card that is used by companies time and time again saying that there is nothing to disclose only for information to come out later. The example of Pakistan Hotel Developers and Shabbar Zaidi’s bushy mustache is still alive in our mind. Let’s give the company the benefit of the doubt that it is just optimism of the market that is behind the price increase and nothing else.

So then what is PSX and Securities and Exchange Commission of Pakistan (SECP) doing in this situation?

With little protection for investors and a lack of knowledge, investors will jump into this opportunity thinking that they can make a quick buck and exit. When an investor is making an investment they understand the risks that are associated. If they end up making a loss, they have no one to blame but themselves. Seeing that operations are restarting, they even have a rationale to buy into the rally.

Market experts believe that if someone is willing to make an investment in such a company, they should be allowed to do so. Speculation is part and parcel of the market and investors need to be aware that market price deviating from intrinsic value can take place. SECP and PSX need to stay out of the matters of the market for the most part as this is part of any market in the world. Regardless of the share trading at Rs 1 or Rs 100, the investors who are participating in the market get to decide whether they want to trade in the shares or not. The onus of researching and carrying out due diligence lies with the investor and they need to make sure they understand the investment before they make it.

However, there is still a case that can be made that they need to have a complete understanding of the company they are investing in. That does not take place in the PSX where a spike in price sees people pouring their savings into the company only to lose it all. Auditor reports, litigation in courts and break up value are not words that are common for many of the individual investors and they end up holding the bag in the end.

No one is saying that something shady is going on. This is part and parcel of the market where other companies have seen unexplained meteoric rise in their share price as well. But does this mean that chirya man is correct? Well one share seeing such distortion cannot be generalized for the whole market and to say so will be disingenuous to say the least. There are hundreds of companies being traded in the market and almost all of them follow some rationale or fundamentals. Plus, the recent increase is also rooted in news and announcements, however flimsy or repetitive it may be. One exception does not make a rule.

Should PSX and SECP do something to fix these exceptions?

When companies fail to meet the compliance and regulatory requirements set by the PSX and SECP, companies are initially placed on the defaulter segment and can even be delisted if they fail to comply. This is a measure taken in order to make sure companies comply or face delisting from the stock market. A similar step can be taken where companies which are facing distress or whose auditors are giving out qualified opinions can be seen as being marginalized by the PSX or SECP. Any investor who is investing in these shares will be cognizant of the fact that they are investing in a distressed company and to carry out their own due diligence when investing.

When reached for comment, the representative at PSX stated that “the prices of the shares of the listed companies are determined based on market supply and demand forces. The investors perform their independent evaluation including assessment of financial position and performance of the companies and release of material announcements from time to time through the announcement system provided by PSX.”

It was further stated that “It is advisable to refer to the Company’s Announcements section where companies disseminate their periodic financial results and material announcements which form the basis for taking such investment decisions among various other factors. Rest assured, PSX regularly monitors market trades through surveillance system to detect any market misconduct in the form of price manipulation, insider trading etc. and takes regulatory actions including referral of cases to apex regulator as per PSX Regulations in order to conduct additional investigation and decide appropriate action(s) in accordance with the securities market laws.”

The SECP was contacted regarding this price increase and they communicated that “the SECP, inter alia, is mandated to maintain fair, orderly and efficient capital markets, promote robust corporate sectors and protect the rights of investors through beneficial regulations. Further, SECP as a Regulator, is all for fairness and fair practices in the capital market, and is monitoring the markets from the perspective of incidences of market misconduct.”

It further added that “in order to perform its regulatory functions SECP takes action where any violation of law is established, whether the offense is criminal or otherwise. Please note that Stock prices in the stock market are a function of demand and supply. We are analysing Dewan Farooque Motors, as well as other stocks, as a matter of routine and any incident of market misconduct, if found, shall be dealt with according to law.”